IRS clarifies crypto question on tax form - Michael Cohn, Accounting Today:

The IRS said the digital assets can include convertible virtual currency and cryptocurrency, as well as stablecoins and NFTs. Taxpayers will need to check the yes box if they:

-Received digital assets as payment for property or services provided;

-Transferred digital assets for free (without receiving any consideration) as a bona fide gift;

-Received digital assets resulting from a reward or award;

-Received new digital assets resulting from mining, staking and similar activities;

-Received digital assets resulting from a hard fork (a branching of a -cryptocurrency's blockchain that splits a single cryptocurrency into two);

-Disposed of digital assets in exchange for property or services;

-Disposed of a digital asset in exchange or trade for another digital asset;

-Sold a digital asset; or,

-Otherwise disposed of any other financial interest in a digital asset.

Related: New Tax Guidance Issued on Cryptocurrency Transactions.

Updates to question on digital assets; taxpayers should continue to report all digital asset income - IRS.

Everyone who files Form 1040, Form 1040-SR or Form 1040-NR must check one box, answering either "Yes" or "No" to the digital asset question. The question must be answered by all taxpayers, not just those who engaged in a transaction involving digital assets in 2022."

...

Besides checking the "Yes" box, taxpayers must report all income related to their digital asset transactions. For example, an investor who held a digital asset as a capital asset and sold, exchanged or transferred it during 2022 must use Form 8949, Sales and other Dispositions of Capital Assets, to figure their capital gain or loss on the transaction and then report it on Schedule D (Form 1040), Capital Gains and Losses, or Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, in the case of gift.

If an employee was paid with digital assets, they must report the value of assets received as wages. Similarly, if they worked as an independent contractor and were paid with digital assets, they must report that income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Schedule C is also used by anyone who sold, exchanged or transferred digital assets to customers in connection with a trade or business.

Janet Yellen Expects EV Subsidy Rules to Prompt New Trade Deals - Andrew Duehren, Wall Street Journal:

As part of the 2022 Inflation Reduction Act, the U.S. revamped a tax credit for consumers who buy electric vehicles in hopes of reducing U.S. reliance on China. To qualify for the full $7,500 tax credit, among other requirements, 40% of the value of the minerals in an electric vehicle’s battery must come from a country that has a free-trade agreement with the U.S. That amount is set to rise to 80% after 2026.

The requirements have irked allies that don’t have traditional trade agreements with the U.S. Some trade experts and European officials raised the possibility that because the Treasury hasn’t settled which trade deals count, the EU and Japan could be considered to already meet the requirement.

If it has to get through Congress, nothing will happen quickly.

Manchin takes aim at Treasury delay for EV tax credit restrictions - The Hill. "The legislation takes aim at a Treasury Department move in December to temporarily delay the stipulations — which are expected to pose hurdles for consumers who want to get a federal subsidy for their electric car."

Is a Bonanza of Electric Vehicle Gifts on the Horizon? - Jay Soled and James Alm, Tax Notes ($) (my emphasis). "Congress anticipates that its newly formulated tax credits for clean vehicle purchases will hasten the general populace’s transition away from internal combustion engine use and generate the production of battery minerals in the United States and those countries with which it has free trade agreements. Indeed, these effects seem likely to occur. However, Congress also expects that the tax credit will benefit taxpayers of moderate economic means. In this regard, it may have made a miscalculation. Instead, this legislation may result in a bonanza of automobile-related gifts by taxpayers whose incomes meet the legal requirements for the generous clean vehicle credit to related taxpayers (for example, parents, grandparents, and siblings) whose large incomes would otherwise disqualify them from taking the credit."

Eide Bailly Sees Risk Awareness Driving Growth in Sales Tax Automation - Isaac O'Bannon, CPA Practice Advisor. "Some clients first realize they are noncompliant when they receive a notice from a state, while others are prompted into action through continuing advisory services, said John Gupta, principal of the Eide Bailly SALT Services group. He continued to say that when these clients are able to have a discussion with their advisor about their risk exposure, it is often an eye-opening experience."

