Programming note: Eide Bailly offices are closed Monday, July 4, and Tuesday, July 5, for the July Fourth holiday, so there will be no Roundups. Regular programming resumes Wednesday, July 6.

Senate Democrats see 'major progress' on Biden agenda bill, hope for July vote – Sahil Kapur, CNBC. “Senate Democrats are close to a deal to lower prescription drug costs as part of a larger party-line package to advance a number of President Joe Biden's economic priorities, three sources familiar with the negotiations said.”

More from the article:

Democrats plan to submit a ‘finalized agreement’ on allowing Medicare to negotiate prices with pharmaceutical companies to a key Senate official ‘in the coming days’ to see whether it complies with the chamber's strict budget rules, one of the sources said.

This article is about the Build Back Better bill that is expected to include tax increases and pass both chambers of Congress with just support from Democrats. If it passes both chambers, President Biden will definitely sign it into law. But before the legislation arrives at the White House there are a number of outstanding tax issues that need to be cleared up. They include:

- Will the bill expand who qualifies and how much they receive from the Child Tax Credit?

- Will the bill extend the Obamacare tax credits that are scheduled to expire next year?

- Will the bill tax profits on financial statements? (A former Treasury official deemed the provision “not your first choice” when it comes to enacting tax policy.)

This is just a sampling of the unresolved tax issues confronting lawmakers who want to pass BBB. More coverage on this topic can be found in yesterday’s Roundup.

Worth repeating: Yesterday's Roundup also included an article about Sen. Patrick Leahy (D-Vt.) breaking his hip and having surgery to fix it. Eide Bailly wishes him a full and healthy recovery. But the accident and time for recuperation could put congressional Democratic leaders in a time crunch when it comes to passing Build Back Better, which is basically the only legislative vehicle that can include tax increases and pass Congress.

House and Senate lawmakers must approve the same Build Back Better bill for it to be signed into law. They also must do this before September 30th, which is when the congressional year ends and the legislative protections for the Build Back Better bill expire.

The Senate is scheduled to be in session for 38 days between now and September 30th. Passing Build Back Better will require at least a handful of days of Senate floor time as the bill will be besieged by debate and votes on amendments as well as procedural time hurdles. There will then be the final vote, which Leahy must be present because passage will require the support of all Senate Democrats plus the support of Vice President Kamala Harris. In other words, and assuming no other absences occur, Senate passage of Build Back Better is now dependent on the speed at which Sen. Leahy recovers from his injury and surgery - assuming a vote happens.

Leahy recovering from hip replacement surgery – David Lerman, Roll Call:

The 82-year-old Vermont Democrat was ‘comfortably recovering’ at a Washington area hospital, his office said in a statement Thursday night.

‘He is expected to begin a physical therapy regimen after sufficient healing that will allow Patrick and Marcelle to begin taking their daily long walks together again,’ the statement read, referring to Leahy's wife.

It wasn't immediately clear when Leahy would be able to return to the Capitol for votes.

Leahy doesn't have to walk into the chamber. In the past, Senators have been taken directly from their hospital beds and wheeled into the Senate chamber to cast winning votes. Sen. Pete Wilson (R-Calf.) was one such lawmaker. Sen. Robert Byrd (D-W.Va.) was wheeled into the chamber for a health care vote. And Sen. James Wilson Grimes (R-Iowa) was carried into the chamber on May 16, 1868, for a vote regarding the impeachment of President Andrew Johnson.

Leahy ain't the only hurdle:

The set up: Congressional Democrats want to pass two bills from Congress before August: the aforementioned Build Back Better bill and semiconductor legislation (which goes by many, many names). The semiconductor legislation will need Republican support to pass the Senate.

The hurdle: Senate Republican leader Mitch McConnell (R-Ky) has threatened that members in his party will oppose the semiconductor bill if Democrats pass Build Back Better because it will include tax increases.

McConnell on Twitter:

Let me be perfectly clear: there will be no bipartisan USICA as long as Democrats are pursuing a partisan reconciliation bill.

Can Congress get a USICA deal? The USICA bill – Chips, the Bipartisan Innovation Act, whatever you want to call it [aka semiconductor legislation] – suddenly finds itself in the middle of a complex new calculus.

Senate Minority Leader Mitch McConnell warned on Thursday that if Democrats are still ‘pursuing a partisan reconciliation’ package, he’ll sink USICA… A number of Senate Republicans want to pass USICA, which is designed to boost U.S. competitiveness with China on high-tech research and manufacturing, but they’ll stick with McConnell here.

Passing Build Back Better, which only needs Democratic support, is also an open question.

