This Isn’t Your Father’s Tax Extender Package - Doug Sword, Tax Notes ($):

How to pay for a tax extender package that could run into the hundreds of billions of dollars is a key topic and possible sticking point in year-end negotiations. That distinguishes these talks from past extender efforts, which typically ended with stuffing dozens of small, unpaid-for tax breaks into an omnibus spending bill as it sped by.

...

“It could be a big number,” (House Majority Leader) Hoyer said of the possible tax package. “The child tax credit alone is a big number.” Both Neal and Wyden have said in interviews that the size and duration of what’s being considered make for “a different conversation” during negotiations compared with past extender talks dealing with far less expensive tax provisions that typically had just one-year extensions.

Lawmakers exclude cannabis language from defense authorization text - Caitlin Reilly, Roll Call. "The fiscal 2023 defense reauthorization bill text released Tuesday excluded cannabis banking provisions after lawmakers were unable to reach a compromise that would satisfy progressive Democrats or overcome objections from prominent Republicans."

IRS Proposes New Rules to Police Land-Conservation Tax Deals After Court Losses - Richard Rubin, Wall Street Journal ($):

The agency on Tuesday proposed regulations that would require participants and promoters of so-called syndicated conservation easement transactions to disclose those deals to the government, with steep penalties for omissions. The move would help the IRS identify and audit the easement deals, which senior IRS officials say are tax shelters that deprive the government of billions of dollars in revenue.

The regulations would restore a virtually identical 2016 IRS disclosure requirement that was effectively struck down by the U.S. Tax Court last month, following a similar decision earlier this year by the Sixth U.S. Circuit Court of Appeals. The tax court said that the 2016 IRS requirement didn’t follow the required formal procedures for regulations, including public notice and opportunity for comment.

Trump Organization convicted in N.Y. criminal tax fraud trial - Shayna Jacobs, Washington Post:

In the criminal case, jurors saw a number of Trump Organization payroll and expense records spanning years that showed how executives received perks like luxury apartments and Mercedes Benzes while purposely concealing them from tax authorities.

...

In his testimony, Weisselberg detailed how he and the company’s comptroller, Jeffrey McConney, schemed to cheat state and federal tax authorities beginning in 2005 and lasting more than a decade. Weisselberg used the company to cover major personal expenses like rent for a luxury apartment on the Hudson River, Mercedes Benz leases for himself and his wife, and private school tuition for his grandchildren.

Democrats' conundrum with Trump's taxes - Benjamin Guggenheim, Politico. "Well, House Ways and Means Committee Democrats finally have access to six years of President Donald Trump’s tax returns and could publicly release them before the chamber turns Republican on Jan. 3. But that doesn't mean it would be wise for them to do so, as Daniel Hemel of New York University School of Law writes."

Tax Pros Can't Reach IRS Despite 'Line-Jumping' Deterrent - David van den Berg, Law360 Tax Authority ($):

Some organizations seek an unfair advantage by using technology that places hundreds of phone calls to the agency and holds multiple places in line for single callers, according to the IRS. To thwart such technology, the IRS implemented a pilot program that asks callers to repeat a phrase or complete a simple math equation, the IRS told Law360. Those who do so are put into the regular queue, and those who can't are disconnected, the agency said. It announced the pilot program in an email newsletter in October.

...

The ability to access the phone line is important for practitioners in representing their clients. Despite the pilot program, getting through on the practitioner line remains difficult, practitioners and groups representing them told Law360. They also raised some concerns about the pilot program, including about how it handles accents.

IRS Practitioner Helpline ‘Nearly Inoperable,’ NAEA Says - Alexandar Rifaat, Tax Notes ($). "The National Association of Enrolled Agents (NAEA) has asked the IRS to make improving customer service the agency’s top priority, arguing the phone system for tax professionals has become virtually nonexistent."

The Pros and Cons of Family Limited Partnerships - Lori Ioannou, Wall Street Journal. "To avoid problems with the IRS, the partnership must be conducted as a business entity. Meetings must be held with formal minutes taken; general partners must be compensated for their services; and limited partners must pay taxes on their share of the income from the partnership."

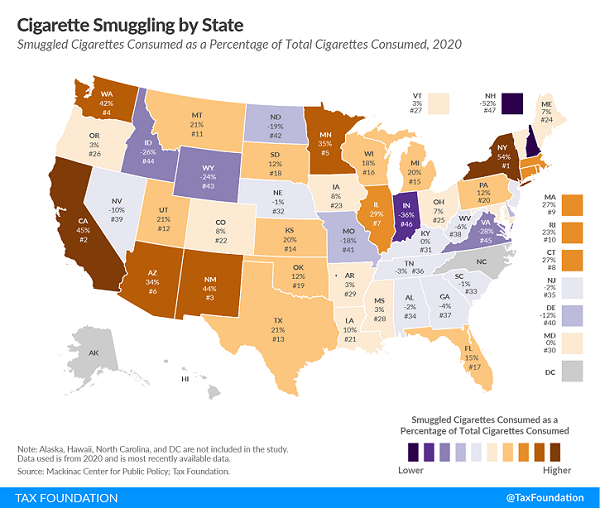

Cigarette Taxes and Cigarette Smuggling by State, 2020 - Adam Hoffer, Tax Policy Blog. "Policymakers interested in increasing tax rates should recognize the unintended consequences of high taxation rates. Criminal distribution networks are well-established and illicit trade will grow as tax rates rise."

