New York’s SALT Cap Challenge Rejected by Supreme Court – Aysha Bagchi, Perry Cooper and Donna Borak, Bloomberg ($). “The Supreme Court declined to review a New York-led constitutional challenge to the $10,000 cap on state and local tax deductions imposed by Congress in the 2017 tax law.”

The high court issued an order Monday denying the request from New York, New Jersey, Maryland, and Connecticut to review a decision of the U.S. Court of Appeals for the Second Circuit. The appeals court rejected several state legal arguments against the cap, including that it unconstitutionally coerces the states to abandon their preferred fiscal policies…

The Monday order leaves the cap in place. U.S. Rep. Bill Pascrell of New Jersey (D) said his state’s Democratic delegation 'remains absolutely united to enacting SALT reform through the Congress this year.' He and other Democrats have vowed to oppose any White House tax proposals that don’t raise the $10,000 cap.

Challenge to SALT deduction cap fails in Supreme Court – Aysha Bagchi, Perry Cooper and Donna Borak, Accounting Today:

The states argue the cap unconstitutionally interferes with their sovereign authority to levy and collect property and income taxes. The Second Circuit rejected their arguments, finding that neither Article I of the Constitution nor the 16th Amendment bars Congress from curtailing the SALT deduction, even if that means citizens in certain states will pay billions of dollars in additional federal taxes. Such injuries aren’t significant enough to be coercive under the Tenth Amendment, the appeals court ruled.

U.S. Supreme Court Rejects States’ SALT Cap Suit – Andrea Muse, Tax Notes ($). “In an April 18 order, the Court denied the January 3 cert petition of New York, Connecticut, Maryland, and New Jersey in New York v. Yellen, letting stand the Second Circuit decision that the states had standing to challenge the cap but that the cap does not unconstitutionally coerce the states to abandon their preferred fiscal policies.”

‘The SALT cap was a politically motivated money grab orchestrated by the previous president that continues to cost Connecticut families an estimated $2.8 billion a year,’ Connecticut Attorney General William Tong (D) said in an emailed statement. ‘We are disappointed with the Supreme Court’s denial. It is now up to Congress to right this wrong.’

Republicans have a very good chance of becoming the majority party in the House and (growing more likely) the Senate after November elections. They created the SALT cap and it is likely that they will seek to extend it beyond 2025 if they remain in power on Capitol Hill.

Lawsuit Alleges IRS’s Appraiser Penalty Procedures Are Illegal – Kristen Parillo, Tax Notes ($). “The IRS is violating conservation easement appraisers’ due process rights by assessing overvaluation penalties without giving them a meaningful opportunity to defend themselves, according to a new lawsuit.”

‘The assessment of the section 6695A penalty should only be made after a hearing where the IRS appraisal report can be fully explored and examined,’ two appraisers argue in an April 15 complaint in Kirksey v. United States.

Treasury Blames Audit Imbalance on Underfunding of IRS - Christopher Condon, Bloomberg ($). “U.S. Treasury officials blamed the Internal Revenue Service’s outsized number of audits on low-income households on severe underfunding of the agency by Congress.”

Audits on filers with higher net worth require more time and expertise, and the agency’s underfunding has led to a significant loss of personnel capable of performing those, senior Treasury officials told reporters in a telephone conference Friday.

They were responding to a study from Syracuse University showing households making less than $25,000 were almost three times as likely to get audited in tax year 2021 than those making $200,000 to $1 million.

The IRS has said that it does not audit lower-income taxpayers more than those with higher incomes.

Treasury Says IRS Stuck With 1950's Tech as Tax Season Closes – Alexander Rifaat, Tax Notes ($). “A steady decline in the IRS’s budget has left its workforce at ‘1970s levels’ amid the most challenging tax season in decades, according to Treasury officials, who have called for more stable, long-term funding.”

The 20 percent decrease in the agency’s budget over the last 20 years, adjusted for inflation, has made the IRS ‘stuck using 1950s technology in a 2022 world,’ the officials said during an April 15 call with reporters.

