Biden signs bill boosting US chip manufacturing as he kicks off victory lap – Maegan Vazquez and Kate Sullivan, CNN:

President Joe Biden on Tuesday signed into law a bill aimed at boosting American chip manufacturing as he kicked off a victory lap to celebrate a string of wins in Washington.

The CHIPS and Science Act will invest more than $200 billion over the next five years in a bid to help the US regain a leading position in semiconductor chip manufacturing. It is aimed at countering China's growing economic influence, lowering the cost of goods, making the US less reliant on foreign manufacturing and mitigating supply chain disruptions in the wake of the Covid-19 pandemic.

The bill includes a 25 percent tax credit for manufacturing semiconductors in the United States and some have questions about it:

Chips Bill Tax Perk Opens Timing Eligibility Questions for Pros – Erin Slowey, Bloomberg ($):

Under the current statute, there is a four-part test for what constitutes qualified property: The property must be tangible and depreciation ‘allowable,’ it must be constructed by the taxpayer, and it must be 'integral to the operation of the advanced manufacturing facility.'

The tax credit is for property placed in service by January 1, 2027, but some wonder what “placed in service” means.

Defining placed in service will become more important as companies approach the sunset of the credit, [Brandon Morris, a partner at Akin Gump Strauss Hauer & Feld LLP] said, so companies know when to place the property in service to qualify for the credit before the deadline.

Andy Starnes, a tax partner at Moore Colson, added he’d like to see more details on the timeline for using the credit and how long companies will be able to carry the credit forward if a project was started but not finished before the 2026 sunset.

The next piece of legislation that Congress is expected to pass is the reconciliation Inflation Reduction Act formerly known as Build Back Better:

Pelosi to urge House to pass Biden inflation-reduction bill as is – Reuters. “House Speaker Nancy Pelosi said on Tuesday she will ask members of the House of Representatives to pass without changes a $430 billion climate and prescription drug bill approved by U.S. Senate over the weekend, calling it a historic piece of legislation.”

The House of Representatives is expected to vote on the bill on Friday. Passage is expected. From there, the legislation goes to the White House to be signed into law.

The bill does not include a provision that fixes or adjusts the SALT cap. And the “No Salt, No Deal” thing ain’t happening:

SALT-Expansion Dreams Die as Biden Tax Bill Heads to House - Laura Davison, Bloomberg ($). “The House Democrats who had threatened to block President Joe Biden’s tax and climate plan unless it also expanded the deduction for state and local taxes are now signaling they’ll back the legislation when it comes up for a vote later this week.”

Are taxes included in the bill? You betcha!

Inflation Reduction Act extends ‘pass-through’ tax break limits for 2 more years. Here’s what that means for entrepreneurs – Greg Iacurci, CNBC:

Senate Democrats curtailed a tax break for certain pass-through businesses as part of the Inflation Reduction Act passed Sunday.

A pass-through or flow-through business is one that reports its income on the tax returns of its owners. That income is taxed at their individual income tax rates. Examples of pass-throughs include sole proprietorships, some limited liability companies, partnerships and S-corporations.

Democrats’ legislation — a package of health-care, tax and historic climate-related measures — limits the ability of pass-throughs to use big paper losses to write off costs like salaries and interest, according to tax experts.

Corporations Would Pay More, Middle Class Less Under US Tax Bill - Laura Davison, Bloomberg ($):

Corporations will pay nearly $296 billion more in US federal taxes over the next decade, and middle-income households will see some tax cuts, under the tax-and-climate bill that is likely to become law in the coming days.

That’s the takeaway from analysis released Tuesday by the Congressional Joint Committee on Taxation.

Expected tax changes in the bill:

Households earning less than $100,000 will see net tax cuts through 2025, largely due to an extension of subsidies for Affordable Care Act premiums. After that, taxes for middle- and low-income households are largely unchanged. The bill also includes some tax incentives for electric cars and home-energy efficiency -- contributing to the decrease in tax burden.

Taxpayers earning at least $500,000, a group that’s more likely to own stocks, will see their taxes go up by about 1% next year, reflecting indirect tax increases tied to the corporate-tax hikes. While the legislation doesn’t include any direct tax increases on high-earners, the Joint Committee on Taxation’s model directs some of the corporate-tax burden on shareholders.

Recon Bill’s Corporate Taxes Skew Hit on $1 Million Households – Doug Sword, Tax Notes ($). “Meanwhile, households making more than $1 million a year would bear the brunt of the cost of changes through 2027 but would see tax cuts once a cap on the deductibility of excess business losses for the owners of S corporations, partnerships, and sole proprietorships expires January 1, 2029.”

