California storm victims qualify for tax relief; April 18 deadline, other dates extended to May 15 - IRS:

California storm victims now have until May 15, 2023, to file various federal individual and business tax returns and make tax payments, the Internal Revenue Service announced today.

The IRS is offering relief to any area designated by the Federal Emergency Management Agency (FEMA). This means that individuals and households that reside or have a business in Colusa, El Dorado, Glenn, Humboldt, Los Angeles, Marin, Mariposa, Mendocino, Merced, Monterey, Napa, Orange, Placer, Riverside, Sacramento, San Bernardino, San Diego, San Joaquin, San Luis Obispo, San Mateo, Santa Barbara, Santa Clara, Santa Cruz, Solano, Sonoma, Stanislaus, Sutter, Tehama, Ventura, Yolo and Yuba counties qualify for tax relief. Other areas added later to the disaster area will also qualify for the same relief. The current list of eligible localities is always available on the Tax Relief in Disaster Situations page on IRS.gov.

The tax relief postpones various tax filing and payment deadlines that occurred starting on January 8, 2023. As a result, affected individuals and businesses will have until May 15, 2023, to file returns and pay any taxes that were originally due during this period.

This includes 2022 individual income tax returns due on April 18, as well as various 2022 business returns normally due on March 15 and April 18. Among other things, this means that eligible taxpayers will have until May 15 to make 2022 contributions to their IRAs and health savings accounts.

May 15 is now Tax Day for California flooding victims - Kay Bell, Don't Mess With Taxes. "Estimated taxpayers in the above noted California counties can skip making the fourth quarter payment, and instead include it with the 2022 return they file, on or before May 15. The first 2023 estimated payment should be sent separately on or before May 15."

California Storm Victims’ Tax Deadline Pushed Back to May 15th - Russ Fox, Taxable Talk. "The IRS announced today that California storm victims have until May 15th to file any tax returns and make any payments that are due between now and May 14th, including the fourth quarter federal estimated tax payment due January 17th, partnership and S-Corporation tax returns due on March 15th, and individual and C-Corporation tax returns due April 18th."

Conservatives Say McCarthy Committed to National Sales Tax Vote - Doug Sword, Tax Notes ($):

The FairTax Act of 2023 was introduced January 10 by Rep. Earl L. “Buddy” Carter, R-Ga., who said the bill would both eliminate the income tax and abolish the IRS.

“In addition to eliminating all personal and corporate income taxes, the death tax, gift taxes, and the payroll tax, the Fair Tax would also eliminate the need for the Internal Revenue Service,” Carter said in a release. “The Fair Tax would repeal the current tax code and replace it with a single national consumption tax.”

Wikipedia has more:

As defined in the proposed legislation, the initial sales tax rate is 30%. Advocates promote this as a 23% tax inclusive rate based on the total amount paid including the tax ($23 out of every $100 spent in total), which is the method currently used to calculate income tax liability.

The popularity of a 30% sales tax, on top of current state sales taxes, is yet to be determined.

The bill is uncertain to pass the House of Representatives, let alone the Senate.

‘Dirty Dozen’ Scheme Purveyor Can’t Defeat IRS Bank Summonses - Nathan Richman, Tax Notes ($). "Slim Ventures buys the asset the taxpayer wants to sell with an installment note, immediately resells the asset to the intended buyer, and introduces the taxpayer to a third-party lender offering limited recourse monetization loans. With the loan proceeds in hand, the taxpayer would be out only approximately 5 percent in transaction fees instead of the 25 percent taxes owed on the sale, according to Slim Ventures."

The IRS Dirty Dozen tax scam list discusses monetized installment sales:

In a typical transaction, the seller enters into a contract to sell appreciated property to a buyer for cash and then purports to sell the same property to an intermediary in return for an installment note. The intermediary then purports to sell the property to the buyer and receives the cash purchase price. Through a series of related steps, the seller receives an amount equivalent to the sales price, less various transactional fees, in the form of a purported loan that is nonrecourse and unsecured.

Taxpayers who have engaged in any of these transactions or who are contemplating engaging in them should carefully review the underlying legal requirements and consult independent, competent advisors before claiming any purported tax benefits. Taxpayers who have already claimed the purported tax benefits of one of these four transactions on a tax return should consider taking corrective steps, such as filing an amended return and seeking independent advice. Where appropriate, the IRS will challenge the purported tax benefits from the transactions on this list, and the IRS may assert accuracy-related penalties ranging from 20% to 40%, or a civil fraud penalty of 75% of any underpayment of tax.

Seller beware.

College savings plan money left over? Hello, tax-free Roth - Lynnley Browning, Accounting Today. "Under legislation signed into law last month, investors can roll up to $35,000 from a 529 into a Roth individual retirement account starting in 2024. The move morphs leftover money originally intended for a child's college (or kindergarten through 12th grade) costs into retirement dollars, all without socking the saver, or the beneficiary, with a tax bill. With tax-free growth and withdrawals, Roths are an engine of outsize savings and a favorite of wealth advisors, especially those to the affluent."

EV Tax Credit Rules Spell Confusion For Auto Industry - Linda Chiem, Law360 Tax Authority ($)

Notably, the Treasury Department also said a separate $7,500 tax credit for commercial clean vehicles — known as the Section 45W credit — does, in fact, apply to EVs leased by consumers.

