Millions of Destroyed Tax Forms Deal Reviled IRS Fresh Black Eye – Naomi Jagoda, Bloomberg ($). “The revelation that the IRS quietly disposed of around 30 million unprocessed tax documents is the latest blow to the reputation of an agency that has long struggled with its public perception.”

The destruction of the unprocessed paper information returns was first disclosed by an agency watchdog in a September report, but drew the ire of tax professionals and others who follow the IRS closely after it was more prominently mentioned in a report released earlier this week.

Taxpayers won’t face any penalties resulting from destruction of the forms, which are used to help check to see whether taxpayers are reporting the correct amount of income, the IRS announced Thursday. Still, the IRS is facing criticism for not inform the public directly, the latest development as another in a long line of communication missteps.

'They owe the taxpayers of the United States this information,' former National Taxpayer Advocate Nina Olson, now executive director of the Center for Taxpayer Rights, said in an interview.

Speaking of IRS black eyes, when Lois Lerner told a D.C. audience roughly a decade ago that the IRS had targeted certain taxpayers, reporters covering the event ran out of the room to inform their editors about what was said. They ran from the room because it didn't have cell coverage and they needed to speak with their bosses ASAP about huge, breaking news. After the news broke, one reporter I spoke with was stunned about how casually Lerner said what she said, as if it wasn't that big of a deal.

READY TO WEIGH IN – Bernie Becker, Politico Pro ($), “The IRS had been pretty silent in the aftermath of TIGTA’s disclosure this week that it had destroyed some 30 million income verification forms in March 2021… But the agency did weigh in late on Thursday, stressing that taxpayers won’t be hit with any penalties because of the destroyed forms.”

Not only that: The IRS statement suggested this was a one-time issue spurred by the pandemic, because the agency made it a priority to get backlogged refunds out the door, and promised that nothing like this would occur for the tax years of 2021 and 2022.

‘There were no negative taxpayer consequences as a result of this action,’ the agency said in a statement, adding that taxpayers ‘have not been and will not be subject to penalties resulting from this action.’

Expect this statement to be repeated at future congressional hearings regarding this mishap: ‘There were no negative taxpayer consequences as a result of this action.’ And then expect witnesses to be ushered into that hearing who were hurt by 'this action.'

Potential topics for congressional hearings (emphasis added):

IRS Asserts Taxpayers Not Affected by Destruction of Info Returns – Jonathan Curry, Tax Notes ($):

The recent TIGTA report wasn’t the first revelation that the paper return documents had been destroyed — a TIGTA report dated September 2, 2021, delves further into the IRS’s decision-making.

According to that report, IRS management indicated that the decision was made after discussions between the agency’s Wage and Investment and Small Business/Self-Employed divisions. 'Although IRS management considered maintaining the documents in paper form, they decided against this because retrieval of the documents would be difficult,' the report said.

At that time, the agency told TIGTA that SB/SE conducted a risk assessment to determine the impact that destroying the information reporting documents would have on its post-processing compliance activities. The results of that risk assessment weren’t provided with TIGTA’s report.

IRS Names John Hinman as Whistleblower Office Director – David Hood, Bloomberg ($). “The IRS named John Hinman as the new director of the agency’s whistleblower office, an IRS spokesperson confirmed to Bloomberg Tax.”

Hinman succeeds Lee Martin, who left the IRS last month to work as director of the Occupational Safety and Health Administration’s whistleblower office. Hinman most recently worked as director of field operations for transfer pricing practice in the IRS’s Large Business & International Division.

He comes on the job as the agency seeks to speed up processing whistleblower cases that have piled into the thousands, according to the whistleblower division’s most recent annual report, for fiscal year 2020.

Brady Skeptical of Push to Add Tax Perks to Chips Bill – Zach Cohen, Kaustuv Basu and Alex Clearfield, Bloomberg ($). “House Ways and Means Committee ranking member Kevin Brady expressed opposition to including a tax title in a multibillion-dollar manufacturing and innovation bill lawmakers are negotiating. ‘I see no need for a tax title in this conference report, especially one favoring a single industry,’ Brady (R-Texas) said Thursday.”

Later in the afternoon, he somewhat softened that position, saying that if negotiations a tax package designed as a strong counter to the Made in China 2025 plan 'could be worth pursuing.' The Made in China 2025 plan is an initiative by the Chinese government to reduce high-tech imports and invest in manufacturing locally.

