Inflation Causes IRS to Raise Tax Brackets, Standard Deduction by 7% - Richard Rubin, Wall Street Journal:

This is the largest automatic adjustment to the standard deduction since core features of the tax system were first indexed to inflation in 1985. Congress has significantly expanded the deduction beyond those automatic changes, most recently in the 2017 tax law, when it was nearly doubled.

The changes will take effect for tax year 2023...

The adjustments announced Tuesday include the income tax brackets and dozens of other parameters. The estate and lifetime gift tax exclusion will rise to $12.92 million from $12.06

million per person. The annual gift tax exclusion—the amount any person can give to any other without affecting lifetime limits—will climb to $17,000 from $16,000.

Related: IRS Releases Annual Tax Inflation Adjustments - Bailly Finney, Eide Bailly.

Estate Tax Exemption Grows Nearly $1 Million Due to Inflation - Alexander Rifaat, Tax Notes ($):

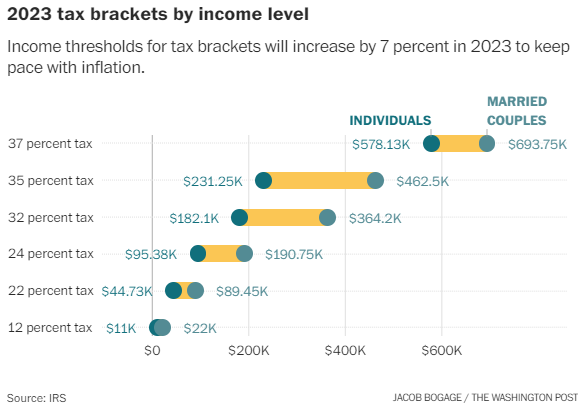

High-income taxpayers will also see nearly $40,000 more in income that won’t be taxed in the highest income tax bracket. The top income tax rate of 37 percent for single taxpayers will apply to individuals with incomes greater than $578,125, up from $539,900 in tax year 2022. For joint filers, the threshold will be $693,750, up from $647, 850.

The standard deduction for married couples filing jointly will increase by $1,800 to $27,700 in 2023, while that for single taxpayers and married couples filing separately will rise by $900 to $13,850.

Related: Eide Bailly Wealth Transition Update, Thursday, October 27. Register Now!

Tax filers can keep more money in 2023 as IRS shifts brackets - Julia Mueller, The Hill. "A single taxpayer making $90,000 in the 2022 tax year would face a top tax rate of 32 percent, while the same income in the 2023 year will face a top rate of 24 percent."

Inflation silver lining: Tax changes could fatten paychecks - Brian Faler, Politico. "A $10,000 cap on the state and local tax deduction also is not pegged for inflation. Nor is a 3.8 percent surtax on investments charged to couples making more than $250,000."

You can keep more money from the IRS next year, thanks to inflation - Jacob Bogage, Washington Post. "Several other elements of the tax code also are indexed to inflation. The maximum 2023 Earned Income Tax Credit, one of the federal government’s main anti-poverty measures, will be $7,430, up from $6,935 in 2022."

Superfund Taxes Due in Weeks Sow Confusion, Supply Chain Strains - Doug Sword, Tax Notes ($):

The new taxes are creating a host of issues, such as which company in the production chain gets stuck with the paperwork to apply for refunds when a product made with already taxed chemicals and substances is exported, according to KPMG LLP officials who spoke on a recent webcast about the new excise taxes.

Meanwhile, acknowledging that the new taxes on 42 chemicals and more than 150 imported substances derived from those chemicals will take some getting used to, the IRS is providing relief from penalties on them through the first quarter of 2023.

Microcaptive Insurers Challenge IRS Bills, Penalties In Tax Court - Anna Scott Farrell, Law360 Tax Authority:

The companies accuse the IRS of failing to provide adequate guidance to the special insurers, which operate as in-house insurance companies specifically to cover the risks of their parent companies and are allowed under Internal Revenue Code Section 831(b) to receive premium payments without paying tax on them.

...