Senate drafts last-ditch drug pricing plan ahead of midterms – Lauren Clason, Roll Call:

[Senate Majority Leader Chuck] Schumer will need the support of all 50 Senate Democrats to pass the bill under the chamber’s budget reconciliation process. But it’s not clear if the deal has the support of other moderate Democrats like Kyrsten Sinema, D-Ariz., or Bob Menendez, D-N.J.

Sen. Joe Manchin (D-W.Va.) has been an omnipresent hurdle to the Senate passing Build Back Better and continues to be. Manchin wants to repeal many of the tax cuts from the 2017 tax reform bill (enacting tax increases shortly before an election can be problematic to those seeking re-election) and he does not appear to be a fan of extending tax credits for Obamacare premiums, which expire in 2023. Negotiations have pretty much reached a critical phase as the calendar creeps toward September.

Punchbowl:

Schumer, Manchin and Speaker Nancy Pelosi have to figure out all of these tricky issues in the next few weeks.

Statement from White House Press Secretary Karine Jean-Pierre on Sen. McConnell Holding American Jobs and Competitiveness Versus China Hostage to Protect Big Pharma

The Republican Senate leader is holding hostage a bipartisan package to strengthen American competitiveness versus China, that would yield hundreds of thousands of manufacturing jobs in places like Southern Ohio, Idaho, and other states around the country. It would lower the cost of countless products, and end our reliance on imports. Why? To protect the ability of big pharmaceutical companies to price gouge. Senate Republicans are literally choosing to help China out compete the U.S. in order to protect big drug companies. This takes loyalty to special interests over working Americans to a new and shocking height. We are not going to back down in the face of this outrageous threat.

More on SALT:

If Senate Reaches Recon Deal, There's Still a House SALT Hurdle – Doug Sword, Tax Notes ($):

Even if Senate Democrats can agree on a slimmed-down reconciliation deal, the package could face head winds this summer as strong in the House as those that knocked it down in the Senate last winter.

That’s because Sen. Joe Manchin III, D-W.Va., is no fan of provisions to raise or repeal the $10,000 cap on state and local tax deductions. The absence of any rollback at all could be a deal killer in the House, where five House Democrats in what they call the No SALT, No Deal caucus have said they would vote against a reconciliation deal that doesn’t include at least some SALT relief.

There is no guarantee that BBB will see floor action before August.

SCOTUS ruling ups pressure on Schumer to strike climate deal with Manchin – Alexander Bolton, The Hill. “Schumer told reporters last week that he’s making progress with Manchin but that they still have significant differences that need to be resolved. He declined to commit to bringing a reconciliation package to the floor before the August recess, which is scheduled to begin Aug. 6.”

Also, passing BBB and the semiconductor bill are not the only things that Democratic leaders want approved before August:

Turning up the heat on July’s agenda – Katherine Tully-McManus, Politico:

There are plenty of other things on Congress’ pre-August recess to-do list. In the House, Majority Leader Steny Hoyer (D-Md.) wants to move spending bills (more on that below), while the Senate is eyeing insulin price legislation and approving the first Senate-confirmed Bureau of Alcohol, Tobacco, Firearms and Explosives director since the Obama administration.

There are also a slew of appropriation bills that leaders want approved and signed into law.

The rest of the month will be interesting on Capitol Hill.

Weeks Left to Make Views Known on Estate and Gift Tax Exclusion – Tax Notes ($):

A proposed antiabuse rule regarding changes in the statutory estate and gift tax exemption amount is among the guidance the IRS wants comments on soon.

Yellen Urges Regulators to Work with Congress on Stablecoins - Allyson Versprille, Bloomberg ($). “Treasury Secretary Janet Yellen is pressing key US financial regulators to work with House lawmakers to regulate stablecoins, according to a Biden administration official.”

IRS Releases New Environmental Taxes Form as Superfund Kicks In – Mary Katherine Browne, Tax Notes ($):

The IRS has posted the form used to calculate environmental taxes on petroleum, ozone-depleting chemicals, and imported products that use ozone-depleting chemicals and other chemical substances that account for the resurrection of Superfund excise taxes.

On June 29 the IRS released Form 6627, ‘Environmental Taxes,’ and its instructions, which were revised to reflect the recent revival of the Superfund excise tax on chemicals under section 4661 and on hazardous substances under section 4671.

The form is here.

Boechler Doesn’t Extend to Deficiency Filing Deadline, IRS Says – Kristen Parillo, Tax Notes ($). “The Supreme Court’s decision on collection due process petition filing rules doesn’t change the Tax Court’s long-standing position that the deadline for contesting deficiency notices is jurisdictional, the IRS is contending in a new pleading.”

Tax Professionals Push Court for More Petitioner-Friendly Rules – Mary Katherine Browne, Tax Notes ($). “Tax professionals have requested further expansion on several proposed changes to practice and procedure rules for litigation before the Tax Court, including making the IRS administrative record more accessible and providing pro bono attorneys in precedential cases with pro se litigants.”