Members of both parties have been angling for the inclusion of various tax measures during conference committee deliberations over the competition legislation. A bicameral conference committee started meeting Thursday in an effort to has out differences between House and Senate bills.

Tax credits, tariffs, trade oversight emerge as key China bill conference issues – Gavin Bade, Politico Pro ($). “Pending legislation to confront China economically has hit a new speed bump — tax policy.”

Lawmakers met on Thursday for a rare conference committee to reconcile House and Senate versions of the legislation. The bill would fund domestic production of semiconductors and potentially toughen American trade laws toward China.

Lawmakers are largely united in approving $52 billion in one-time funding for domestic semiconductor production. But they are divided over whether to include a tax credit for semiconductor plants, contained in the Facilitating American-Built Semiconductors, or FABS Act.

Don't hold your breath on tax provisions being added to this bill. Adding them would likely muddle its chance for enactment and President Biden really, really, really wants to sign it into law.

Climate bill talks in ‘good place,’ Whitehouse says – Ellen Meyers, Roll Call. “Lawmakers are making headway on bipartisan support for an energy and climate legislative package, Sen. Sheldon Whitehouse said Wednesday, as companies head to the Hill for a two-day lobbying spree for carbon-free energy tax credits and other green provisions.”

During a media briefing with sustainability nonprofit Ceres, Whitehouse said he and his Senate colleagues are ‘in a good place’ to finalize a set of bills to carry out some of Democrats’ climate ambitions that Republican lawmakers and moderate Democrats including Sen. Joe Manchin III, D-W.Va., will support.

This sticks out:

Legislative text is expected to be ready within the next two weeks…

So talks are going well on a bill that doesn't exist. Hmmm. As I have told my children a billion times ‘actions speak louder than words.’

Senate Democrats Propose Banning Anti-Union Tax Write-Offs - Paige Smith, Bloomberg ($). “Senate Democrats are taking aim at companies that oppose worker organizing efforts, unveiling legislation that would ban tax deductions for anti-union activities.”

Sen. Bob Casey (D-Pa.) was joined by Sens. Ron Wyden (D-Ore.), Patty Murray (D-Wash.), Chris Van Hollen (D-Md.), and Cory Booker (D-N.J.) in introducing a bill known as the No Tax Breaks for Union Busting Act. The bill would propose that employer spending on anti-union activities qualifies as political speech under the tax code, barring companies from deducting the costs on their taxes.

Just because a bill gets introduced doesn't mean it will become law. This piece of legislation probably falls into this category.

Harder than it sounds: Income-targeted student loan forgiveness invites a ‘train wreck’ – Michael Stratford, Politico Pro ($). “President Joe Biden’s advisers are looking at ways to limit student loan forgiveness based on borrowers’ income to avoid sending benefits to higher-earning Americans. But that approach is already angering progressives and could be a nightmare to implement before the November elections.”

The first hurdle is within Biden’s own administration, where Education Department officials have privately raised concerns about the complexity of adding an income test to student loan forgiveness. They’re warning the White House that the agency lacks the data to automatically cancel loans based on a borrower’s earnings, according to three people familiar with the discussions.

