Mission Creep Wreaks Havoc as IRS Juggles Social Services, Taxes - David Hood and Naomi Jagoda, Bloomberg:

But when the pandemic hit in 2020, Congress quickly looked to the IRS as one of the agencies to lead the federal government’s economic response. A series of pandemic relief bills directed the IRS to issue three rounds of stimulus checks, pay out the child tax credit on a monthly basis, and manage various new and expanded business tax perks.

All those additional responsibilities piled on top of the core work that was already overwhelming the IRS. The number of taxpayers grew about 19% since 2010, while the number of personnel at the agency shrunk about 17% over the same period, according to a January report from National Taxpayer Advocate Erin Collins.

Congress treats the tax law like a Swiss Army Knife of public policy. A knife the size of a railcar ceases to be very good at being a knife.

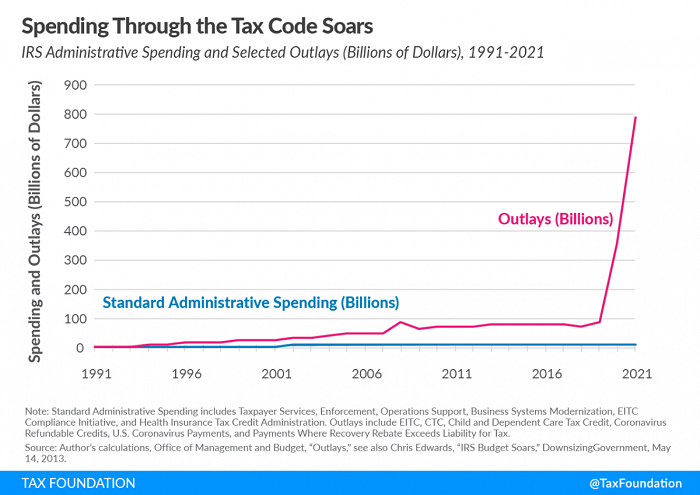

Chaotic IRS Filing Season Shows the Perils of Running Social Policy Through the Tax Code - Alex Muresianu and Garrett Watson, Tax Policy Blog. "In many ways the current chaos is the culmination of a problematic trend in fiscal policy. For the past few decades, policymakers have increasingly relied on the tax code to deliver major social spending initiatives, adding benefits administration to the IRS’s normal responsibilities as a revenue collection agency. At the same time, IRS capacity has not expanded enough to match its major new responsibilities. In the long term, the most stable solution is to move social spending out of the tax code and let the IRS focus its resources on revenue collection."

Taxpayers should file their tax return and pay any taxes they owe as soon as possible to reduce penalties and interest. An extension to file is not an extension to pay. An extension to file provides an additional six months with a new filing deadline of October 17. Penalties and interest apply to taxes owed after April 18 and interest is charged on tax and penalties until the balance is paid in full.

Filing and paying as much as possible is key because the late-filing penalty and late-payment penalty add up quickly.

Even if a taxpayer can't afford to immediately pay the full amount of taxes owed, they should still file a tax return to reduce possible delayed filing penalties. The IRS offers a variety of options for taxpayers who owe the IRS but cannot afford to pay.

And you might be able to get out of penalties if you act quickly:

Taxpayers may qualify for penalty relief if they have filed and paid timely for the past three years and meet other important requirements, including paying or arranging to pay any tax due. For more information, see the first time penalty abatement page on IRS.gov.

The best time to have filed and paid is before the deadline. The second best time is right now.

IRS Releases Guidance On Late Property, Productions Elections - Theresa Schliep, Law360 Tax Authority ($):

People and businesses can make late elections under a trio of tax code statutes involving Native American reservation property, second-generation biofuel plant property or film and television productions by treating the elections as accounting method changes, the IRS said Tuesday.

...

Elections for 2018 and 2019 under those statutes for property placed in service after 2017 can be made late and would be treated as accounting method changes, the IRS said. They can be made by filing an amended tax return, filing an administrative adjustment or a form for changing accounting methods, according to the agency.

Link: Rev. Proc. 2022-23.

Ill. Gets Food And Fuel Tax Cuts, More Credits In $46B Budget - Maria Koklanaris, Law360 Tax Authority ($):

As for groceries and gas, two areas where most people are feeling the effects of inflation, Pritzker's budget suspends the grocery tax for a year and freezes the gas tax for six months. For lower-income families, Illinois expands the state earned income tax credit, both by covering more families and increasing the amount of the credit from 18% of the federal credit to 20%. The change in the state EITC is permanent.

