IRS Still Working Through Last Year’s Returns as This Year’s Tax Season Looms - Richard Rubin, Wall Street Journal:

As of Dec. 9, 2022, the IRS had 1 million paper individual returns and 1.5 million paper business returns awaiting their first processing, according to the report from Erin Collins, the national taxpayer advocate, who runs an independent taxpayer-assistance operation inside the IRS. By Dec. 23, the IRS had lowered those figures to about 400,000 and 1 million. Those totals are down from 4.7 million unprocessed individual returns and 3.2 million business returns as of Dec. 31, 2021, after a combination of pandemic-era closures and new tax-code provisions slowed the agency’s work.

A broader look at IRS inventory requiring manual processing—including amended returns, error corrections and correspondence—shows a decline to about 14 million items in late December 2022 from 22.3 million on Dec. 31, 2021, according to the taxpayer advocate’s office.

Links:

Taxpayer Advocate legislative recommendations

IRS Urged to Relax Charitable Contribution Documentation Rules - Doug Sword, Tax Notes ($):

“This requirement is inconsistent with congressional policy to encourage charitable giving,” the report said.

And it’s harmful to taxpayers and tax-exempt organizations “that are trying to do the right thing but may not be aware of the exact legal requirements,” according to the report, which suggests keeping the requirement for written documentation but allowing that documentation to be presented after the filing or due dates, and giving the IRS the discretion to accept other proof at the time of filing.

IRS Armed To Bolster Service In 2023, Taxpayer Advocate Says - David van den Berg, Law360 Tax Authority. "There are three reasons for the IRS' improved position, Collins said in her annual report to Congress, one of which is the nearly $80 billion funding increase the Inflation Reduction Act provides the agency. The other contributing factors are the hiring of 4,000 customer service representatives using so-called direct hire authority and pursuit of hiring 700 additional workers to provide in-person help at Taxpayer Assistance Centers, along with significant progress in reducing inventory backlogs, Collins said."

NTA Calls for IRS to Be Transparent in Spending $80 Billion - Lauren Loricchio, Tax Notes ($):

“It is incumbent on the IRS to be transparent about its plans and outcomes” regarding the funding it will receive under the Inflation Reduction Act (P.L. 117-169), National Taxpayer Advocate Erin Collins said in her 2022 annual report to Congress.

...

Noting that Treasury Secretary Janet Yellen directed the IRS to develop an operational plan detailing how the funding will be spent that is expected to be released in mid-February, Collins said the plan “must contain details and provide specific performance metrics that outside parties can monitor and verify to measure the results of how the IRS has applied the funds and the success of its efforts to transform the IRS.”

IRS advocate reports big drop in backlog as GOP votes to cut funds - Julie Zauzmer Weil, Washington Post. "She also faulted the IRS for its slow correspondence with taxpayers. On average, it took more than six months for the agency to process taxpayer responses — an increase of 104 days since fiscal 2019. In the meantime, while the taxpayers waited, they often could not access their refund, or risked the IRS taking action against them because the agency did not realize that they had responded to the problem."

SALT Advocates, GOP Women Join Ways and Means Committee - Samantha Handler, Bloomberg ($):

Republican Reps. Claudia Tenney of New York, Michelle Steel of California, Mike Carey of Ohio, Blake Moore of Utah, Brian Fitzpatrick of Pennsylvania, Beth Van Duyne of Texas, Randy Feenstra of Iowa, Michelle Fischbach of Minnesota, Greg Steube of Florida, and Nicole Malliotakis of New York will be the newest members of Ways and Means, according to a House aide.

...

Members are still committed to making provisions of the 2017 tax law permanent, though there could be some hurdles within the caucus. More Republicans from high-tax states like California and New York could present issues with the SALT deduction limitation.

But most Republicans still defend including the $10,000 cap in their tax law, and have opposed the tax break generally as benefiting high tax states.

IRS Reaches Customer Service Hiring Goal, Treasury Says - Alexander Rifaat, Tax Notes ($):

The announcement marks a significant win for the agency after Treasury Secretary Janet Yellen in September 2022 gave the IRS the target of adding 5,000 customer service representatives. In late October the agency confirmed that it had reached approximately 80 percent of that goal.

