Senate Shifting to Reconciliation in April - Kaustuv Basu and Butch Maier, Bloomberg ($). “Senate Finance Committee Chairman Ron Wyden (D-Ore.) said Thursday he anticipates senators will focus on a reconciliation bill after they return from their April break. Wyden said lawmakers are going to hear from voters in their states about the need to move on legislation on prescription drugs, clean energy, and making sure that everybody pays their fair share of taxes.”

‘It’s the starting point of the next round of the debate,’ Wyden said while speaking remotely at a conference organized by the American Council on Renewable Energy in Washington.

Wyden said no decisions have been made on whether to include a corporate minimum tax versus a raise in the corporate tax rate.

A reconciliation bill has stalled in the Senate after passing the House in November because of objections from Sens. Joe Manchin (D-W.Va.) and Kyrsten Sinema (D-Ariz.). There is now renewed interest in the clean energy incentives and other provisions dealing with the tax code that were part of the package.

If a bill materializes (big if), it is expected to include fewer spending proposals but still include the $1.75 trillion in business, international, and individual tax increases that passed the House last year. A rundown of those provisions is here.

But the current focus is on passing tax breaks:

Will Congress Turn Democratic Tax Hikes Turn Into Bipartisan Tax Cuts? – Howard Gleckman, Tax Policy Center. “A funny thing happened to the trillions of dollars of proposed tax increases on corporations and high-income households that were high on the agendas of President Biden and congressional Democrats just a year ago: They seem to have, at least for now, fallen into a deep Capitol Hill hole. And they’ve been replaced by, of all things, talk of billions of dollars of tax cuts for corporations and high-income households.”

For example, the House is planning to vote next week on a pair of bipartisan bills chock full of savings-related tax breaks, many that would benefit the wealthy. And a bipartisan group of senators is pushing to restore an important tax break for business research costs.

Schumer sets up USICA votes on Monday – Punchbowl News ($):

Senate Majority Leader Chuck Schumer has scheduled two votes on USICA – also known as the Bipartisan Innovation Act among other names – on Monday after Sen. Bernie Sanders (I-Vt.) dropped his opposition.

The Senate will vote on a cloture motion to end debate on the legislation, followed by a vote on final passage. Both votes will take place at a 60-vote margin. The Senate is expected to pass the high-profile legislation.

There is a lot of inside-baseball with this bill, but the takeaway is this: There are two bills at play, the Competes Act approved by the House and USICA approved by the Senate. Democratic leaders want to combine these bills, and to do so, both pieces of legislation must have the same bill number, which is what the Senate vote will accomplish. Why is this important? The House bill makes permanent and increases a health care tax credit and it could fix the R&D expense/amortization issue. In short, the bill could be a vehicle to address some very pressing tax issues.

‘Swiss Cheese’ Tax Code Loophole Language Could Use an Overhaul (Opinion) – Rep. Bill Pascrell Jr. (D-N.J.), Bloomberg ($). “Last December, I chaired a hearing in our Ways and Means Oversight Subcommittee on hidden wealth in America. I was floored by what I heard.”

The Pandora Papers probe exposed the secret holdings of 130 billionaires in 45 countries. Piggybacking on that historic work, our hearing further unmasked an extensive web of shelters used by the richest American families. We showed they’re doing it right here on our shores.

Sparsely populated states like South Dakota and Wyoming have become the Grand Cayman of the prairie by enacting laws that are nothing less than open invitations to well-heeled families to conceal their money in the Great Plains. My fear is that more states will seek to emulate those outliers while facilitating titanic tax avoidance by our wealthiest citizens. And there can be no question that inaction by our federal government makes it easier for states and citizens to build tax shelters.

But for my money, the worst loophole in the entire federal tax code is the so-called stepped-up basis loophole. Often opaque names used by politicians and economists don’t adequately capture a subject’s import, which is why I call this loophole the billionaires’ bonanza.

FWIW: Pascrell chairs the House Ways and Means Oversight Subcommittee. This subcommittee oversees agencies like the IRS. The subcommittee normally charged with creating tax legislation is the Select Revenue Measures Subcommittee, which is chaired by Rep. Mike Thompson (D-Calif.). If the full committee were to advance legislation described by Pascrell, it would normally go through Thompson's Subcommittee and not Pascrell's. However, these people talk to one another and releasing an opinion piece on a certain subject could mean that legislation is in the works.

