Retirement Bill Likely to Make Omnibus, Brady Says - Doug Sword, Tax Notes ($):

A large bipartisan retirement package, known as SECURE 2.0, is likely to survive even if a broad tax title isn’t included in the year-end omnibus spending bill, according to House Ways and Means ranking member Kevin Brady, R-Texas.

Chances remained low December 14 for a broad tax title featuring renewal of an expanded child tax credit and the rollback of a tightening of a trio of corporate tax breaks. But Brady said the fortunes of the retirement and general tax title efforts are separate.

House sends Senate one-week stopgap funds extension to buy time - David Lerman, Roll Call:

In another effort to speed up the process, the House sent to the Senate an unrelated shell bill that would be used as a vehicle to carry the massive omnibus. The shell bill was sent automatically when the House adopted a rule for floor debate on the CR on a party-line vote of 216-206.

...

The House Rules panel stripped out that unrelated measure from the shell bill text and replaced it with placeholder language: the House-passed Agriculture spending bill and a separate tax provision that passed the House previously as part of a bill that eventually instead became the vehicle for the semiconductor manufacturing incentives law enacted this summer.

Those items make the shell bill germane in the Senate to add the fiscal 2023 omnibus and any tax provisions negotiators can agree to.

So tax provisions technically can still make it on the year-end omnibus. The odds are not in their favor.

Iowa DOR Proposes Required Composite Returns for Passthrough Entities - Emily Hollingsworth, Tax Notes ($):

ARC 6746C would implement S.F. 608, which became law in June 2021 and imposes the composite tax return requirements for passthrough entities such as partnerships, S corporations, estates, or trusts.

...

The Iowa DOR has previously provided guidance on the composite tax return requirements, noting that the composite tax would be calculated “by multiplying each nonresident member's Iowa-source income from the pass-through entity by the top Iowa tax rate applicable to that nonresident member.”

Iowa is requiring composite returns for 1041, 1065 and 1120-S filers issuing K-1s for non-residents for post-2021 tax years. Draft return forms are available on the Iowa Department of Revenue web site, but they are not yet approved for filing. Composite payments work as withholding for beneficiaries and owners who want to file their own Iowa returns. Nonresident owners can elect out of composite return participation by filing Form 41-475 with the filing entity by the return due date.

SPACs Need Urgent Relief From Buyback Tax, Industry Says - Chandrea Wallace, Tax Notes ($).

The tax will have “deleterious impacts” on SPACs and their shareholders, the SPAC Association wrote December 14 to Lily Batchelder, Treasury assistant secretary for tax policy. The group requested an in-person meeting with Treasury officials to discuss a potential exemption for SPACs or, in the alternative, a process through which the companies can apply retroactively for waivers of the tax on a company-by-company basis.

The buyback tax, enacted by the Inflation Reduction Act (P.L. 117-169), wasn’t intended to apply to stock redemptions that happen when a SPAC simply returns the invested funds to shareholders, either in a liquidation or when the shareholders opt out of owning shares in a post-merger entity formed by the SPAC and its target company, the group argued. Those redemptions are obligations built into the SPAC formation documents, and so are “wholly separate from a voluntary corporate decision to repurchase shares” in order to affect a company’s stock price, it wrote.

SPACs, or "special purpose acquisition companies," are corporations set up to buy businesses. If they fail to find suitable acquisitions, shareholders are entitled to refunds of their invested capital. These refunds are subject to the new buyback tax.

EU Wants Simplified Aid Rules To Counter US Tax Law - Todd Buell, Law360 Tax Authority ($):

The announcement comes amid effort from both the EU and U.S. to find a compromise after Europeans objected to parts of the Inflation Reduction Act that they said excluded European companies.

"Elements of the [Inflation Reduction Act] risk unleveling the playing field and discriminating against European companies, for example through tax credits and production subsidies," von der Leyen said. European authorities are working closely with President Joe Biden's administration "on the most concerning aspects" of the U.S. legislation, she added.

The IRA restricts tax credits based on whether the the vehicles are assembled in North America, and on the sourcing of certain EV components.

IRS Issues Reminder on Mandatory Retirement Plan Withdrawals - Kelly Phillips Erb, Bloomberg. "Your goal when setting up a retirement account is generally to minimize the tax consequences and maximize returns. With traditional plans, that typically means socking money away and deferring income tax as long as possible. Of course, nothing lasts forever—not even tax deferrals. By rule, most taxpayers must start taking withdrawals from a traditional IRA, SIMPLE IRA, SEP IRA, or retirement plan account beginning no later than age 72. Those mandatory withdrawals are called required minimum distributions."

Ho! Ho! Holiday bonus (and tax) time - Kay Bell, Don't Mess With Taxes. "If, however, you get your bonus separate from your regular pay, your employer must use an IRS-approved method to determine how much tax should be withheld. That could be by withholding a flat 22 percent (this rate was dropped from the 25 percent level by the 2017 tax reform law) income tax from your bonus amount. If that turns out to be too much based on your overall tax circumstances, you'll get the excess back when you file your return."

Safeguarding Finances of the Elderly, Stateside and Abroad - Virginia La Torre Jeker, Virginia - US Tax Talk. "The growing trend of email and phone scammers, combined with the potential for diminished cognitive abilities due to aging, can imperil elderly people’s financial safety. For Americans overseas and multinational families, this dilemma takes on more significance—not just from the practical and logistical side of things, but also for the US tax aspects that can arise when an individual wants to assist another person whose financial assets may span the globe."