Tax Bill May Crush US ‘Mom and Pop’ Oil Drillers, Sheffield Says – David Wethe, Guy Johnson and Katie Greifeld, Bloomberg ($). “The proposed new minimum tax on corporations and fees for methane emissions, both of which are in a sweeping bill passed by the US Senate this week, could make life impossible for many small US oil and gas producers, according to one of the country’s biggest independent producers.”

Minimum-Taxed Corporations May Pass by Opportunity Zones - Alan Lederman, Bloomberg ($):

The proposed Inflation Reduction Act’s corporate alternative minimum tax base is financial accounting income that doesn’t incorporate the Internal Revenue Code’s favorable exemption and deferral tax incentives for investments in qualified opportunity funds…

Large corporations whose marginal financial accounting income from QOF [qualified opportunity funds] exit and entry transactions would be subject to the CAMT [corporate alternative minimum tax ] would see the evaporation of their immediate marginal federal corporate income tax benefits from participating in the QOF program.

US Book Tax Will Add Complexity for Companies, Tax Pros Say – Erin Slowey and Michael Rapoport, Bloomberg ($). “The corporate minimum income tax passed by the Senate has prompted questions from tax professionals on implementation and raised concerns about how it will impact financial accounting rulemaking…”

‘There’s going to be all sorts of implementation questions that the IRS is going to have to pursue, like some companies will have good income reports, some will have financial statements that need adjustment, what happens if they change,’ said Steve Rosenthal, a senior fellow in the Urban-Brookings Tax Policy Center at the Urban Institute. ‘It’s just a new regime, so it’s gonna take an awful lot of resources at the IRS to sort through how companies should report under it.’

Senate To Exclude Some Spectrum Buys From New Tax – Christopher Cole, Law360 Tax Authority ($):

The U.S. Senate has agreed to allow wireless companies to deduct the costs they've incurred buying up spectrum licenses from their net income if they fall under a new corporate minimum tax, but for now, the deduction wouldn't apply to purchases going forward…

Companies normally can amortize the cost of spectrum buys from their regular corporate income tax, splitting it up over a 15-year period. However, for purposes of the book minimum, the bill as originally drafted would have cut out that deduction for both past and future costs of buying up the airwaves, raising the tax liability of some large companies.

A Senate Democratic aide confirmed Monday the Senate-passed bill contains a section that would let companies still deduct the expense, but only for purchases prior to the law's enactment, and there is no blanket language allowing the deduction for future spectrum auctions.

The report on the bill's tax effects is here.

The report on the estimated budget effects of the taxes is here.

The bill includes IRS money:

Opinion: Why does the IRS need $80 billion? Just look at its cafeteria - Catherine Rampell, Washington Post. This article includes amazing photos of the cafeteria in the Austin IRS office. Remarkable.

As of July 29, the IRS had a backlog of 10.2 million unprocessed individual returns. Blame the pandemic, sure, but also the agency’s embarrassingly outdated, paper-based system, which leaves stacks and stacks of returns cluttering shelves, hallways and even the cafeteria.

With 87,000 new agents, here’s who the IRS may target for audits – Kate Dore, CNBC:

- The Senate approved nearly $80 billion in IRS funding, with $45.6 billion for 'enforcement,' raising questions about who may be targeted by future audits.

- IRS Commissioner Charles Rettig said the resources won’t increase 'audit scrutiny on small businesses or middle-income Americans.'

- However, with the investment projected to bring in $203.7 billion in revenue, opponents say IRS enforcement may affect everyday Americans.

Strategies to Reduce or Avoid Required Minimum Distributions – Kevin Sigler and Jake Sigler, Tax Notes ($). “Sigler and Sigler explain how required minimum distributions from qualified retirement plans and IRAs can be avoided or minimized for tax purposes.”

Trump Must Turn Over Tax Returns to House Panel, Court Rules - Elizabeth Wasserman, Bloomberg ($):

Former President Donald Trump has to turn over his tax returns to a congressional committee, a federal appeals court ruled.

The US Court of Appeals for the District of Columbia Circuit rejected Trump’s appeal of a lower court’s ruling allowing the tax returns to be sent to the House Committee on Ways and Means.

Returns are expected to be presented to the House Ways and Means Committee within seven days.

Statement from the House Ways and Means Committee Chairman Richard Neal (D-Mass.):

With great patience, we followed the judicial process, and yet again, our position has been affirmed by the Courts. I’m pleased that this long-anticipated opinion makes clear the law is on our side. When we receive the returns, we will begin our oversight of the IRS’s mandatory presidential audit program.

It's not too late to WISP it! WISP it good!!

The Security Summit partners today unveiled a special new sample security plan designed to help tax professionals, especially those with smaller practices, protect their data and information.