What to do if your 1099-K is not OK - Kay Bell, Don't Mess With Taxes. "If you get a Form 1099-K in these nontaxable personal transaction instances or other situations, such as Jane's furniture sale, and get an incorrect Form 1099-K, contact the issuer for a correction. If the company doesn't fix the error, then report the correct amount on your Form 1040. Attach an explanation to your tax return explaining how you are correctly reporting your income, despite the info on the 1099-K copy the IRS received."

How NOT to Use a Charitable Remainder Trust - Roger McEowen, Agricultural Law and Taxation Blog. "If there ever was a case that provides a roadmap for farmers as to how not to use a charitable remainder, Furrer v. Comr., T.C. Memo. 2022-100 is that case. Indeed, it is almost inconceivable that the farmer couple involved in the case were represented by legal counsel. The arguments made on behalf of the Furrers were that bad."

Onetime Trump Foe, Michael Avenatti, Sentenced to 14 Years In Federal Prison - Rebekah Barton, TaxBuzz. "According to an official release from the IRS, Avenatti was sentenced to 168 months behind bars for stealing millions of dollars from his clients – one of whom was a paraplegic with mental health issues – and for obstructing the IRS's efforts to collect more than $3 million in unpaid payroll taxes from a coffee business he owned."

Final regulations aimed at eliminating the “family glitch” in the Affordable Care Act - Wolters Kluwer Tax & Accounting. "This rule will be implemented for the 2023 enrollment period. It is important for individuals to be aware that they or their dependents may be newly eligible for more affordable health insurance in the coming year."

Breathing American Air – Hazardous to your Wealth? (Part I) - Virginia La Torre Jeker, Virginia - US Tax Talk. "Many foreign persons are now becoming increasingly concerned about the long arm of the US Taxman. Even though many have no US connections whatsoever, they are receiving forms from the various financial institutions with whom they may have accounts asking about their US status (usually this is Form W-8BEN). Both US and non-US institutions are asking for this documentation. Often, foreign persons do not understand why they must provide it."

Time Is Running Out To Reduce 2022 Tax Burden Using PTE Payments - John Richman and Catherine Riddick, Tax School Blog. "Even though a pass-through entity may incur penalties for late payment of PTE tax, they will likely be better off paying the full year’s tax by December 15."

The TCJA Five Years Later: State Tax Issues - David Stewart, Andrea Muse, and Steven Wlodychak, Tax Notes Opinions. "But then that brings us to what was probably the biggest response, which is the SALT PTE taxes, passthrough entity taxes. The way this would work is essentially instead of imposing the tax on the distributive share of income that was received by the shareholders or the passthrough entity owners, the partners who would pay it at the individual level, instead this would be a direct tax on the passthrough entity itself."

Does The Child Tax Credit Reduce Child Poverty Or Discourage Work? - Elaine Maag, TaxVox. "But controversy exists over how many people leave the labor force entirely if they receive the full CTC. The answer is unclear. I, along with colleagues at Urban, used survey data from 2020 and 2021 to see if people who received the monthly payments of the CTC were any less likely to work while receiving the payments than those that did not. We found no evidence that CTC recipients worked less."

Wallingford attorney pleads guilty to tax evasion - IRS (Defendant name omitted):

According to court documents and statements made in court, Defendant is an attorney specializing in personal injury law. For the 2013 through 2017 tax years, Defendant reported approximately $585,025 in income taxes owed to the Internal Revenue Service as a result of his legal practice and certain rental income. During that time period and thereafter, Defendant made only limited payments of his taxes due and owing, and interest and penalties accrued as a result of his non-payment.

Between December 2014 and May 2019, Defendant received at least 12 notices from the IRS advising him of his tax amounts due and instructions on how to pay his overdue taxes. When the IRS levied certain personal bank accounts used by Defendant, he closed those accounts and evaded the payment of taxes, interest, and penalties by writing checks from his law firm’s operating account payable to his paralegal, which subsequently were converted to cash and deposited into the bank accounts of limited liability companies (“LLCs”) that Defendant had created in association with his real estate holdings. Defendant also took substantial additional cash withdrawals from his law firm bank accounts and redeposited the monies in the LLCs bank accounts. Between approximately 2013 and 2019, Defendant paid approximately $600,000 in personal expenses from the LLCs bank accounts, including expenditures for gambling at casinos, restaurants, vacations and the purchase of a BMW automobile.

It's hard to discern a strategy here. The taxpayer apparently filed returns, but didn't pay amounts due and subsequently tried to hide funds. The trips to the casino seem like good financial management by comparison.

Fly to Illinois. Today is International Civil Aviation Day and National Illinois Day.

Make a habit of sustained success.