Utah Governor Approves Income Tax Cut, State EITC - Paul Jones, Tax Notes ($):

The bill lowers the flat income tax rate for corporations and individuals from 4.95 percent to 4.85 percent, creates a nonrefundable EITC equal to 15 percent of the taxpayer's federal tax credit, and expands eligibility for the state’s nonrefundable tax credit for Social Security benefits by raising the thresholds for its income-based phaseout. The provisions under the bill are retroactive to the beginning of 2022.

Trump Organization Accountants Disavow Years of Company Financial Statements - Corinne Ramey, Wall Street Journal ($):

Accounting firm Mazars USA LLP said earlier this month it would withdraw from its work for former President Donald Trump’s company and can no longer stand by financial statements it has previously prepared, according to a letter made public Monday.

...

“We write to advise that the Statements of Financial Condition for Donald J. Trump for the years ending June 30, 2011—June 30, 2020 should no longer be relied upon and you should inform any recipients thereof who are currently relying upon one or more of those documents that those documents should not be relied upon,” said the letter, which was dated Feb. 9 and addressed to the Trump Organization’s chief legal officer.

The letter says the firm is walking away from uncompleted returns due today. Wall Street Journal reporter Richard Rubin speculates that the uncompleted returns include the former President's 2020 Form 1040; if it had been extended to October, it would have been further extended to February 15 as a result of the Hurricane Ida disaster declaration. The letter states (my emphasis):

As of this writing, there are only a limited number of tax returns that still remain to be filed, including those of Donald J. Trump and Melania Trump. We will be providing you a list of those returns and their status towards completion separately. The due date to file those returns is February 15, 2022. We believe the only information left to complete those returns is the information regarding the Matt Calimari Jr. apartment. As you know, Donald Bender has been asking for this information for several months but has not received it. Once that information is provided to your new tax preparers, the returns can be completed. However, if those returns are filed late, there may be a late filing penalty of $10,000 per return, which will likely be subject to abatement. We also believe that due to prior tax payments, there was an overpayment of taxes, thus, there should be no late payment penalty if these returns are in fact filed late.

I am guessing that the $10,000 penalty refers to a foreign disclosure of some sort, as those typically carry an automatic $10,000 penalty for late filing. Examples would include the Form 5471 for information on controlled foreign corporations; Form 8938, for foreign financial assets; Form 8865, for controlled foreign partnerships; and Form 8858, for foreign disregarded entities.

If the letter is to be believed, the deadline wouldn't have been a problem if the taxpayer had provided information to the preparer when asked - a situation all-to-familiar to preparers. The next item may provide a clue as to why the information wasn't forthcoming.

Related: Key International Tax Filing Deadlines & Delays.

Trump’s longtime accountant says his financial statements cannot be relied upon - Jonathan O'Connell and Shayna Jacobs, Washington Post ($).

The Mazars letter also mentioned one piece of tax business that it has said was unresolved regarding an apartment of Matthew Calamari Jr., son of longtime Trump security director and chief operating officer Matthew Calamari Sr.

Calamari Jr. was called to testify last year in a separate criminal case being brought by the Manhattan District Attorney’s Office and James regarding an alleged tax fraud scheme in which employees allegedly received untaxed payments, cars and apartments.

Chicago Alderman From Daley Family Convicted Of Fraud - Lauraann Wood, Law360 Tax Authority ($):

A federal jury found that Thompson, a lawyer at Burke Warren MacKay & Serritella PC who has served on Chicago's city council since 2015, told the FDIC and its agent in 2018 that he owed only either $100,000 or $110,000 to now-shuttered Washington Federal Bank for Savings when he actually owed $269,000 and that he lied about the money going toward home improvement when he knew it was actually used as his buy-in at the law firm. The jury also convicted the alderman of filing tax returns falsely reflecting the amount of mortgage interest payments he made between 2013 and 2017.

Thompson is a nephew and grandson, respectively, of storied Chicago Mayors Richard M. and Richard J. Daley, and is the first sitting city alderman to be tried in decades. His family name and service on the Chicago City Council brought significant attention to his case. He represents a part of the city that includes Guaranteed Rate Field, the home of the Chicago White Sox.

Patrick Daley Thompson trial: Jury finds Chicago alderman guilty of tax fraud, lying to feds - Craig Wall and Liz Nagy, AC7 Chicago:

The jury deliberated his fate for a little over three hours. Defense attorneys tried to convince jurors that what happened in this case was simply a series of mistakes on his taxes by an over-scheduled alderman with a well-known last name.

But prosecutors successfully convinced the jury that Thompson knew exactly what he was doing when he falsely claimed thousands of dollars in mortgage deductions over five years for a loan that wasn't a mortgage and one that he only made a single payment on.

The moral? No matter how busy you are, read your return.

Manchin Pushes Democrats to Revisit Tax-Rate Hikes, Sinema Could Present a Roadblock - Andrew Duehren and Richard Rubin, Wall Street Journal ($):

Democrats hoping to resurrect the party’s economic agenda are facing a problem: Sen. Joe Manchin’s goal for raising tax rates clashes with Sen. Kyrsten Sinema’s opposition to doing so.