Billionaire Ken Griffin Sues the IRS - Rebekah Barton, TaxBuzz. "According to a report from The Wall Street Journal, the hedge-fund manager is seeking damages following the disclosure of his personal tax documents. The data, published by news organization ProPublica beginning in June 2021, specifically mentioned Griffin's tax data from May and July of that year. "

IRS Can Issue Refund When Automatic Levy Payments Result In An Overpayment - Leslie Book, Procedurally Taxing. "In today’s post I discuss a recent IRS Program Management Technical Assistance that considers when a taxpayer who may have been subject to levy has in fact overpaid their tax liability. In particular, the PMTA discusses how a taxpayer may be entitled to receive a refund when the automatic levies continue even though the liability is extinguished."

Related: IRS Collection issues.

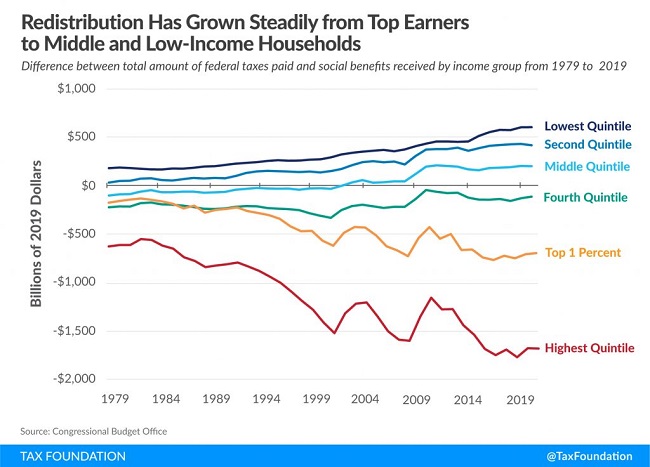

Federal Fiscal System Is Very Progressive, Latest CBO Report Shows - Scott Hodge, Tax Policy Blog. "However, the more significant story is the middle quintile’s changing fortunes. These households also benefited substantially from the expansion of tax credits, and we can see that beginning in 2002—following the doubling of the Child Tax Credit—they became net beneficiaries from federal fiscal policy rather than net contributors. Thus, the gap between the amount of federal benefits the middle quintile received and the federal taxes they paid grew over the succeeding 15 years."

The TCJA Five Years Later: Federal Tax Issues - David Stewart, Nathan Richman, and Jennifer Acuña, Tax Notes Opinions. "On the legislative front and on the regulatory front, [section] 174, the amortization of R&E, that was a raiser, some of the pain that was afflicted in the TCJA, that kicked in at the beginning of this year. It's considered an expiring tax provision because it kicked in. It's kind of the reverse expiration."

Options to Improve the Child Tax Credit for Low-Income Families - Elaine Maag, TaxVox. "Talks on the expansion of the Child Tax Credit appear to have stalled, with a key sticking point being opposition of some lawmakers to making the credit fully refundable – or allowing low-income families to qualify for the maximum credit regardless of how much they earn. However, there are potential compromises short of full refundability that would still increase the credit for some of the almost 19 million children in families receiving less than the full credit now because their earnings are too low."

Lesson From The Tax Court: Taxpayers Behaving Badly 2022 - Bryan Camp, TaxProf Blog. "At trial the Podluckys testified that the assets they purchased were not for them, but were for the purpose of 'dealing with Tibetan monks in Asia' who, they said, wanted hard assets rather than cash. As Judge Lauber wrote, with admirable restraint: 'This testimony was utterly implausible.' Mr. Podlucky was 'unable to tell the court where the putative monks resided or... Explain why Buddhist monks would be eager to acquire women’s jewelry, particularly jewelry that was sized to fit [Ms. Podlucky’s] wrist.'"

Jacksonville man sentenced to more than four years in federal prison for facilitating “off the books” pay scheme as part of conspiracies to defraud the IRS and workers’ compensation insurance company - IRS (Defendant name omitted):

According to court documents, between 2016 and 2020, Defendant conspired with others to facilitate the payment of construction workers "off the books" in order to avoid paying premiums for workers' compensation insurance and payroll taxes. Construction contractors and subcontractors entered arrangements with Defendant and his co-conspirators, through which shell companies facilitated both the distribution of proof of insurance and the payment of workers with cash.

...

Defendant and others also facilitated the deposit of checks into the shell companies' bank accounts, as well as the withdrawal of cash to be paid to the employees of the contractors and subcontractors – all without withholding, or paying over, payroll taxes to the IRS. Through these arrangements with Defendant, the construction contractors and subcontractors could disclaim responsibility for withholding and paying payroll taxes to the IRS or ensuring that the workers were legally authorized to work in the United States. By facilitating the payment of workers of more than $49 million without payroll taxes being withheld, Defendant and his co-conspirators caused the U.S. Treasury to lose more than $12 million in tax receipts.

The defendant may have thought it was clever to pay all these people in cash and skip withholding. Yet every time he did this with "contractors and subcontractors," he created new potential informants, which isn't clever at all. As the man says, sometimes it's better to just pay the taxes.

Look sharp, eat cupcakes. Today is both National Wear Your Pearls Day and National Cupcake Day. Lacking pearls, it's cupcakes for me.

Make a habit of sustained success.