The IRS has been moving slower than usual to process tax returns. Administration officials say that is the result of years of Republican-backed budget cuts. Republicans say the agency hasn’t given priority to taxpayer service. Some recent years have been particularly difficult. In fiscal 2019, the aftermath of a government shutdown caused a backlog. The IRS slowed again when the coronavirus pandemic began in 2020 and is still months behind schedule in processing paper returns.

As of April 29, the IRS has 9.6 million unprocessed individual tax returns, some from tax year 2020 and some from 2021. The agency says it is taking more than 20 weeks to handle amended tax returns and hopes to catch up on all of its processing backlogs by the end of 2022.

It's not just your tax refund, and it's not your preparer's fault. As consolation, you will get 4% interest when the IRS finally issues your refund.

Wary Dems Want R&D Proposal Paired With Refundable Tax Credits - Benjamin Guggenheim, Tax Notes ($):

Legislation that would preserve full expensing of research and development costs may need to include the extension of refundable tax credits for families and workers to get wary Democrats on board.

The comments echo the views of some observers who are skeptical that Democrats would give a big tax break to businesses while allowing extensions of the child tax credit and the earned income tax credit to stall in the Build Back Better Act (H.R. 5376).

2017 tax law changes provided for amortization of R&D expenses over five years, replacing immediate deductions of the costs. Many observers thought that the provision would never be allowed to take effect, but it's still there.

Checking for research opposition - Bernie Becker, Politico:

Chances are that Congress will bring back immediate expensing for research at some point in the near future. But business advocates and key supporters on the Hill — who include some Democrats in potentially tough races this fall — want that to happen on the soonest possible vehicle, and that could easily be this bipartisan China competition legislation currently being hammered out.

All of which is a long way of saying — keep an eye on the opposition from progressives and key Democrats to attaching the research provision to that broader competitions bill. Those skeptics have noted, among other things, that it’s off-key for Democrats to spend tens of billions on corporate tax cuts when they can’t keep the expanded Child Tax Credit on the books for more than a year.

Corporate America takes first battle over future of Trump tax cuts - Jeff Stein and Yeganeh Torbati, Washington Post ($). "On Wednesday, the Senate voted overwhelmingly on a nonbinding measure to recommend that the research and development corporate tax incentive be included in a bill aimed at keeping the U.S. economy competitive with China’s... But many liberals had argued Democrats should not agree to reinstate it without some concession from the GOP, such as an extension of the Child Tax Credit or an increase in the corporate tax rate."

TIGTA Foresees Big Benefits for IRS From Grand E-Filing Plan - Jonathan Curry, Tax Notes ($):

A comprehensive strategy to enhance options for the electronic filing of tax returns could pay off big for the IRS, according to the Treasury Inspector General for Tax Administration.

...

The ongoing COVID-19 pandemic-induced backlog has been so severe that the IRS opted to destroy about 30 million unprocessed paper-filed information returns, like Forms 1099-MISC, in March 2021, TIGTA found.

From the TIGTA report:

As of December 31, 2021, the IRS reports that there are more than 2,000 outstanding requests for paper-filed tax return–related documents needed by an IRS functional area to address a taxpayer case. The Chief Operating Officer of the National Archives and Records Administration stated that requests for tax records are one of the three largest types of backlogged requests being addressed by the National Archives and Records Administration. He estimated that it will take several years to fulfill the existing outstanding requests.

If it takes several years to fetch documents, the Taxpayer Advocates recommendation for scanning everything on paper seems like it should be the first IRS step. It's amazing how much easier it is to find things in a paperless database.

Despite Operating Legally in Many States, Marijuana-Related Businesses Face Significant Federal Income Tax Law Challenges - Erin Collins, NTA Blog:

All but four states have legalized marijuana use in some form (i.e., for recreational or medicinal use). Per the Chief Economist for the National Cannabis Industry Association, there were 35,329 adult-use or medical licenses issued in the U.S. as of October 2021, up from 29,604 such licenses at the start of 2021. Revenue from the licensed marijuana industry is projected to grow to nearly $30 billion annually by 2025.

...

While businesses can generally deduct from their gross income “all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on [the] trade or business” pursuant to section 162(a), there are exceptions. Section 280E, enacted in 1982, forbids businesses from deducting expenses from their gross income if the business consists of illegally “trafficking” in Schedule I or II controlled substances... There is an exception for the cost of goods sold (COGS); marijuana businesses can offset their gross receipts by their COGS, even for products considered controlled substances under federal law. Even so, marijuana-related businesses end up paying federal taxes on gross profit rather than net income.

It's not just higher taxes. It's harder for cannabis businesses to give the IRS money:

There is an exception for the cost of goods sold (COGS); marijuana businesses can offset their gross receipts by their COGS, even for products considered controlled substances under federal law. Even so, marijuana-related businesses end up paying federal taxes on gross profit rather than net income.

