Key Takeaways

- IRS quietly restarts collection machine.

- Minnesota paid leave rules loom.

- WSJ on IRS OSHA/ERC guidance.

- Monetized installment sale regs - too broad?

- Iowa proposes rules for new retirement income exclusion.

- Coke loses $882M case in Tax Court.

- Tax ballot measure recap.

- Which corporations pay the most tax?

- Foreign partnership planning.

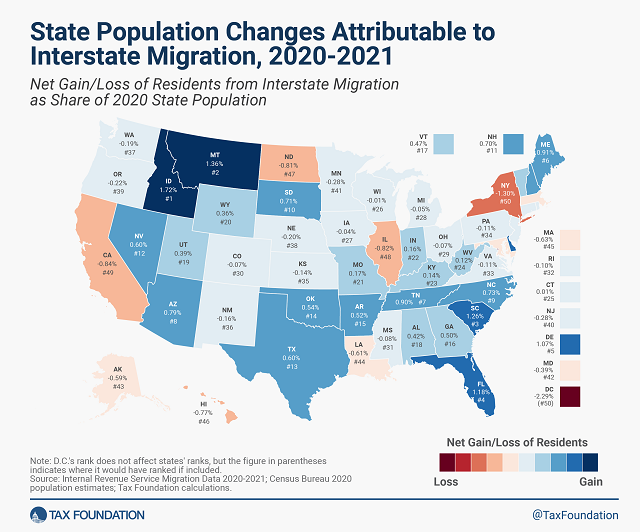

- Taxes and interstate moves.

- "Anatomy of a Tax Shelter: They Called IRS ‘Too Stupid’ to Notice"

- OC attorney faces orange outfits.

- Scrapple and Tempranillo.

So It Begins: IRS Resumes Long-Paused Collection Notices - Jonathan Curry, Tax Notes ($):

The IRS has at least partially resumed sending out automated collection notices to taxpayers with a balance due after an almost two-year hiatus, although without any fanfare.

...

The IRS announced it had paused the issuance of many of its automated collection notices in early 2022, when the agency was mired in a massive backlog of unprocessed tax returns and correspondence. Some taxpayers who had filed or submitted payments for taxes owed were receiving automated letters informing them that they needed to file or pay, even though they had already done so, leading to confusion and worsening the backlog.

The IRS has been eyeing a restart for a long time, and an official said in June that the agency was looking to resume issuing the notices in late summer of this year, until the more recent suggestion that it would be bumped to 2024.

The article refers to a blog post by Erin Collins, the National Taxpayer Advocate, where she notes:

My concern is the longer the notices are delayed, the more that taxpayers may have a false sense that the IRS may have forgotten about their tax balance—or maybe taxpayers fail to understand that interest and penalties continue to accrue until final payment. But regardless of a taxpayer’s understanding, the IRS does remember those outstanding balances, and as long as the balance goes unpaid, interest and applicable penalties continue to accrue.

She offers some sound advice: "Rather than wait for the IRS to resume sending notices, taxpayers may benefit from acting now to stop additional interest and penalties from accruing. Ignoring unfiled tax returns or unpaid taxes only makes the situation worse (and more expensive)."

Related: IRS Collection Issues.

Minnesota paid leave rules take effect for 2024. From the Minnesota Department of Labor and Industry:

Effective Jan. 1, 2024, Minnesota’s earned sick and safe time law requires employers to provide paid leave to employees who work in the state. Minnesota’s current sick and safe leave law remains in effect until Dec. 31, 2023 and will be replaced by the new earned sick and safe time law on Jan. 1, 2024.

...

An employee is eligible for sick and safe time if they:

-work at least 80 hours in a year for an employer in Minnesota; and

-are not an independent contractor.

IRS Warns Employers About This One Tactic to Claim Pandemic Tax Credit - Richard Rubin and Ruth Simon, Wall Street Journal:

To qualify for the ERC, employers have two routes. They can show a minimum specified revenue drop, an easy metric for the IRS to verify. Or they can show that a government order suspended their operations.

...

IRS Commissioner Danny Werfel said Tuesday that the memo addresses an area where taxpayers have aggressively stretched definitions. “For example,” he said, “simply wearing gloves and practicing routine hygiene practices like handwashing don’t translate into a serious impact on a business to qualify for the credit.”

IRS Monetized Installment Regs Could Snare Legitimate Deals - Kat Lucero, Law360 Tax Authority ($).

The rules, proposed in August, aim to target installment sales that involve intermediaries, which can be promoters, that take advantage of legitimate arrangements under Internal Revenue Code Section 453. The transactions at issue involve an intermediary facilitating an arrangement in which a seller immediately receives proceeds from the sale of an appreciated asset while deferring income tax by securing a lender's nonrecourse loan to the seller that is equal to the amount of the proceeds.

The proposal would also cover transactions "substantially similar'' to monetized installment sales, but the rules do not detail what those similar arrangements could look like. It's a situation that could subject participants and trustees who facilitate the sale of a property or another kind of asset held in a trust to reporting requirements and penalties, according to trust and estate lawyers.

Iowa DOR Proposes Rule on Retirement Income Exclusion - Emily Hollingsworth, Tax Notes

According to the rule, qualifying retirement income includes IRAs and Roth IRAs; simplified employee pension IRAs (SEP-IRAs); savings incentive match plans for employees (SIMPLE IRAs); qualified deferred compensation plans under IRC sections 401(k) and 457(b); and other benefit plans, pension plans, profit-sharing plans, or stock bonus plans under IRC section 401.

