Senate’s Energy Incentives Partially Shielded From OECD Impact – Colin Wilhelm and Michael Rapoport, Bloomberg ($):

Alternative energy incentives in the recent compromise between Senate Majority Leader Chuck Schumer (D-N.Y.) and Sen. Joe Manchin (D-W.Va.) favor certain technologies, like carbon capture and hydrogen, by making them less likely to be disrupted by the global minimum tax agreement between over 130 countries.

The value of some of the other credits in the tax bill such as for wind and solar energy, however, could be negated by the global agreement’s pending 15% minimum tax, tax and energy experts said. Under the current framework, a global minimum tax has less impact on direct pay subsidies—like refundable tax credits—than non-refundable tax incentives, which would see their value diminish for companies that pay the tax.

The Senate Finance Committee's summary of the energy provisions is here.

Important to note: the 15% minimum tax in the Schumer/Manchin bill is NOT the 15% global tax being vetted by other countries.

Yellen’s Global Tax Plan Gets No Love From Manchin-Schumer Deal - Christopher Condon, Bloomberg ($):

For Treasury Secretary Janet Yellen, there’s one stinging omission from the compromise legislation agreed to this week by Senator Joe Manchin and Majority Leader Chuck Schumer.

Tax changes included in the bill fail to bring the US in line with a global deal championed by Yellen and backed last year by almost 140 countries, which aims to reshape the way multinational companies are taxed around the world.

Failure to get the US on board for the specific change -- a 15% global minimum corporate tax -- risks forgoing billions in tax revenue and sinking one of President Joe Biden’s and Yellen’s key accomplishments.

US Corp. Minimum Tax Disconnected From Global Levy – Dylan Moroses, Law360 Tax Authority:

A U.S.-designed 15% corporate alternative minimum tax shares some similarities with the Organization for Economic Cooperation and Development's global minimum tax, but not enough to be considered part of the plan, leaving open questions about effective tax rate calculations.

The tax contained in the Inflation Reduction Act agreed to this week by Senate Democrats might appear similar to the OECD's Pillar Two, which would establish a 15% global minimum tax rate based on adjusted financial statement income. However, the reconciliation package doesn't include a suite of proposed international tax law changes that would have aligned the U.S. tax on global intangible low-taxed income more closely with Pillar Two.

Instead, the 15% tax is based upon financial statements:

Reconciliation Deal Pulls Accounting Rulemaker Into Tax Politics - Nicola White, Bloomberg ($):

A panel of unelected accountants in suburban Connecticut would play an outsized role in shaping tax policy for the nation’s largest corporations under a provision inside Senate Democrats’ sweeping tax, climate, and healthcare bill.

The draft legislation uses a version of company income, as measured under US financial accounting rules, to determine what businesses owe in taxes. It’s designed to ensure that large companies making big “book” profits get taxed at a minimum rate of 15%. It puts pressure on what companies report in their financial statements, the rules for which are crafted by the Financial Accounting Standards Board.

Manchin Spending Deal Includes Billions in Taxes on Oil Sector - Ari Natter, Bloomberg ($):

The climate and tax spending deal announced last week by Senate Majority Leader Chuck Schumer and Senator Joe Manchin could cost the oil industry $25 billion in new taxes.

The legislation, which may get a Senate vote as soon as next week, would reinstate and increase a long-lapsed tax on crude and imported petroleum products to 16.4 cents per gallon, according to a summary of the plan released Sunday by the Senate’s tax-writing committee.

Part of the increase stems from reinstating the Superfund tax. The committee’s summary of that tax:

Section 13601. Reinstatement of Superfund.

This provision reinstates the Hazardous Substance Superfund Financing Rate on crude oil and imported petroleum products at the rate of 16.4 cents/per gallon, indexed to inflation, and reinstates the tax on taxable chemicals. This provision is made effective after December 31, 2022.

This provision reinstates the authority for advances to be appropriated to the trust fund through December 31, 2032.

The recently enacted infrastructure bill included a Superfund Chemical Excise Tax. Eide Bailly’s breakdown of that tax is here.

