IRS Sets 2023 First-Year Vehicle Deduction Limit At $20.2K - Emlyn Cameron, Law30Tax Authority ($). "Passenger automobiles that were acquired later than Sept. 27, 2017, that were placed in service in 2023 and are eligible for an additional deduction under Internal Revenue Code Section 168(k) are limited to a deduction of $20,200, the IRS said in Revenue Procedure 2023-14. The deductions limit decreases to $6,960 for each year after the third tax year for such vehicles, according to the revenue procedure."

IRS Updates Auto Depreciation Limits for 2023 - Bailey Finney, Eide Bailly. "The tax law has special depreciation limits for motor vehicles - often incongruously called the 'luxury auto' rules."

Nebraska Governor Announces Tax Relief Package - Emily Hollingsworth, Tax Notes ($):

Taking a phased approach, L.B. 754 would reduce the top individual income tax rate from 6.84 percent to 6.27 percent for tax year 2023; to 5.70 percent for 2024; to 5.14 percent for 2025; to 4.56 percent for 2026; and to 3.99 percent for 2027. The bill would also reduce the top corporate income tax rate from 7.25 percent to 6.80 percent on all taxable income over $100,000 for tax year 2023 and phase it down each year to reach 3.99 percent for 2027.

The state's top individual income tax bracket applies to single filers with incomes above $29,000 and joint-filing taxpayers with incomes above $58,000.

Pillen touts ‘historic’ package of tax cuts, saying ‘we have to compete better’ with other states - Paul Hammel, Nebraska Examiner:

Aspects of the governor’s plan, which was introduced in the Legislature, are:

- Reducing the state’s income tax rates, which now top out at 6.2%, gradually to a flat tax of 3.99% by tax year 2027.

- Taking the funding of community colleges off the property tax rolls and making it a state responsibility, which would mean a $280 million shift from property taxes to state sales and income taxes.

- Putting a cap of 3.5% on increases in valuations of farm and ranch land, addressing the explosive growth in ag land valuations in recent decades. Also, valuation of farmland for tax purposes would change from being based on recent sales to being based on income potential, as is done in Iowa and South Dakota.

- Accelerating the elimination of taxes on Social Security income adopted last year on a phased-in basis and making it immediate. That would amount to a $16.7 million tax break.

- Providing $25 million a year in tax credits for those who donate toward private school scholarships.

Wait Times Falling for Practitioner Helpline - Kristen Parillo, Tax Notes ($):

The IRS has for the last two weeks been answering phone calls to its practitioner helpline in under 10 minutes, thanks to the hiring of new customer service representatives and efforts to thwart robocalls.

“I know that our level of service has not been where you all expect and where it needs to be, but hopefully over the last two weeks or so, you’ve noticed — particularly for our practitioner priority service [line] — that we are answering the phones in under 10 minutes,” said Ken Corbin, the IRS’s taxpayer experience officer and Wage and Investment Division commissioner.

Anecdotes from practitioners are consistent with this.

Gov. Tim Walz proposes boost in education spending, tax credits for Minnesota families - Jessie Van Berkel, Star Tribune. "One of the biggest pieces of the governor's family and children-focused budget is an expansion of the state's child and dependent care tax credit, which his administration said would help about 100,000 households with child-care costs. Families that earn less than $200,000 could get up to $4,000 if they have one child, $8,000 for two children and $10,500 if they have three kids."

Minn. Bill Seeks Portability Of Estate Exclusion For Spouses - Zak Kostro, Law360 Tax Authority ($). "H.F. 350, introduced Tuesday by Rep. Paul Torkelson, R-Hanska, would allow the surviving spouse of a person who had an interest in property in the state to take into account the decedent's unused exclusion amount, according to the bill text. The law would require a personal representative of the decedent's estate to file the required return and make the portability election, according to the bill."

Related: IRS opens door for more late portability elections.

W.Va. House Approves Income Tax Rate Cuts - Jaqueline McCool, Law360 Tax Authority ($):

Under the bill, in the first year, individual and married filers with income up to $5,000 would see their tax rate reduced to 2.1%. Filers with income from $5,000 to $12,500 would be taxed at 2.8%; income over $12,500 up to $20,000 would be taxed at 3.15%; income over $20,000 up to $30,000 would be taxed at 4.2%; and income over $30,000 would be taxed at 4.55%.

