SECURE 2.0 Error Would Prohibit 401(k) Catch-up Contributions - Austin Ramsey, Bloomberg ($):

A technical glitch in the massive retirement access bill Congress passed late last year would prohibit older workers from making catch-up 401(k) contributions in 2024 unless lawmakers or the IRS fix it this year.

Part of the SECURE 2.0 Act (Pub.L. 117–328) legislation President Joe Biden signed into law in December was intended to require the contributions workers nearing retirement make to their accounts to be post-tax Roth deferrals. The elimination of a key paragraph in the bill during the drafting process inadvertently eliminated catch-up contributions entirely.

That error, first spotted by counsel at the American Retirement Association, can be reversed by a technical correction in Congress or by guidance from the IRS. The process for technical corrections on the Hill has already begun, and the ARA brought the catch-up contribution issue to the Joint Committee on Taxation and the Treasury Department. It’s still unclear whether the error requires legislative or regulatory input.

If a legislative fix is required, Katy bar the door. It will be a must-pass bill and every lawmaker will try to attach every pet proposal to it. It will likely wind up a "Christmas Tree," which in congressional parlance means a bill that includes too many provisions and can't pass Congress. Not good.

What's currently in the bill:

BTAX Roadmap: Secure 2.0 Act - Seyi Tuyo and Nadia Masri, Bloomberg ($):

The recently enacted SECURE 2.0 Act imposed a number of sweeping changes to how Americans save for retirement. The most significant changes include new requirements to auto-enroll employees in employer offered 401(k) plans. The law also directs certain plans to offer automatic contribution percentages and annual increases, or face penalties.

Manufacturers’ Lobby Urges Tax Writers to Prioritize R&D Expensing – Lauren Vella and Chris Cioffi, Bloomberg ($):

The largest US manufacturing industry group called on leaders of Congress’ top tax-writing panels to ‘act without delay’ and restore popular tax breaks in areas like research and development.

This group, the National Association of Manufacturers, has been beating this drum for awhile. Currently, the optimistic view is that a tax bill will get done later this year – like year-end. If a recession rocks the economy, a tax bill might happen sooner. The pessimistic view is that a tax bill will not happen in this Congress (2023 – 2024) because the two political parties can’t agree on expanding the Child Tax Credit.

Twenty-four GOP senators warn they will oppose debt limit increase without fiscal reforms – Alexander Bolton, The Hill:

Nearly half of the Senate Republican Conference has signed on to a letter to President Biden warning they will not vote for any bill to raise the nation’s debt limit unless it’s connected to spending cuts to address the nation’s $31 trillion debt.”

The letter, led by conservative Sens. Mike Lee (R-Utah) and Ted Budd (R-N.C.), says it is the policy of the Republican conference that any increase in the debt ceiling must be accompanied by cuts in federal spending or ‘meaningful structural reform in spending.’

Reality check: If 24 of the 49 Senate Republicans refuse to increase the debt ceiling without spending cuts, then 25 Senate Republicans might be open to increasing the debt ceiling without spending cuts. Assuming all Democrats support a "clean" debt ceiling increase (i.e., with no spending cuts), it'll only take nine Senate Republicans to pass legislation from the upper chamber. The House, however is a different situation. Republicans control that chamber and could block "clean" debt ceiling legislation from receiving a floor vote.

W.H. will release budget in early March - Jake Sherman and John Bresnahan, Punchbowl News ($):

The Biden administration plans to release the president’s budget March 9, according to multiple sources familiar with the plan.

Federal law mandates that the White House submit a budget to Congress on the first Monday in February. But on more than 20 occasions during the last century, the president has blown past the deadline. President Joe Biden will continue that tradition this year, sources tell us.

If President Biden proposes tax increases or cuts, it will be in this document.

Court Rejects Car Dealer’s Emergency Motion in Collection Case – Mary Katherine Browne, Tax Notes ($):

A former car dealership owner crashed and burned in his attempts to lift levies placed on his promissory note installments after he failed to pay income taxes and pay over employment taxes for one of his businesses.

In a January 27 opinion and order in United States v. Varner, Judge J. Philip Calabrese of the U.S. District Court for the Northern District of Ohio denied Richard W. Varner’s emergency motion to return collection jurisdiction to the IRS for an appeal.

IRS Proposes Surprise Change to REIT Domestic Control Rules – Chandra Wallace, Tax Notes ($):

Proposed regulations issued just before year-end would change the way domestic control is determined — an unwelcome surprise for foreign investors in real estate investment trusts, tax professionals say.

REG-100442-22, 2023-3 IRB 423, released December 28, 2022, includes a “real fun surprise” that affects taxable foreign investors in REITs, Kendal A. Sibley of Hunton Andrews Kurth said during a January 30 Practising Law Institute event. That surprise will make it more difficult for foreign investors in REITs to qualify for favorable tax treatment, she said.