For businesses, the budget provides grants to small businesses and suspends licensing fees for restaurants and bars. It also renews the state's signature corporate tax credit, the Economic Development for a Growing Economy, or EDGE, credit through 2027. And it allows startup firms to be eligible for EDGE, which provides a nonrefundable income tax credit that is equal to 50% of the income tax withholdings for new jobs created in Illinois. The credit increases to 75% if the project meets certain criteria.

State pension plans in Illinois are only about 39 percent funded, the second worst funding rate nationally. Just two years ago, Illinois Governor Pritzker insisted the state needed a big tax increase, but he was rebuffed by voters.

Florida Gov. DeSantis Seeks to End Walt Disney World’s Special Tax District - Arian Campo-Flores and Robbie Whelan, Wall Street Journal ($):

Losing the special district would be a blow to Disney’s operations in Florida. The provision exempts the company from a host of regulations, and saves it tens of millions of dollars every year, according to a person familiar with the company’s finances who studied the issue over a decade ago.

In recent weeks, Mr. DeSantis has clashed with Disney over the company’s opposition to Florida’s Parental Rights in Education bill, which Mr. DeSantis signed into law last month.

COST Supports Iowa's Proposed NOL Computation Fix, Opposes Sales Tax Expansion - Carolina Vargas, Tax Notes ($):

S.F. 2372 would amend the definition of the term "net income" for corporate income tax purposes to mean a taxpayer's federal taxable income before accounting for an NOL deduction, for tax years beginning on or after January 1, 2023. According to Nicely, without this change, taxpayers would be required to use their taxable income after taking the federal NOL deduction when computing their net income for the Iowa corporate income tax. Using the federal NOL deduction amount "does not properly calculate a corporation's NOL for Iowa corporate income tax purposes because the State appropriately does not conform to several tax base expansions in the federal 2017 Tax Cuts and Jobs Act," which could cause some taxpayers to calculate an NOL that "is not reflective of the income tax base it must report on its Iowa corporate income tax returns," he wrote.

Interview: IRS Commissioner Talks About the State of the Service - Cara Griffith and Charles Rettig, Tax Notes Opinions. "Ten years ago we would've been answering those phone calls. We would've been processing that mail in a more timely manner. Instead, we're somewhat caught on our heels."

Ireland Exempts Income Of Ukrainians Displaced By War - Matthew Guerry, Law360 Tax Authority ($). "Ireland will grant relief to those Ukrainians who would have performed their work in their home country if not for the war and who remain subject to Ukrainian income taxes for 2022, according to the brief. The country will also disregard for corporation tax purposes the presence of Ukrainian employers in Ireland that relocated because of the conflict, according to the government."

Progressives’ favorite new punching bag: Elon Musk’s taxes - Christiano Lima and Aaron Schaffer, Washington Post ($). "Musk has likely stoked even more congressional contempt by tweeting lewd and derogatory comments at top lawmakers, including Sanders and Sen. Ron Wyden (D-Ore.), who chairs the powerful Senate Finance Committee."

It appears the feeling is mutual.

IRS Audit Issue – S Corporation Reasonable Compensation - Roger McEowen, Agricultural Law and Taxation Blog:

Many S corporations, particularly those that involve agricultural businesses, have shareholders that perform substantial services for the corporation as officers and otherwise. In fact, the services don’t have to be substantial. Indeed, under a Treasury Regulation, the provision of more than minor services for remuneration makes the shareholder an “employee.” Once “employee” status is achieved, the IRS views either a low or non-existent salary to a shareholder who is also an officer/employee as an attempt to evade payroll taxes and, if a court determines that the IRS is correct, the penalty is 100 percent of the taxes owed.

...

If S corporate gross receipts derive from the services of non-shareholder employees, or capital and equipment, then they should not be associated with the shareholder/employee’s personal services, and it is reasonable that the shareholder would receive distributions as well as compensation. Alternatively, if most of the gross receipts and profits are associated with the shareholder’s personal services, then most of the profit distribution should be classified as compensation.

This is one of the few areas the IRS is examining aggressively.

Internet Activities Protected From State Tax Under P.L. 86-272 - Wolters Kluwer Tax & Accounting. "A business must have nexus with a state for the state to tax it. P.L. 86-272 protects some sellers from having income tax nexus. To help promote uniform application of P.L. 86-272, the Multistate Tax Commission (MTC) adopted a Statement of Information Concerning Practices of Multistate Tax Commission and Supporting States Under Public Law 86-272. Recently, the MTC adopted a revised statement to address when P.L. 86-272 protections extend to internet activities."

