Programming note: Tomorrow we will introduce a regular roundup of state and local developments. We will post this on Friday afternoons throughout the spring state legislative season, highlighting legislative and other news in the SALT world. After all, most of us live or work in a state!

Heavy Scrutiny of Credit Claims Expected After IRS Funding Boost - Lauren Loricchio, Tax Notes ($):

With the IRS receiving roughly $80 billion in additional funding from the Inflation Reduction Act (IRA, P.L. 117-169) to spend through fiscal 2031, “expect a lot of audits with the credits that are out there right now,” Stephen J. Turanchik of Paul Hastings LLP said January 24 at the University of Southern California Gould School of Law Tax Institute.

“There’s a lot of fraud out there and we’re going to see it as more and more credits are claimed,” according to Turanchik, a former attorney with the Justice Department tax division. The IRS will receive $45.6 billion that is dedicated for enforcement from the IRA.

Neb. Gov. Calls For Income Tax Cuts, Property Tax Relief - Michael Nunes, Law360 Tax Authority ($):

Republican Gov. Jim Pillen called on lawmakers to lower property taxes in the state and recommended cutting the state's top income tax rates for individuals and corporations to 5.84% in 2023 and 2024, with further reductions taking the rate to 3.99% by 2027. The top rates are currently set at 6.64% for individuals and 7.25% for corporations in 2023.

...

Last year, the state enacted a law lowering the top individual income tax rate from 6.84% to 6.64% in 2023 and 6.44% in 2024, and the corporate rate from 7.5% to 7.25% in 2023 and 6.5% in 2024. Both rates are set to decrease to 5.84% by 2027.

Who Goes First on Your Joint Tax Return? Probably Not the Woman - Richard Rubin, Wall Street Journal.

According to a first-of-its-kind assessment from researchers from the U.S. Treasury Department and the University of Michigan, men’s names were listed first on 88% of joint returns filed by opposite-sex married couples in 2020. That figure has trickled down a little since 1996, when nearly all returns—97%—listed the man’s name first.

...

There is now someone in America with the actual title of Second Gentleman. That is Douglas Emhoff, a lawyer who is married to Vice President Kamala Harris, and who slowed his career down after her election. Yet on their tax return, the Second Gentleman is Number One, while Ms. Harris is effectively Vice Taxpayer. (The vice president’s office didn’t respond to a request for comment.)

If taxpayers heed the advice of the IRS, the "ladies not first" rule will only erode via time, death, and divorce: "The Internal Revenue Service instructions for Form 1040 include a tip for taxpayers: If you are filing a joint return with the same spouse as last year, put your names and Social Security numbers in the same order as last year." Also bonus points for describing IRS return processing operations as a "labyrinth of sadness."

Democratic Congressional Leaders Pour Cold Water on Enacting ‘Fair Tax’ - Jay Heflin, Eide Bailly:

The House is expected to vote on legislation that would impose a national sales tax on the use or consumption of taxable property or services in the U.S. The levy would replace the current tax system.

House Republican leaders have yet to announce when a vote will occur on the legislation. If a vote occurs, it is not clear if the bill will pass the chamber unless House Speaker Kevin McCarthy (R-Calif.) pushes his caucus to support it.

This from Renu Zaretsky (Daily Deduction) doesn't make we want to bet on house passage: "Speaker Kevin McCarthy has told reporters he opposes the Fair Tax Act, which would levy a 30 percent national sales tax. McCarthy reportedly promised a House vote on the legislation to secure the Speaker’s gavel. Now it appears the bill first may be referred to the Ways & Means Committee, where it may get no more than a hearing. At least three Republican congressmen have pledged to oppose the bill."

If three Republicans are already in opposition, it's hard to see Fair Tax advancing given the five-vote GOP House majority.

The IRS Paused New Crypto Form 1099 Tax Reporting Rules for Brokers - Paul Sirek and Jenny McGarry, Eide Bailly. "The Internal Revenue Service recently released Announcement 2023-2 allowing brokers to postpone new digital asset reporting (as of December 23, 2022) until final regulations are issued."

Manchin Bill Calls For Pause Of EV Tax Credit - Madeline Lyskawa, Law360 Tax Authority ($). "U.S. Sen. Joe Manchin announced a bill Wednesday pushing the U.S. Department of the Treasury to ensure compliance with certain supply chain requirements before implementing new consumer electric vehicle tax credits, as intended by the Inflation Reduction Act of 2022."

Congress is not expected to move on a delay.

How to make your home more energy efficient — and get a tax break too - Erica Werner, Washington Post. "Induction ranges can be pricey, though they’re getting more affordable, with models starting around $1,000. The IRA includes an $840 rebate for people with qualifying household incomes to purchase an electric range. Induction ranges and traditional electric coil stoves would qualify. The rebates are available to people making up to 150 percent of the median income in their area."

The 2023 ROAM Index: How State Tax Codes Affect Remote and Mobile Workers - Andrew Wilford, National Taxpayers Union Foundation. "This inaugural edition of the Remote Obligations and Mobility (ROAM) Index ranks states on the burdens they place upon remote and mobile workers and their employers. Remote workers are defined in this analysis as employees who work either fully remote or on a hybrid schedule of commuting to work and working from home. Mobile workers are employees who travel around the country as part of their job. This report uses laws as they stood as of the end of 2022."