The IRS issued a notice in 2016 flagging microcaptive arrangements as potentially abusive and requiring that they be disclosed under threat of penalty. The next year, microcaptive insurance firm CIC Services LLC sued over the notice, saying it unfairly depicted them as tax scammers. This March, a Tennessee federal judge struck down the notice, saying the IRS did not show that microcaptive insurance arrangements have a potential for tax avoidance or evasion.

Tax Law Changes, Hiring Among Big Challenges for IRS, Report Says - Lauren Loricchio, Tax Notes ($). "In a report released October 18, the Treasury Inspector General for Tax Administration outlined the agency’s top management and performance challenges for the fiscal year that began October 1: improving taxpayer service, protecting taxpayer data and agency resources, modernizing its operations, implementing tax law changes, boosting domestic and international tax compliance and enforcement, and limiting tax fraud and improper payments."

From the report:

As the IRS prepares for the 2023 Filing Season, it continues to struggle with eliminating the backlog of unprocessed tax returns and other types of tax account work from prior filing seasons. The pandemic, pandemic-related tax law changes, and significant staffing shortages hampered the IRS's efforts to address the backlog inventories, resulting in millions of tax returns not being timely processed, refunds not being timely issued, the Federal Government paying interest on delayed refunds, and taxpayers not timely receiving assistance with their tax account issues. As of August 12, 2022, the IRS had more than 14 million individual and business paper returns waiting to be processed.

The report says that all individual paper returns received in 2021 were processed by August 12 of this year, while 135,000 business returns filed in 2021were still backlogged. Nearly 14.5 million individual and business paper filings from 2022 were still awaiting processing.

This part of the report is sobering:

According to the Commissioner of Internal Revenue, the IRS was experiencing just over 1 million cyberattacks per day in 2017. Currently, the IRS sustains more than 1.5 billion attacks each year.

Md. Digital Ad Tax Quash Likely To Chill Other State Proposals - Maria Koklanaris, Law360 Tax Authority ($). "No other state but Maryland has enacted a tax on digital advertising alone, although New Mexico, which also taxes other forms of advertising, has proposed regulations to tax digital advertising services. But at least a dozen other proposals that have cropped up in various states have been put on hold as those states appear to have adopted a wait-and-see approach."

Maryland Digital Ad Tax Ruling Applauded but Questions Remain - Andrea Muse, Tax Notes ($). "Anne Arundel Circuit Court Judge Alison Asti concluded during an October 17 motions hearing in Comcast v. Comptroller that the tax violates the dormant commerce clause, the First Amendment, and the ITFA. Saying she was ruling from the bench rather than issuing a written opinion in the interest of time and brevity, the judge granted the plaintiff’s motion for summary judgment and asked plaintiffs’ counsel to submit a more specific proposed order by October 21."

Tax issues when tapping retirement accounts after a disaster - Kay Bell, Don't Mess With Taxes. "Whenever you withdraw money that has yet to be taxed, be it your — and in the case of a workplace plan, your employer's matching — contributions or tax-free earnings, those amounts are subject to tax."

Partial COVID failure-to-file penalty relief may still be available after deadline - NATP Blog. "Taxpayers who missed the Sept. 30 filing deadline for COVID-19 penalty relief may still be eligible for limited penalty relief if they file in the next few months, according to the IRS."

IRS provides tax-return-filing and payment relief for taxpayers impacted by Hurricanes Ian and Fiona - Mark Friedlich, Wolters Kluwer Tax & Accounting. "As of the publication date of this article, the relief applies to individuals and households that reside or have a business anywhere in Puerto Rico, Florida, North Carolina, and South Carolina."

Could A Data Tax Partially Replace the Corporate Income Tax? - Howard Gleckman, TaxVox. "For those of us used to a world of income or consumption taxes, it is a far-fetched idea. But administratively it would be not so different from a more familiar levy—a carbon tax that is imposed on the total volume of greenhouse gasses emitted by a firm."