State Tax Changes Taking Effect July 1, 2022 – Janelle Fritts, Tax Foundation. “Although the majority of 2022 state tax changes take effect at the start of the calendar year, some are implemented at the beginning of the fiscal year. Individual and corporate income tax changes usually take effect at the beginning of the calendar year to maintain policy consistency throughout the tax year, but sales and excise tax changes often correspond with the beginning of a fiscal year.”

Gas Tax Holiday: Is Your State Suspending the Gas Tax? – Dan Avery, CNET. “Six states have suspended gas taxes, and more than a dozen others are debating similar gas tax ‘holidays.’”

NJ Assembly OKs Retroactively Ending Tax Audit Extensions – Paul Williams, Law360 Tax Authority ($). “New Jersey would retroactively end the pandemic-related suspension of its statute of limitations for tax audits, and be required to issue refunds of taxes collected from certain assessments, under a bill approved by the state Assembly.”

California Governor Signs $234.4 Billion Budget With Cash Relief – Laura Mahoney, Bloomberg ($). “Gov. Gavin Newsom signed 29 bills enacting the state budget in time for the July start of the new fiscal year that includes $9.5 billion in cash payments to California taxpayers to ease the pinch of inflation.”

NY Vacation Home Doesn't Make Couple Residents, Court Says – Maria Koklanaris, Law360 Tax Authority ($). “An out-of-state man who worked in New York City is not a New York statutory resident just because he and his wife owned a vacation home upstate, a state appellate panel ruled Thursday, overturning the state tax appeals tribunal.”

Puerto Rico Lawmakers Pass Key Corporate Tax Reform Bill – Jim Wyss, Bloomberg ($). “Puerto Rico’s House and Senate passed a critical bill late Wednesday that swaps out an expiring corporate excise tax for an income tax that officials say will preserve the island’s finances and pass muster with the US Treasury.”

News from the Garden State:

Murphy Signs $50.6 Billion Budget With Cash Gifts for Taxpayers – Elise Young, Bloomberg ($). "New Jersey Governor Phil Murphy signed a $50.6 billion annual spending plan with property-tax relief and a full pension payment for the second year."

N.J. Governor Signs Child Tax Credit, Business Relief Bills – Donna Borak, Bloomberg ($). “New Jersey businesses that received tax credits under an economic development program would be able to carry forward unused tax credits for a seven-year period under a bill signed by Gov. Phil Murphy on Thursday.”

New Jersey Companies Face $300 Million Payroll Tax Hike – Donna Borak, Bloomberg ($). “New Jersey businesses can expect to pay a higher payroll tax starting Friday after state lawmakers failed to pass a plan that would have eased the burden on replenishing the state’s unemployment trust fund.”

An International Tax Agenda for Congress on the Anniversary of the Global Tax Deal – Daniel Bunn, Tax Foundation:

Key Findings

- A year since the global tax deal was agreed to by more than 130 countries, progress on implementing legislation has hit a lull.

- Implementation of the minimum tax rules is not expected until the end of 2023 or in 2024.

- Since the 2017 U.S. tax reforms and other recent international rules changes, onshoring of intellectual property (IP) to the U.S. has increased and outward investment strategies for U.S. companies have shifted. This should impact how the U.S. approaches the global tax deal.

