Bad Actors Are Fattening Their Wallets, Not Boosting Conservation – Senator Steve Daines (R-Mont.), Bloomberg ($):

Recent guilty pleas and indictments over conservation easement tax schemes reflect a small portion of the manipulation of the conservation easement deduction. The tax benefit should continue, but the fraud and abuse of conservation easements has to stop, says Sen. Steve Daines (R-Mont.).

Further down the article:

In 2020, then-Senate Finance Committee Chairman Chuck Grassley (R-Iowa) and Ranking Member Ron Wyden (D-Ore.) completed an exhaustive investigation into SCE transactions. They found the following:

‘The syndicated conservation-easement transactions examined in this report appear to be nothing more than retail tax shelters that let taxpayers buy tax deductions at the end of any given year, depending on how much income those taxpayers would like to shelter from the IRS, with no economic risk … [The] promoters told their taxpayer-investors that for every dollar the taxpayer-investors paid to the promoters, they would save two dollars on their taxes.’

Even further down the article:

Sens. Debbie Stabenow (D-Mich.), Wyden, Grassley, and I are working with our Senate colleagues to advance a bill to stop these abusive tax shelters by codifying and building upon the 2016 IRS listing notice. Our Charitable Conservation Easement Program Integrity Act targets the most egregious abuses by prohibiting deductions above 250% of an investor’s purchase price, unless a pass-through entity holds the land for over three years. Under this legislation, a syndicate could no longer buy a property for $10 million, have it inaccurately appraised for over $35 million, and take more than $25 million worth of deductions.

There are a few legislative vehicles for this bill to bum a ride on. But it will likely take ten Republicans to pass it in the Senate. It is not clear if that number exists.

End-of-Year Tax Title May Depend on Clean Energy, R&D Progress – Benjamin Guggenheim, Tax Notes ($):

Congress will likely consider a post-election tax title only if Democrats aren’t able to roll back research and development amortization regs and extend clean energy credits in a reconciliation package, a House aide said.

That end-of-year tax title necessitated by inaction on the R&D rules and clean energy credits could provide an opportunity for stakeholders to push their favorite tax provisions, according to Jon Bosworth, legislative director for House Ways and Means Committee member Earl Blumenauer, D-Ore.

Interest in Retention Credit Remains Strong, Hill Aide Says – Steven Cooper, Law360 Tax Authority ($). “Congressional lawmakers are looking for ways to revive a bipartisan tax credit for retaining employees that prematurely ended last year without overwhelming the IRS' limited resources needed to administer the incentive, a senior Democratic tax staff member said Friday.”

Taxpayer Information Disclosure - Butch Maier, Bloomberg ($). “House Ways and Means Committee Republicans, led by Rep. Adrian Smith (R-Neb.), sent a letter to Rettig and Treasury Inspector General for Tax Administration Russell George dated Thursday, asking for a ‘comprehensive briefing’ about the agency’s capacity to refer for prosecution cases of unauthorized access and disclosure of taxpayer information.”

‘A recent report by the U.S. Government Accountability Office revealed some concerns that merit further scrutiny, such as the IRS not meeting its internal timeliness goals’ for completing investigations, the Republicans wrote.

Republicans do not control the House so they can’t call a hearing. The “comprehensive briefing” is basically a hearing that likely will not be public. If Republicans take control of the House after the election, this issue will most definitely get a public hearing. And it will likely center on IRS data leaks that are reported by ProPublica.

Speaking of:

The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax – Jesse Eisinger, Jeff Ernsthausen and Paul Kiel, ProPublica. “ProPublica has obtained a vast cache of IRS information showing how billionaires like Jeff Bezos, Elon Musk and Warren Buffett pay little in income tax compared to their massive wealth — sometimes, even nothing.”

Biden Aide Says Inflation Fight Can Advance If Congress Helps - Tony Czuczka, Bloomberg ($). “A top economic adviser to President Joe Biden said he’s hopeful that Congress will pass measures the administration says will help fight inflation in the coming weeks.”

‘Prices are unacceptably high right now,’ National Economic Council Director Brian Deese said in an interview for CBS’s ‘Face the Nation’ on Sunday. ‘That’s why the president has said we need to make this our top economic focus and do everything that we can to get them down.’

He cited measures to lower the cost of prescription drugs, tax incentives for energy and a ‘long-overdue tax reform’ as ways to help US households deal with the fastest inflation in 40 years and signal to markets that the US is “deadly serious” about curbing rising prices.

Deese is talking about the reconciliation Build Back Better bill that has stalled in the Senate for roughly half a year. The legislation includes tax increases on businesses and wealthier taxpayers. It seems politically risky to enact tax increases as inflation roars.

