Biden suggests extra tax on energy giants if they don’t reduce gas prices - Jeff Stein, Evan Halper, and Yasmeen Abutaleb, Washington Post. "Biden’s remarks on Monday are unlikely to lead to the passage of a new law but mark the culmination of months of internal debates within the administration over the proper response to high gas prices and reflect a hardening of presidential rhetoric against the energy giants. Gas prices stand at roughly $3.76 per gallon, according to AAA — up from roughly $3.40 around this time last year but down significantly from around $5 at one point this summer."

Biden Mulling Tax On Oil Companies' Profits - Kat Lucero, Law360 Tax Authority. "Biden did not elaborate on how he will motivate Congress to endorse the tax proposal on companies' profits — also known as a windfall tax — during a lame-duck session, the period between when lawmakers are elected and when they are sworn into office."

What European Countries Are Doing about Windfall Profit Taxes - Cristina Enache, Tax Policy Blog. "It’s unlikely these implemented and proposed windfall taxes will achieve their goals of addressing high gas and energy prices and raising additional revenues. They would more likely raise prices, penalize domestic production, and punitively target certain industries without a sound tax base."

Former IRS Chiefs Warn Agency: Don’t Blow It - Jonathan Curry, Tax Notes ($):

Just because the IRS has an extra $80 billion to spend doesn’t mean a successful transformation of the agency’s various services and functions is a foregone conclusion, a pair of former IRS commissioners warned.

...

At a basic level, the IRS needs to hire more staff, but that alone isn’t a sufficient solution to challenges involving taxpayers’ interactions with the agency, Rossotti said. If new staff are hired to answer phones but they either don’t have sufficient training to answer taxpayers’ questions or have insufficient data to inform their responses, that doesn’t actually address the problem, he said.

Foreign Withholding Taxes Emerge As Key Issue In Final Regs - Natalie Olivo, Law360 Tax Authority:

Foreign tax credits are designed to prevent multiple taxes on the same earnings. When foreign taxes aren't creditable, the combined rates on income taxed in multiple countries can be brutal.U.S. companies have repeatedly raised concerns about final regulations that could limit the way many foreign taxes qualify for credits back home — particularly withholding taxes, which have prompted enough outcry from businesses that the U.S. Treasury Department is taking another look.

Treasury's foreign tax credit regulations have sparked continual backlash from corporations following the finalization of the rules in December, and business groups have spotlighted the rules' treatment of offshore withholding taxes as a specific source of concern. The rules generally deny credits for withholding taxes on service payments and royalties unless the taxing country determines the related income source in ways that align with U.S. laws, which often diverge from other jurisdictions.

Second Tranche of Beneficial Ownership Regs Nearing Release - Andrew Velarde, Tax Notes ($). "The second set of beneficial ownership information regs from Treasury’s Financial Crimes Enforcement Network is closer to release, with proposed regs now under review at the Office of Information and Regulatory Affairs."

IRS drafts new K-2. K-3 instructions - Michael Cohn, Accounting Today. "Partnerships only recently needed to worry about filing Schedules K-2 and K-3 to report on foreign activity, and there has been confusion about the requirements. The IRS introduced the new reporting requirement for the 2021 tax year for any passthrough entities with international activities, creating the two new forms to supplement all their Schedule K-1 filings. These forms are supposed to clarify and standardize the reporting and documentation of international items to the IRS, but many organizations have been uncertain about what to do because not all parts of these forms are relevant to every exempt organization, and figuring out which parts are relevant requires extra analysis."

Trump asks Supreme Court to block release of his taxes to House - Rebecca Beitsch, The Hill. "Trump on Thursday lost his latest bid to block the panel from accessing his records after the D.C. Circuit Court of Appeals declined to reconsider a unanimous August ruling from one of the court’s three-judge panels ordering their release."

