Key Takeaways

- Yellen touts IRS digital progress, blasts proposed funding cuts.

- IRS: Artificial Intelligence will help target audits; real agents will do them.

- House to study, not ban, IRS use of AI.

- Ohio legalizes taxed weed.

- Refund tracking tool upgraded by IRS.

- OSHA guideline not a shutdown for ERC.

- Split-interest land buys.

- Withhold your horses (internationally).

- Inequality overstated, per study.

- Finland publishes high earner list.

- Vegas real estate guy sentenced for tax charge.

- Dunce Day.

Yellen Hails Paperless Processing Milestone, Blasts GOP - Alexander Rifaat, Tax Notes ($):

The IRS has achieved its goal of allowing taxpayers to digitally respond to all correspondence, according to Treasury Secretary Janet Yellen, who scolded House Republicans for their efforts to rescind funding for the agency.

...

IRS Commissioner Daniel Werfel also emphasized the customer service improvements for the upcoming filing season, highlighting the updated callback option available to 95 percent of taxpayers for which the projected wait time exceeds 15 minutes.

Yellen Warns Against 'Damaging' IRS Funding Cuts - David van Den Berg, Law360 Tax Authority ($):

Maintaining the Inflation Reduction Act's funding increase for the IRS and providing the agency with "robust discretionary funding" would deliver a modernized IRS, she said. The current proposals to cut IRS funding make this an important time to discuss agency goals for the 2024 filing season, she said.

Those goals include maintaining a commitment to an 85% level of service on phone lines and adding improvements to the "Where's My Refund?" tool, including "conversational voice bot technology" to help taxpayers get answers sooner, she said.

From Secretary Yellen's published remarks:

Last August, I announced an ambitious goal: For the 2024 filing season, taxpayers would be able to choose to digitally upload all correspondence and responses to notices, instead of mailing them. I am proud to announce that we met this goal last month, much ahead of schedule. The impact will be significant and far-reaching. Taxpayers will save time and effort. The IRS will reduce errors and storage costs. And we’ll speed up processing times for the system as a whole. Today, I’m announcing another key milestone to make the IRS even less reliant on paper processing. By the start of the filing season, taxpayers will be able to electronically file 20 additional tax forms, including some of the most common forms for businesses.

Artificial Intelligence to Help With IRS Audit Selection - Nathan Richman, Tax Notes ($).

The IRS’s artificial intelligence tools are often best used to find who it should or shouldn’t audit and to provide feedback on what has been working, an IRS official said.

The IRS may be preparing to unleash AI-powered tools on large partnerships, but those programs won’t be conducting the examinations and will instead assist in selecting the partnership returns to audit, Marc Borella of the IRS Large Business and International Division said November 6 at the Tax Executives Institute-San José State University High Tech Tax Institute.

House Will Consider Studying IRS Use of AI, Nixes Ban - Doug Sword, Tax Notes ($):

The House Rules Committee voted late November 6 to consider a pair of amendments from House Ways and Means Oversight Subcommittee Chair David Schweikert, R-Ariz., suggesting that the Treasury Inspector General for Tax Administration study how the IRS is using AI. Schweikert’s subcommittee oversees the IRS for the taxwriting committee.

The Rules Committee didn’t include among the amendments that will be considered by the full House an amendment barring the IRS from spending any funds to use AI for enforcement. Instead it chose to put Schweikert’s two amendments to a vote on the House floor.

Chicago City Council OKs Real Estate Tax Hike Referendum - Jaqueline McCool, Law360 Tax Authority ($). "If approved, the real estate transfer tax would increase from $3.75 to $10 for every $500 of the price on transfers between $1 million and $1.5 million. For properties with a transfer price over $1.5 million, the tax would be $15 for every $500 of the transfer price."

Cannabis Legalization Gets Voters' OK In Ohio - Sam Reisman, Law360 Tax Authority ($). "Additionally, the legalization proposal will tax the sale of recreational cannabis at 10%, with a quarter of tax revenues earmarked for substance use and addiction efforts, 36% going to municipalities that host dispensaries and 36% going to create a social equity and jobs fund. The remaining 3% of funds will be set aside to support the department's operations."

IRS refund tracking tool gets 2024 filing season upgrades - Kay Bell, Don't Mess With Taxes. "Overall, the refund tracking tool will incorporate conversational voice bot technology to help taxpayers get answers more quickly. It also will provide clearer and more detailed information in plain language. This should help taxpayers deal with return process problems and get their refunds more quickly."

OSHA Guidance Issued During COVID-19 Pandemic Not Likely to Justify ERC Claims per IRS Memo - Ed Zollars, Current Federal Tax Developments. "The analysis and conclusions set forth make it evident that the IRS typically does not concur with the notion that various pieces of OSHA guidance can demonstrate that a taxpayer was under a government order causing a full or partial suspension of their trade or business operations."

Split-Interest Land Acquisitions – Is it For You? (Part 2) - Roger McEowen, Agricultural Law and Taxation Blog. "A closely-held C corporation is a relatively efficient entity for creating after-tax dollars with the current tax rate at a flat 21 percent. Even though C corporation after-tax dollars are used for the acquisition of most of the cost of land, the split-interest technique avoids the long-term negative aspect of having the farmland trapped inside the C corporation, and thus avoids the risk of double taxation of land appreciation."