Biden Says Decision Nearing on Gas-Tax Pause, Student Debt – Josh Wingrove and Jenny Leonard, Bloomberg ($). “President Joe Biden said he’s aiming to decide this week whether to move to suspend the federal gasoline tax in a bid to ease the impact of soaring prices at the pump.”

“Yes, I’m considering it,’ Biden said while speaking to reporters on the beach in Delaware on Monday. ‘I hope I have a decision, based on data I’m looking for, by the end of the week.’

It will require Congress to act.

Further down the article:

Biden was also asked if he was nearing a decision on whether to cancel some federal student debt by executive order, and replied simply that he was. Asked if another extension of repayments -- which have not been required since he took office -- is possible, he replied: ‘it’s all on the table right now.’

IRS Service Woes Slowing Streamlined Low-Income Taxpayer Audits – Naomi Jagoda and Richard Tzul, Bloomberg ($). “The Internal Revenue Service’s long-standing resource constraints and customer-service challenges are hampering what is supposed to be a streamlined process used to audit low-income taxpayers who claim the earned income tax credit.”

The problem centers on correspondence audits. A low-income taxpayer claiming the EITC gets a letter from the IRS and they basically have no way of contacting the tax agency to figure out what the letter says and what is expected of them.

Further down the article:

Ambiguity in the IRS letters sent to audit targets, combined with the agency’s lingering backlog of unprocessed paper tax documents and low answer rate for its help lines, is slowing down the process. Since EITC audits often are conducted before tax returns are processed, audit delays leave taxpayers waiting to receive their refunds.

‘The barriers are stacked against them,’ said Sabrina Strand, assistant director of the University of Denver’s low income taxpayer clinic. ‘Whether it’s a language barrier, a time barrier, the inability to contact the IRS, or not understanding what the IRS is asking for.’

Wyden Floats Refundable Savers Credit in Broad Retirement Bill – Benjamin Guggenheim, Tax Notes ($). “The Senate retirement legislation includes a refundable savers credit of 50 percent of IRA or retirement plan contributions, up to $2,000 per individual, that would phase out for joint filers earning between $41,000 and $71,000 — a slightly higher threshold than the $68,000 limit under current law.”

The Senate Finance Committee will “mark up” this legislation on June 22nd by proposing to amend it. More information on this event was in yesterday’s Roundup.