...

Mr. Manchin has pointed to raising the corporate tax rate to 25% from 21%, raising the top capital-gains rate to 28% from 23.8% and increasing taxes on private-equity managers’ carried-interest income.

But Democrats abandoned those tax proposals last year because of opposition from Ms. Sinema (D., Ariz.).

Senator Sinema eventually agreed to a "surtax" on high-income individuals (and not-so-high income trusts), which is a rate increase by another name, but Manchin's opposition to other parts of "Build Back Better" has put the bill on ice.

White House, congressional Democrats eye federal gas tax holiday as prices remain high, election looms - Tony Romm and Jeff Stein, Washington Post ($). "But Larry Summers, a former treasury secretary and top White House economist under prior Democratic administrations, called the idea of a gas tax holiday 'short-sighted, ineffective, goofy, and gimmicky.' A high-profile critic of the Biden administration on the issue of inflation, Summers said the policy’s impact is at best unclear because it may boost demand in other parts of the economy."

Treasury Letter Provides Clarity on Crypto Reporting Requirements - Mary Katherine Browne, Tax Notes ($). "Treasury has signaled to Congress that its upcoming proposed regulations on recently enacted cryptocurrency reporting requirements won’t rope in crypto miners or stakers, or those who sell hardware and software for crypto wallets."

Elon Musk Gave $5.7 Billion of Tesla Shares to Charity Last Year - Rebecca Elliot and Meghan Bobrowsky, Wall Street Journal ($):

The donations were made in the middle of a series of stock sales by Mr. Musk, who sold more than $16 billion worth of Tesla shares in the past two months of 2021. The Tesla chief executive, who is compensated in stock awards and doesn’t accept a cash salary from the electric-vehicle maker, also converted roughly 22.9 million vested stock options into shares last year.

Deductions of charitable donations of appreciated securities are subject to an annual limit of 30% of adjusted gross income. Musk would have needed a $19 billion AGI to deduct the whole amount in one year.

Donations of appreciated publicly-traded securities held for over one year are tax efficient. Donors get a deduction for the full fair market value of the securities without ever recognizing the appreciation in taxable income, and without the need for expensive appraisals.

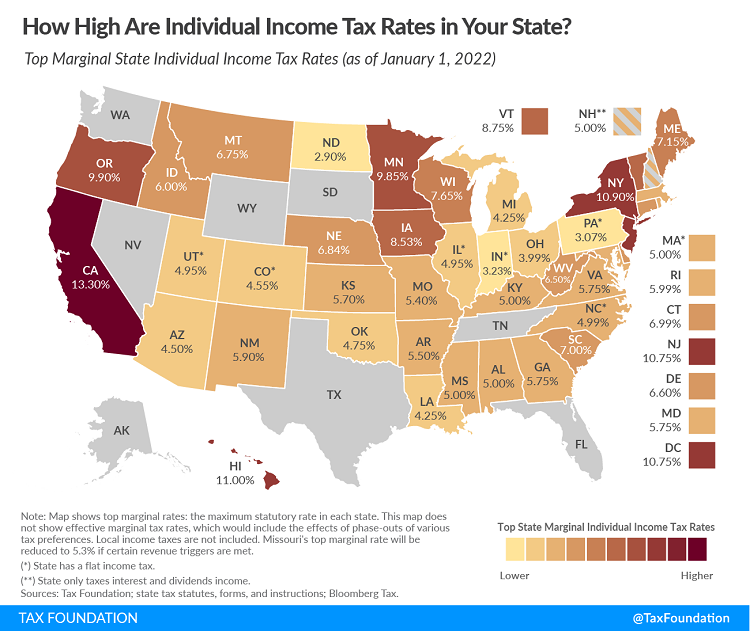

State Individual Income Tax Rates and Brackets for 2022 - Timothy Vermeer and Katherine Loughead, Tax Policy Blog. "In some states, a large number of brackets are clustered within a narrow income band. For example, Georgia’s taxpayers reach the state’s sixth and highest bracket at $7,000 in taxable income. In other states, the top rate kicks in at a much higher level of marginal income. For example, the top rate kicks in at $1 million or more in California (when the “millionaire’s tax” surcharge is included), as well as in New Jersey, New York, and the District of Columbia. In New York, an additional top rate for income exceeding $25 million was enacted during the 2021 legislative session."

That 6 Million Return Backlog? Oops, We Mad a Math Error: It’s Really 24 Million - Russ Fox, Taxable Talk. "By the way, do you know how many IRS employees there are per phone call coming in to the IRS? For every 16,000 calls, there’s one employee. (Yes, employees take more than one call a day, but if you wonder why you and I can’t get through, that’s the answer.)"

It's worth visiting some old headlines here:

IRS commissioner says he hopes to clear tax refund backlog by summer - ABC News, 3/18/21.