IRS or Waffle House? Hot Market Fuels Struggle to Fill Key Roles – Naomi Jagoda and David Hood, Bloomberg ($). “IRS Commissioner Chuck Rettig got a wake-up call about the state of the IRS workforce at an unlikely place: a Waffle House he stopped in during a visit to see his son at Fort Benning, Ga.”

Rettig noticed a sign advertising positions starting at $15 an hour. The reality dawned on him that the diner chain pays its entry-level staff more than the IRS was offering some of its front-line workers very recently.

‘Do you know that prior to the executive order a few months back we were paying $14.57 for the privilege to come on board and serve the country?’ Rettig said during remarks at a March tax conference.

While the agency still has fewer workers than it did 10 years ago, the Biden administration wants to give the IRS an additional $80 billion over a decade. The Treasury Department estimates that money would allow the agency to add nearly 87,000 auditors and other employees, which would more than double the current workforce of roughly 75,000.

IRS pleads for more funding as it looks back over tax season – Michael Cohn, Accounting Today. “The Internal Revenue Service is renewing its call for extra money in its budget Monday as it closes out a challenging tax season.”

The IRS hopes to hire 10,000 more employees by the end of the year to deal with the processing backlogs that have plagued the agency since before the start of the year, especially for paper returns. This tax season was especially complicated as taxpayers and preparers had to take into account the advance payments on the enhanced Child Tax Credit as well as the third round of Economic Impact Payments and the Recovery Rebate Credit that was used to claim any EIPs that weren’t received in earlier rounds of the stimulus payments.

Top GOP Tax-Writers Press Treasury on Data Leaks to ProPublica - Kaustuv Basu, Bloomberg ($). “The two top Republican tax-writers in Congress still want answers from Treasury on how a news outlet got private tax information on some of the wealthiest Americans.”

Senate Finance Committee ranking member Mike Crapo (R-Idaho) and House Ways and Means Committee ranking member Kevin Brady (R-Texas) are pressing the Treasury Department again to identify how the information ended up with ProPublica, which has published a series of articles based on the tax data.

’Please identify whether Treasury and the IRS continue to maintain that both do not know even whether there has been a threat of a data breach at the IRS in connection to ProPublica’s claims that it possesses individual taxpayer information that Treasury and the IRS are legally charged to protect,’ the lawmakers said in an April 18 letter to Treasury Secretary Janet Yellen. They want to know when the investigation of the issue will finish and demanded answers by May 1.

The letter is here.

Warren Wants Info From Intuit CEO on Free Tax-Filing Program - Colin Wilhelm, Bloomberg ($). “Sen. Elizabeth Warren (D-Mass.) and Reps. Katie Porter (D-Calif.) and Brad Sherman (D-Calif.) want information from Intuit Inc, the maker of TurboTax tax preparation software, about how much money the company makes off of low- and middle-income filers, and information about how many Intuit employees previously worked for federal agencies.”

In a public letter sent Monday addressed to Intuit CEO Sasan Goodarzi, the trio accuse the company of misleading consumers and using former government officials to shield it from government action. The Federal Trade Commission recently sued the company over its advertisements for free filing services, claiming deceptive practices.

The Democrats ask Intuit to provide information on the amount of money it makes from taxpayers who make $73,000 or below and would thus be eligible for free filing, and how many government officials it has employed since 1999.

Multistate Tax Commission Eyes Update For Model Laws, Regulations – Michael Bologna, Bloomberg ($). “The Multistate Tax Commission wants to give the states more consistent and up-to-date advice on its dozens of model regulations and laws through a proposed continuous review process.”

The interstate tax commission will examine a staff proposal during its spring meeting Wednesday, asking the states for input on the development of a continuous 'process of reviewing the regulations and considering updates and conforming changes.' The staff proposal responds to shifts in national and global tax policy, and concerns that the various models don’t properly address the tax issues states are currently experiencing.