Global Minimum Tax Pact Could Undermine Biden Domestic Agenda – Colin Wilhelm, Bloomberg ($). “A deal to rewrite global tax rules could erode key tax breaks in President Joe Biden‘s economic agenda as lawmakers try to revive the administration’s climate and social spending plan.”

The House Ways and Means Committee—responsible for drafting much of that agenda—first recognized and flagged the potential contradiction to Treasury in January, after nearly 140 countries backed the global deal in October and after a late December change to the formula used to calculate enforcement of the new global minimum tax agreement, according to several sources familiar with the situation who asked for anonymity to speak freely.

When the OECD released final model rules for the deal’s 15% minimum tax in December, companies, lobbyists, and policymakers were surprised by a newly bolstered provision that allows countries to ‘top-up’ a company’s tax when it’s paying below the minimum rate in its home country—known as the under-taxed payments or profits rule, or UTPR.

Coupled with a provision that treats certain kinds of credits differently than others, the final rules would mean some companies could lose the benefit of tax breaks they get at home for things like low-income housing and research and development.

Business Group Reiterates Concerns With Foreign Tax Credit Rules – Michael Rapoport, Bloomberg ($). “A business group repeated its concerns Thursday about new regulations on the foreign tax credit and again urged the Treasury Department to delay implementing them.”

The U.S. Council for International Business participated in a call with Treasury officials earlier this month on the new regulations, but the group said in a letter Thursday that it still believes the regulations create ‘significant uncertainty and complexity to apply for taxpayers and the IRS.’

From the letter:

Generally, USCIB acknowledges US Treasury’s stated objective of the final regulations to clarify the creditability of extraterritorial taxes such as the so-called digital services tax (and similar measures) that a number of foreign jurisdictions have enacted in recent years. We also observe that the final regulations have gone well beyond this objective in a way that creates significant uncertainty and complexity to apply for taxpayers and the IRS. Those sections of the regulations on determining whether a foreign tax is an income tax to introduce new standards of creditability that will likely result in significant double taxation that did not exist before.

FTC Analysis Worries Persist in Regs, USCIB Warns U.S. Treasury – Stephanie Soong Johnston, Tax Notes ($):

Moreover, the new analyses will make it more costly for U.S. companies to carry out business in other jurisdictions, including developing countries, especially in situations in which bilateral tax treaties don’t exist, USCIB said.

'This residual tax cost will put U.S. business at an investment disadvantage to its foreign competitors, e.g., China, and could force U.S. business to withdraw investment from key jurisdictions such as Brazil, by far the largest economy in Latin America, whose corporate income tax could fail the attribution requirement in the final regulations,' the letter warns.

EBay Backing Online Sellers Coalition to Address Tax Threshold - Erin Slowey, Bloomberg ($). “EBay is launching a coalition to lobby for 1099-K fairness in response to the decrease in the business transaction threshold established by the American Rescue Plan Act last year, the company announced in a media briefing Thursday.”

‘The coalition aims to promote the interests of millions of Americans casually selling goods online and advocate for common sense tax regulations to govern the online goods resale market,’ said Jordan Sweetnam, eBay senior vice president and general manager of the Americas market.

The ARPA provision required third-party networks to send 1099-K forms to taxpayers who have business transactions of more than $600 without a minimum threshold for number of transactions, beginning in 2022. The previous threshold was $20,000 with a minimum of 200 transactions.

Inadequate tax account help is contributing to IRS backlog – Michael Cohn, Accounting Today. “The Internal Revenue Service needs to make changes in its management of taxpayer accounts to reduce the backlog of millions of unprocessed tax returns, according to a new report.”

The report, released Wednesday by the Treasury Inspector General for Tax Administration, found that the backlog of old inventory in the IRS’s Accounts Management function has been an ongoing challenge for the service. That’s in addition to the problems stemming from the COVID-19 pandemic, which closed many IRS facilities in 2020, and recent pandemic-related tax law changes, which only further exacerbated the old inventory. As of Nov. 20, 2021, the IRS reported having 7.8 million cases in its Accounts Management inventory, with 56.8% of the inventory being 'over-aged,' according to the report.

IRS Lagging on Third Stimulus Payments, Treasury Watchdog Finds - Kaustuv Basu, Bloomberg ($). “About 645,000 individuals who could be eligible for a third round of stimulus payments issued by the IRS in 2021 have not received their money, the Treasury Inspector General for Tax Administration found.”