New Hampshire rates best, Delaware worst.

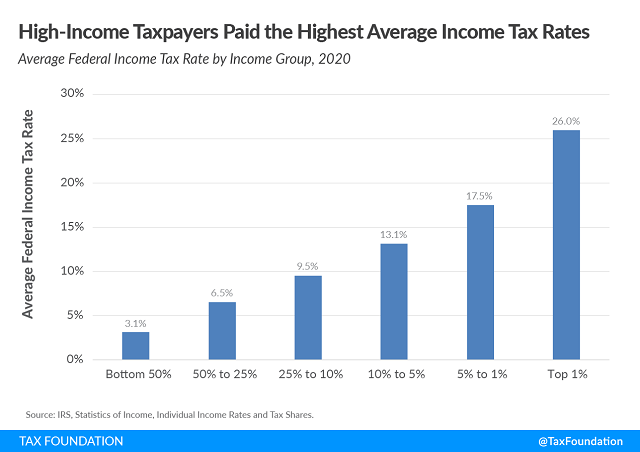

Summary of the Latest Federal Income Tax Data, 2023 Update - Erica York, Tax Policy Blog. "Taxpayers reported more than $12.5 trillion in AGI on 157.5 million tax returns in 2020, an increase of $650 million in AGI and 9.3 million in returns above 2019. Total income taxes paid rose by $129 billion to $1.7 trillion, an 8 percent increase above 2019. The average individual income tax rate inched up slightly from 13.29 percent in 2019 to 13.63 percent in 2020."

8 tax tips for first-time filers - Kay Bell, Don't Mess With Taxes. "1. Get organized. This is a habit that will serve you well not only for your first-ever filing, but for the rest of your tax life. You'll be glad you established a good organizational habit from the get-go. By now, you should have received all the tax documents you need to file. This checklist also can help you see what other information you might need to file, such as charitable donations, work-related expenses, college expenses, and medical coverage costs. The bottom line is that you definitely can't file until you get a W-2 form if you were a salaried employee."

Success of Atlanta Braves Spinoff Hinges on One Tax Code Section - Robert Willens, Bloomberg. "Unless a trade or business has been actively conducted by the distributing or controlled corporation for at least five years, or has been acquired within the past five years in a wholly tax-free transaction (from a seller who had itself conducted the business for at least five years), the trade or business can’t be relied on for the satisfaction of the active business requirement."

The IRS and Abusive Trust Arrangements: Non-Grantor Trusts - Matthew Roberts, Freeman Law. "To try to avoid the grantor trust rules, tax promoters commonly incorporate language into trust documents that provide that the settlor or grantor is a third party and not the taxpayer. In these instances, the third party generally makes a nominal contribution to the trust and then 'resigns' or removes himself or herself altogether from the trust. Thereafter, the taxpayer contributes more significant assets to the trust. The tax promoter’s purpose in using a third-party settlor here is clear: it is an attempt to distance the taxpayer from application of the grantor trust rules by contending that the true grantor or settlor was the third party and not the taxpayer."

IRS makes permanent flexible installment payment options for some individuals and sole proprietors - Mark Friedlich, Wolters Kluwer Tax & Accounting. "Individuals and sole proprietors who are no longer in business and who owe $250,000 or less in taxes may create a customized installment payment plan that satisfies their liabilities by the end of the collection statute period - with no financial statement required."

Mr. FBAR Gets Bolder in Toth – “Deemed Willfulness” for FBAR Violation - Virginia La Torre Jeker, Virginia - US Tax Talk. "The focus of the appeal was that the FBAR penalty was in constitutional violation of the Eighth Amendment’s Excessive Fines Clause. The First Circuit denied Toth’s appeal on that issue. It held that the Excessive Fines Clause does not apply to civil FBAR penalties because the IRS’ assessment against her was 'not tied to any criminal sanction” and served a 'remedial” purpose (as opposed to a 'punitive” purpose."

Man Sentenced to Federal Prison For Falsifying Gambling Winnings - Rebekah Barton, TaxBuzz. "In addition to his 30-month prison term, [defendant] has been ordered to pay restitution in the amount of $1,771,011.67."

Colorado businessman pleads guilty to tax evasion - IRS (defendant name omitted):

According to court documents, Defendant, of Bow Mar, co-owned restaurants and an oil production business, which had employees from whose paychecks he withheld income taxes and Social Security and Medicare taxes. From at least 2002 and continuing for many years, Defendant did not pay over the withheld payroll taxes to the IRS or file the required payroll tax returns for his businesses. In an effort to prevent the IRS from collecting the taxes he owed through bank levies, Defendant kept the balances of his personal and business bank accounts low, often leaving them with only $0.01. To do so, Defendant, or an employee acting at his direction, transferred just enough funds to cover expenses and then transferred any remaining money to a bank account not subject to IRS levy. In total, the defendant caused a tax loss of approximately $737,128.

Few things are as likely to attract intense IRS attention as failure to remit withholding. Taking your bank account to one cent doesn't help.

Open wide. Today is National Dental Drill Appreciation Day!

Make a habit of sustained success.