Key Takeaways

- EV tax credits go largely unknown

- IRS funding cuts play role in delaying spending bill

- Senate tax chief seeks to snag wealthy tax cheats

- Progressive overstep

- ERC fraud is huge

- Direct file and States

- Calls to extends BOI deadline

- Taxes and Halloween candy

Exclusive: 40% of Americans say they've never heard of Biden's EV tax credits – Ben Geman, Axios:

Polling shared first with Axios shows huge swaths of Americans don't know about federal subsidies up to $7,500 for buying electric vehicles.

Driving the news:Just 22% know a "great deal" or "good amount" about the credit, which was expanded — with strings attached — under the 2022 climate law.

White House Warns That Biden Would Veto GOP’s Israel Aid Bill - John Harney, Bloomberg ($):

The White House said President Joe Biden would veto a bill proposed by House Republicans to provide assistance for Israel that would be paid for by slashing funds for the Internal Revenue Service.

The Office of Management and Budget, in a lengthy statement on Tuesday night, said the measure “fails to meet the urgency of the moment by deepening our divides and severely eroding historic bipartisan support for Israel’s security.”

The legislation, championed by the new House speaker, Mike Johnson, has already run into stiff bipartisan opposition from the US Senate, creating a standoff as he tries to reunite the Republicans who form his chamber’s narrow majority.

Here’s the thing: This isn’t the spending bill to extend funding for the Federal government beyond November 17th – which is roughly two weeks away. This is a “supplemental” spending bill that – by the way – doesn’t need to have a cost offset. I can't help but wonder if the newbie Speaker knows this. Meanwhile, tick-tock on funding the Federal government.

I’m not the only one who thinks the Speakership is being run by newbies:

Johnson fills senior-staff ranks with leadership newbies - Jake Sherman, Punchbowl News ($):

Within a week of winning the speakership, the Louisiana Republican has filled every key position on his leadership team. But unlike previous speakers who sought seasoned hands in such roles, Johnson has mostly eschewed experience in favor of political allies and fellow conservative travelers.

Wealthy Tax Dodgers to Get Senate Finance Committee Scrutiny - Samantha Handler, Bloomberg ($):

Senate Finance Chair Ron Wyden (D-Ore.) said he plans to hold a hearing in the coming weeks as he investigates how the wealthy avoid paying taxes.

The lawmaker told reporters Tuesday that he’s moving forward in examining the “questionable tax practices” of rich individuals such as Republican donor Harlan Crow and Apollo Global Management co-founder Leon Black. Wyden has been pressing Crow to answer questions about gifts and travel he provided to Supreme Court Justice Clarence Thomas and is investigating Black’s financial and tax planning ties to disgraced financier Jeffrey Epstein.

The Senate Finance Committee will have a hearing soon on how wealthy individuals legally avoid paying taxes, but a date hasn’t been set, a committee spokesperson confirmed.

If legislation comes from the hearing, it will likely target more than just the people named in this article. However, such legislation is highly unlikely to pass the House and, therefore, cannot become law in the current Congress.

Former Official Warns Against Progressive Mission Creep for IRS – Jonathan Curry, Tax Notes ($):

Refundable tax credits for low-income taxpayers and green energy credits for businesses all fulfill worthy policy goals, but there’s a risk of the IRS being spread too thin while overseeing them, former Treasury Secretary Lawrence Summers warned.

The IRS has taken criticism for the high number of correspondence audits of tax returns claiming the earned income tax credit, and in response, it has pledged to reduce the number of those audits and focus its attention elsewhere, namely on high-income taxpayers. But according to Summers, that’s a potentially risky tradeoff.

“I think those of us with progressive loyalties need to be very careful,” Summers said October 31 on a Center for American Progress webcast. Progressives are rightly enthusiastic about the anti-poverty effects of a wide range of refundable credits for individuals, and the fact that that Congress has allowed some benefits — like the expansion of the child tax credit — to expire is a tragedy, he said.

IRS Criminal Investigations Intensify for Pandemic Tax Credit - Erin Slowey, Bloomberg ($):

IRS Criminal Investigation has started probes involving over $3.4 billion in potentially fraudulent employee retention credit claims, the agency announced Tuesday.

The ERC is a refundable tax credit that was designed to encourage companies to keep employees on their payroll and help businesses stay afloat during the pandemic. But some third-party companies misled taxpayers into claiming relief they didn’t qualify for.

Contingency Fees a Red Flag for ERC Fraud, Practitioner Says – Lauren Loricchio, Tax Notes ($):

Taxpayers that paid a contingency fee for the submission of their employee retention credit claim could see their tax returns flagged for potential fraud.

The IRS will be more cautious when it comes to processing tax credits because of the high amount of pandemic-related fraud and challenges with recouping paid-out funds, Sandra R. Brown of Hochman Salkin Toscher Perez PC said on an October 31 webinar hosted by Wolters Kluwer and Alvarez & Marsal.