Currently, the lowest income bracket is taxed at 3% and the highest is taxed at 6.5%.

JCT Lists Expiring Tax Provisions Through 2034 - Tax Notes ($). "Among provisions scheduled to expire in 2025 are modified individual income tax rates, the increased child tax credit, the new markets tax credit, the paid family leave credit, the work opportunity credit, the increased individual standard deduction, the suspension of miscellaneous itemized deductions, and the limitation on the state and local tax deduction."

Link: JCS-1-23 (pdf download).

Any US Plans For Global Minimum Tax On Ice, For Now - Natalie Olivo, Law360 Tax Authority ($). "A split Congress is unlikely to pass any international tax bills during the next two years, including legislation that would align with minimum tax rules that form the second pillar of the global corporate tax rewrite. Meanwhile, other countries have eyed 2024 for applying Pillar Two, which involves top-up taxes to ensure that multinationals with revenue above €750 million ($809.5 million) pay an effective tax rate, or ETR, of at least 15% in each jurisdiction where they operate."

IRS turns to bank data to investigate tax criminals - Michael Cohn, Accounting Today:

IRS-CI chief Jim Lee presented statistics Wednesday showing that 15.8% of all investigations opened by his division in fiscal year 2022 originated from a BSA form, which are typically filed by banks and other financial institutions, although they can also be filed by other types of businesses and even individuals.

In addition, 84.2% of all investigations opened by IRS CI during FY 2022 have BSA filings related to the primary subject of the investigation, and 90.4% of IRS-CI cases were searched against BSA data in FY 2022.

BSA = Bank Secrecy Act.

Related: BSA data serves key role in investigating financial crimes.

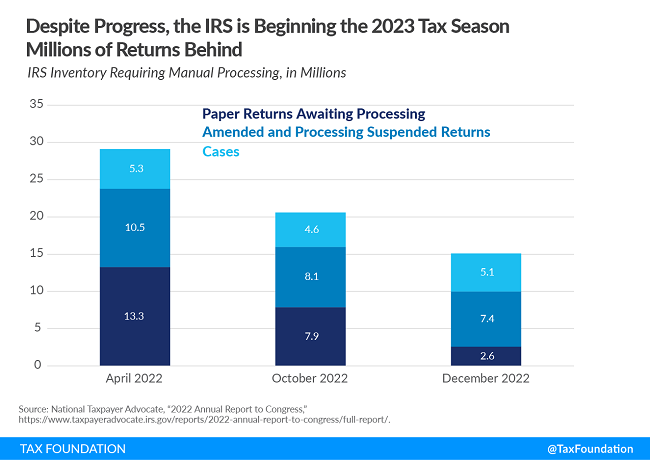

Frustration and Delays as the 2023 Tax Filing Season Begins - Erica York and Garrett Watson, Tax Policy Blog. "A combination of long-standing operational deficiencies, a temporary closure due to the pandemic, and the now-expired pandemic relief produced a perfect recipe for a paper backlog. The IRS carried its backlog into 2021, then into 2022, and now into 2023."

"If lawmakers learn any tax policy lesson from the past three years, let it be that simplifying the tax code is paramount"

7 reasons to file your tax return early - Kay Bell, Don't Mess With Taxes. "The sooner you fill out your Form 1040, the sooner you'll know exactly how much you owe the U.S. Treasury. Then you'll have time to figure out how to come up with the cash."

IRA Building Energy Efficiency Incentives for Retail - Kristin Gustafson, Eide Bailly. "The Inflation Reduction Act, which was signed into law in August 2022, significantly increased the energy efficiency tax incentives currently in play for the retail industry."

IRS CCMs on Crypto Donations and Crypto Losses - Andrew Mirisis, Freeman Law. "The IRS likely issued these written determinations in advance of the kickoff of the individual tax filing season to inform similarly situated taxpayers how to treated unrealized cryptocurrency losses and substantiating cryptocurrency donations where the taxpayer intends to claim a deduction greater than $5,000."