Manchin Sets High Bar for Tesla and GM Electric-Car Tax Credits – Gabrielle Coppola and Ari Natter, Bloomberg ($). “It was tempting when Democrats announced their surprise climate deal to imagine American auto executives popping champagne bottles. But any bubbly probably ought to stay on ice until Washington finalizes the fine print of the bill that would lift the cap on tax credits for electric vehicles.”

Kildee Wants Phase-In for Clean Vehicle Tax Credit Requirements – Doug Sword, Tax Notes ($). “A revamping and extension of the electric vehicle tax credit in Senate Democrats’ reconciliation rewrite has a longtime backer of the credit hoping for a phase-in period to give suppliers and manufacturers time to adjust to the new requirements.”

This provision will be hard to add to the bill once it passes the Senate. Any modifications to the bill by House lawmakers must be approved by the Senate. Essentially, the bill goes back to square one. Not a good move for lawmakers who want this bill to become law ASAP.

Next Steps for the new bill:

Democratic Lawmakers Set Sights on Passing Reconciliation Tax and Spending Bill – Jay Heflin and Mel Schwarz, Eide Bailly. “On July 27, 2022, Senate Democratic leaders released a modified version of the reconciliation tax and spending bill that the House of Representatives passed last year, which is commonly referred to as ‘Build Back Better’… The Senate has renamed the legislation to the ‘Inflation Reduction Act of 2022.’”

The Senate could vote on the bill as early as this week, but it could take longer. Assuming it passes the Senate, the House of Representatives will then vote on it. However, passage from the Senate requires that all Senate Democrats support the bill (plus Vice President Kamala Harris). Senator Krysten Sinema (D-Ariz.) has yet to announce her support for the bill, and reporting below says she won’t show her hand until the bill is ready for action on the chamber’s floor:

Manchin Messaging - Richard Tzul, Bloomberg ($). “While Manchin is now ready to support a package of tax code changes, energy incentives, and health care subsidies, it isn’t yet clear where Sen. Kyrsten Sinema (D-Ariz.) stands on the proposal. Sinema’s office has said she won’t make her position known until after the Senate parliamentarian reviews the legislation.”

Rather odd messaging from Manchin:

Manchin discussed the plan during appearances on various Sunday shows and attempted to frame the tax proposal as something that wouldn’t conflict with Sinema’s opposition to tax increases in the current economy.

'I agree with her 100% in that we are not going to raise taxes and we won’t,' Manchin said during an interview on CNN’s 'State of the Union.'

The deal includes a 15% corporate minimum tax and a change to the carried interest provision. Manchin has described those policies as 'closing loopholes' rather than tax increases.

Closing loopholes increase effective rates.

‘Inflation Reduction Act’ Has Little Inflation Help, Study Says – Erik Wasson and Ramsey Al-Ribabi, Bloomberg ($). “The Inflation Reduction Act of 2022, the breakthrough US legislative deal on key parts of President Joe Biden’s agenda, likely won’t reduce inflation at all, according to a study.”

From the Penn Wharton Budget Model report:

The Act would very slightly increase inflation until 2024 and decrease inflation thereafter. These point estimates are statistically indistinguishable from zero, thereby indicating low confidence that the legislation will have any impact on inflation.

Still, manufacturers might feel squeezed by the bill:

Democrats’ Corporate Tax Plan Threatens Higher Bills for Manufacturers – Richard Rubin and Theo Francis, Wall Street Journal ($):

Manufacturers and other companies making capital investments could pay the bulk of the new corporate minimum tax in Senate Democrats’ fast-moving fiscal legislation, according to an analysis of the plan.

The 15% minimum tax would take effect next year and apply to U.S.-based companies that report financial-statement profits averaging at least $1 billion over three years, according to legislation released this week that mirrors a House-passed bill from last year.