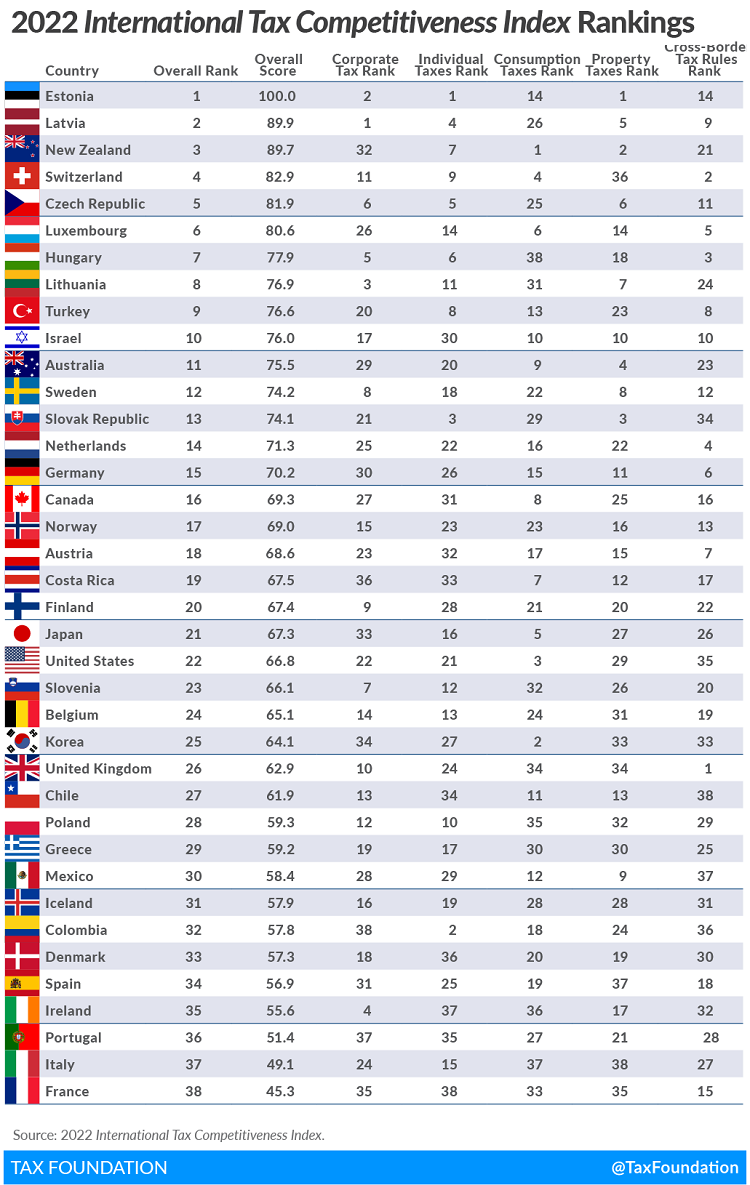

International Tax Competitiveness Index 2022 - Daniel Bunn, Tax Policy Blog. "For the ninth year in a row, Estonia has the best tax code in the OECD. Its top score is driven by four positive features of its tax system. First, it has a 20 percent tax rate on corporate income that is only applied to distributed profits. Second, it has a flat 20 percent tax on individual income that does not apply to personal dividend income. Third, its property tax applies only to the value of land, rather than to the value of real property or capital. Finally, it has a territorial tax system that exempts 100 percent of foreign profits earned by domestic corporations from domestic taxation, with few restrictions."

Montgomery tax preparer sentenced to 16 months in prison for filing false return - IRS (Defendant name omitted). "According to her plea agreement and other court records, Defendant operated a tax preparation service located on South Court Street in Montgomery. At her business, Defendant prepared federal income tax returns for customers. During her plea hearing in September of 2021, Defendant admitted that on February 26, 2018, she prepared and electronically transmitted a tax return that claimed a client incurred $8,726.00 in qualified solar electric property costs, $6,358.00 in medical and dental expenses, and $8,364.00 in gifts to charity, despite knowing that the client was not entitled to claim these items for calendar year 2017. The IRS subsequently paid a larger refund to the taxpayer based on these misrepresentations and Defendant profited from the falsely inflated amount."

The biggest refund isn't always the mark of the best preparer.

No Deathsticks? Today is National Medical Assistants Day. We can also celebrate Hagfish Day. If you can't get excited about that, it's also Evaluate Your Life Day.

Make a habit of sustained success.