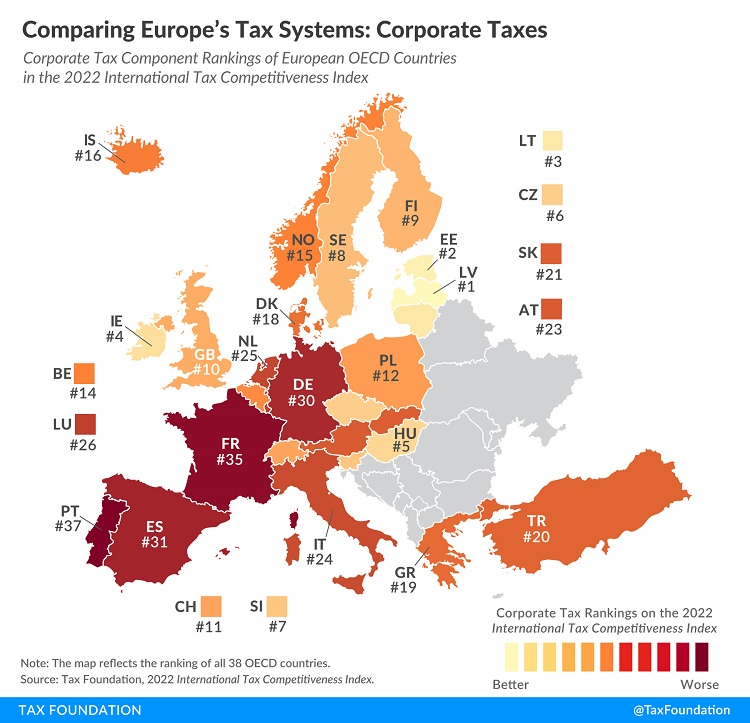

Comparing Europe’s Tax Systems: Corporate Taxes - Sean Bray, Tax Policy Blog. - "Our corporate income tax component scores countries not only on their corporate tax rates but also on how they handle net operating losses, capital allowances, inventory valuation, and allowances for corporate equity. We also consider whether and to what extent distortionary patent boxes and R&D tax incentives are granted, the application of digital services taxes, and the complexity of the corporate income tax."

The U.S. ranks between the Slovak Republic and Austria.

When Can Depreciation First Be Claimed? - Roger McEowen, Agricultural Law and Taxation Blog. "Simply signing a purchase contract or taking delivery of a depreciable materials (such as for the construction of a pole barn, etc.) to be used in the taxpayer’s business does not mean that those assets are depreciable – they aren’t yet ready for use in the taxpayer’s business. It doesn’t matter that the taxpayer has paid for the asset. The key is whether the asset is ready for use in the taxpayer’s business."

Tax Gap now $496 billion, says IRS - Kay Bell, Don't Mess With Taxes. "But the agency notes that taxes associated with illegal activities have been outside the scope of Tax Gap estimates because the government's objective is to eliminate those criminal acts, thereby eliminating any associated tax."

IRS Finalizes Regs That Fix "Family Glitch" in Premium Tax Credit - Parker Tax Pro Library. "The IRS issued final regulations which provide that, for purposes of determining eligibility for the Code Sec. 36B premium tax credit (PTC), affordability of employer coverage for individuals eligible to enroll in the coverage because of their relationship to an employee of the employer (related individuals) is determined based on the employee's share of the cost of covering the employee and the related individuals."

It is Time To Take Remedial Steps To Improve The Timeliness of Tax Court Dispositions - Leslie Book, Keith Fogg, Steve Olsen, Nina Olsen, and Jack Townsend, Procedurally Taxing. "There is enough anecdotal evidence of cases taking what appears to be too long to reach disposition after assignment to a judge that the Court should take steps to correct the situation. We cannot know the full extent or answer to this problem without better information from the Tax Court. From the quote above, the Tax Court does not track the time it takes for case disposition or non-dispositive matters. If it doesn’t track that time, it becomes difficult to assess the pain points in the process causing long delays in the disposition of cases."

Referral to Procedurally Taxing Blog on Tax Court Delays - Jack Townsend, Procedurally Taxing. "To me, the most shocking point made in the PT blog is that the Tax Court (really through such management as the Tax Court has) does not track these bottlenecks."

'Chrisley Knows Best' Stars Won't Get New Trial In Fraud Case - Hailey Konnath, Law360 Tax Authority ($). "The couple, who live in Nashville, Tennessee, was also accused of hiding the millions of dollars earned from the television show within one of their companies, so the IRS could not recover hundreds of thousands of dollars in unpaid personal taxes."

Albuquerque woman pleads guilty to conspiracy to defraud the United States - IRS (Defendant names removed):

According to the plea agreement and other court records, beginning in January 2005, Defendant and her business partner... operated National Business Services, which promoted, sold and created Limited Liability Companies (LLCs) under New Mexico State Law. For many clients, National Business Services would open bank accounts under the names and IRS employer identification numbers (EIDs) of the LLCs, and the clients – whose names were not associated with the bank accounts - would have access to the funds in those accounts. Clients received debit cards, online bank access information and pre-signed checks with Defendant's signature, which clients could use to access the money despite the bank never associating the client with the account.

Defendant and Partner organized at least 192 LLCs in New Mexico between 2005 and 2015 on behalf of clients seeking to shield income from the IRS. Defendant opened at least 114 bank accounts for these clients.

...

Partner was indicted on June 23, 2021, along with National Business Services client...

We know one client has been indicted, then. The other clients are presumably in touch with their lawyers.

Halloween's over. It's National Brush Day - "...time to remind your kids about the importance of taking care of their teeth!"

Make a habit of sustained success.