Rettig: Acting Commissioner Choice to Be Announced Imminently – Jonathan Curry, Tax Notes ($):

The Biden administration is set to announce on October 28 who will temporarily take the reins of the IRS and fill the role of acting commissioner until a long-term successor is confirmed.

That’s according to current IRS Commissioner Charles Rettig, who previewed the announcement October 27 at the UCLA Extension Tax Controversy Institute.

'Everyone is pushing to get a confirmed commissioner as quickly as possible,' Rettig said. 'That’s an absolutely necessary thing, and it’s critical for the funding and what we’re doing with regard to implementation' of the Inflation Reduction Act’s (P.L. 117-169) extra $80 billion for the agency, he added.

2023 PTIN renewal period underway for tax professionals - IRS:

The Internal Revenue Service urges the nation's more than 750,000 active tax return preparers to start the upcoming 2023 filing season smoothly by renewing their Preparer Tax Identification Numbers (PTINs) now. All current PTINs will expire December 31, 2022.

Anyone who prepares or helps prepare a federal tax return for compensation must have a valid PTIN from the IRS before preparing returns, and they need to include the PTIN as the identifying number on any return filed with the IRS.

The fee to renew or obtain a PTIN is $30.75 for 2023. The PTIN fee is non-refundable.

IRS Readying Hard Look at Employee Retention Credit Claims – Nathan Richman, Tax Notes ($):

The IRS Small Business/Self-Employed Division has trained 300 auditors to examine claims involving employee retention credits, and criminal tax investigators are looking at enablers and promoters of the credits.

The 300 revenue agents completed a 56-hour training course but won’t be detailed to only ERC claims, Alfredo Valdespino of SB/SE said October 27 at the UCLA Extension Tax Controversy Institute.

The IRS can’t audit its way out of any issues with ERC compliance after the credit was created to help alleviate problems caused by the COVID-19 pandemic, according to Valdespino. That means the IRS needs an examination strategy beyond the newly trained revenue agents, he said. The IRS is considering options for that strategy, including a possible soft letter campaign or a voluntary disclosure practice, he said.

IRS Research Credit Refund Memo Intended to Speed Claim Process – Wesley Elmore, Tax Notes ($). “A controversial IRS memorandum on research credit refunds was intended to speed processing of those claims and lead to more effective audits, according to one author of the memo.”

‘We are trying to get these claims processed in a more timely manner. We want things to move more efficiently,’ Kathryn Meyer of the IRS Office of Chief Counsel (Small Business/Self-Employed) said October 27.

IRS Notches Hiring Win, Predicts Smoother Filing Season – Jonathan Curry, Tax Notes ($):

Taxpayers can expect a much higher level of service from the IRS in the 2023 tax return filing season, thanks to 4,000 and counting new customer service representatives the agency has hired this year.

The IRS touted that milestone in an October 27 release, in which it attributed the successful hiring effort to the grant of direct-hire authority it received earlier this spring, as well as the $80 billion in additional funding it received from the Inflation Reduction Act (P.L. 117-169).

IRS ‘fully committed’ to better customer service as agency hires 4,000 new workers – Kate Dore, CNBC:

- The IRS said it has hired 4,000 new customer service workers as the agency prepares for the 2023 tax filing season.

- The agency plans to hire 1,000 more before the end of the year, with most training being complete by Presidents Day 2023.

The IRS release is here.

Taxpayer Advocate Sees Progress and Challenges in IRS Backlog – Nathan Richman, Tax Notes ($):

The IRS should substantially reduce its backlog of unprocessed returns but might not reach the goal of getting the number below 1 million within a few weeks, according to National Taxpayer Advocate Erin Collins.

Before the IRS flips its systems from the 2022 filing season to the 2023 filing season, the Taxpayer Advocate Service is hopeful the backlog will be well below the 6 million left over at that point last year, Collins said October 27 at the UCLA Extension Tax Controversy Institute.

The IRS still has about six weeks before it makes the change, so the number will definitely be below 6 million, but it is unclear how far above 1 million it will be, according to Collins.