Related: A Game Changer - Sales Tax Reform.

Progressives again raise a wealth tax - Jeremy White, Lara Corte, Matthew Brown, and Ramon Castanos, Politico. "California would seem to have the groundwork in place to enact a wealth tax. But don’t bet your yacht on it."

U.S. taxpayers are subject to tax on worldwide income from all sources and must report all taxable income and pay taxes according to the Internal Revenue Code.

Taxpayers residing abroad, including those who are on military duty outside the U.S., are permitted an automatic two-month extension – until June 15 – to file their tax return.

Related: Eide Bailly Global Mobility Services

.

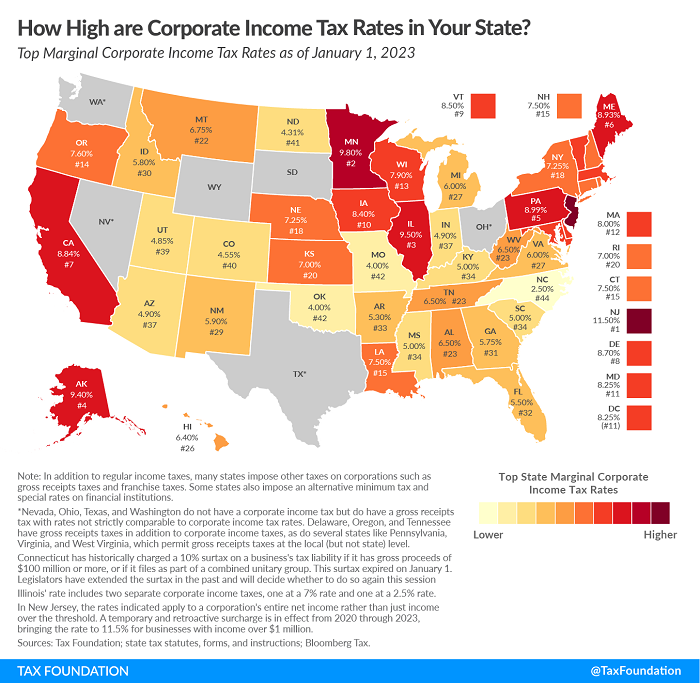

State Corporate Income Tax Rates and Brackets for 2023 - Janelle Fritts, Tax Policy Blog. "Corporate income taxes are levied in 44 states. Though often thought of as a major tax type, corporate income taxes accounted for an average of just 7.07 percent of state tax collections and 4.04 percent of state general revenue in fiscal year 2021. And while these figures are not high, they represent a substantial increase over prior years. Corporate income taxes accounted for 2.26 percent of general revenue in FY 2020, which is more in line with historical norms."

Top 10 IRS criminal tax cases in 2022 include reality TV stars, a celebrity attorney, and Ponzi schemes - Kay Bell, Don't Mess With Taxes. "Despite the diversity of their criminal tax acts, they shared one thing. They got caught. And sent to jail."

Chief Counsel's Office Says No Section 165 Deduction for Decline in Value of Cryptocurrency - Parker Tax Pro Library. "The Office of Chief Counsel advised that a taxpayer, who purchased for personal investment cryptocurrency in 2022 for $1 per unit that declined in value to less than one cent per unit at the end of 2022, did not sustain a loss under Code Sec. 165."

Two Key Provisions of the SECURE 2.0 Act - John Richmann, I Tax School. "SECURE 2.0 requires 401(k) and 403(b) plans to enroll participants automatically beginning in 2025."

IRS Extends April 18 Tax Deadline To May 15 For Georgia & Alabama Storm Victims - Robert Wood, Forbes. "This includes 2022 individual income tax returns due on April 18, as well as various 2022 business returns normally due on March 15 and April 18. Among other things, this means that eligible taxpayers will have until May 15 to make 2022 contributions to their IRAs and health savings accounts."

Stimulus Checks: Why 2023 is the Year to Get Tax Compliant - 1040Abroad. "It is estimated that 9 to 10 million people who have not yet received their stimulus payments are still eligible. Are you one of them? The cost of becoming compliant, such as hiring a professional to help you with your taxes, can be covered by the money you receive from the stimulus check."