Translation Error Raises Question as to Taxpayer's Willfulness in Failing to File FBAR - Parker Tax Pro Library. "The court found that the taxpayer, a Japanese speaker who does not speak English and did not reside in the United States in the years at issue, only read a Japanese version of the questionnaire that included an explanation of the FBAR filing requirement, and the Japanese version stated that the requirement applied only to 'U.S. resident taxpayers' and therefore a question of fact as to the taxpayer's willfulness in failing to file the FBAR existed."

Withhold Your Horses! - Alex Parker, Things of Caesar. "The Amount A project began as a reaction to the proliferation of proposed and enacted digital services taxes, which target the revenue (not income) of online activities like advertising or data collection. Lawmakers passed these responding to public outrage over the perceived non-taxation of tech companies, due to an outdated tax system that often is based on the physical presence of a taxpayer."

Also, the story of public domain superhero "Marksman."

OECD’s Pillar One: A Step Towards Chaos Rather Than Stability - Adam Michel, Liberty Taxed. "Pillar One aims to redistribute $205 billion of multinational corporate profits to countries based on customer location, regardless of a company’s physical location."

Related: Eide Bailly International Business Structuring.

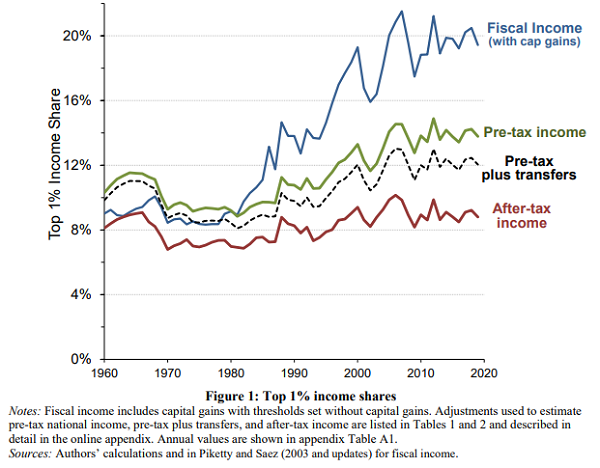

Income Inequality in the United States: Using Tax Data to Measure Long-Term Trends - Gerald Auten and David Splinter, Davidsplinter.com. "Our analysis of pre-tax income shows that top income shares are lower and have increased less since 1980 than other studies using tax data. In addition, increasing government transfers and tax progressivity have resulted in rising real incomes for all income groups and little change in after-tax top income shares."

Details and Analysis of Making the 2017 Tax Reforms Permanent - Tax Foundation.

Taken together, full TCJA permanence would boost GDP by 1.2 percent and employment by 829,000 full-time equivalent jobs and reduce revenue by $3.7 trillion on a conventional basis. On a dynamic basis, the cost falls by 16 percent to $3.1 trillion as higher economic output raises some additional tax revenue. Incorporating added interest costs, the deficit impact would be $4.1 trillion on a conventional basis and $3.7 trillion on a dynamic basis. Without other offsets, the long-run debt-to-GDP ratio would increase by 26.6 percentage points (conventional) or 18.4 percentage points (dynamic) above its baseline of 231.8 percent."

...

Making all the changes permanent would prevent sudden tax increases and would grow the economy. However, it would also substantially increase the deficit at a time when deficits are already too high and forecast to grow higher still.

What Is Nikki Haley’s Tax and Budget Platform? - Howard Gleckman, TaxVox. "When it comes to economic policy, Haley focuses on tax cuts, less regulation, and a balanced budget—all standard Republican fare. But she also nods to the GOP’s current populist mood by bashing big business subsidies, even though she offered hundreds of millions of dollars to big corporations as South Carolina’s governor."

Tax Data: Wolt founder records Finland's biggest income in 2022 - YLE:

Miki Kuusi, who founded the Wolt delivery service and sold it to the American firm DoorDash last year, was Finland's highest income earner in 2022.

He made some 79 million euros in total, ensuring he topped the list of taxpayers published on Wednesday morning.

In second spot was Pekka Kopra, who sold the Versowood Group company last year. His income was 53.9 million euros altogether.

Finland posts (link in Finnish) annually a list of the highest earners in that country. Our custom in the US is to leak that information.

It's worth noting that in Finland, the highest incomes are one-timers for people who sold their businesses. In the US, there is a lot of turnover at the top of the taxable income lists for thiis reason.

Las Vegas real estate developer sentenced for evading $1.9 million in taxes - IRS (Defendant name omitted):

Defendant... was sentenced on November 3 to one year and one day in prison for evading payment of his federal income taxes. Defendant pleaded guilty to tax evasion on July 26, 2022.

According to court documents and statements made in court, from approximately 2009 through 2019, Defendant owned and operated Turn Two Inc., a Nevada real estate company. In March 2010, the IRS levied Defendant's personal bank account in an attempt to satisfy an outstanding tax debt. After learning of the IRS levy, Defendant began taking steps to thwart IRS collection efforts by, among other things, cashing large portions of his wife's paycheck to keep the funds out of a bank account the IRS could levy. Beginning in 2011, Defendant began depositing his wife's entire paycheck and other earnings into a corporate bank account not subject to levy and held by Turn Two and used that account to pay most of his family's personal living expenses.

When you complete a double play in baseball, you "turn two." Here the taxpayer failed to touch second and threw the ball into the stands. He should have taken the safe play and paid the tax in the first place.

My time has come. It's National Dunce Day!

Make a habit of sustained success.