Trump Peppered IRS for Details About Release of His Tax Returns - Laura Davison, Bloomberg ($):

Donald Trump demanded reams of information from the Internal Revenue Service as it was preparing to turn over his personal tax returns to a congressional committee, papering the agency with a deluge of Freedom of Information Act requests in search of a behind-the scenes look at its deliberations, new documents show.

Further down the article:

Trump’s decision to use the public records request law to get information from his own government is unconventional, largely because as commander-in-chief and leader of the Executive Branch he has numerous options to get data from federal agencies that don’t require him to use a last-resort tool available to anyone.

IRS Provides New Rules on Accounting Method Used by Developers - Naomi Jagoda, Bloomberg ($). “The IRS has released new guidance for an accounting method real-estate developers can use to determine when common improvement costs can be included in the basis of a project’s individual units.”

Could taxed marijuana sales lower Texans’ property taxes? - Sarah Self-Walbrick, KERA News. "It’s estimated that’s state could add at least 400 million dollars in revenue if it legalized and taxed cannabis sales. What could that go toward? Well, [Jake] Syma [president of Lubbock’s chapter NORML, the National Organization for the Reform of Marijuana Laws] believes offsetting property taxes is a good option.

‘If Governor Abbott wants to declare victory for all property owners in Texas, this is a good way to approach it in my opinion,’ he said.

Low-Carbon Concrete Tax Incentives Signed into Law in New Jersey - Stephen Lee, Bloomberg ($). “New Jersey Gov. Phil Murphy (D) on Monday signed a bill that gives businesses tax credits for using concrete made with lower carbon emissions.”

Chip Maker Entitled to $152 Million Refund for NY Tax Credits – Perry Cooper, Bloomberg ($). “Semiconductor manufacturing company GlobalFoundries U.S. Inc. will get a $152 million refund on its corporate income taxes for carryover Empire Zone investment tax credits, resulting in a 100% refund for 2014, a New York tribunal ruled.”

Idaho Tax Commission Publishes Information on E-Filing Individual Income Taxes – Bloomberg ($):

The Idaho State Tax Commission Jan. 1 published information on electronic filing for individual income taxes. Taxpayers can prepare income tax returns and file them electronically using tax software. Taxpayers must use the same tax software if they choose to e-file both their federal and state returns.