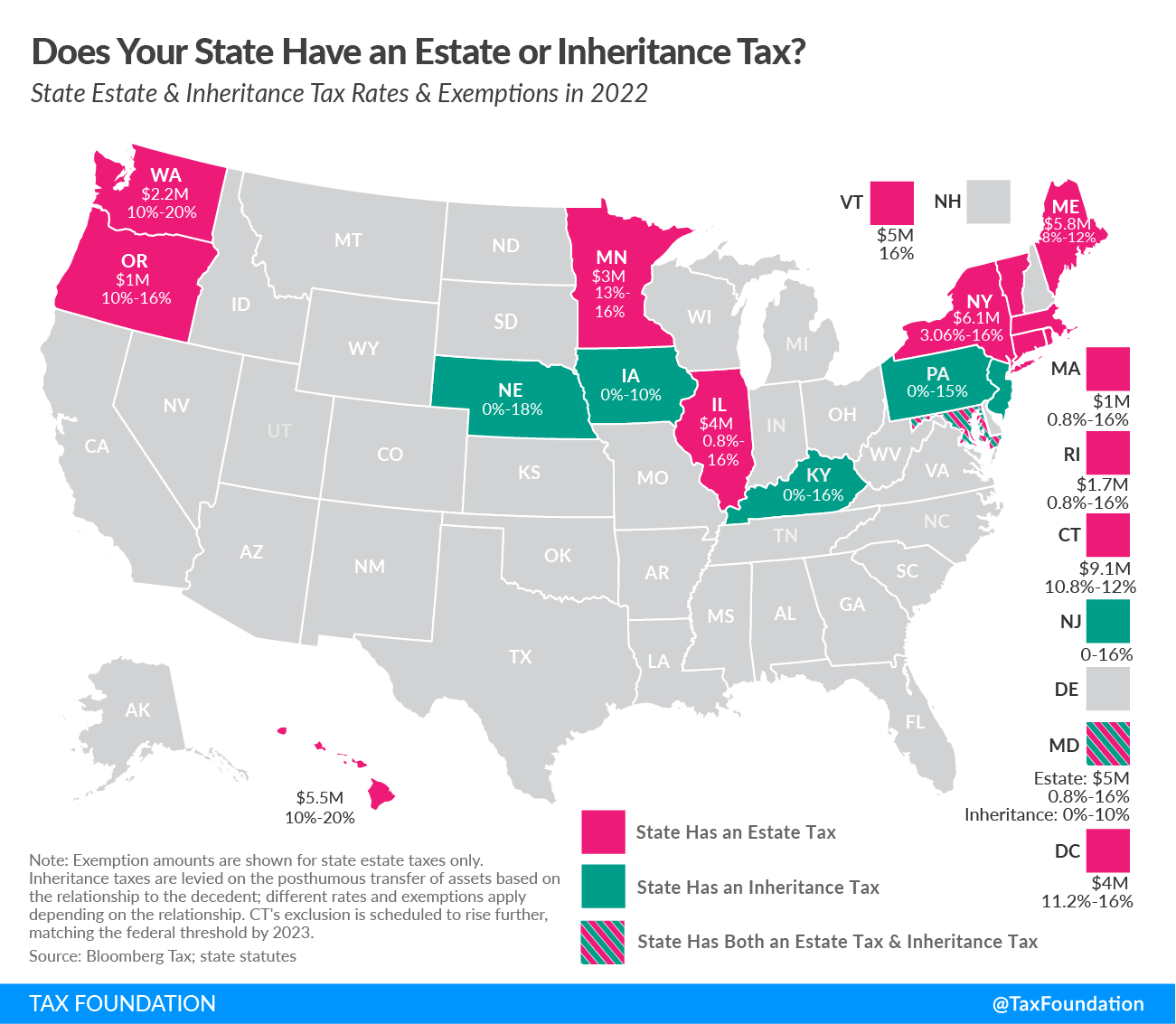

Does Your State Have an Estate or Inheritance Tax? – Janelle Fritts, Tax Foundation. “In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional state estate tax or state inheritance tax. Twelve states and the District of Columbia impose estate taxes and six impose state inheritance taxes. Maryland is the only state to impose both a state estate tax rate and a state inheritance tax rate.”

Virginia Legislature Rejects Governor’s Gas Tax Holiday - Angélica Serrano-Román, Bloomberg ($). “Virginians won’t get the gas tax holiday Gov. Glenn Youngkin pressed for, after the state Senate on Friday rejected the proposal he made in a budget amendment sent to lawmakers earlier in the week.”

Microsoft, Discord Win California Tax Credits for Job Promises – Laura Mahoney, Bloomberg ($). “Microsoft Corp., online group-chat platform Discord Inc., and 3D-printed rocket maker Relativity Space Inc. are the biggest winners in the latest round of California income tax credits awarded to companies that promise to hire more workers and invest more capital in the state.”

California Budget Plans Aim to Soften Unemployment Tax Hike – Laura Mahoney, Bloomberg ($). “ Employers in California are staring down a tax increase to pay back a federal loan to cover pandemic unemployment insurance claims, but officials are trying to help. Budgets are on deck in New York and New Jersey. In Puerto Rico , officials hope for a tax overhaul. And tussles over capital gains taxes in Massachusetts and Washington continue in court.”

Recreational marijuana sales tax could appear on November ballot – Clara Harter, Santa Monica Daily Press. “City Hall has yet to legalize the sale of recreational marijuana, however they are already thinking about how to tax it. In a June 14 Council meeting, Councilmembers voted unanimously to have staff research a ballot measure that would allow the City to place a Santa Monica tax on the sale of recreational cannabis.”

Top US Court to Weigh Fines for Not Reporting Overseas Accounts - Greg Stohr, Bloomberg ($):

The US Supreme Court agreed to decide how steep the penalties are for people who fail to file required reports with the federal government listing their foreign bank accounts.

The justices said they will hear arguments from Alexandru Bittner, a businessman who was assessed a $2.72 million penalty for not filing timely reports for five years when he was living in Romania. Bittner contends the maximum fine under federal law is $50,000.

The fight centers on the Bank Secrecy Act, a law designed to combat tax evasion and money laundering by requiring US citizens and residents to report on their foreign holdings. For unintentional violations, the law authorizes penalties of as much as $10,000.

Could this fall under the category of ‘something borrowed’?

A Wedding, a $750,000 Horse and the Complexity of IRS Seizures – David Voreacos and Elise Young, Bloomberg ($). “Christina Fisher was planning her wedding when she got a call that federal agents were seizing her horse.”

‘I kept pleading with them just to wait until I got there,’ said the 29-year-old, whose father was indicted earlier this year in an alleged tax scam. She says she told the agents to ‘take whatever you want that’s monetary, but you can’t treat a living animal like this.’ The horse, a champion show jumper she calls Lex, ‘did nothing against the government,’ she said.

The seizure of the 15-year-old Holsteiner, bought by her father in 2017 for $750,000, is one example of unusual assets the US government has gone after in a wide range of criminal and sanctions cases

It’s National Daylight Appreciation Day! Soak in the rays because soon the world will tilt and make daytime shorter. Bummer.

Make a habit of sustained success.