IRS Waives RMD Penalty for Certain Inherited Retirement Accounts – Melissa White, Eide Bailey:

The 2019 SECURE Act made big changes in how retirement plan assets must be distributed. While we still await final Regulations related to required minimum distributions (RMDs) from retirement plans, the IRS has now issued Notice 2022-53 affirming their position on required minimum distributions from inherited IRAs.

Government Outlines Rationale for PTEP Reg Withdrawal – Andrew Velarde, Tax Notes ($). “The recent stand-alone withdrawal of old regs on previously taxed earnings and profits (PTEP) reflects the government’s concerns over large noneconomic built-in loss transactions as well as the lengthy time needed to issue new guidance.”

Moderate Democrats Push for Deal on Child, Business Tax Breaks - Erik Wasson, Bloomberg ($):

The New Democrat Coalition, which numbers 99 lawmakers, wants to revive the expanded child-tax credit, which was raised from $2,000 per child to as much as $3,600 in President Joe Biden’s pandemic response plan in 2021. The higher benefit, which was distributed via monthly payments rather than being included in a tax refund, expired at the end of last year.

Such a deal could be part of a multibillion dollar tax package after the midterm elections but before the new Congress is sworn in. That will be the last chance for Democrats to try for the expanded credit before a likely GOP takeover in the House. Republicans have criticized it for not being tied to work requirements.

The group also is pushing renewal of a tax perk for research and development costs that allows companies to write off expenses in the year they’re incurred. That break expired at the end of 2021 and without a law change, companies have to spread out those deductions over several years. Manufacturers and pharmaceutical companies are among some of the industries that would most benefit.

Prior Eide Bailly coverage on this subject is here.

The political argument over expanding the Child Tax Credit and allowing R&D costs to be expensed has gone on for months. If the argument gets resolved, the odds for passing a year-end tax bill increases. If it doesn't get resolved, passing a year-end tax bill is unlikely.

The main arguments for enacting each:

- Not allowing R&D expensing could cause thousands to lose their jobs, according to the National Association of Manufacturers.

- Children in poverty fell 46% in 2021, according to the U.S. Census Bureau. The enhanced Child Tax Credit in the American Rescue Plan contributed to this decline.

Permanent 100 Percent Bonus Depreciation Even More Important When Inflation Is Elevated – Garrett Watson and Huaqun Li, Tax Foundation:

Starting next year, 100 percent bonus depreciation for short-lived investment—originally enacted in the 2017 Tax Cuts and Jobs Act (TCJA)—will begin to phase down through the end of 2026. Making 100 percent bonus depreciation permanent would boost economic growth and American incomes in any economic environment, but this policy change would be especially valuable if inflation remains elevated in the coming years.

Further down the article:

We find that under the baseline inflation scenario, making 100 percent bonus depreciation permanent increases long-run economic output by 0.4 percent, raises American incomes by 0.3 percent, and creates about 73,000 full-time equivalent jobs. Under a 4 percent inflation scenario, permanent bonus depreciation increases long-run output by 0.5 percent, raises American incomes by 0.4 percent, and creates about 94,000 jobs.

Foundations Set Up by the Rich Increasingly Use Charity Loophole – Noah Buhayar, Bloomberg ($):

The flow of money from private foundations to donor-advised funds has jumped substantially in recent years, highlighting the increasing use of a controversial loophole in charitable law, a new audit shows.

Private foundations, which many wealthy people use to administer their philanthropy, gave $1.68 billion to a group of DAF sponsors in the most recent year studied by California Attorney General Rob Bonta ’s office. That was 48% more than two years earlier…

DAFs allow donors to get an upfront tax break and then are used to administer grants. But because there’s no deadline for money to leave the funds, they’ve stoked concern that contributors are piling up money, getting tax benefits without actually helping working charities.