Not to mention the obvious and not-so-obvious problems arising from having to deal in cash.

Erin Collins heads the Taxpayer Advocate Service, "an independent organization within the IRS."

Depressing - Russ Fox, Taxable Talk. "The conclusions of this report are obvious. If at all possible, efile your return. If you do have to mail something to the IRS, bring patience (a whole lot of patience). And if you’re Commissioner Rettig and you’re stating 'everything will be cleared up by year-end,' let’s just say I hope you’re right but I really, really doubt it."

Governor Lamont Signs Budget That Includes the Largest Tax Cut in Connecticut History - Press Release. "Tax cuts in the package include suspending Connecticut’s excise tax on gasoline through November 30, 2022; enacting a $250 per-child tax credit for lower and middle-earning families; funding payments for earned income tax credit eligible households; increasing the property tax credit from $200 to $300; and speeding up a plan to eliminate taxes on pensions and annuities. In addition, bus fares on all public buses statewide will continue to be suspended until December."

Bill to ease property taxes for homeowners sails through Colorado Legislature - Nick Coltrain, Denver Post. "In its unveiling, Gov. Jared Polis said it would save the owner of a $500,000 home an average of $274 a year. It will cost the state an estimated $700 million over two years, funded via one time money, as tax refunds required under the Tax Payer Bill of Rights or simply chalked up as lost revenue."

Texans Approve Property Tax Cuts - Paul Jones, Tax Notes ($). "Texas voters have approved two state constitutional amendments to provide property tax relief to the elderly and disabled, and to homeowners generally."

Florida Enacts $1 Billion in Property, Gas, and Sales Tax Relief - Benjamin Valdez, Tax Notes ($). "The bill establishes sales tax holidays for children’s books from May 14 to August 14; for disaster preparedness supplies from May 28 to June 10; for baby clothes and shoes from July 2022 to June 2023; for Energy Star appliances from July 2022 to June 2023; and for impact-resistant windows, doors, and garage doors from July 2022 to June 2024. It also lowers the sales tax on new mobile homes from 6 percent to 3 percent and exempts some farm equipment."

Tax Court Upholds Limitations Period Extension Against Taxpayer - Mary Katherine Browne, Tax Notes ($). "The Tax Court found no evidence that an appeals officer intimidated a taxpayer into agreeing to extend the statute of limitations period by threatening to assess fraud penalties against her."

Link to opinion: T.C. Memo. 2022-48

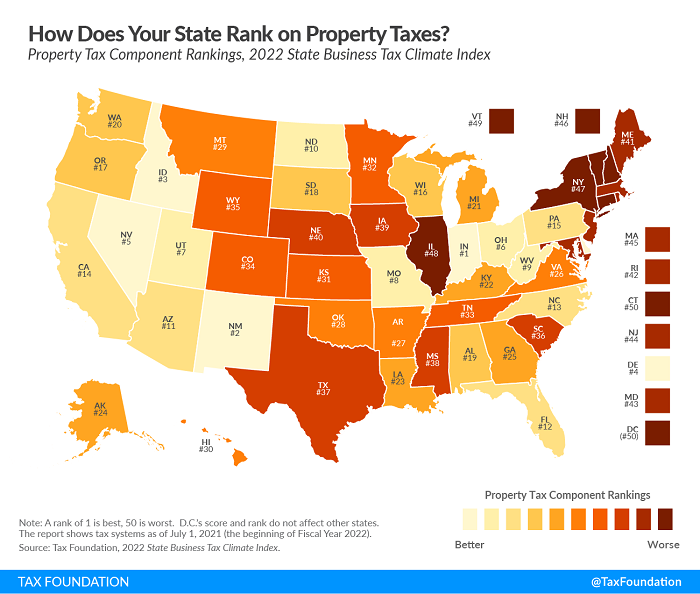

Ranking Property Taxes on the 2022 State Business Tax Climate Index - Janelle Cammenga, Tax Policy Blog. "Today’s map shows states’ rankings on the property tax component of our 2022 State Business Tax Climate Index. The Index’s property tax component evaluates state and local taxes on real and personal property, net worth, and asset transfers. The property tax component accounts for 14.4 percent of each state’s overall Index score."

IRS Taxes Kentucky Derby Wins, But Can You Deduct Losses? - Robert Wood, Forbes. "It is important to keep an accurate diary or similar record of your gambling winnings and losses. To deduct your losses, you must be able to provide receipts, tickets, statements or other records that show the amount of both your winnings and losses."

IRS holding Austin hiring event this week, additional job fairs also scheduled - Kay Bell, Don't Mess With Taxes. "Specifically, the IRS is looking for clerks and tax examining technicians to work out of its Austin campus."