Further down the article:

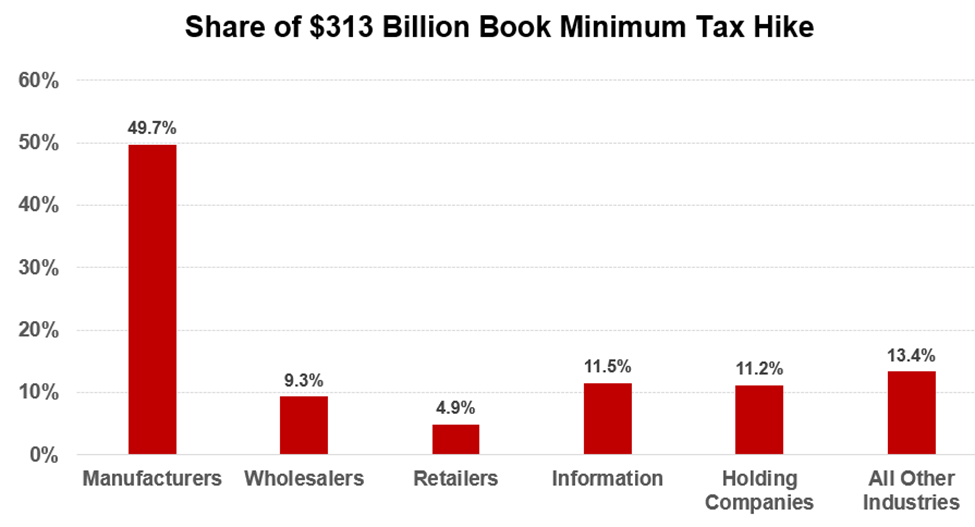

Overall, the plan would affect about 150 companies annually and raise about $313 billion over a decade, according to a report this week from the congressional Joint Committee on Taxation. Nearly half of the revenue would come from manufacturers, the committee said, using a broad definition that might include some pharmaceutical and technology companies.

The following chart is from the Republican side of the Senate Finance Committee (who oppose the bill), but the details come from the non-partisan Joint Committee on Taxation:

The Joint Committee on Taxation has a report on who would be paying the taxes in the bill. According to it's analysis, people earning less than $400,000 would see a tax increase if the legislation becomes law. This is an issue because Democrats have vowed to not raise taxes on this income group.

"Up to $16.7 billion worth of tax increases, JCT estimates," Punchbowl News reports.

Carried-Interest Change Would Hit Top Wall Street Brass, but Could Be Hard to Make Stick – Miriam Gottfried, Wall Street Journal ($):

Senate Democrats are trying to get some of the wealthiest people on Wall Street to pay more in taxes, but that may not be as simple as they hope.

The last-minute deal between Sens. Joe Manchin (D., W.Va.) and Chuck Schumer (D., N.Y.) struck late Wednesday included a tax increase on carried-interest income, which private-equity and hedge-fund managers receive when their investments are sold for a profit. Under current rules, carried interest on investments held at least three years can qualify for long-term capital-gains tax rates, which are well below those applied to ordinary income.

Further down the article:

Tax experts, including many who support ending the special treatment of carried interest, say the way the provision is structured leaves too much room for interpretation and manipulation. The bill’s success rests heavily on whether regulators at the Internal Revenue Service and the U.S. Treasury can quickly write rules that make it easier to understand and can then effectively enforce them. Neither one is a given, though the bill also includes about $80 billion in additional IRS funding aimed at tightening tax enforcement broadly.'

Treasury and IRS Delay QDP Reporting Requirements Until 2025 – Carrie Brandon Elliot, Tax Notes ($). “For the second time, Treasury and the IRS have extended the effective date of the requirement to report qualified derivative payments (QDPs). Section 59A(h) requires taxpayers to report QDPs to be exempted from base erosion payment status.”

IRS Adjusts Eligibility Calculation for Premium Tax Credit – Erin Slowey, Bloomberg ($). “The IRS changed the numbers to calculate an individuals premium tax credit and required contribution percentage on Friday.”

The IRS document is here.

Opportunity Zone Projects Hindered by Inflation, Higher Rates – Angélica Serrano-Román and Richard Tzul, Bloomberg ($). Supply chain SNAFUs and inflation worries might be putting OZ projects on ice, according to Sean Lyons, real estate developer with Jackson Dearborn Partners

‘Sponsors are more inclined to wait for the delays and higher costs to come down further before kicking off a new project,’ said Lyons, who focuses on fundraising and investor relations. ‘Many sponsors are in ‘wait and see’ mode for the market to normalize before starting their next project, so this indirectly impacts the choices and options investors have in a higher cost environment.’