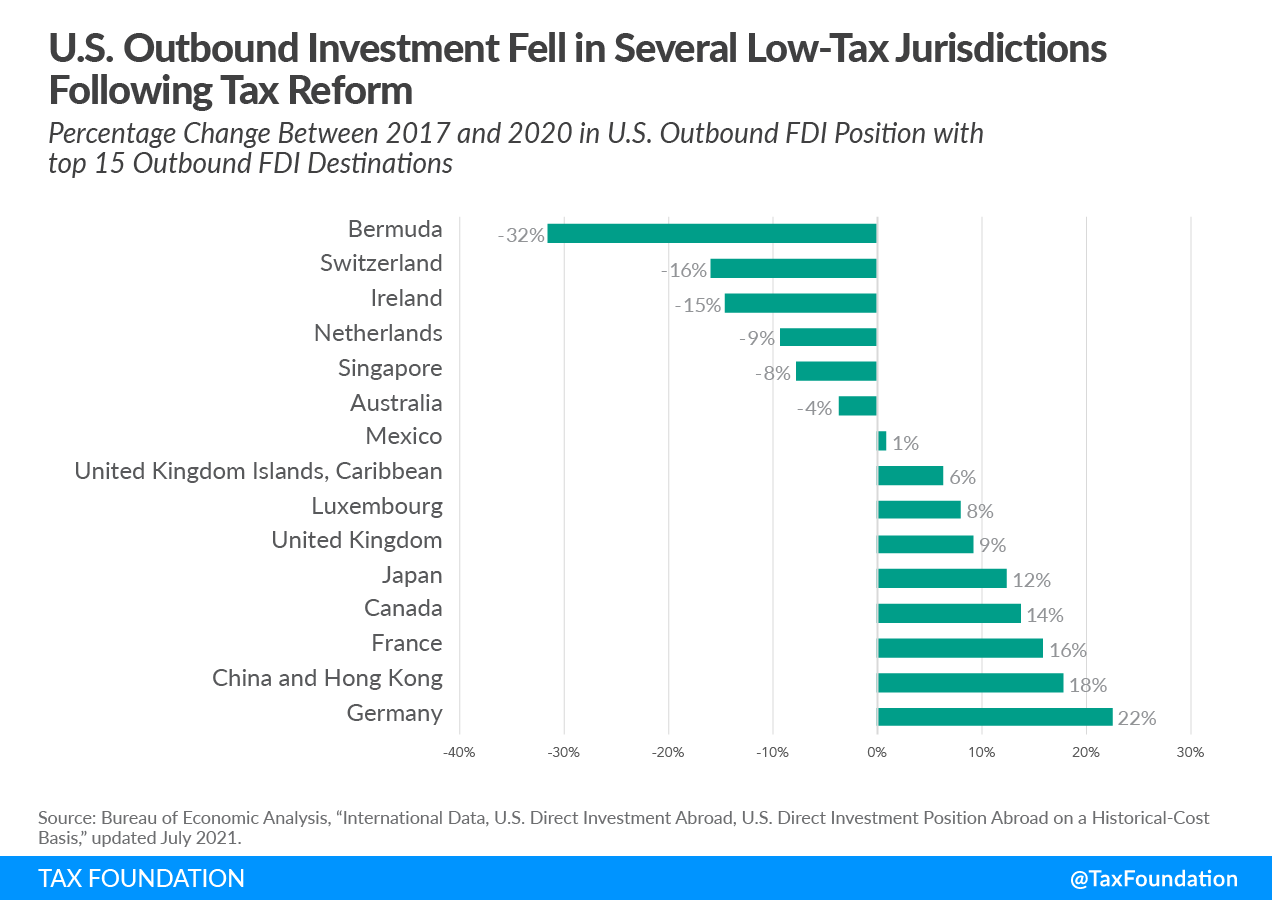

Article’s chart regarding last bullet point:

EU Deflects Talk Of Skirting Unanimity Rule On Minimum Tax – Todd Buell, Law360 Tax Authority ($):

The European Union's executive arm said Thursday that it remains focused on finding unanimous agreement among EU member countries on a 15% minimum corporate tax, deflecting talk of circumventing the unanimity that is normally required to change tax laws.

Spokesman Daniel Ferrie said at the European Commission's regular news briefing, which was webcast, that EU member countries have made progress over the last two months on reaching a deal on the tax. Poland had lifted its veto just as Hungary blocked the measure in mid-June.

'Our plan remains to continue work on this, to reach unanimity,' he said.

From the ‘Sorry, Not Sorry” department:

Disbarred Lawyer’s Excuses for Tax Noncompliance Fail to Impress – Kristen Parillo, Tax Notes ($). “A prominent criminal defense attorney-turned-convicted felon’s cavalier attitude about his failure to pay taxes over several years prompted a judge to reject his bid to resume practicing in federal court.”

In 2021, the defendant was convicted of seven felony counts, which involved money laundering by helping a former client wash drug money. That got him a 42-month stretch in the pokey followed by a year of supervised release. He was ultimately disbarred in Massachusetts until 2021. But practicing in front of federal courts is still a no. Why? The defendant did not appear sorry enough.

U.S. District Court Judge F. Dennis Saylor IV:

‘If a lawyer is to be reinstated after committing serious felonies, and in the absence of any mitigating circumstances, at a minimum that lawyer should demonstrate complete acceptance of responsibility, an extraordinary degree of remorse, and substantial evidence of rehabilitation,’ Saylor wrote. ‘In the Court’s view, those qualities are lacking here.’

The defendant “grudgingly” accepted responsibility for his crimes, but also said he was merely “technically” involved, the article reports.

That didn’t cut it for Saylor:

‘Petitioner is free to assert that he committed the crimes because he was ‘too busy’ and ‘too negligent’ to obey the law,’ Saylor wrote. ‘But that is not an expression of complete remorse, and this Court declines to construe it as such.’

Perhaps Sir Elton John said it best when he penned the lyric “Sorry Seems To Be The Hardest Word.”

It definitely seems that way for the defendant.

Today is National Creative Ice Cream Flavors Day, which is a great precursor to Monday’s July Fourth celebration AND National Barbecued Spareribs Day! Great combo!

Make a habit of sustained success.