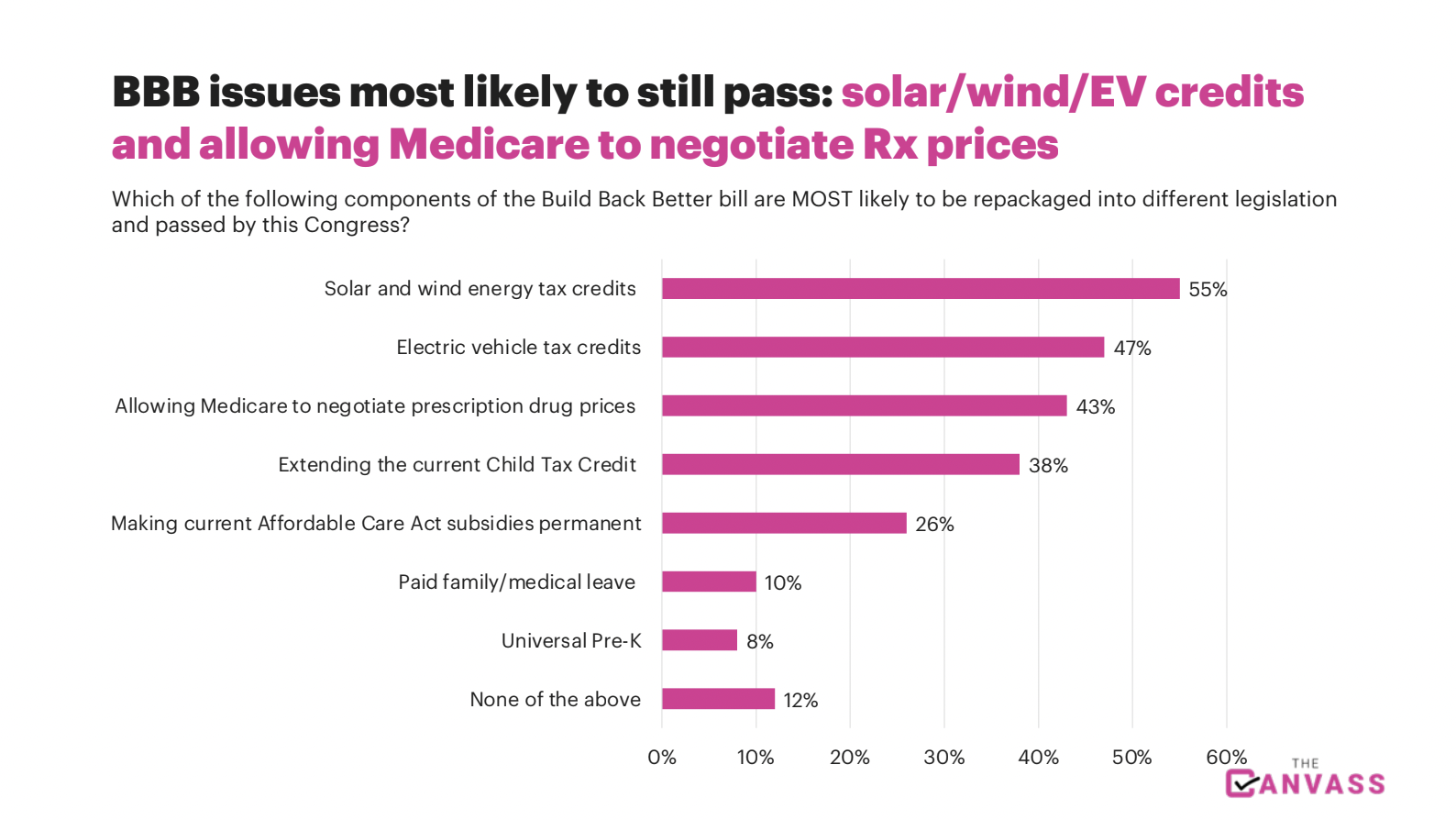

Regarding the Build Back Better bill, here is what lobbyists think can still pass, according to Punchbowl News:

Pay no attention to the fact that tax increases are not listed. If a bill moves forward, tax increases will more than likely be a part of it. That being said, every day that passes the odds shrink for Congress passing a Build Back Better bill.

Individual Denied Deductions for Donations, Business Expenses – Tax Notes ($):

The Tax Court, in a summary opinion, held that an individual was not entitled to deductions related to charitable donations, unreimbursed employee expenses, business startup costs, and real estate passive activity loss, finding that she had not sufficiently substantiated the expenses and sustaining a late filing penalty.

Oh, the irony:

Accounting Professor Charged With Tax Evasion, DOJ Says – Tax Notes ($):

Gordian A. Ndubizu was charged with four counts of tax evasion and four counts of filing false tax returns for allegedly preparing false returns and underreporting income for the pharmacy he co-owned with his wife while he was an accounting professor at a Pennsylvania university, the Justice Department said in a May 12 release.

Minn. Senate OKs Cut To Lowest Income Tax Rate – Sanjay Talwani, Law360 ($). “Minnesota's lowest income tax rate would drop by nearly half under a major tax package approved by the state Senate and headed to the House for consideration of Senate amendments and possible resolution in a conference committee.”

The Republican-led Senate on Wednesday approved H.B. 3669 by a 42-22 vote with amendments, replacing much of the bill as passed May 4 by the Democratic-controlled House. If enacted, the bill would cut the income tax rate for the state's lowest income bracket from 5.35% to 2.8%, eliminate state taxation on Social Security benefits, phase out the state's portion of corporate property taxes and make several other changes.