- These missed payments total about $1.6 billion and include those who didn’t receive payments for eligible dependents or because of problems with their tax accounts, among other issues.

- The IRS also issued $1.9 billion of payments to those not eligible for the payments, including duplicates, ineligible dependents, and nonresidents.

IRS Underreported Private Debt Collection Costs, Watchdog Says – Colin Wilhelm, Bloomberg ($). “The IRS’s private debt collection program has major accounting issues, the Treasury Inspector General for Tax Administration concluded in a report made public Thursday. According to the report, which the IRS disputes, the agency underreported $7.2 million in costs related to its private debt collection program.”

According to TIGTA, the IRS did not fully disclose the cost of contracts, labor, and background investigations from the program between fiscal years 2016 and 2019. The inspector general also found the IRS misreported nearly one-fourth of the $121.2 million in overall costs related to the program from fiscal years 2016 to 2020.

’Without adequate tracking of its program costs, the IRS runs the risk of spending more than authorized and wasting Federal resources if the costs exceed the benefits,’ TIGTA concluded.

CI Investigates More Than $1.8 Billion in Alleged COVID Fraud – Tax Notes ($):

The agency investigated 660 tax and money laundering cases related to COVID fraud, with alleged fraud in these cases totaling $1.8 billion. These cases included a broad range of criminal activity, including fraudulently obtained loans, credits and payments meant for American workers, families, and small businesses.

‘The Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law nearly two years ago as a safety net for Americans in light of an unprecedented health crisis. Unfortunately, even during times of crisis, criminals pop their heads out to look for ways to take advantage of those in their most vulnerable state. Thanks to the investigative work of IRS-CI special agents and our law enforcement partners, we've ensured criminals who try to defraud CARES Act programs face consequences for their actions,’ said IRS-CI Chief Jim Lee.

Enrolled Agent Fee Increase Proposal Could Dissuade Applicants - Erin Slowey, Bloomberg ($). “An increase in the application and renewal fees proposed by the IRS might deter potential enrolled agent candidates, according to a national association executive.”

‘Educated, trained tax preparers are essential right now, and creating any sort of barriers that are going to impact attracting new talent into the profession is a concern,’ Megan Killian, executive vice president of the National Association of Enrolled Agents, said in a video interview.

The NAEA wants specific justifications for the fee hike.

Looking on the bright side:

IRS has $1.5 billion in refunds for people who have not filed a 2018 federal income tax return; April deadline approaches – IRS. “Unclaimed income tax refunds totaling almost $1.5 billion may be waiting for an estimated 1.5 million taxpayers who did not file a 2018 Form 1040 federal income tax return, but people must act before the April tax deadline, according to the Internal Revenue Service.”

‘The IRS wants to help people who are due refunds but haven't filed their 2018 tax returns yet,’ said IRS Commissioner Chuck Rettig. ‘But people need to act quickly. By law, there's only a three-year window to claim these refunds, which closes with this year's April tax deadline. We want to help people get these refunds, but they need to file a 2018 tax return before this critical deadline.’

The IRS estimates the midpoint for the potential refunds for 2018 to be $813 — that is, half of the refunds are more than $813 and half are less.

Court Tax Regulatory Rulings Offer Early Legal Insight (Podcast) - Aysha Bagchi and Jeffery Leon, Bloomberg ($). “Recent court rulings striking down two Internal Revenue Service reporting requirements suggest the agency may need to change its procedures so that its rules will hold up in court.”

The U.S. Court of Appeals for the Sixth Circuit struck down a tax reporting requirement on March 3 inMann Construction, Inc. v. United States . That decision was cited by the U.S. District Court for the Eastern District of Tennessee when it struck down a separate reporting requirement on March 21 inCIC Services, LLC v. IRS .

The decisions come as the Treasury Department, and the IRS within it, face increasing scrutiny over whether their tax rulemaking procedures have met legal requirements.

Pa. Resident Says Wayfair Doesn't Permit Cleveland Tax – Asha Glover, Law360 ($). “The U.S. Supreme Court's Wayfair decision that allowed states to collect tax on sales from out-of-state businesses did not empower Cleveland to tax a Pennsylvania resident who worked remotely for a Cleveland business, she told an Ohio court.”

The Cuyahoga County Court of Common Pleas should reject Cleveland's argument that the South Dakota v. Wayfair decision showed that physical presence is no longer required under the U.S. Constitution's due process clause and commerce clause for tax purposes, Pennsylvania resident Manal Morsy told the court Wednesday.