IRS chief says agency is close to clearing backlog of 2019 tax returns - The Hill, 5/19/21. "IRS Commissioner Charles Rettig on Wednesday estimated the agency would be able to clear its backlog of 2019 tax returns within 60 days."

Pressure mounts in Congress for IRS to give taxpayers relief - Politico, 1/26/22. "According to recent IRS and TAS updates, the IRS backlog included 6 million original individual returns as of Dec. 31 and 2.3 million amended individual returns as of Jan. 8; 1.1 million unprocessed quarterly business tax returns and about 440,000 amended quarterly business tax returns as of Jan. 19; and nearly 5 million pieces of other taxpayer correspondence as of mid-December."

The backlog has gone from about 9.4 million returns to 24 million in about 3 weeks. Business filers: be sure you have a better handle on your inventory when you file your return than the IRS does.

State PTE Tax Updates: Agency Guidance and Even More Differences! Steven Wlodychack, Tax Notes. "Generally, the election must be made on the regular return that the entity files with the state for the tax year for which the taxpayer wants the PTE election to apply. Some states require the submission of additional documentation. Massachusetts, for example, also requires a separate electronic confirmation of the election in addition to the actual making of the election on the entity’s tax return."

New K-2 and K-3 Forms: Crisis or Headache? - Eide Bailly Tax News & Views. "The new form requirements are annoying, costly, and probably unwise under the circumstances. Still, panic is unwarranted. Most taxpayers should be able to dig up the information they need for filing."

What’s the Character of the Gain From the Sale of Farm or Ranch Land? - Roger McEowen, Agricultural Law and Taxation Blog. "Sales that are deemed to be in the ordinary course of the taxpayer’s business generate ordinary income. I.R.C. §1221(a)(1). However, the sale of a capital asset (such as land) generates capital gain. The different tax rates applicable to ordinary income and capital gain are often large for many taxpayers (sometimes as much as a 15 percentage-point difference) with the capital gain rates being lower. So, a farmer, rancher or land investor will want to treat the gain from the sale of land as a capital gain taxed at the preferential lower rate. That will be the outcome, unless the land is determined to have been held by the seller for sale to others in the ordinary course of their business."

1040 Virtual Currency Confusion from Two Years Ago Is Still Confusing - Annette Nellen, 21st Century Taxation. "V-Bucks and Robux are obtained with US dollars and can be converted back. They arguably act as real currency because they are needed in order to play these online games. So, why did the IRS remove them from the virtual currency website and imply that they are not virtual currency? Not clear."

Crypto Tax Challenges Just Keep Growing - John Buhl, TaxVox. "The taxpayers argue that staking is akin to a baker making a cake, which isn’t taxable until it’s sold. But more than a few tax practitioners argued on social media that the application of existing law likely would result in the rewarded tokens being deemed taxable. As one law professor explained, using the bakery analogy, the individuals involved in token staking don’t own the bakery (blockchain); they’re working for the bakery and getting paid in cakes (tokens). In the meantime, crypto investors are watching to see if proof-of-stake income can secure special treatment."

LB&I Division Announces New Campaign Focusing on Limits on Deduction Due to Partner's Basis Under §704(d) - Ed Zollars, Current Federal Tax Developments. "The limited summary on the IRS webpage states: 'Partners that report flow-through losses from partnerships must have adequate outside basis as determined pursuant to IRC § 705 to deduct the losses or else the losses are suspended per § 704(d) to the extent they exceed the partner’s basis in the partnership interest.'"

IRS sending 1099-INTs to taxpayers who got interest added to tax refunds - Kay Bell, Don't Mess With Taxes. "Where it took the Internal Revenue Service more than 45 days from the return's due date — which was May 17, 2021 — to issue the refund, the agency had to add interest to the amount it eventually delivered." Some consolation for those still waiting on 2020 refunds.

Tax Facts About IRS Form 1099 - Robert Woods, Forbes. "Each Form 1099 is matched to your Social Security number, so the IRS can easily spew out a tax bill if you fail to report one. If you don’t include the reported item you’re almost guaranteed an audit or at least a tax notice if you fail to report a Form 1099. Even if an issuer has your old address, the information will be reported to the IRS (and your state tax authority) based on your Social Security Number. Make sure payers have your correct address so you get a copy. Update your address directly with payers, and put in a forwarding order at the U.S. Post Office. It’s also a good idea to file an IRS change of address Form 8822. The IRS explains how to notify IRS."

Patriots In Iowa And Tax Cuts In Conn.: SALT In Review - David Brunori, Law360 Tax Authority ($):

A proposal in Iowa, H.F. 2180, would reduce the state sales tax on sales of American-made products...

There may be a worse tax proposal introduced this year, but my money says there won't be. The law would create an administrative and compliance nightmare. Think about it. Amazon sells millions of products available to Iowans. It would take 100 years to figure out what was subject to a 3% or 6% tax rate.

And, as the article points out, the Supreme Court has ruled that states can't discriminate against foreign commerce.

Happy National Flag of Canada Day!

Make a habit of sustained success.