Yellen said the additional customer service staff would cut phone wait times that averaged nearly 30 minutes in 2022 to less than 15 minutes, and she set an ambitious target for the IRS to achieve an 85 percent level of service in answering taxpayer phone calls in 2023.

South Dakota Governor Reveals Plan to Cut Unemployment Tax - Emily Hollingsworth, Tax Notes ($). "Noem announced that the state Department of Labor and Regulation will introduce a bill to modify employer contribution rates to South Dakota’s unemployment trust fund. The legislation would not only serve as an unemployment tax cut but also "bring an estimated $18 million savings to South Dakota businesses over the next couple of years," the governor said."

IRS completes issuing refunds for taxpayers who overpaid tax on 2020 unemployment compensation - Mark Friedlich, Wolters Kluwer Tax & Accounting. "The Internal Revenue Service recently completed the final corrections of the tax year 2020 accounts for taxpayers who overpaid their taxes on unemployment compensation they received in 2020. The agency corrected approximately 14 million returns. These corrections resulted in nearly 12 million refunds totaling $14.8 billion, with an average refund of $1,232."

Idaho Governor Calls for Property Tax Relief - Emily Hollingsworth, Tax Notes ($):

Little’s address and his fiscal 2024 budget confirmed that the state is on track to fully implement the corporate income tax reductions and flat income tax rate approved during the Legislature's 2022 special session.

Under H.B. 1, the state's individual income tax brackets were replaced with a flat 5.8 percent tax rate on income over $2,500 for single filers and income over $5,000 for joint filers. It also reduced the corporate income tax rate from 6 percent to 5.8 percent.

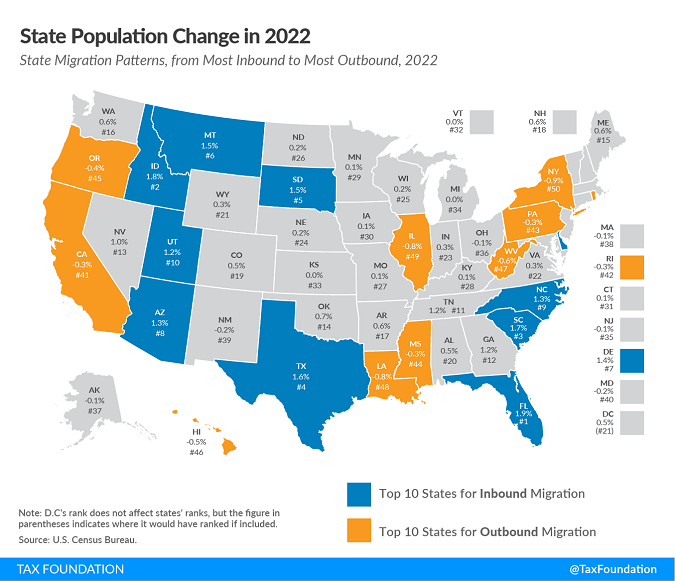

Americans Moved to Low-Tax States in 2022 - Janelle Fritts, Tax Policy Blog. "This population shift paints a clear picture: people left high-tax, high-cost states for lower-tax, lower-cost alternatives."

Tax documents you need to file your 2022 return - Kay Bell, Don't Mess With Taxes. "W-2 — This is the tax form that most folks anxiously await. It's the wage statement from your employer (or employers, if you hold more than one job) that details how much money you made, how much income tax was withheld, the amounts taken out for Social Security and Medicare, and contributions to workplace benefit programs, such as 401(k) and similar retirement plans, medical accounts, and child care reimbursement plans."

Here’s Why Small Businesses Fall Victim to the Payroll Tax Trap - Scott Curley, Bloomberg. "I can’t stress this point enough: Never 'borrow' from your payroll tax fund. Other than tax evasion, payroll taxes are the worst type of tax debt you can have."