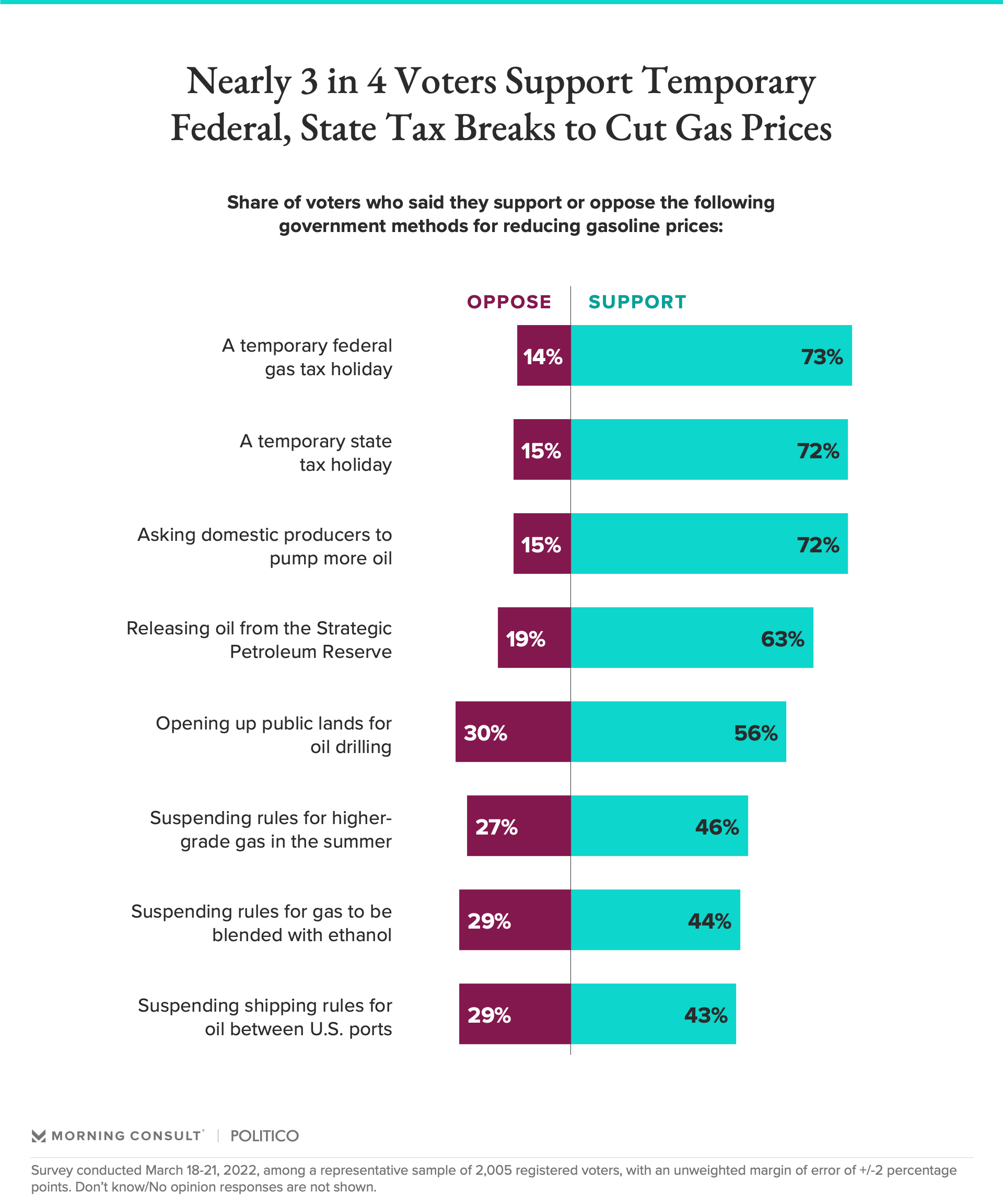

Most Voters Support Temporary Gas Tax Breaks, Boosting Domestic Oil Supplies to Combat Rising Fuel Prices – Brian Yermal, Morning Consult. “As state and federal officials mull different measures to reduce the price at the pump, a new Morning Consult/Politico survey shows that voters support temporary breaks on gas taxes and measures to boost domestic oil production in order to ease soaring gas prices.”

