Welcome to our first state and local tax roundup! State taxes are a big part of business tax planning. State legislatures are busy this time of year. Eide Bailly's SALT team is watching them closely. We will share their observations here.

The posts will start with items of multi-state import, followed by an alphabetical list of state developments. We will try to identify legislative items that either have been enacted or seem to have a good chance of passing. The posts will end with something that we hope will make it worth your while to scroll to the bottom.

We hope this proves useful to you. Please send any comments or tips to me at jkristan@eidebailly.com.

Billionaires in blue states face coordinated wealth-tax bills - Julie Zauzmer Weil, Washington Post:

Left-leaning proponents of taxing the assets held by America’s billionaires have a new target: In lieu of a federal wealth tax, state lawmakers want to tax billionaires where they live, in states like California, Washington and New York.

A group of legislators in statehouses across the country has coordinated to introduce bills simultaneously in seven states later this week, with the same goal of raising taxes on the rich.

The states involved are California, Connecticut, Hawaii, Illinois, Maryland, New York, and Washington. The article notes that prior attempts to advance wealth taxes in some of these states have failed to advance. Higher income taxes have a better chance of advancing than wealth levies.

Related coverage:

Several States Make New Moves to Tax Wealth – ITEP

State Wealth Tax Proposals Take Aim at Investment - Tax Foundation.

Supreme Court To Decide If “Home Equity Theft” Is Unconstitutional - Nick Sibilia, Forbes. "The U.S. Supreme Court agreed to hear the case of Geraldine Tyler, a 94-year-old widow who had her entire home’s equity confiscated after she failed to pay $2,300 in property taxes. Although the case stems from a property tax dispute in Hennepin County, Minnesota, it could have nationwide implications for real estate and the Bill of Rights."

State-by-state update

Arizona

Arizona Corporate Tax Cut Bill Advances in House - Paul Jones, Tax Notes ($). "The bill’s passage out of the first two committees this early in the session doesn’t guarantee it a speedy path through the legislature. Garrick Taylor, a spokesman for the Arizona Chamber of Commerce and Industry, said the legislation 'has a long way to go,' noting that even if the Legislature passes it, newly sworn-in Gov. Katie Hobbs — a Democrat who doesn’t share former Republican Gov. Doug Ducey’s enthusiasm for large tax cuts — 'may have other ideas.'"

Link: HB2003

Colorado

Hawaii

Hawaii Bills Propose Tax Cuts And Credits Advocated By Gov - Jaqueline McCool, Law360 Tax Authority ($). H.B. 1049 and S.B. 1347, which were introduced and passed their first vote in their respective chambers Wednesday, would restructure the state's income tax brackets and cut income tax for all brackets, double the standard deduction from $2,200 to $5,000 for individual filers, and double the personal exemption from $1,144 to $2,288. The bills would also create tax credits for teacher expenses and for renters." Links: H.B. 1049 and S.B. 1347.

Hawaii Bills Propose Entity-Level Tax To Bypass SALT Cap - Jacqueline McCool, Law360 Tax Authority ($). "Hawaii would give pass-through entities a workaround to the $10,000 federal cap on state and local tax deductions by letting them elect to pay at the entity level under bills introduced in the state Legislature." Links: S.B. 1437 and H.B. 1362

Iowa

Iowa Pass-through Entity Tax Introduced. A bill that would give Iowa an optional pass-through entity tax as a SALT deduction cap workaround has cleared a House Ways and Means Subcommittee. The bill as introduced would be effective for years ending on or after December 31, 2022. Some version of the bill is likely to pass this legislative session, but not necessarily with this due date, according to a lobbyist familiar with the bill. Link: HSB 69.

Kentucky

Kentucky expands services subject to sales tax effective January 1, 2023 Link: Kentucky Sales Tax Facts.

Kansas

Kansas' Gov.-Backed Bills Would End Tax On Groceries - Jacqueline McCool, Law360 Tax Authority ($).

S.B. 57 and H.B. 2111 would immediately bring Kansas' sales tax on groceries to zero. The bill would also exempt feminine hygiene products and diapers from tax. In 2022, Kelly signed a bill reducing the tax on groceries from 6.5% to 4% beginning Jan. 1, 2023. The rate is currently set to drop to 2% beginning in 2024 and to zero in 2025.

