Yellen sees room for deal with Manchin over meds, ACA - Christopher Condon, Accounting Today:

Treasury Secretary Janet Yellen said the Biden administration can and should still move ahead with important legislation that will help lower costs for American consumers, despite the blow to a wider fiscal package from Democratic Senator Joe Manchin of West Virginia.

White House Downplays Global Tax Deal Concerns - Alexander Riffaat, Tax Notes ($):

At a July 18 White House press briefing, CEA member Jared Bernstein said that while there are “a lot of moving parts right now,” Biden and Treasury remain committed to the deal.

The comments come after Sen. Joe Manchin III, D-W.Va., confirmed his opposition to the adoption of a global minimum corporate tax rate as part of any reconciliation bill in Congress.

Semiconductor Tax Incentive Bill Edging Closer to Vote - Benjamin Geggenheim, Tax Notes ($):

In a July 18 speech on the Senate floor, Senate Finance Committee member John Cornyn, R-Texas, lauded Sen. Joe Manchin III, D-W.Va., for effectively killing the climate and tax provisions in the ultra-slimmed-down social policy package, adding that he is ready to move forward with the United States Innovation and Competition Act of 2021 (USICA, S. 1260) — a bipartisan bill that until now has been held hostage by Senate Minority Leader Mitch McConnell, R-Ky., over opposition to Democrats’ partisan reconciliation bill.

HILL TAX BRIEFING: Narrower Chips Bill Gains Momentum in Senate - Richard Tzul, Bloomberg Tax ($):

A scaled-down China competition bill that would provide $52 billion to encourage domestic semiconductor manufacturing appears to be gaining support in the Senate.

IRS’s Present-Value Regs Belie ‘Unnerving’ Tweaks on Interest - Jonathan Curry, Tax Notes ($):

The new guidance would establish a three-year grace period before present-value concepts — an accounting principle that considers the time value of money — would need to be applied to post-death, deductible estate expenses.

Space Jam! Accounting for and Taxation of Brands in the NFT Space - Sarah A. Hinchliffe, B. Anthony Billings, and William H. Volz, Tax Notes ($):

Much has already been written and discussed about blockchains, tokens, and cryptocurrencies. Unlike fungible cryptocurrencies like bitcoins, NFTs are one-of-a-kind digital assets stored on a blockchain platform.

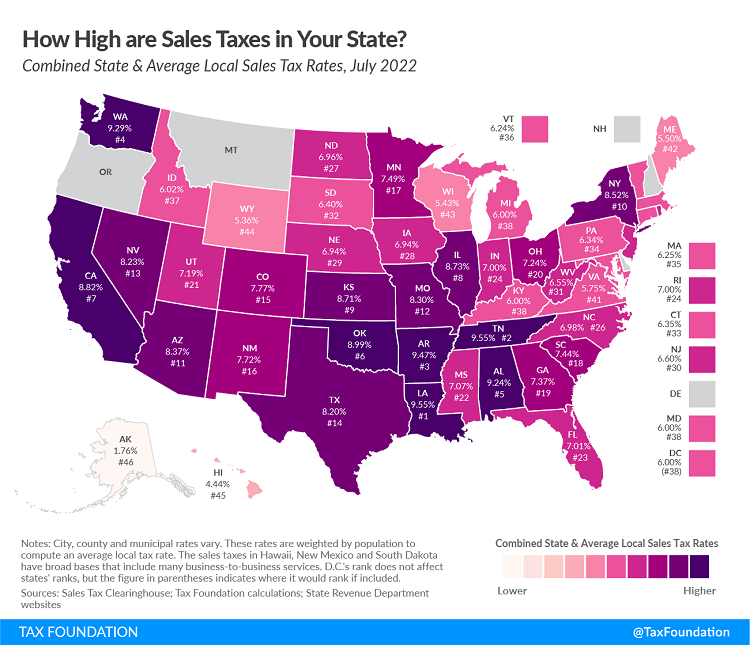

State and Local Sales Tax Rates, Midyear 2022 - Janelle Fritts, Tax Foundation:

"This report provides a population-weighted average of local sales taxes as of July 1, 2022, to give a sense of the average local rate for each state."

Charitable Acknowledgements For Tax Purposes Go Badly Wrong - Peter Reilly, Forbes:

"All in this is a good illustration about how meticulous you should be with charitable contributions in general but particularly those of property and to donor advised funds."

Calif. CPA Admits To $1.2M In COVID Biz Relief Fraud - Anna Scott Farrell, Law360 ($):

"A California accountant has admitted he created a fake tax return to help his longtime client defraud the government's small-business pandemic relief program of $1.2 million."

Be extra kind if you are flying today. It is Flight Attendant Safety Professionals' Day.

Make a habit of sustained success.