The special plan, called a Written Information Security Plan or WISP PDF, is outlined in a 29-page document that's been worked on by members of the Security Summit, including tax professionals, software and industry partners, representatives from state tax groups and the IRS.

Federal law requires all professional tax preparers to create and implement a data security plan. The Security Summit group – a public-private partnership between the IRS, states and the nation's tax industry – has noticed that some tax professionals continue to struggle with developing a written security plan.

States Well-Positioned to Combat Inflation, Slow Growth: Fitch - Mackenzie Hawkins, Bloomberg ($). “After two years of surging surpluses, state budgets are well prepared to weather the headwinds of rising inflation and slow economic growth, Fitch Ratings said in a report released Monday.”

OR, they could give it back:

US States Slash Taxes Most in Decades on Big Budget Surpluses - Mackenzie Hawkins, Bloomberg ($). “More than half of US states are using record budget surpluses to fund their biggest collective tax break in decades, risking future revenue shortfalls to help residents combat inflation and make some long-sought cuts.”

Minnesota DOR Issues Information on Income Tax Treatment of Federal Relief Programs – Bloomberg ($):

The DOR provides that: 1) taxpayers who excluded grants or forgivable loans from the federal programs on their federal income tax return must add them back to their state returns; and 2) taxpayers must use the appropriate nonconformity schedule or follow the form instructions for federal adjustments for the year the income was received.

Indiana Governor Signs Law Amending Multiple Income, Sales and Use, Excise Tax Provisions – Bloomberg ($). “The Indiana Governor Aug. 5 signed a law amending multiple individual income, sales and use, and excise tax provisions.”

Wayfair Sues Colo. City Over Sales Tax Complexity – Sanjay Talwani, Law360 Tax Authority ($). “Wayfair LLC, the online retailer that prevailed in the U.S. Supreme Court's 2018 landmark ruling on state taxation of remote sales, sued a Colorado city, saying it assessed tax without mitigating its burdens as required in that ruling.”

California Bill Excludes Travel Sites From Car Rental Sales Tax - Laura Mahoney, Bloomberg ($). “Car rental companies would be solely responsible for collecting California sales tax on car rentals under a bill lawmakers have sent to Gov. Gavin Newsom (D).”

Digital Advertising Subject to New Mexico’s Receipts Tax – Michael Bologna, Bloomberg ($). “New Mexico clarified Tuesday that revenue earned by tech companies from online advertising is subject to the state’s gross receipts tax and is compatible with tax treatment of receipts from broadcast and print advertising.”

Mo. Voters Will Decide On Legalizing, Taxing Recreational Pot – Paul Williams, Law360 Tax Authority ($). “Missouri voters will decide in November whether to legalize and tax sales of recreational cannabis, the state's secretary of state announced Tuesday, saying that he certified for the ballot a citizen-driven initiative constitutional amendment on the question.”

NYC Congestion Pricing Calls for Extra $23 Toll for Some Drivers – Skylar Woodhouse and Michelle Kaske, Bloomberg ($). “New York City’s Metropolitan Transportation Authority is one step closer to rolling out a congestion pricing plan that would charge some motorists as much as $23 to enter Manhattan’s central business district.”

Missouri High Court Strikes Down Solar Panel Tax Break – Perry Cooper, Bloomberg ($). “Missouri’s tax exemption for “solar energy systems not held for resale” is invalid because it covers property not specifically enumerated in the state constitution, the state’s high court ruled.”

How States Are Avoiding Square-Peg Tax Policies for Technology - Gary Bingel, Bloomberg ($):

States tend to be five years or more behind new sales tax developments. Once appropriate guidance is enacted on a new topic, the issues that were sought to be addressed have often morphed into something completely different.

In addition to creating an ever-changing game of catch-up by states, this environment also forces taxpayers and tax practitioners to apply square-peg tax guidance to evolving round-hole technology. To combat this, many states have created tax laws that are as broad as possible to address technological and societal developments. This is especially true of digital goods and digital products. Approximately 31 states impose sales tax on digital goods and products in some way.