Massachusetts grandmother lost her savings to tax foreclosure law - Christina Martin, The Hill. "With chronic health problems and living on a fixed income, Foss fell behind on her property taxes when she hit a rough financial patch. That’s when the city sold a $9,626 tax lien on her home to a private investment company. Under Massachusetts law, the lien gave the company power to take full title to her property when she didn’t pay her debt quickly enough. The company evicted Foss and quickly sold the property. Almost before she could grasp what was happening, she had lost her home and $210,000 in equity."

What to Do After Receiving a Notice of Claim Disallowance - Keith Fogg, Procedurally Taxing. "In order to preserve the right to obtain payment beyond the two-year period, the taxpayer must either file suit or ensure that they and an authorized IRS employee sign a Form 907, Agreement to Extend the Time to Bring Suit."

Decision of IRS CCISO Does Not Bind Chief Counsel for Innocent Spouse Relief Request Raised in Tax Court Deficiency Proceeding - Ed Zollars, Current Federal Tax Developments. "The Tax Court ruled that the IRS Chief Counsel has the ultimate say on whether an individual qualifies for innocent spouse relief even though the Cincinnati Centralized Innocent Spouse Operation (CCISO) determined the taxpayer was entitled to relief when the request for relief initially arises as part of litigation in Tax Court."

The TIGTA Report: Lessons From a Decade of FATCA - Robert Goulder, Tax Notes. "Imagine how much simpler FATCA enforcement would be if the statutory regime contained a same-country exemption. Simply put, no U.S. taxpayer would need to identify financial accounts held in FFIs located in their country of residence. Say someone happens to work for a multinational tech company in Dublin. The person’s local checking account would be outside the scope of FATCA. If that same Irish resident maintained a financial account in Liechtenstein (or any place other than Ireland), it would be game on for FATCA."

The Elephant in The Room: The Gap Between Federal Retiree Benefits and Taxes Paid - Eugene Steuerle, TaxVox. "Under current law, the Social Security and Medicare trust funds that pay out crucial benefits to retirees will go insolvent by roughly 2034 and 2026, respectively, triggering large mandatory benefit cuts. Meanwhile, the gap between scheduled benefits and taxes paid directly to cover the cost of these programs continues to grow. Every elected official knows this. And no one expects benefits for existing retirees suddenly to be cut in 2034 or 2026. But fixing the problem requires some combination of tax hikes and reduction in the rate of growth of future benefits, neither of which pleases Congress’ or presidents’ political palates for admitting to having made promises that couldn’t be kept."

Review Of ‘Only The Rich Can Play’ By David Wessel - Peter Reilly, Forbes: "Taxpayers with capital gains, long or short, from pretty much anything can invest their gains in Qualified Opportunity Funds. There are two, possibly three, benefits. The benefit that seems to generate the most excitement is that recognition of the capital gain is deferred till 2026. In earlier years there would also be a reduction in the taxable gain. The really big incentive is that after 10 years any gain from the QOF investment is tax free."

IRS Stole Money and Hid the Details for Years - Kathy Sanchez and Daryl James, Reason:

The IRS stonewalled for more than six years when our public interest law firm, the Institute for Justice, sought access to the agency's forfeiture database. Initially, the IRS wanted $750,000 in fees before it would accommodate the request—an unreasonable demand that would render the Freedom of Information Act useless for all but the wealthiest citizens.

Once in court, the IRS attempted a bait and switch. Rather than provide the actual data, it released a summary report that was 99 percent redacted. It then declared that it had gone above and beyond the legal requirements.

The article relates to "civil forfeiture," a procedure where government agencies can seize assets on an allegation of crime - often without ever bringing charges - with owners forced to go through expensive and complex litigation to get assets returned. It works as an arbitrary and punitive tax often imposed on innocent parties without the resources to resist.

Two Owners of Tony Luke’s Philadelphia Cheesesteak Restaurant Plead Guilty to Conspiracy to Defraud the IRS - US Department of Justice:

According to evidence summarized at today’s hearing, the defendants paid a significant number of their employees and partially “off-the-books.” To avoid withholding and paying over to the IRS employment taxes of the “off-the-books” amount, defendants gave their employees paychecks that reflected a portion of the employees’ hourly wages with the required taxes withheld. However, the wages the defendants paid and reported in this fashion represented only a portion of the true hours the employees worked. The Lucidonios then directed their employees to endorse their paychecks and give them back to the defendants and their restaurant managers. In exchange for return of the endorsed payroll checks, defendants provided their employees envelopes containing cash. This process allowed the defendants to understate the hours each employee worked. The scheme caused Tony Luke’s accountant to substantially understate the wages paid to the employees, and subsequently, the payroll taxes due to the United States.

One little flaw may have undone this plan. When you do this, every employee becomes a potential informant. Eventually, you will have a disgruntled employee. Just pay the taxes.

Hungry? It's National Shrimp Day! "In the United States, shrimp is eaten more than any other type of seafood, so of course, it deserves its own day!"

Make a habit of sustained success.