Key Takeaways

- Debt and taxes

- Like-Kind exchange deadlines

- Drought and tax filings

- Non-profit = profits

- Ex-Pats and E-filing

- Ex-Pats seeking permanent exit

- Happy Indigenous Peoples Day!

When Does Federal Debt Reach Unsustainable Levels? – Jagadeesh Gokhale, Kent Smetters and Mariko Paulson, Penn Wharton Budget Model (PWBM):

Summary: PWBM estimates that---even under myopic expectations---financial markets cannot sustain more than the next 20 years of accumulated deficits projected under current U.S. fiscal policy. Forward-looking financial markets are, therefore, effectively betting that future fiscal policy will provide substantial corrective measures ahead of time. If financial markets started to believe otherwise, debt dynamics would “unravel” and become unsustainable much sooner.

What does this have to do with taxes? There are basically three ways the Federal government can reduce its debt: 1. Cut spending. 2. Increase current taxes, or 3. Create a new tax system.

For decades, lawmakers have been discussing the advent of a new tax system that would co-exist with the current tax system. Much of this discussion has been about creating a VAT (Value Added Tax), which basically taxes a product as it goes from raw material to finished product.

The odds of lawmakers enacting a VAT are very long. Congress is politically divided, and 'bipartisanship' is currently a dirty word on Capitol Hill.