The Rise of the Robotic Tax Analyst - Benjamin Alarie, Tax Notes ($). "Prediction 5: AI-driven analysis will become an essential part of competent tax advice. AI-driven analysis capabilities are rapidly becoming essential tools for legal practitioners, and they will become even more important and necessary in the coming years. As AI improves, it will become increasingly difficult to do legal analysis without it, as the sophistication of legal cases and the amount of data involved continues to grow."

Tax Preparer Sentenced to Federal Prison as Tax Season Begins - Rebekah Barton, TaxBuzz. "On numerous occasions, the trio knowingly reported false earnings, made-up charitable contributions, and ineligible tax credits to increase their clients' refunds. The returns often claimed that taxpayers were permitted to claim credits and deductions for which they did not qualify."

Being an Accidental American: A Tax Perspective - 1040Abroad. "A non-U.S. citizen can have a child born in the U.S. while they are there on temporary employment or student visas. This child, born in the United States, automatically became a U.S. citizen at birth and might not be aware of it later on."

Am I Being Cynical? Serious Problems Acknowledged -Too Little, Too Late for Taxpayers Outside the US - Virginia La Torre Jeker, Virginia - US Tax Talk. "Despite the approximate 9 million US citizens who live abroad as well as green card holders who live overseas, not nearly enough has been done by the IRS or by Congress to address the problems faced by this distinct group of taxpayers. The Report acknowledges that overseas taxpayers face numerous barriers to their ability to meet their US tax obligations. The problem starts with the extremely complicated laws to which they are subject (PFIC, CFC, foreign trust reporting rules, anyone?). Some of the rules are oblivious to the real-world problems faced by Americans abroad (for example, statutorily mandated response times to a notice of deficiency ignore the reality of mailing delays that occur in foreign countries)."

Related: Eide Bailey Global Mobility Services.

Trump’s Tax Returns and the Future of Transparency - David Stewart and Joseph Thorndike, Tax Notes Opinions. "They might release tax returns for labor union presidents or the CEOs of large charities, or on the other side of the aisle, maybe large corporations. Lots of people could find themselves the target of this sort of thing. If you can gin up a plausible legislative purpose for your investigation, then you might be able to convince courts that you need to see these tax returns, and once you have the tax returns, you can release them."

New Jersey tax preparer and Arizona man charged with conspiracy to defraud and identity theft - IRS (Defendant names omitted):

The astonishing part is that it worked, to the extent that the IRS (allegedly) sent the defendants over $4 million. But I don't think they'll get to keep it.According to documents filed in this case and statements made in court:

Defendants were relatives who worked together and with others to steal victims' identities, which they used to file false tax returns and fraudulently receive tax refunds from the IRS. They electronically submitted tax documents to the IRS falsely claiming that the individual taxpayers listed on those documents had earned certain income or won thousands – and in some cases millions – of dollars in gambling and lottery winnings. The false filings also claimed tax withholdings on the purported income or gambling winnings that entitled the tax filer to refund payments from the IRS. The Defendants and others typically submitted these fraudulent tax filings using the names and personal identifying information of victims without the victims' knowledge or permission. The fraudulent filings caused the IRS to pay $4.49 million in tax refunds, the Defendants and others directed to various bank accounts that they controlled.

The rise and fall of the Chrisleys, the latest reality stars to go to prison - Emily Yahr, Washington Post:

News outlets have been paying especially close attention to the Chrisleys since November, when Todd and his wife, Julie, 50, were sentenced to 12 and seven years in federal prison, respectively, for fraud and tax evasion. During a nearly three-week trial in Atlanta last spring, prosecutors said the couple conspired to defraud community banks out of more than $30 million in loans and evaded federal income taxes for years.

...

The Chrisleys have steadfastly maintained their innocence on all charges, and their attorneys are working on an appeal.

This sentence hits home to me:

Even as the Chrisleys built an empire (spinoff shows, podcasts, brand deals and the flagship “Chrisley Knows Best,” which will air its 10th and final season early this year), it operated in that strange basic-cable space where millions watch their shows and track their every move, even while large swaths of the population have no idea they exist.

Until they started showing up in tax stories, I had never heard of them.

Fresh out of eye of newt. Today is Brew a Potion Day. "What better way to celebrate Brew a Potion Day than by getting out your cauldron and brewing a potion for the people you love? Just make sure to use wholesome ingredients." Or you can just observe National Popcorn Day instead.

Make a habit of sustained success.