Puerto Rico’s ‘Grossly Unfair’ Tax System Needs Overhaul: Study – Jim Wyss, Bloomberg ($). “As Puerto Rico’s congress contemplates another round of tax reforms, lawmakers should focus on eliminating some of the 424 tax breaks that cost the island about $21 billion a year and have contributed to creating a “grossly unfair and terribly inefficient” system, according to a new report.”

In a policy brief released Tuesday, the Center for a New Economy, an island-based think tank, said the U.S. commonwealth’s byzantine tax code undermines competitiveness, penalizes work and hinders entrepreneurial activity.

‘It should not surprise us that Puerto Rico’s growth rate has slowed down during the last 25 years, that close to half of its population lives in poverty and that more than 50% of its people do not participate in the labor force,’ the group said.

Arkansas Finance Department Releases 2022 Pass-Through Entity Income Tax Election, Revocation Form With Instructions – Bloomberg ($):

The Arkansas Department of Finance and Administration (DFA) Dec. 10, 2021 released the 2022 Arkansas Pass-Through Entity Income Tax Election or Revocation Form with instructions for individual income tax purposes. S corporations, limited liability companies, and partnerships must file this form to make the election of being taxed at the entity level. If the entity doesn’t pay the tax when due, the DFA may assess the individual members of the entity based on each members’ pro-rata share of income in addition to assessing the entity for the tax liability. The election is due before the due date or extended due date of the entity’s tax return for each tax year. To revoke the election the entity must provide the first date of the tax period after the entity’s last return was filed under the election.

Nebraska Court Rules Beneficiary Should Cover Inheritance Tax – Perry Cooper, Bloomberg ($). “When a will directs that inheritance taxes are charged to an estate’s residue but it has run out of funds, the tax obligation falls on the individual receiving the property, the Nebraska Supreme Court ruled in a case of first impression.”

Blain Larson’s will devised half of his livestock and pharmacy business, and some personal property to Matthew Larson, his son from a former marriage. The other half of his livestock and pharmacy business, and the remainder of his estate went to Cindy Svoboda, with whom he had lived for the last decade of his life. The will provided that inheritance taxes should be paid from the residue of the estate. When the residue failed to cover the tax obligation, the trial court split the debt between Matthew Larson and Svoboda.

The Nebraska Supreme Court reversed that portion of the trial court’s ruling, finding Svoboda should bear more of the tax burden because the estate’s residue should have covered inheritance taxes.

Kentucky Legislature Overrides Governor’s Veto, Enacts Law Amending Income, Sales, Excise, Property Tax Provisions – Bloomberg ($):

The Kentucky General Assembly April 13 voted to enact, over the governor’s veto, a law amending individual income, trust income, sales and use, excise, and property tax provisions. The law includes measures: 1) proposing an individual income tax rate reduction for the taxable year beginning on Jan. 1, 2023, if certain conditions are met, and implementing an annual process to review and report future reductions; 2) eliminating personal income tax credits for a fiduciary and an estate; 3) expanding the sales tax base to include the taxation of certain new services; 4) exempting from sales tax drugs and over-the-counter drugs purchased by a person regularly engaged in the business of farming; and 5) imposing a new excise tax of three cents per kilowatt-hour on electric vehicle power distributed in the state by an electric vehicle power dealer. The law generally takes effect Jan. 1, 2023.

