Travel expense deductions are low-hanging fruit for IRS examiners, if taxpayers let them be. A taxpayer made it easy for the IRS in a summary opinion released today.

It's easy for the IRS to disallow travel expenses - such as vehicle costs - because Code Sec. 274 imposes extra substantiation requirements on taxpayers claiming those deductions. From the opinion:

To meet the heightened substantiation requirements, taxpayers must substantiate by adequate records or by sufficient evidence corroborating their own statements (1) the amount of the expense, (2) the time and place of the expense or use of listed property, (3) the business purpose of the expense or use, and (4) the business relationship. § 274(d). Even if the expense would otherwise be deductible before the enactment of section 274(d), section 274(d) may still preclude a deduction if the taxpayers do not present sufficient substantiation.

This requirement is why there are still paper auto mileage logs, along with newfangled auto mileage apps, to corroborate business use of vehicles. Properly maintained, they work when the IRS visits. Improperly maintained, you get results like those in Tax Court today.

The taxpayer attempted to support claimed fuel purchase deductions with a combination of a mileage log and bank statements to document expenses. Problems arose. From the opinion (taxpayer name omitted; my emphasis):

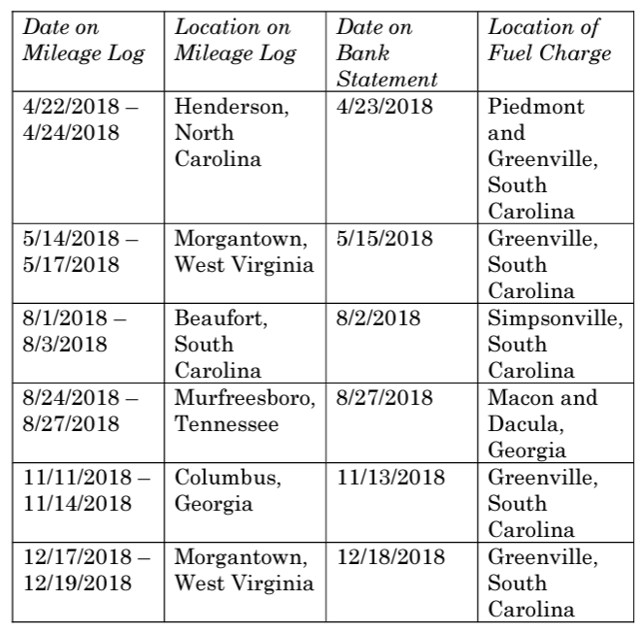

Moreover, the mileage log shows that Mr. Taxpayer was on a trip in one state while the bank statements show a fuel purchase, for which he seeks a deduction, in another state. Mr. Taxpayer failed to articulate a reason for the discrepancies. These discrepancies include but are not limited to:

Even if the Court determined that the mileage log was credible, it alone would not be sufficient to meet the strict substantiation requirements in section 274(d). To substantiate the expenses, petitioners would additionally need to provide corroborating documentary evidence to establish the required elements of the expense... In addition to the mileage log, petitioners submitted their bank statements and testimony at trial. As outlined above, the bank statements contradict more of the trips on the mileage log than they corroborate.

Decision for IRS. What lessons can we draw?

- Keep your mileage log current, with dates, times, and amounts.

- Keep your receipts.

- Document the why of your trips carefully. Note who you will be meeting and why the meeting is a business meeting.

The deductions you save may be your own.

Related: Here’s what taxpayers need to know about business related travel deductions.

Make a habit of sustained success.