High Court Privilege Case Could Hinder In-House Counsel – Kat Lucero, Law360 Tax Authority ($):

The U.S. Supreme Court has agreed to review a tax-related case concerning the scope of attorney-client privilege for multipurpose communications, and the outcome could potentially interfere with the work of in-house counsel, whose communications within a company often involve nonlegal business matters.

The high court this month agreed to hear the case, known as In re: Grand Jury, which could potentially affect the way all attorneys manage their discussions with clients. In the case, an unnamed law firm specializing in international tax is challenging a Ninth Circuit decision from last year that ordered it to disclose communications and other materials related to a client's expatriation and tax return preparation to grand jury subpoenas.

Appeals Court Upholds House’s Effort to See Trump’s Tax Returns – Charlie Savage, New York Times. “A full federal appeals court denied on Thursday former President Donald J. Trump’s attempt to block Congress from gaining access to his tax returns, leaving in place a three-judge panel’s ruling that a federal law gives a House committee chairman broad authority to request them despite Mr. Trump’s status as a former president.”

State Tax Revenues Continue Strong, Will Slow, Fitch Reports – Donna Borak, Bloomberg ($):

State tax collections are still showing signs of strong growth through the first fiscal quarter ended Sept. 30, but will slow as economic activity declines, according to a Fitch Ratings report released Thursday.

California is the only state in the ratings agency’s latest economic outlook that saw a year-over-year decline in overall tax revenue, driven by a falloff in personal income tax. Quarterly collections were $4.8 billion, or 11% below that state’s budget forecast.

California Governor Signs Individual Income Tax Law Expanding CalSavers Retirement Savings Program Initiative for Workers – Bloomberg ($). “The California Governor Aug. 26 signed an individual income tax law expanding the CalSavers Retirement Savings Program initiative to cover more workers.”

Louisiana DOR Issues Revenue Ruling on Income Tax Implications of Federal, State COVID-19 Benefits, Assistance – Bloomberg ($). “The Louisiana Department of Revenue (DOR) Oct. 26 issued a revenue ruling on individual income and corporate income tax implications of federal and state COVID-19 assistance and benefits for individuals and businesses.”

Maryland Comptroller Issues Individual Income Tax Alert Describing State Impact of Federal Student Loan Forgiveness – Bloomberg ($):

The tax alert includes that: 1) discharged student loan debt excluded from federal adjusted gross income due to changes made in the American Rescue Plan Act does not qualify for the state subtraction; 2) the Maryland Student Loan Debt Relief Tax Credit is available to individuals with undergraduate or graduate student loan debt; and 3) federal student loan forgiveness isn’t subject to Maryland state income tax.

Tax Credits for Natural Gas, Hydrogen Passed in Pennsylvania - Zach Bright, Bloomberg ($):

The natural gas industry, hydrogen hub development, and semiconductor manufacturers would have access to millions of dollars in new and expanded tax credits under a Pennsylvania bill that awaits Gov. Tom Wolf’s signature.

The package, H.B. 1059, includes tax credits for clean hydrogen hubs, semiconductor and biomedical manufacturers, and biomedical research companies. The House passed it 139-59 and the Senate 41-8 on Wednesday.

California’s Wealth Tax For Electric Vehicles Trailing in Poll - Romy Varghese, Bloomberg ($). “California’s Proposition 30, which would levy an additional 1.75% tax on income above $2 million to raise money for electric vehicles and wildfire prevention if passed next month, lacked the support of the majority of likely voters in a poll by the Public Policy Institute of California.”

LA Cannabis Co. Owes $60K For Taxes And Fees, City Says – Collin Krabbe, Law360 Tax Authority ($). “A California cannabis company owes the city of Los Angeles about $60,000 for unpaid tax assessments and should be made to pay up after not filing a responsive pleading, a recent filing contends.”