California Vote to Raise Bar for Tax Increases Delayed to 2024 – Laura Mahoney, Bloomberg ($). “Backers of a California ballot measure that would make it more difficult to enact local tax increases are postponing their effort from November 2022 to 2024.”

The California Business Roundtable and other supporters have gathered almost 1.2 million signatures to qualify the Taxpayer Protection and Government Accountability Act, and were aiming for the November statewide ballot, spokesman Michael Bustamante said Thursday.

They would need to turn in at least 1.5 million signatures in the next few weeks to give the Secretary of State enough time to verify at least 997,139 of them are valid and meet a late-June deadline to lock in the list of measures on the ballot. Instead, the supporters will take more time and aim for 2024.

Newsom wants to eliminate California's cannabis cultivation taxes – Alexander Nieves, Politico Pro ($):

Gov. Gavin Newsom on Friday will propose overhauling California’s cannabis tax code, a plan that includes an elimination of its levy on cannabis growers and a temporary reduction of the overall tax rate, while leaving the door open for tax increases on pot sales, according to an administration official.

Delaware Latest State to Pass Recreational Pot Legalization Bill - Joyce E. Cutler, Bloomberg ($). “Delaware lawmakers on Thursday approved legislation to legalize adult-use cannabis and sent the measure to the governor.”

The bill (H.B. 371) removes civil and criminal penalties for simple possession and for giving cannabis as gifts to adults. The Senate passed the measure 13 to 7, and on May 5 the House cleared the bill, 26 to 14. A separate bill (H.B. 372) that would regulate Delaware’s legal cannabis market proposes a 15% retail sales tax. The House Appropriations Committee passed the measure on May 10 and sent it to the full House. The chamber must approve tax measures with a three-fifths majority vote.

Related: Lawmakers on Capitol Hill want to allow banks in states where marijuana is legal to accept money from sales of the product. Lawmakers wrote a letter stating this on May 12th. Here's the problem: It doesn't have enough Republicans supporting it. Without the support of at least ten Senate Republicans, this bill goes nowhere.

Kansas Governor Signs Sports Betting Legislation With 10% Tax - Angélica Serrano-Román, Bloomberg ($). “Kansas became the 35th state to legalize sports betting after Gov. Laura Kelly (D) signed legislation Thursday.”

Lawmakers had approved the measure, SB 84, on April 28—the House by a 73-49 vote, the Senate 21-13.

The law sets a 10% tax on gaming revenue, sending 80% of the revenue to a fund to incentivize professional sports teams to come to Kansas.

The Kansas Racing and Gaming Commission must adopt regulations by Jan. 1, 2023

Colorado Court Orders Rethink of Interest on Improper Tax Sale – Perry Cooper, Bloomberg ($). “A trial court must recalculate interest in a suit to recover land improperly transferred by treasurer’s deed after a Colorado appeals court ruled on the date interest begins to accrue.”

Interest accrues from the date each expenditure was made, except with respect to improvements, the Colorado Court of Appeals ruled Thursday.

New York Tribunal Upholds State Tax on Partnership Share – Perry Cooper, Bloomberg ($). “New York properly taxed a nonresident’s full distributive share of partnership income from a company that brokers health insurance to college students, a state tribunal ruled.”

ISOA LLC is a domestic partnership engaged in the brokerage business in New York. “While petitioner contends that much of the partnership work was done by him outside the United States, he has not offered a scintilla of evidence to support these factual assertions,” Administrative Law Judge Kevin R. Law of the Tax Appeals Tribunal ruled in a determination released Thursday.

A bill in search of a legislative vehicle:

Wyden, Portman Introduce Bipartisan Bill to Disallow Foreign Tax Credits and Other Tax Benefits for Companies Operating in Russia – Senate Finance Committee:

Senate Finance Committee Chair Ron Wyden, D-Ore., and Senate Finance Committee Member Rob Portman, R-Ohio, today introduced legislation to disallow Foreign Tax Credits for companies that pay taxes to the Russian government, and other tax benefits.

Happy Friday the 13th! (Happy?)

The website History explains how this day became bad news:

According to biblical tradition, 13 guests attended the Last Supper, held on Maundy Thursday, including Jesus and his 12 apostles (one of whom, Judas, betrayed him). The next day, of course, was Good Friday, the day of Jesus’ crucifixion.

The seating arrangement at the Last Supper is believed to have given rise to a longstanding Christian superstition that having 13 guests at a table was a bad omen—specifically, that it was courting death.

Make a habit of sustained success.