S.B. 56 and H.B. 2109 would increase the income threshold for those exempt from paying state income tax on Social Security income. Under the bills, the threshold would be raised from $75,000 to $100,000.

Michigan

Mich. Gov. Whitmer Seeks To Nix Retirement Tax, Raise EITC - Paul Williams, Law360 Tax Authority ($). "Whitmer, a Democrat, said in her State of the State address on Wednesday that she wants to do away with the state tax on pensions and other retirement income and raise the level of the EITC. The governor said doing both would provide hundreds of millions of dollars' worth of tax cuts to state residents."

Missouri

MO PTET Return and Instructions - Melissa Menter, Eide Bailly. "Missouri released form MO-PTE, 2022 Pass-Through Entity income tax return. Partnerships and S corporations electing to become affected business entities must file the return on or before the 15th day of the fourth month following the end of the tax year. If an affected business entity extends its federal income tax return, Form MO-PTET is automatically extended." Links: Pass-Through Entity Tax FAQs (Missouri Department of Revenue); Form MO-PTE.

St. Louis Ordered To Issue Tax Refunds To Teleworkers – Paul Williams, Law360 Tax Authority ($). “St. Louis must issue earnings tax refunds to a group of remote workers for days worked outside the city after the start of the COVID-19 pandemic, a Missouri judge ruled Thursday, saying the city improperly applied the tax to telecommuters.”

Montana

Mont. Gov. Proposes More Income Tax Cuts - Michael Nunes, Law360 Tax Authority ($). "Republican Gov. Greg Gianforte delivered his address Wednesday evening, promising that the state would reduce the state's top individual marginal tax rate to 5.9% and enact property tax relief for small businesses in the state."

Minnesota

MN Updates Conformity for 2017-2022 - Melissa Menter, Eide Bailly. "MN passed legislation updating conformity with the Internal Revenue Code through December 15, 2022. Taxpayers who filed a MN income tax return with a nonconformity schedule for years from 2017-2021 may need to file amended returns. The statute of limitations to claim a refund related to these changes has been extended to December 31, 2023." Link: 2023 Federal Conformity for Income Tax, Minnesota Department of Revenue.

Nebraska

Nebraska Governor Announces Tax Relief Package - Emily Hollingsworth, Tax Notes ($):

Taking a phased approach, L.B. 754 would reduce the top individual income tax rate from 6.84 percent to 6.27 percent for tax year 2023; to 5.70 percent for 2024; to 5.14 percent for 2025; to 4.56 percent for 2026; and to 3.99 percent for 2027. The bill would also reduce the top corporate income tax rate from 7.25 percent to 6.80 percent on all taxable income over $100,000 for tax year 2023 and phase it down each year to reach 3.99 percent for 2027.

The state's top individual income tax bracket applies to single filers with incomes above $29,000 and joint-filing taxpayers with incomes above $58,000.

North Dakota

ND Bill Would Swap Progressive Income Tax For Flat Tax - Michael Nunes, Law360 Tax Authority ($):

North Dakota would scrap its progressive income tax regime and establish a 1.5% flat tax as part of a bill introduced in the state's House of Representatives, roughly following a proposal put forward by the governor.

Introduced Tuesday, H.B. 1158 would levy a 1.5% rate on income over $44,725 for individuals and $74,750 for joint filers. Republican Gov. Doug Burgum in his State of the State address that same day urged lawmakers to pass his tax package, which included the 1.5% flat tax but put thresholds higher, at $54,725 for single filers and $95,600 for joint filers.

South Dakota

SD House Tax Panel OKs Ending Remote Sales Threshold - Zak Kostro, Law360 Tax Authority ($):

South Dakota would simplify criteria dictating which remote sellers must collect and remit the state's sales tax by removing a threshold based on the number of sales into the state under a bill the state House Taxation Committee advanced Thursday.

S.B. 30, which passed the committee by a 10-3 vote after a hearing, would eliminate the 200-transaction threshold for sales of tangible personal property, products transferred electronically or services delivered into the state, according to the bill text. Under current law, a remote seller is defined as a business without a physical presence in South Dakota that in the previous or current calendar year achieved gross sales exceeding $100,000 or completed 200 or more separate transactions into the state, according to the bill.