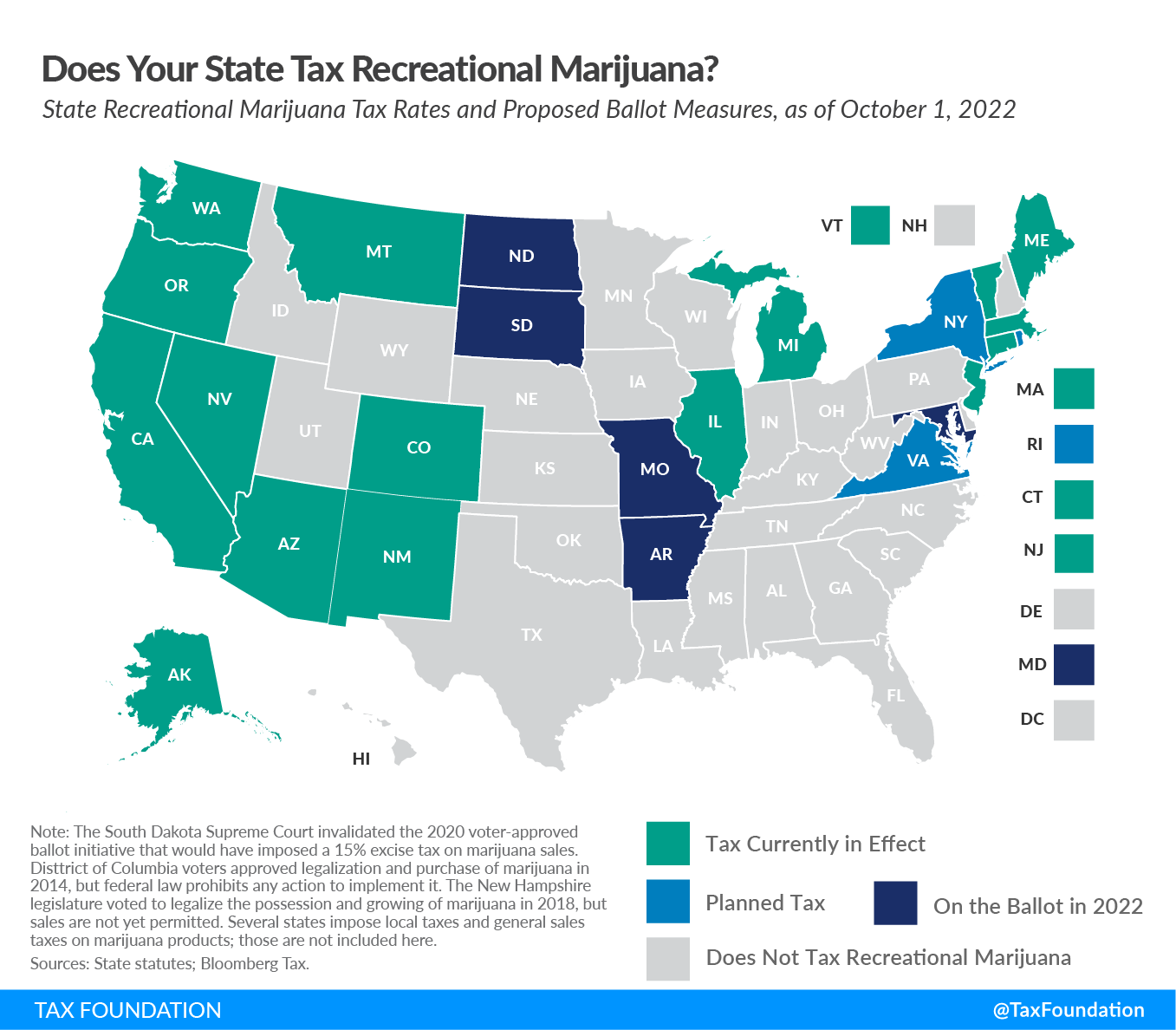

Cannabis Taxes Back on the Ballot in 2022 – Adam Hoffer, Tax Foundation. “While changes to federal cannabis law are slow, changes at the state level are accelerating. Recreational cannabis is on the ballot in five states this November—Arkansas, Maryland, Missouri, North Dakota, and South Dakota—giving voters the ability to join 19 states that have already legalized recreational marijuana.”