“This is a different world we are now living in when it comes to these credits,” said Brown, former acting U.S. attorney for the Central District of California and chief of its tax division. “If there’s fraud . . . the money is gone, and so the IRS is, I think, really trying to address that.”

States Will Play Crucial Role in IRS Direct-File Success – Nana Ama Sarfo, Tax Notes ($):

In the United States, the possibility of a free, government-run direct federal income tax filing system is potentially one step closer to reality. Next year, the IRS intends to launch a direct file pilot program for taxpayers in a select group of states to measure taxpayer response, experience, and the system’s usability.

Launching a permanent direct-file program would put the IRS on track with several of its peer tax administrations around the world. However, it is navigating difficult terrain, particularly the thorny issue of incorporating state and local tax filings into a federal electronic-filing (e-file) program. Taxpayers want a one-stop solution, like the commercial tax preparation software that many already use. The IRS is exploring what it can do, but there are logistical and organizational impediments that will have to be overcome. Success of an IRS direct-file program will hinge in part on whether the agency can offer a system that integrates all three kinds of filing — a massive feat that will take many years to develop and refine.

1st Tax Easement Convictions Will Likely Embolden DOJ, IRS – Bill Curtis and Lauren DeSantis-Then, Law360 Tax Authority ($):

On Sept. 22, after a nine-week trial in the U.S. District Court for the Northern District of Georgia, a federal jury convicted two promoters — accountant Jack Fisher and attorney James Sinnott — in the U.S. Department of Justice's first criminal tax fraud trial over allegedly abusive syndicated conservation easements.

The same jury acquitted Clayton Weibel, an appraiser, of all charges.

This split verdict in U.S. v. Lewis is a major development in the DOJ's investigation into syndicated conservation easements and adds two convictions to the six guilty pleas related to the Inland Capital Management LLC conservation easement funds.

Taking Inventory of the IRS’s Latest Attack on Qualified Conservation Contributions - Vivian Hoard, Kip Nelson and Adam Young, Tax Notes ($). “In this article, the authors examine the IRS’s recent decision to limit income tax deductions for donations of conservation easements to adjusted basis despite its history of allowing them based on fair market value.”

Northrop Grumman Employee Who Worked Abroad Must Pay US Taxes - Bernie Pazanowski, Bloomberg ($):

A taxpayer from Arizona, who worked for Northrop Grumman Corp. in Australia, wasn’t entitled to exclude her salary from her gross income on her US taxes, the US Tax Court said.

Nicole Henaire signed a valid waiver and didn’t show she was otherwise qualified for the exclusion, the memo by Judge James S. Halpern said Monday. In addition to claiming she was entitled to wage and housing exclusions from her gross income, Henaire also alleged malfeasance in the execution of the waiver.

AICPA, others call for a one-year extension of BOI report deadline - Martha Waggoner, The Tax Adviser:

The AICPA and over 50 affiliated organizations recommended in a letter to Treasury's Financial Crimes Enforcement Network (FinCEN) that the agency extend the effective date for the beneficial ownership information (BOI) reporting requirement by one year to give the millions of affected businesses time to learn about the new and complex rules. The letter asked that the scope of the one-year deadline delay include not only new entities created in 2024, but all entities created thereafter and all entities making updates or corrections to their original filings.

"FinCEN should give all businesses a fair time frame to gain awareness and a reasonable time frame to comply with BOI requirements," said the letter, dated Oct. 30 and signed by Sue Coffey, CPA, CGMA, the AICPA's CEO–Public Accounting.

More Specific Min. Tax Guidance Coming, OECD Official Says – Dylan Moroses, Law360 Tax Authority ($):

The Organization for Economic Cooperation and Development should issue new administrative guidance addressing a series of more narrow issues related to the global minimum corporate tax known as Pillar Two before the end of the year, an OECD official said Tuesday.

The upcoming guidance will focus on the country-by-country reporting safe harbor and how certain activities should be accounted for when determining whether a multinational qualifies, said John Peterson, acting head of the OECD's cross-border and international tax division. Peterson spoke during a panel at a conference hosted by the OECD and U.S. Council for International Business in Washington, D.C.