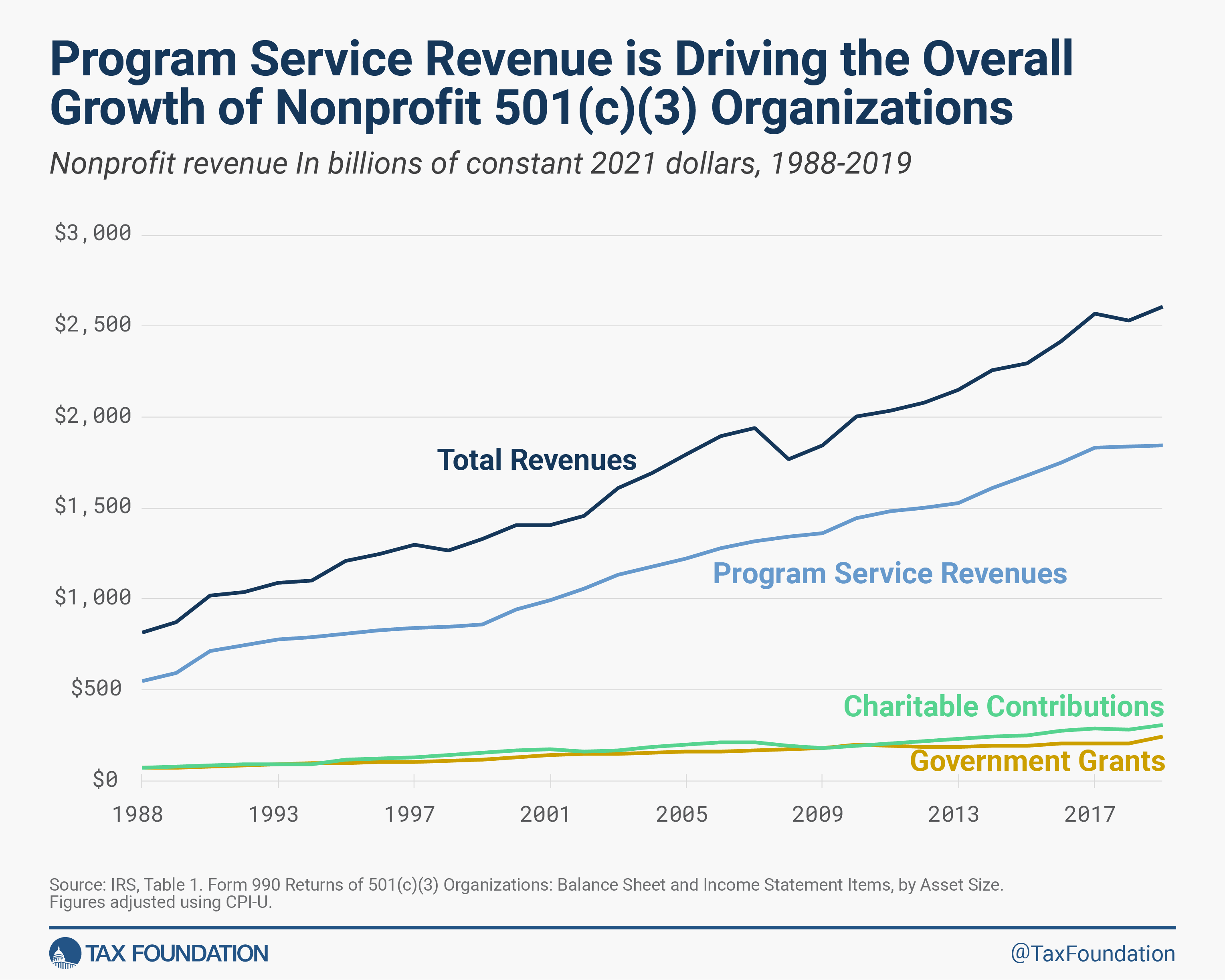

Nonprofits are Financially Healthy and Doing Big Business – Scott Hodge, Tax Foundation:

Based on IRS data, 501(c)(3) tax-exempt nonprofit organizations have never been financially healthier than they are today. In 2019, the latest data available, revenues from charitable donations reached a record high in both nominal and inflation-adjusted terms.

Moreover, total revenues—including government grants and program service income—also reached record levels. Total nonprofit revenues now equal 12 percent of GDP.

Like-Kind Exchange Deadlines That Fall on Weekends and Holidays - Bradley Borden, Tax Notes ($):

In this article, Borden examines several court decisions that have extended section 7503 deadlines to the next business day, and he argues that the same extension applies to the deadlines under section 1031 for like-kind exchanges of property.

Farmers & ranchers in 49 states get drought tax relief – Kay Bell, Don’t Mess with Taxes:

The agency late last month reminded eligible farmers and ranchers forced to sell livestock due to drought that they may have an extended period of time in which to replace the livestock and defer tax on any gains from the forced sales.

The extension of an additional year applies to eligible farmers and ranchers who qualified for the four-year, instead of two-year, replacement period, if they are in a region listed by the National Drought Mitigation Center as suffering exceptional, extreme, or severe drought conditions during any week between Sept. 1, 2022, and Aug. 31, 2023.

The IRS reminder is here.

Americans Abroad: IRS’s E-Filing Plan Won’t Solve the Problem! - Virginia La Torre Jeker, Tax Notes ($):

Taxation is a fundamental aspect of any country’s financial system, and the United States is no different. However, the complexity of the U.S. tax system, especially for Americans living abroad, has been a subject of concern and debate for quite some time.

An excellent recent article by Nana Ama Sarfo in Tax Notes1 discusses U.S. litigation about taxpayer privacy and how a so-called pixel incident is causing lawmakers to consider alternatives. Sarfo’s article explores the initiatives of foreign tax agencies offering free direct e-filing services to their taxpayers and how their models could assist the IRS as it examines the possibility of a direct e-filing system. That’s right — bypassing return preparers may be on the horizon.

The Tax Notes article mentioned is here (subscription required).

Speaking of Ex-pats, from the “Payback can be a Pain” file:

Former Americans Who Gave Up Their Citizenship Want Their Money Back – Sopan Deb, New York Times:

Former U.S. citizens who live abroad have filed a class-action lawsuit saying the $2,350 fee to relinquish their nationality was exorbitant.

The State Department on October 9th lowered the fee to $450.

Ex-pats want their $1,900 back.

Can’t say I blame them, but the State Department doesn’t seem into it:

The State Department declined to comment on the lawsuit. But in its proposal announcing the fee shift on Monday, it said that citizenship renunciations were “extremely costly for the department, requiring consular officers and employees overseas,” as well as in the United States, to “spend substantial time” handling those requests. It said that in 2010 the $450 fee “represented less than 25 percent of the cost to the U.S. government.”

What’s the tax angle? The Foreign Account Tax Compliance Act.

The act made filing taxes compulsory for Americans with foreign assets living abroad, despite the fact that many of them do not have strong ties to the United States….

The United States is one of only a few countries that levy taxes based on citizenship rather than geography. This means that Americans living abroad must file a tax return, and they may find it more difficult to open a bank account, because of reporting rules for foreign banks imposed by the U.S. government.

Happy Indigenous Peoples' Day!

PBS:

Why is it called Indigenous Peoples Day?

Indigenous Peoples Day has been recognized for decades in different forms and under a variety of names to celebrate Native Americans’ history and culture and to recognize the challenges they continue to face.

In 2021, Biden issued the first-ever presidential proclamation of Indigenous Peoples Day. He said in a statement that the day is meant to “honor America’s first inhabitants and the Tribal Nations that continue to thrive today.”

Make a habit of sustained success.