Few ‘Tea Leaves’ to Read in Treasury’s Take on Book Income for AMT – Chandra Wallace, Tax Notes ($).

Tax advisers trying to square up book and tax income adjustments regarding the new corporate alternative minimum tax are looking for “tea leaves” to read, while Treasury is hewing close to the language of the statute.

Section 56A defines adjusted financial statement income (AFSI) for purposes of the corporate AMT and includes a specific grant of regulatory authority for the Treasury secretary to adjust items and how they are treated for purposes of the tax. Exercise of that authority will affect both whether companies are subject to the tax and how much affected companies pay.

Caterpillar Settles Dispute Over Swiss Profits for $740 Million – William Hoke, Tax Notes ($):

Caterpillar Inc. said that its previously announced settlement will see the company pay $740 million to resolve a 10-year dispute with the IRS over the treatment of profits earned by its Swiss subsidiary.

In its third-quarter financial statements, Caterpillar said October 27 that the settlement for 2007-2016 consists of $490 million in taxes and $250 million in interest. The company announced it had reached a settlement in a September 12 filing with the SEC but didn’t state the amount at that time. Caterpillar previously said that the IRS claimed that it owed about $2.3 billion in taxes, penalties, and interest.

The IRS had maintained that profits earned by Switzerland-based Caterpillar SARL on parts transactions should have been taxed in the United States. 'The company vigorously contested the IRS’s application of the ‘substance-over-form’ or ‘assignment-of-income’ judicial doctrines and its proposed increases to tax and imposition of accuracy related penalties,' Caterpillar said in its most recent filing. 'The settlement does not include any increases to tax in the United States based on those judicial doctrines and does not include any penalties.'

Estonia, Hungary Wait on Sidelines of Global Minimum Tax Efforts - Jan Stojaspal, Bloomberg ($):

Estonia is taking a wait-and-see approach to any potential implementation of the global minimum tax rate in Europe, and so is Hungary, representatives of both countries told a tax conference in Tallinn on Thursday.

The combination of high energy prices, soaring inflation, and Russia as an immediate neighbor leaves little room for public debate on how to implement the new tax rules in Estonia, said Helen Pahapill, a tax policy adviser at the Estonian Ministry of Finance.

In addition, there is uncertainty on how Estonia’s tax system—which shifts the payment of corporate income tax from when profits are earned to when they are distributed—would actually fit in with the new tax rules, she added.

From the “came back to bite you” file:

NYC Gets Nuisance Suit Over Untaxed Cigarettes Revived on Appeal – Perry Cooper, Bloomberg ($):

New York City sufficiently alleged that a store’s repeated possession and sale of untaxed cigarettes created a public nuisance, a state appeals court ruled, reviving the dismissed case.

The Big Apple case against City Tobacco House 1 Corp. and others was originally dismissed because the defendants didn’t meet the threshold. They possessed 178 packs of untaxed cigarettes instead of 250 packs, which is the amount that must be met to establish an intent to sell. The New York Appellate Division saw things differently.

The New York Appellate Division, Second Department, reversed Wednesday, finding that ‘the fact that the complaint only alleged the recovery of 178 packs of untaxed cigarettes from the subject premises did not prevent it from stating a cause of action.’ Instead the 5,000-cigarette threshold renders proof of intent to sell unnecessary, the court said in an unsigned opinion.

New York State and the Big Apple impose a combined $5.85 excise tax on each 20-cigarette pack sold, according to the article.

Under state and city law, anyone who sells or possesses for the purpose of sale any unstamped cigarettes is guilty of a misdemeanor, and anyone who reoffends within five years of a conviction is guilty of a felony.

This wasn’t the defendants first infraction as arrests at the company had been made "on several occasions over a six-month period."

The defendants could be fined no more than $5,000 and do jail time no longer than 30 days, according to a law firm that seems to specialize in this sort of crime.

Working our way to the main event on Monday, today is National Frankenstein Friday. If monsters aren’t your thing, it’s also National Chocolate Day. Have at it!

Make a habit of sustained success.