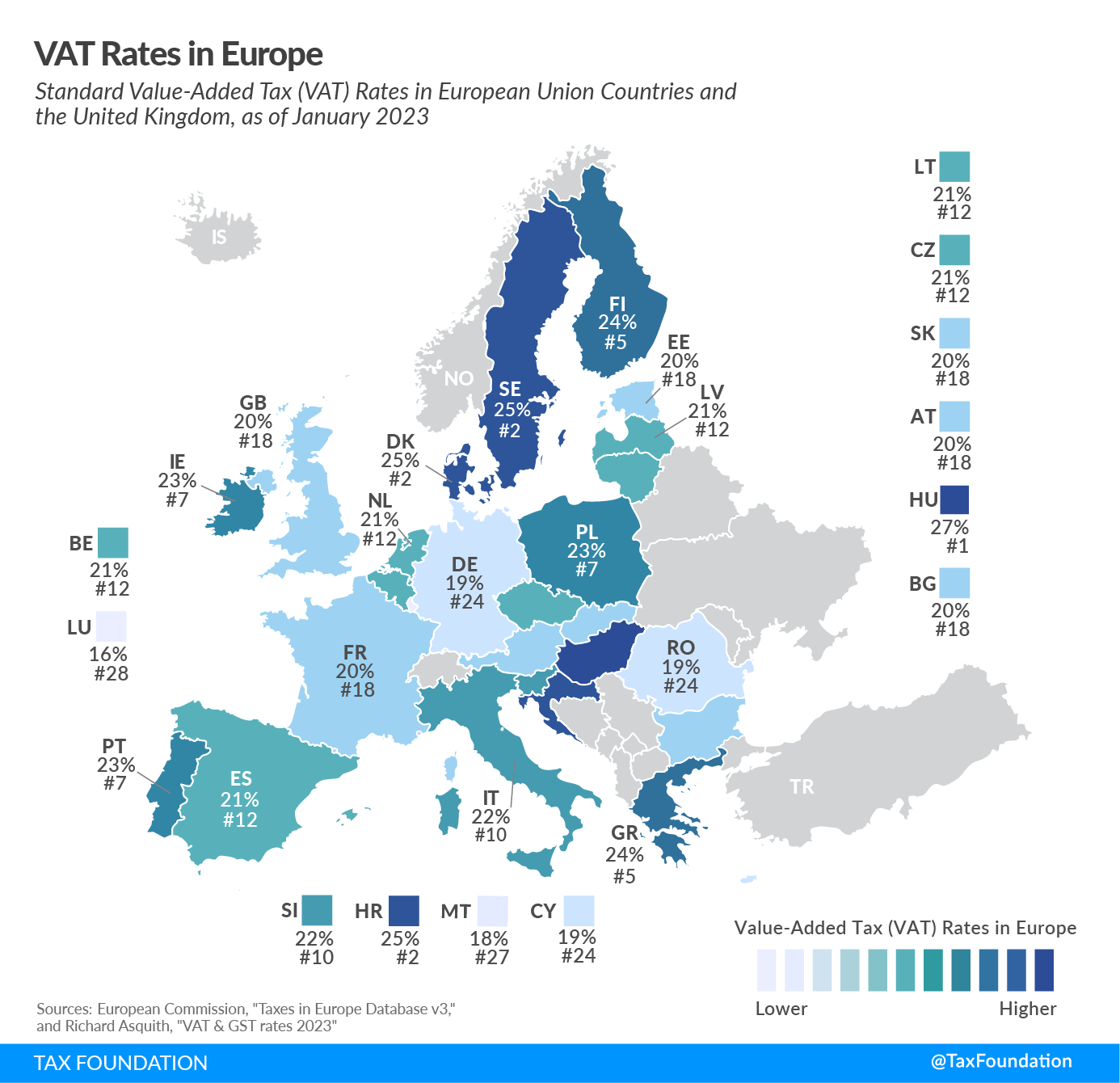

2023 VAT Rates in Europe – Cristina Enache, Tax Foundation:

More than 170 countries worldwide—including all European countries—levy a Value-Added Tax (VAT) on goods and services. As today’s tax map shows, EU Member States’ VAT rates vary across countries, though they’re somewhat harmonized by the European Union (EU).

VATs have been discussed by U.S. lawmakers and the common thought is for a VAT to be enacted the political parties would have to switch positions.

Currently:

- Democrats oppose a VAT because it would be a regressive tax on poorer people.

- Republicans oppose a VAT because it taxes richer taxpayers.

For a U.S. VAT to be enacted, these positions would have to switch. So:

- Democrats would support a VAT because it taxes richer taxpayers.

- Republicans would support a VAT because it taxes poorer people, which means they are paying some level of tax and have 'skin in the game.'

Notice that these arguments have nothing to do with the tax itself. They are based on party positions. Welcome to the Nation's Capital.

Oil Industry Pushes for Drilling Cost Adjustment in Book Minimum Tax - Lauren Vella, Bloomberg ($):

The oil and gas industry is lobbying lawmakers and the Treasury to get an adjustment for intangible drilling costs included when calculating the corporate alternative minimum tax.

Industry groups representing these energy companies argue intangible drilling costs, or IDCs, are a unique capital investment category that should be eligible for a tax incentive similar to tangible assets for other industries.

Lobbyists say if the corporate alternative minimum tax, or CAMT, is not amended to include IDCs, it will limit companies’ cash flow and, along with it, the extent to which they can invest in new drilling projects and clean energy projects incentivized in the Inflation Reduction Act.

From the “Inside Baseball” file:

The tax-writing House Ways and Means Committee will officially begin publicly working on legislation (and investigations) today.

Announcement from the Committee:

Chairman Smith has scheduled an Organizational Meeting of the Committee on Ways and Means to be held in 1100 Longworth House Office Building on Tuesday, January 31, 2023, at 10:00 AM.

The tax-writing Senate Finance Committee is expected to be up-and-running soon.

Bloomberg (after linking to website, scroll down):

Senate Majority Leader Chuck Schumer (D-N.Y.) said on the Senate floor that he expects committee rosters to be finalized by the end of this week.

The 14 Democrats on the Finance Committee are the same as the last Congress, but Republicans have not named their members yet.

It will be interesting to see if these two committees will agree on any piece of legislation. According to public statements from their respective chairmen, it seems they will be focused on different subjects.

For example, the House Ways and Means Committee is expected to hold a “field hearing” (i.e., a hearing held in a Member’s district and not in the Capitol) next month. The hearing is expected to focus on how working folks and their families are affected by the current state of the economy. Democrats on the Committee were told that the hearing will be about "woke" corporations, according to a source close to the Democratic party. If true, whatever emerges from this hearing will likely not gain any attention from the Senate Finance Committee.

Happy National Plan for Vacation Day! Today “reminds us to plan our vacation at the start of the year for the rest of the year,” according to National Day Calendar. On it!!

Make a habit of sustained success.