Link: SB 30

Washington

Wash. Justices Question Capital Gains Tax Constitutionality - Maria Koklanaris, Law360 Tax Authority ($):

Washington state justices questioned Thursday whether the state's capital gains tax, the only one in the nation in a state without an income tax, is permissible under both the Washington state and U.S. constitutions.

The justices grappled with those issues during an oral argument in which they peppered both sides with queries at a fast clip. In the case, the state is appealing a March 1 ruling by a lower court invalidating the tax. A group of individuals who are challenging the state had sued to strike it on grounds that it ran afoul of a provision in the Washington Constitution declaring all income to be property, and of the dormant commerce clause of the U.S. Constitution.

West Virginia

W.Va. House Approves Income Tax Rate Cuts - Jaqueline McCool, Law360 Tax Authority ($). "Under the bill, in the first year, individual and married filers with income up to $5,000 would see their tax rate reduced to 2.1%. Filers with income from $5,000 to $12,500 would be taxed at 2.8%; income over $12,500 up to $20,000 would be taxed at 3.15%; income over $20,000 up to $30,000 would be taxed at 4.2%; and income over $30,000 would be taxed at 4.55%."

General State Tax News

The 2023 ROAM Index: How State Tax Codes Affect Remote and Mobile Workers - Andrew Wilford, National Taxpayers Union Foundation. "This inaugural edition of the Remote Obligations and Mobility (ROAM) Index ranks states on the burdens they place upon remote and mobile workers and their employers. Remote workers are defined in this analysis as employees who work either fully remote or on a hybrid schedule of commuting to work and working from home. Mobile workers are employees who travel around the country as part of their job. This report uses laws as they stood as of the end of 2022."

New Hampshire rates best, Delaware worst.

Related: Telecommuting Workers in Refuge States Complicate State Taxes.

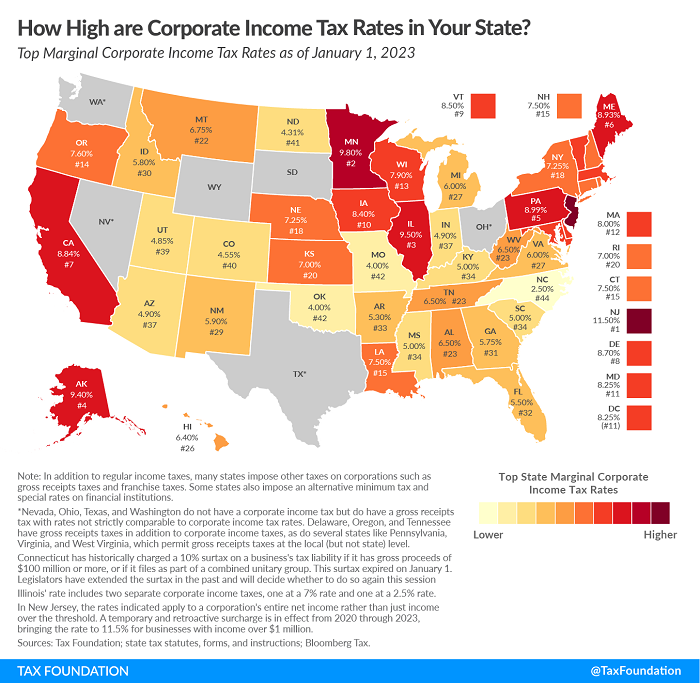

State Corporate Income Tax Rates and Brackets for 2023 - Janelle Fritts, Tax Policy Blog. "Corporate income taxes are levied in 44 states. Though often thought of as a major tax type, corporate income taxes accounted for an average of just 7.07 percent of state tax collections and 4.04 percent of state general revenue in fiscal year 2021. And while these figures are not high, they represent a substantial increase over prior years. Corporate income taxes accounted for 2.26 percent of general revenue in FY 2020, which is more in line with historical norms."

Did you know? Wisconsin enacted the first modern state income tax in 1911.

Make a habit of sustained success.