And while some of these efforts could slow the Biden administration’s climate agenda, the survey indicates that voters aren’t strongly supportive of some measures to bolster U.S. climate change efforts in the near term.

Diesel-Tax Holidays Dismay U.S. Truckers Being Targeted for Help - Keith Laing, Bloomberg ($). “The move by some states to soothe the sting of soaring fuel prices by temporarily suspending diesel fuel taxes has some unlikely opponents: truckers, the very people it’s supposed to help.”

Trade groups representing truckers argue that the suspensions won’t have much benefit to them and that it would mean less money to maintain the roads that they must travel.

‘It probably wouldn’t have much of an impact,’ Darrin Roth, vice president of highway policy for the American Trucking Associations, said. ‘Most of those savings wouldn’t be passed onto consumers. The long-term cost, if the money is not replaced, would be our already deteriorating infrastructure would deteriorate more. That’s more of a concern than a couple of cents change in the price of gas from our perspective.’

States Fire Back at Feds in SALT Cap Dispute – Andrea Muse, Tax Notes ($). “Whether Congress can impede the states’ sovereign taxing authority by imposing a cap on the federal deduction for state and local taxes is a novel and important question that the U.S. Supreme Court should resolve, New York and three other states have argued.”

New York, Connecticut, Maryland, and New Jersey asserted in their March 23 reply brief in New York v. Yellen that the federal government’s arguments that the Court does not need to review the Second Circuit’s decision upholding the Tax Cuts and Jobs Act's $10,000 SALT deduction cap ‘rest chiefly on an erroneous view of the applicable constitutional provisions and federalism principles.’

The brief, submitted by New York Attorney General Letitia James (D), argues that ‘the long and unbroken lineage of the SALT deduction for property and income taxes reflects a constitutional mandate, not a policy choice.’

Kentucky Businesses Win Relief on Unemployment Taxes – Michael Bologna, Bloomberg ($). “Kentucky businesses will get some relief on their unemployment tax obligations under legislation signed by Gov. Andy Beshear on Thursday.”

The first-term Democrat signed H.B. 144, which makes several employer-friendly adjustments to the state’s unemployment insurance fund to support, ‘employers who may still be experiencing slow growth or tight margins due to the effects of the pandemic,’ the administration said. A key feature extends for an additional year a freeze on employers’ unemployment taxes that was created last year.

Arizona Debates Skipping State Tax on Cryptocurrency Freebies – Brenna Goth, Bloomberg ($). “Customers would be able accept free, or airdropped, cryptocurrency without worrying about paying income tax under legislation being considered in Arizona.”

The House-passed legislation (H.B. 2204) is among several potential tax changes up for debate in Phoenix.

In addition to clarifying that a free crypto token wouldn’t be taxable income, the measure seeks to let taxpayers subtract transaction fees known as “gas fees” when declaring gains or losses after selling virtual currency. It also would add stolen virtual currency and non-fungible tokens (NFTs) to the list of allowable tax deductions for personal casualty losses and remove the requirement that the loss is tied to a federally declared disaster and other federal limitations.

Miss. House Pitches New Proposal To Eliminate Income Tax – Michael Nunes, Law360 ($). “In the continuing battle between the Mississippi House of Representatives and Senate over cutting the state income tax, the lower house proposed a slower elimination of the state's personal income tax.”

Mississippi House Speaker Philip Gunn, R-Clinton, released a statement Wednesday, saying the chamber delivered a conference report to the Senate that proposes cutting $100 million from the personal income tax every year until the tax is eliminated.

The proposal in the conference report, according to a statement from Gunn's office, would eliminate the income tax in at least 18 years, but includes a provision that would halt the cuts six years. The Legislature would have to remove the provision every six years for the cuts to continue.

Former Appraiser, District Immune From Suit, Texas Court Rules – Perry Cooper, Bloomberg ($). “Homestead owners challenging a utility assessment on their property can’t sue the county appraisal district or the former chief appraiser because they are protected by sovereign immunity, a Texas appeals court ruled.”

But the current chief appraiser is still on the hook for allegations that he exceeded his statutory authority by making up a new improvement on the property assessed at $6,000, the Texas Tenth Court of Appeals ruled Wednesday.

The Lord of the Rings fans, it’s Tolkien Reading Day! The book’s author, J.R.R. Tolkien, died during the Nixon administration and has sold over 150 million copies of his book posthumously. Sadly, he couldn’t take it with him.

Make a habit of sustained success.