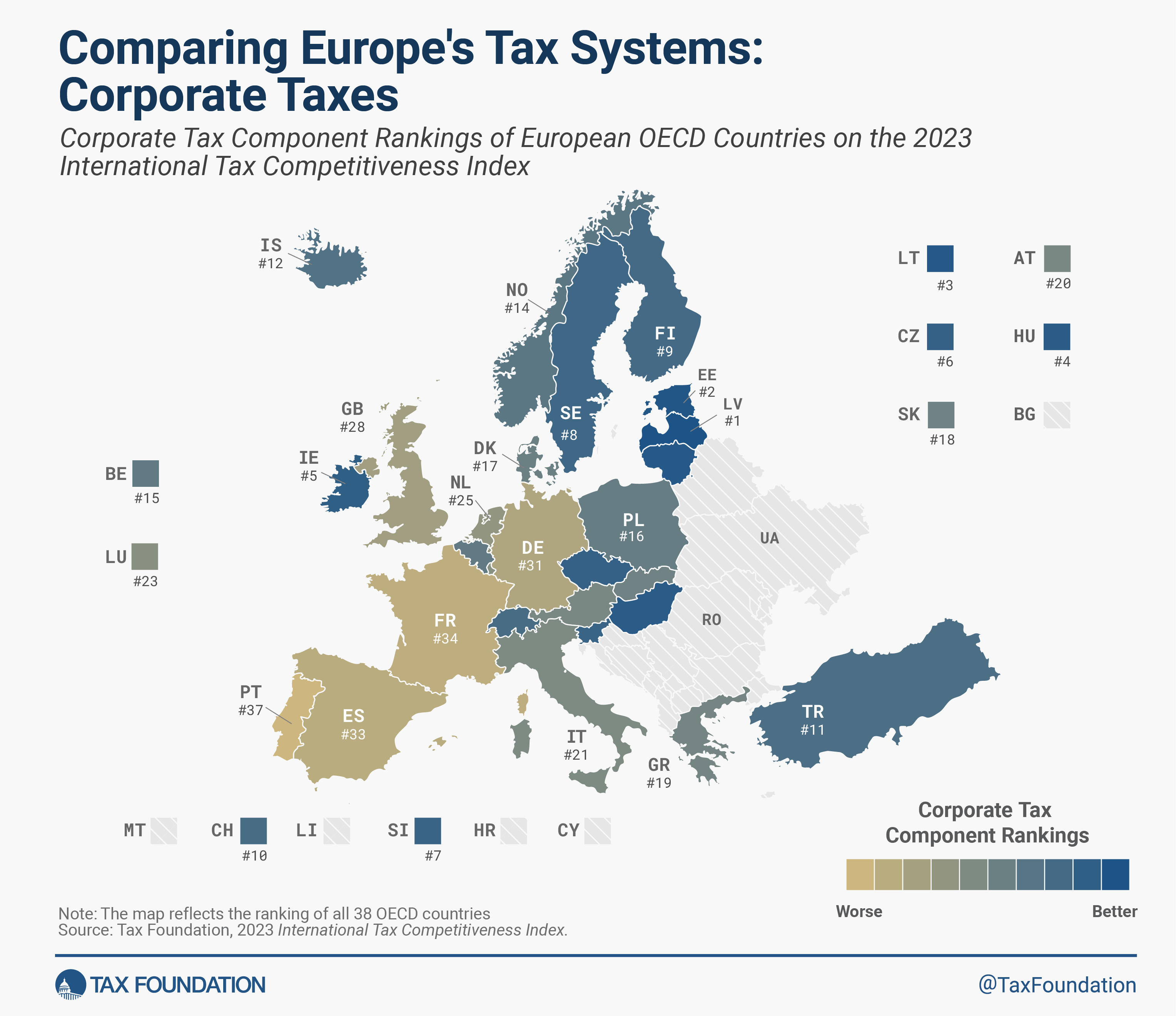

Comparing Europe’s Tax Systems: Corporate Taxes – Alex Mengden, Tax Foundation:

Unlike other studies that compare tax burdens, the Index measures how well a country structures its tax code. A tax code that is competitive and neutral promotes sustainable economic growth and investment and raises revenue for government priorities with minimal distortions. Our corporate income tax component scores countries not only on their corporate tax rates but also on how they handle net operating losses, capital allowances, inventory valuation, and allowances for corporate equity; whether and to what extent distortionary patent boxes and research and development (R&D) tax incentives are granted; the application of digital services taxes; and the complexity of the corporate income tax.

From the “I wish I knew this yesterday” file:

Halloween Candy Raises Spooky Tax Questions – John Buhl, Tax Policy Center:

What scares come to mind when purchasing Halloween candy: ghosts, witches, or taxes? Yes, taxes should be on the list because Halloween reminds us how simple-sounding policy can end up downright spooky (or at least confusing).

Almost every state with a sales tax offers reduced rates or exemptions for groceries to help people afford essential food items.

But just as policymakers want to make nutritious food more affordable, they often don’t want to subsidize or encourage shoppers to buy unhealthy items. As a result, candy gets slapped with a tax even if it’s bought in a grocery store along with untaxed milk and bread. That’s why you may see more taxable line items on your receipt when stocking up for Halloween supplies compared to your regular grocery bill.

Yesterday, I bought ten-loads of candy fearing that we would run out as trick or treaters invade our porch. We live on a busy street so few visits were made to our home. I basically incurred a huge tax payment for no apparent reason.

Halloween hangovers. Happy Day of the Dead and All Saints Day! The first deals with Mexicans welcoming deceased relatives to visit them. The second honors all saints of the Roman Catholic Church.

Make a habit of sustained success.