Experts explained that the 45W credit applies to businesses that use or lease the vehicle in connection with their trade or business and, more importantly, doesn't have any of the income, MSRP, domestic sourcing or final assembly requirements of those in the 30D consumer credit.... In other words, consumers have a better shot at the tax credit by leasing rather than buying an electric vehicle until the Treasury Department says differently.

Save the planet with friendly lease financing.

Yellen to stay on as Biden's Treasury chief as debt fight looms - Ben White, Politico. "Another official close to Yellen said that while she weighed returning to private life, she has remained energized about the implementation of policies enacted during Biden’s first two years. These include hundreds of millions of dollars in tax credits for electric vehicles and semiconductor manufacturers, and new money for Internal Revenue Service tax enforcement."

Newsom Offers Narrower Tax Agenda Due to Falling Revenue, Deficit - Laura Mahoney, Bloomberg ($):

His proposals include reinstating a tax on managed care organizations that expired in 2019 and enabled California to get matching federal funds from the Centers for Medicare and Medicaid Services....

Newsom also proposed to:

-

Eliminate restrictions on eligibility for an existing New Employment Credit for qualifying semiconductor manufacturing and research and development firms so companies can be based anywhere in the state, not just high-poverty areas. The credit has been in place since 2014.

-

Extend the existing film and television production tax credit to 2030 and make them refundable so companies can claim the credits in years they have no income tax liability. Funding for the program is capped at $330 million a year.

-

Exclude forgiven student debt from state income taxes as long as President Biden’s debt relief program survives legal challenges.

SD Governor Promotes Eliminating Sales Tax On Food - Jaqueline McCool, Law360 Tax Authority ($). "Republican Gov. Kristi Noem previously laid out her plans to eliminate the state's 4.5% sales tax on groceries in December, when she unveiled her 2024 fiscal plan."

Minn. House OKs Conformity With Federal Tax Law Changes - Jared Serre, Law360 Tax Authority ($). "H.F. 31, introduced by the lead sponsor, Rep. Aisha Gomez, D-Minneapolis, passed the House on Monday by a 132-0 vote. The legislation would add federal statutes on certain deductions, subtractions and more to the state tax code."

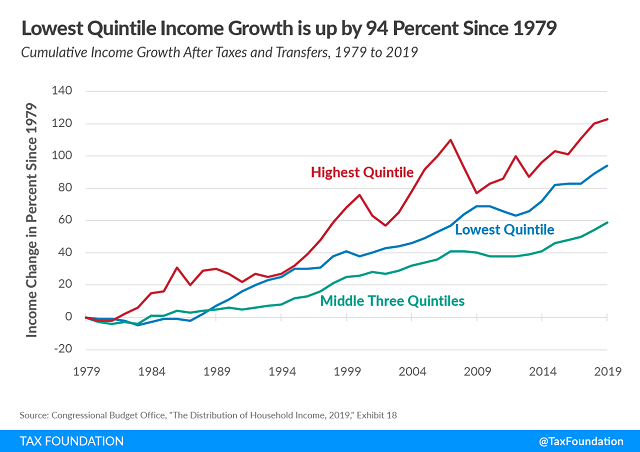

CBO Analysis Finds Income Growth and Progressive Tax Code in 2019 - Garrett Watson, Tax Policy Blog. "Newly published data from the Congressional Budget Office (CBO) indicates in 2019, before the onset of the pandemic, American incomes continued to rise as part of a broad economic expansion. It also shows that, contrary to common perceptions, the federal tax system is progressive."

2023 U.S. Tax Legislation Forecast - David Stewart and Jeremy Scott, Tax Notes Opinions. "Well, the expanded child tax credit is probably the thing that people talk about the most. There's a number of other smaller tax provisions that people were hoping to slip into this spending bill that didn't get in. I don't know that any of that's going to be taken up in the new year. I think you're going to see a legislative slowdown, if I'm using a generous term. I think that anything that didn't get done at the end of 2022 is probably not going to be a focus in 2023 and 2024, but we'll see."

GOP Hits Staggering IRS With A Low Blow - Amber Gray-Fenner, Forbes. "As unlikely as this bill is to become law, the very idea of it is premised on a mind-boggling amount of misinformation and misdirection."

Former Trump Organization CFO Allen Weisselberg Sentenced to 5 Months for Tax Crimes - Corinne Ramey, Wall Street Journal:

Mr. Weisselberg, 75 years old, pleaded guilty in August to 15 felonies for participating in a scheme to compensate certain Trump Organization employees, including himself, with off-the-books benefits to evade taxes. Mr. Weisselberg also admitted that from 2005 through 2021 he failed to report $1.76 million in benefits to tax authorities. This unreported compensation came in the form of a rent-free Manhattan apartment, leased Mercedes-Benz cars, home furnishings and private-school tuition for his grandchildren, Manhattan prosecutors said.

...

When the Trump Organization went on trial this fall for tax crimes, Mr. Weisselberg told jurors that he knew that off-the-books benefits were being paid and that some perks had been authorized by Donald Trump himself.

Trump’s Longtime Finance Chief Sentenced to 5 Months in Jail - Ben Protess, Jonah E. Bromwich, and William K. Rashbaum, New York Times. "He has been on paid leave and recently received his annual bonus from the company for last year, one of the people said. He is expected to receive a broader severance package as well."

Got Milk? It's National Milk Day! If you are unable to celebrate, it's also National Step In A Puddle And Splash Your Friends Day.

Make a habit of sustained success.