Deja Vu: Wayfair Back in Court Objecting to Sales Tax Codes – Michael Bologna, Bloomberg ($):

Most state tax wonks assumed Wayfair Inc.'s last trip to court offered enough drama and disappointment to last a lifetime. That crusade ended with an appearance before the US Supreme Court and a landmark ruling that found the company—and millions of other remote retailers—had a duty to collect and remit sales taxes in states where they had economic nexus. The 2018 ruling overturned decades of state tax policy and legal precedents that linked these duties to physical presence in a state.

Now the global seller of homewares is back in court, challenging features of the tax environment it helped create. Just last month, Wayfair filed suit in Colorado state court against the city of Lakewood and the Colorado Department of Revenue, objecting to a $604,322 sales tax assessment. The lawsuit contends Wayfair has no legal duty to comply with the assessment because Colorado’s tax processes are massively complicated, constituting ‘an administrative nightmare’ and an unconstitutional ‘undue burden on interstate commerce.’

West Virginia Senate Rejects Personal Income Tax Cut - Angélica Serrano-Román, Bloomberg ($). “The West Virginia Senate late Friday rejected the governor’s proposal to cut the state’s personal income tax. Lawmakers acted in a special session Gov. Jim Justice (R) called to consider the measure (HB 301), which would have permanently cut personal income tax by an aggregate of 10%. The House voted 78-3 in favor but the Senate declined to take up the issue.”

Calif. Offers Tax Relief To Businesses Affected By Wildfire – Jaqueline McCool, Law360 Tax Authority ($). “California businesses affected by a Mariposa County wildfire will be eligible for a three-month extension for filing and paying taxes, as well as other relief, the state's Department of Tax and Fee Administration announced Friday.”

Indiana Advances Special Session Inflation Relief Tax Bills - Alex Ebert, Bloomberg ($). “A pair of bills that would spend more than $1 billion of Indiana’s budget reserves on tax relief for inflation-strapped Hoosiers received initial passage in the Indiana General Assembly Friday.”

Amgen Fights IRS Over $10.7 Billion Tax Bill – Richard Rubin, Wall Street Journal ($):

Biotech Amgen Inc. is in a pitched battle with the Internal Revenue Service over the company’s international tax strategy and $10.7 billion in back taxes and penalties that the agency says it is owed.

The IRS says that Amgen underreported its taxable income by nearly $24 billion from 2010 to 2015 by inappropriately attributing what the agency says should have been U.S. profits to a Puerto Rico subsidiary that oversees manufacturing of the company’s drugs.

Amgen’s dispute with the IRS is the latest example of heightened government scrutiny of the international tax practices of pharmaceutical, technology and other companies.

From the ‘Get-This-Man-a-PR-Coach-Stat!” file:

I'm not very good at math.' Lt. Gov. Robinson pays off tax bills dating back to 2006 after WRAL inquiry - Bryan Anderson, WRAL.com:

Lt. Gov. Mark Robinson was confident his past financial woes were a thing of the past.

‘I don’t have any unpaid taxes,’ Robinson, North Carolina’s top Republican executive officeholder, told WRAL News on Wednesday afternoon.

Or does he?

When presented with documents, Robinson took out his reading glasses and glanced through the invoices he was handed.

'Oh no, oh no,' Robinson said. 'That is not the case.'

But the Guilford County records showed four bills in Robinson’s name.

First excuse: wife blaming:

He indicated that his wife, Yolanda Hill, handles their tax filings and other financial paperwork.

Second excuse: I’m a bad counter:

'When you start talking about taxes, if I’m the guy doing them, then I’m going to jail,' Robinson said. 'I’m not very good at math.'

Robinson paid the bills, so he squared things with the tax department. Not sure how he squares things with his wife.

Attention Kids! It’s National Respect for Parents Day! Clean. Your. Rooms!

Make a habit of sustained success.