Nonqualified deferred compensation plans under IRC section 409A and nonqualified annuities wouldn’t qualify for the retirement income exclusion, according to the rule.

This is consistent with the way the Department defined retirement income for partial exclusion for retirement income that applies to pre-2023 tax years. Taxpayers must be 55 or older to qualify, unless they are a surviving spouse, or a survivor with an insurable interest, of a decedent who would have qualified.

Link: ARC 7109C

Coke Stuck With $882M Adjustment For Brazilian IP Transfers - Dylan Moroses, Law360 Tax Authority ($):

Voters approve cannabis tax ballot measure, split on property tax relief initiatives - Kay Bell, Don't Mess With Taxes:

Colorado voters overwhelming rejected Proposition HH, a proposal by Democratic lawmakers to provide them property tax relief and boost school funding.

...

Proposition HH would have directed some of those excess TABOR funds to local governments, allowing for property tax relief. However, that change would have lowered future tax rebate checks.

How to Cash In Clean Vehicle Tax Credits at Point of Purchase - Tax School Blog. "Taxpayers making the election transfer the EV credit to the car dealers and receive the equivalent amount in return from the dealer, either as cash or a partial down payment. The IRS will then reimburse the dealers for the credit within 72 hours."

Which Corporations Pay the Most Federal Income Tax? - Martin Sullivan, Tax Notes Opinions. "We emphasize that these are estimates of undisclosed federal cash income tax payments (we will explain the details below). If they accurately reflect actual cash payments to the U.S. treasury, those top three companies would account for almost 8 percent of all federal tax payments in 2021 and 2022. The entire list of 10 would account for nearly 15 percent of all federal corporation tax payments in those years. Other companies (not shown in the table) with an estimated $2 billion to $2.7 billion of federal income tax payments are: Walmart Inc., Goldman Sachs Group Inc., CVS Health Corp., Morgan Stanley, Bristol-Myers Squibb Co., AbbVie Inc., Gilead Sciences Inc., Cisco Systems Inc., and Marathon Petroleum Corp."

The top three? Alphabet, Microsoft, and Apple.

Foreign Partnerships with a US Partner? Some Planning Ideas - Virginia La Torre Jeker, US Tax Talk. "An earlier blog post explained how easy it is for the foreign person to fall into some nasty US tax traps when entering a foreign partnership with a US person. Even if that foreigner never sets foot in America and works solely from the foreign location, he can end up paying US taxes. In addition, the foreign partnership itself will have US tax duties – annual filing of a partnership US tax return (Form 1065) as well as withholding tax obligations."

Related: Eide Bailly International Business Structuring.

How Do Taxes Affect Interstate Migration? - Andreay Yushkov and Katherine Loughead, Tax Foundation. "Many factors influence an individual’s or family’s decision to move from one state to another—employment or educational opportunities, proximity to family or friends, and geographic and lifestyle preferences like weather, natural landscape, and population density, to name a few. Cost-of-living considerations, including tax differentials, may not be the primary reason for an interstate move, but they are often one of several factors people consider when deciding whether—and where—to move."

Taxes aren't everything, but they are a thing.

Anatomy of a Tax Shelter: They Called IRS ‘Too Stupid’ to Notice - Michael Bologna, Bloomberg ($):

For more than a year, wealth management advisers gathered online to hash out strategies to defend wealthy Americans stashing billions in Maltese individual retirement arrangements. The offshore tax shelters purportedly permitted millionaires and billionaires to deposit their riches in retirement accounts without the limits and tax consequences found in domestic IRAs.

This is a tremendous look behind the curtain of the promotion of an abusive tax shelter that is featured on the IRS "Dirty Dozen" list. I hope that Bloomberg eventually lets it out from behind the paywall, as it is full of amazing nuggets that deserve a wider audience. This, for example:

“Every one of us knew this was a sham as it lacked any economic substance, especially the taxpayers who came to us looking for a way to evade taxes,” said the adviser, who spoke on condition of anonymity due to potential legal exposure. “Because of the large fees, we played audit roulette and hoped that the IRS would never challenge it.”

Now the IRS has "served hundreds of criminal summonses on taxpayers and promoters." Audit roulette, indeed. Be careful out there.

Related: Eide Bailly IRS Dispute Resolution services.

Orange County tax attorney pleads guilty to underreporting $1.68 million in income, including funds embezzled from client’s family trust - IRS (Defendant name omitted):

Defendant, of Trabuco Canyon... pleaded guilty to three counts of subscribing to a false tax return. Defendant has agreed to pay $644,579 in restitution to the IRS and to transfer deeds on two properties purchased with money embezzled from a deceased person's family trust for which she was the trustee.

According to her plea agreement, the settlor of the trust died in March 2016, and in December 2016 Defendant embezzled $1.1 million from a bank account belonging to the trust by causing a wire transfer to a Citibank account in the name of JAWLO LLC, which Defendant controlled. She subsequently wired those funds from JAWLO's bank account to an escrow account to purchase a residence for herself in Coto de Caza.

She may have trouble keeping her law license after this.

A natural pairing. It's both National Scrapple Day and National Tempranillo Day. "Scrapple combines pork scraps with buckwheat flour, cornmeal, and spices in what is a great example of taking food that would otherwise have gone to waste and turning it into something tasty and delicious."

Make a habit of sustained success.