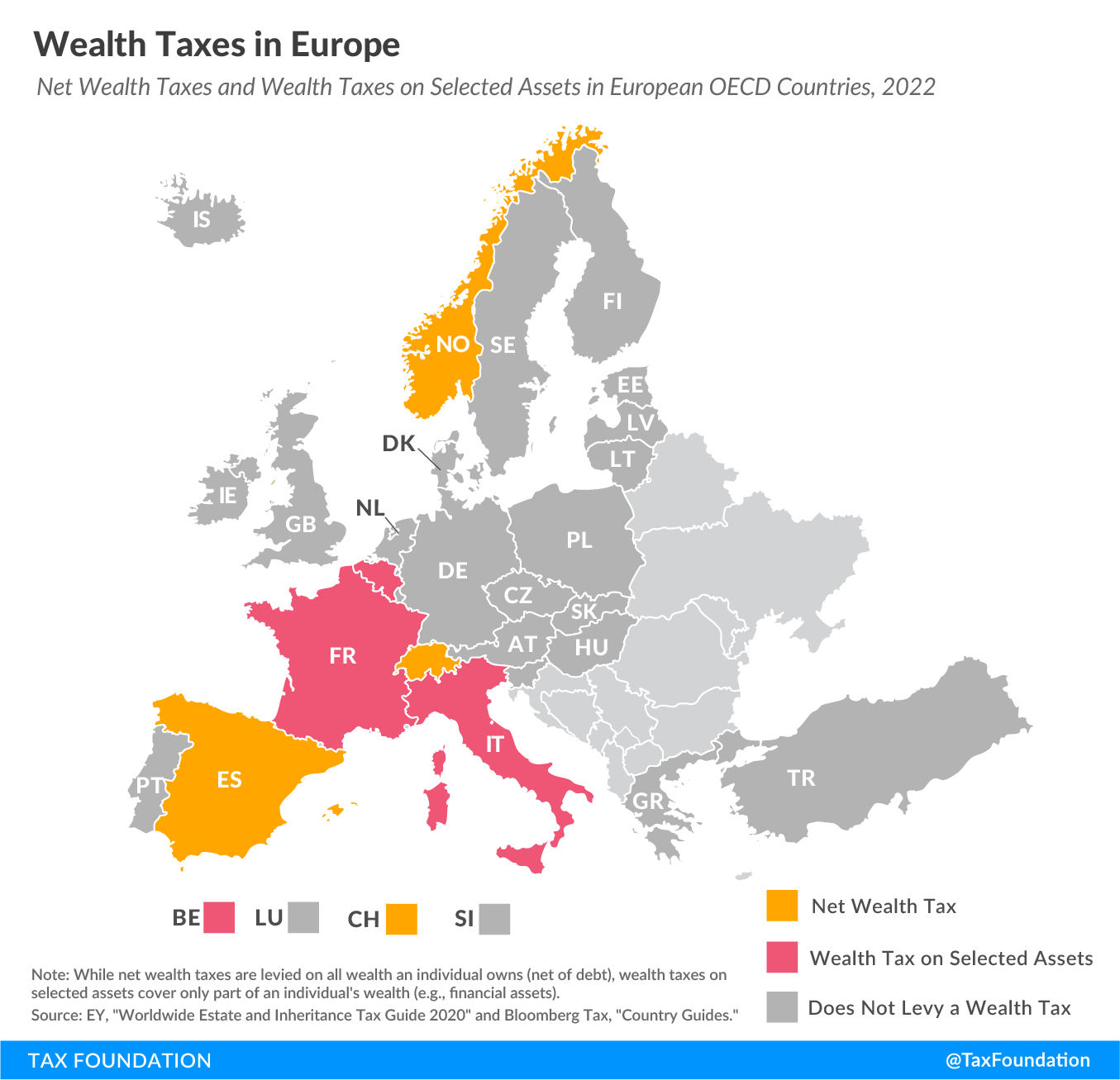

Wealth Taxes in Europe – Christina Enache, Tax Foundation. “Net wealth taxes are recurrent taxes on an individual’s wealth, net of debt. The concept of a net wealth tax is similar to a real property tax. But instead of only taxing real estate, it covers all wealth an individual owns. As today’s map shows, only three European OECD countries levy a net wealth tax, namely Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets but not on an individual’s net wealth per se.”

Happy National Hanging Out Day! Nope, this ain't about socializing with friends. Today is about laundry, money, and saving the earth.

From National Day Calendar:

This day encourages communities to learn about the benefits, both financially and environmentally, of using a clothesline for drying laundry. According to Project Laundry Lists’ website, clothes dryers account for an astonishing six to ten percent of residential energy consumption.

Make a habit of sustained success.