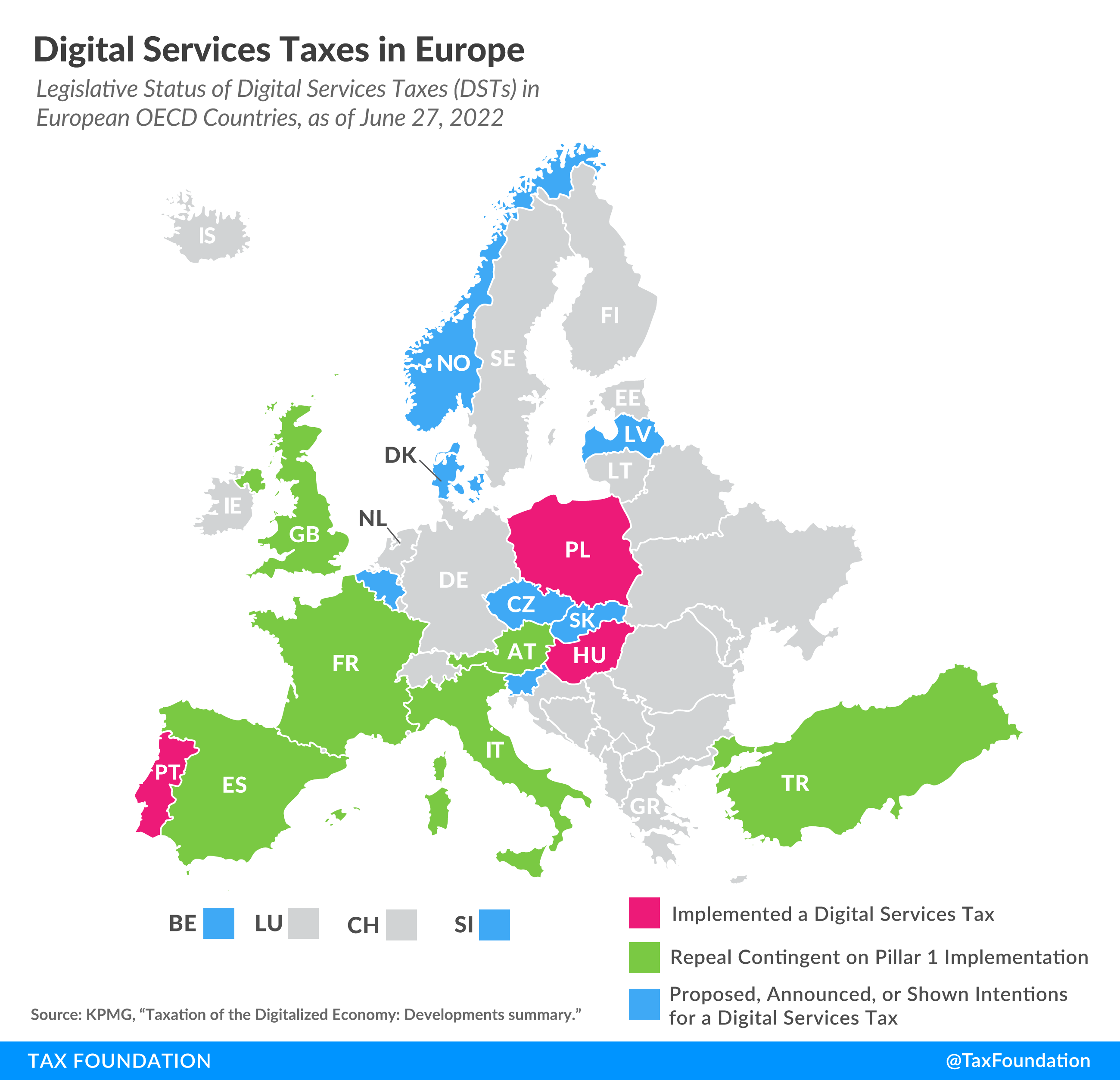

What European Countries Are Doing about Digital Services Taxes – Daniel Bunn and Elke Asen, Tax Foundation. “Over the last few years, concerns have been raised that the existing international tax system does not properly capture the digitalization of the economy. Under current international tax rules, multinationals generally pay corporate income tax where production occurs rather than where consumers or, specifically for the digital sector, users are located. However, some argue that through the digital economy, businesses (implicitly) derive income from users abroad but, without a physical presence, are not subject to corporate income tax in that foreign country.”

From the "there's-no-money-in-politics" file:

How Wall Street wooed Sen. Kyrsten Sinema and preserved its multi-billion dollar carried interest tax break – Brian Schwartz, CNBC:

- To get Sinema’s vote, and the Inflation Reduction Act passed, Senate Majority Leader Chuck Schumer said Democrats had “no choice” but to drop the carried interest provision from the broader bill.

- Sinema’s been fighting to help preserve the loophole since at least last year when she told Democratic leaders she opposed closing the carried interest tax break.

- Since the start of the 2018 election cycle, she’s raked in at least $2 million from the securities and investment industry — outraising Senate Banking Chairman Sherrod Brown’s $770,000 in industry donations over the same time, FEC data shows.

FWIW: Sen. Sinema was lobbied hard by folks to kill portions of the bill that would negatively impact voters in her state. Apparently, she was mostly concerned with how the bill affected investment groups.

Chillax! It’s National Lazy Day! Hammocks and cool breezes for everyone!

Make a habit of sustained success.