IRS Gives Californians an Additional Month to File Taxes - Rebekah Barton, Tax Buzz. "The IRS is offering relief to any area designated by the Federal Emergency Management Agency (FEMA). Currently, this includes the counties of Alameda, Colusa, Contra Costa, El Dorado, Fresno, Glenn, Humboldt, Kings, Lake, Los Angeles, Madera, Marin, Mariposa, Mendocino, Merced, Mono, Monterey, Napa, Orange, Placer, Riverside, Sacramento, San Benito, San Bernardino, San Diego, San Francisco, San Joaquin, San Luis Obispo, San Mateo, Santa Barbara, Santa Clara, Santa Cruz, Solano, Sonoma, Stanislaus, Sutter, Tehama, Tulare, Ventura, Yolo and Yuba."

IRS Extends April 18 Tax Deadline To May 15 For California Storm Victims - Robert Wood, Forbes. "As a result, affected individuals and businesses will have until May 15, 2023, to file returns and pay any taxes that were originally due during this period. This includes 2022 individual income tax returns due on April 18, as well as various 2022 business returns normally due on March 15 and April 18. Among other things, this means that eligible taxpayers will have until May 15 to make 2022 contributions to their IRAs and health savings accounts."

Tax tips for gig economy entrepreneurs and workers - IRS. "Taxpayers must report all income on their tax return unless excluded by law, whether they receive an information return such as a 1099 or not."

Treaty Tie-Breaker: Oh the Pitfalls Beware! - Virginia La Torre Jeker, Virginia - US Tax Talk. "The United States is unique in its approach to taxing individuals who are US citizens or lawful permanent residents (green card holders). Such individuals are taxed on worldwide income regardless of where they may reside. On account of this taxation approach, US citizens and green card holders who live outside of America may be subject to income tax in the US and in the foreign country of residence at the same time."

Related: Eide Bailly Global Mobility Services.

The Low-Income Taxpayer and Form 1099-K - Nicole Appleberry, Procedurally Taxing. "There will also be people caught by the new rule who didn’t think they were operating businesses at all – like the folks replacing their garage sales with Facebook Marketplace, who most certainly don’t have documentation for their basis in the items sold. Or those who had enough friends inadvertently tag the Venmos for their share of meal or gift expenses as 'goods and services' instead of 'friends and family.'"

The IRS’s Christmas Gift to Airbnb and PayPal Is a Loss for Law-Abiding Taxpayers - Daniel Hemel and Steven Rosenthal, TaxVox. "Third-party payment platforms such as Airbnb, eBay, and PayPal found a surprise gift from the Biden Administration in their Christmas stockings last month—one that likely will cost the federal government more than $1 billion this tax season. And beyond the short-term budgetary impact, it sets a terrible precedent for the future of tax enforcement."

Defending the Undertaxed Profits Rule - Robert Goulder, Allison Christians, and Tarcisio Diniz Magalhaes, Tax Notes Opinions. "So their income is a big pool and the tax revenues are a big pool, and it's not that one country has a superior claim over another. They have equal and competing claims and this is a coordinated regime."

Former Portland attorney sentenced to more than eight years in federal prison for embezzling client funds - IRS (Defendant name omitted):

A former Portland attorney was sentenced to federal prison today for defrauding more than one hundred clients out of millions of dollars in insurance proceeds and using the stolen money to bankroll a lavish lifestyle.

Defendant was sentenced to 101 months in federal prison and three years' supervised release. Defendant was also ordered to pay more than $4.5 million in restitution to her victims.

101 months is over eight years, which is a pretty stern sentence. What was the crime?

According to court documents, between April 2011 and May 2019, Defendant used manipulation and deceit to systematically defraud at least 135 clients out of more than $3.8 million in insurance proceeds she held in trust on their behalf. To accomplish her scheme, Defendant stole her clients' identities, forged insurance checks made payable to them, deposited client funds into her personal bank accounts, and continually lulled clients into a false sense of hope that they would receive compensation for their injuries. Many of Defendant's victims were particularly vulnerable to her criminal behavior after sustaining serious brain and bodily injuries and never received the insurance payouts they were owed.

But as a trained legal professional, the attorney surely reported all income on timely filed tax returns?

On June 27, 2022, she pleaded guilty to one count each of mail, wire, and bank fraud; money laundering; and filing a false tax return; and two counts of aggravated identity theft.

Maybe not.

No sugar, please. Today is National Hot Tea Day!

Make a habit of sustained success.