A Quick Hobby Loss Refresher: Why These Losses Are Useless (At Least Until 2026) - Leslie Book, Procedurally Taxing. "Given the temporary disallowance of all miscellaneous itemized deductions, the stakes are even higher when a taxpayer is deemed to not have the requisite profit intent."

Understanding Revenue Implications For State Pass-Through-Entity Taxes - Lucy Dadayan and John Buhl, TaxVox. "State PTE tax structures and rules vary widely, which can lead to complications, especially for businesses operating across state lines. Whether paying a PTE-level tax reduces shareholders’ income tax liability or not depends on each state’s tax rates, credits, and deduction limits for individuals versus for PTEs."

Related: IRS Blesses Entity-level Tax Deduction used as SALT Cap Workaround.

IRS Going To 7th Circ. In Tax Battle Over Tribune's Cubs Sale - Theresa Schliep, Law360 Tax Authority. The Chicago tribune sold the Chicago Cubs to the Ricketts Family in 2009, but the tax consequences are still being disputed 14 years later:

In a notice of appeal made public Friday, the U.S. indicated it would challenge the Tax Court decision from October that let Tribune Media Co. off the hook for taxes after a 127-page opinion from 2021 had mixed results for both the defunct media company and the Internal Revenue Service.

The court had concluded that the $249 million in funds used to finance the 2009 sale of MLB's Chicago Cubs from Tribune to the Ricketts family couldn't reduce the gains the media company earned from the sale. But it also found that the portion of a $704.9 million distribution from a holding company to Tribune under the agreement, attributable to a different tranche of financing, is not subject to tax, and rejected the IRS' attempts to recharacterize the transaction from a disguised sale to an outright sale.

The tax issues are complicated (see the 127-page Tax Court opinion). Oddly, an IRS victory might help the Cubs by increasing their basis in the purchased assets.

Tax Court Sustains Salesman's Decade Of Deficiencies - Asha Glover, Law360 Tax Authority ($). "The court rejected (taxpayer's) argument that the deposits he received from an elderly client in tax years 2012 through 2015 were nontaxable loan proceeds that shouldn't have been included in calculating his income"

Another appropriate headline would have been "'Debt' of a salesman," as a key issue in the case was whether amounts received by the taxpayer were loans or income. The Tax Court decided "income" was the correct answer.

The insurance salesman involved apparently stopped filing returns after 1996. The Tax Court upheld IRS assessments and a fraudulent failure to file penalty, which is 75% of the amount of tax that should have been reported for the ten years at issue. So the salesman does have a legitimate debt now.

Cite: US Tax Court Docket No. 25974-17

Toronto gambler sentenced for falsifying income tax returns - IRS (Defendant name omitted):

According to court documents, Defendant, of Toronto submitted duplicate and inflated refund requests to the IRS Service Center in Austin as a Canadian citizen seeking automatically withheld gambling winnings. In doing so, he defrauded the U.S. Department of Treasury of nearly $1.8 million in tax refund money from 2006 to 2010. Defendant pleaded guilty to two counts of the nine-count indictment brought against him in October 2022.

"Mr. Defendant, who admitted his addiction to gambling, lost his biggest bet," said U.S. Attorney Jaime Esparza of the Western District of Texas. "He got caught on his gamble that he could cheat the U.S. government on his taxes. I appreciate the work of IRS Criminal Investigation (CI) to investigate Mr. Defendant's deceitful conduct, allowing our system to deliver justice."

He should have stuck with the slots.

I brought my own dinner, thanks. Tonight is Burns Night. "Burns Night honors the iconic Scottish poet Robert Burns, who wrote the New Year’s Eve anthem Auld Lang Syne. Many Scots host a Burns supper on January 25, the poet’s birthday, although they can be held throughout the year. Some of the suppers can be grand affairs; others less formal. The events will often feature a bagpiper or traditional Scottish music, and the Scottish pudding, Haggis, is served."

Make a habit of sustained success.