Related: Is it war?

Math Error Notices: What You Need to Know and What the IRS Needs to Do to Improve Notices - NTA Blog. "If the taxpayer does not contest the notice within the 60-day time period, the IRS can immediately assess the liability, and move toward its normal collection procedures if the assessment is not paid, or retain the refund not paid due to the math error adjustment. After the 60-day time period has expired, the taxpayer can no longer challenge the adjustment in U.S. Tax Court; instead, the taxpayer must challenge the adjustment in the U.S. District Court or the U.S. Court of Federal Claims. If the taxpayer has a balance due, the taxpayer must first pay the tax and file a claim for refund to challenge the adjustment in one of these courts."

Don't dare deduct these expenses, but… - Kay Bell, Don't Mess With Taxes. "Keep track of your miles, too, if you're self-employed. Every legitimate, and documented, mile traveled to conduct your entrepreneurial enterprise counts. These business trip tallies go on the Schedule C or C-EZ filed by sole proprietors. So keep good records."

Inside the Black Box: An Underwriter’s Perspective on Tax Insurance - Jeffrey M. Lash, Justin Pierce Berutich, Bryce R. Pressentin, Kyle Reiter, and Sydney Lodge, Tax Notes ($). "The four standard exclusions in a tax insurance policy are generally quite narrow. The first applies to loss resulting from fraud or a materially inaccurate statement, act, or omission by the insured. The second applies to loss resulting from the insured taking a position on its return that is inconsistent with the insured tax position. The third applies if the insured settles with the tax authority without the insurer’s consent (with such consent not to be unreasonably withheld). And the fourth applies to the extent that a prospective change in law (that is, statute or regulation) adversely affects the insured tax position. Notably, loss arising as a result of a retroactive change in law — that is, a change in law that occurs after the policy is bound but applies to a prior tax period — is not typically excluded. Additional exclusions may apply depending on the facts and circumstances of a particular risk."

Losing Interest: Delayed IRS Assessments - Caleb Smith, Procedurally Taxing. "Over the last two years I cannot count the number of times I’ve had to give extraordinarily unsatisfying advice to my clients. That advice being, 'please wait.' Wait for the IRS to process your return. Wait for the refund to be issued. Wait for your Collection Due Process hearing."

How IRS Can Tax ‘Gifts’ and Impose Big Penalties - Robert Wood, Forbes. "But what about foreign gifts and inheritances? These rules aren’t as well publicized but the stakes are huge. If you receive a gift or inheritance, it isn’t income so you might think there's nothing to report. Besides, if there is a gift or estate tax, the person giving you the money or property pays it, not the recipient. However, if you’re concerned about proving that something was a gift or inheritance instead of income, you’d better file IRS Form 3520. Ditto if you are concerned about avoiding penalties."

Can Employers Pay Wages in Cryptocurrency? - Christopher Wood, Thomson Reuters Tax & Accounting. "The IRS representative provided a reference to a list of frequently asked questions (FAQs) on the subject. FAQ # 11 specifically says that remuneration paid in virtual currency to an employee in exchange for services constitutes wages for federal employment tax purposes."

On The Further Weaponization of the APA and Chevron Deference - Jack Townsend, Federal Tax Procedure. "I post this case on the Federal Tax Procedure Blog because, inspired by the Federalist Society and fellow travelers among some spectrum of scholars and judges, the APA is a hot topic in tax cases, which has prompted numerous offerings on the FTP Blog."

States Forecast Weaker Revenue Growth Ahead of Growing Uncertainties - Lucy Dadayan, TaxVox. "State revenue growth was strong in fiscal year 2021, despite widespread economic disruptions caused by the global pandemic. But it appears the current fiscal year 2022 (July-June for 46 of the 50 states) may end up with weaker revenue growth, and forecasters are now projecting a gloomier outlook for fiscal 2023."

Surely a coincidence. Today is both National Cheddar Fries Day and 420 Day. Regarding the latter, "Every year on April 20th, cannabis producers, consumers, advocates, and those who are just curious have long celebrated 420 Day. Once an unconventional day, the day has become the rallying cry of those who seek to legalize marijuana for medicinal and recreational uses."

Make a habit of sustained success.