Biden Pardons Marijuana Possession, Orders Criminal Review - Jordan Fabian, Bloomberg ($):

President Joe Biden took his first major steps toward decriminalizing marijuana, pardoning thousands of Americans convicted for possession of the drug and ordering a review of its legal status.

Biden on Thursday issued a blanket pardon for all prior federal offenses for simple possession of marijuana. He will also urge governors to issue similar pardons for state offenses involving marijuana, senior administration officials said.

‘Sending people to prison for possessing marijuana has upended too many lives and incarcerated people for conduct that many states no longer prohibit,’ Biden said in a statement, noting that people of color have been disproportionately arrested, prosecuted and convicted for the crime.

Decriminalization and legalization are too different things:

DECRIMINALIZATION VS LEGALIZATION OF DRUGS… - Turnbridge:

What is Decriminalization?

Decriminalization is the act of removing any criminal sanctions against a certain drug, including its use or possession under a specified amount. A decriminalized drug is still illegal, but the punishment for it is much less harsh.

What is Legalization?

Legalization is the act of a substance becoming permissible by law. In other words, it means that a once-banned substance is no longer illegal. People can use the substance without worry of being convicted or fined.

However, Biden has taken a step that could allow expenses associated with marijuana sales to be tax deductible at the federal level.

Biden pardons thousands convicted of marijuana possession, pushes for end of federal ban – Jonathan Salant, NJ.com:

Biden said he was asking for a review of marijuana’s classification as a Schedule 1 drug, the same as heroin. That classification has hindered research into any medical benefits of cannabis, while hindering legal marijuana businesses from obtaining financial services such as checking accounts for federally chartered banks, and preventing those businesses from deducting their expenses on their federal tax returns.

There is always an IF:

Biden Review of Marijuana Scheduling Could Have Tax Implications – Wesley Elmore, Tax Notes ($):

[I]f the Biden administration were to decide to reschedule marijuana, it would have to be added to a lower schedule — or descheduled entirely — for cannabis businesses to no longer be prohibited from taking deductions or claiming credits.

Biden Resolute Over Proper Handling of Semiconductor Tax Credits – Alexander Rifaat, Tax Notes ($):

President Biden once again sought to assuage fears that tax credits in the recently enacted CHIPS and Science Act of 2022 (P.L. 117-167) might be misspent, guaranteeing his administration will claw back any misused funds.

Biden’s October 6 speech at an IBM facility in Poughkeepsie, New York — where the technology giant announced $20 billion worth of investments over the next decade — mirrored comments he made in Ohio last month on the merits of the tax credits.

‘The CHIPS and Science Act is not handing out blank checks to companies,’ Biden said. ‘I have directed my administration . . . to be laser-focused on the guardrails that are going to protect taxpayers’ dollars.’

Former Treas. Official Casts Doubt on Passing Retirement Bill this Year – Jay Heflin, Eide Bailly. “The odds for Congress passing retirement legislation this year is markedly low, according to Mark Iwry, a former Deputy Assistant Secretary for Retirement and Health Policy at Treasury.”

‘I don’t think it is probable that it will be enacted in this lame duck session,’ he told the Tax Policy Center during an interview on the organization’s The Prescription webcast.

Trade Limits On Energy Tax Credits Could Restrict Payments – Kat Lucero, Law360 Tax Authority ($). “Public utilities for the first time can directly receive refundable tax credits for developing clean energy facilities under Democrats' landmark climate law, but provisions that require many materials and components of the facilities be sourced domestically could limit their availability.”

Further down the article:

To meet the energy and global competition goals, the new law expanded existing production and investment tax credits so that more clean energy development projects such as energy storage and biogas properties can take advantage of the incentives. To spur U.S. manufacturing, the new law offers a bonus 10% tax credit — on top of the base credits — to clean energy projects that meet "domestic content" rules that require that the steel and iron, as well as other building materials and components, be made in America.

However, supply chain disruptions brought on by the COVID-19 pandemic, combined with U.S. manufacturing still trying to catch up with the growing demand for clean energy development, could make the tax credit elusive for many project owners.

That's significant for tax-exempt entities — including electricity companies owned by state, municipal or tribal governments — that want to take advantage of a new direct tax payment option under the new law.

Custom Life Insurance Defended as Extreme Wealth Management Tool – Chandra Wallace, Tax Notes ($). “A congressional investigation into private placement life insurance (PPLI), recently expanded to examine more entities, isn’t likely to turn up wrongdoing or result in significant additional tax revenue, an investment adviser says.”

IRS: Don’t miss this important Oct. 17 tax extension deadline – Internal Revenue Service (email). “The Internal Revenue Service today reminds taxpayers who requested an extension to file their 2021 tax return to do so by Monday, Oct. 17.”

However, some taxpayers have additional time, which includes:

- Members of the military and others serving in a combat zone. They typically have 180 days after they leave the combat zone to file returns and pay any taxes due.

- The IRS calls special attention to people hit by recent national disasters, including Hurricane Ian. Taxpayers with an IRS address of record in areas covered by Federal Emergency Management Agency disaster declarations in Missouri, Kentucky, the island of St. Croix in the U.S. Virgin Islands and members of the Tribal Nation of the Salt River Pima Maricopa Indian Community have until Nov. 15, 2022, to file various individual and business tax returns. Taxpayers in Florida, Puerto Rico, North Carolina, South Carolina, parts of Alaska and Hinds County, Mississippi, have until Feb. 15, 2023. This list continues to be updated regularly; potentially affected taxpayers by recent storms should visit the disaster relief page on IRS.gov for the latest information.

IRS not doing enough to vet bogus charities – Michael Cohn, Accounting Today:

The Internal Revenue Service's streamlined application process for tax-exempt status could be allowing corrupt charities to claim exemptions before the IRS has enough information to check on them and enable them to carry out illegal activities, according to a pair of new reports.

The reports, posted Thursday by the Treasury Inspector General for Tax Administration, cast a wary eye on charity fraud at a time when questions have emerged in Congress about them as well.

Shortened Tax Exemption Application Insufficient, Watchdog Says – Naomi Jagoda, Bloomberg ($). “A streamlined form that organizations can use to apply for 501(c)(3) tax-exempt status doesn’t ask for enough information, the Treasury Inspector General for Tax Administration said in a report.”

‘Although the IRS has developed timesaving procedures for processing Forms 1023-EZ, the application itself does not provide the IRS with sufficient information to appropriately approve or deny an organization’s tax-exempt status,’ TIGTA wrote.

The report is here.

IRS May Look To Better Tailor Audits Of Big Biz, Official Says – Asha Glover, Law360 Tax Authority ($). “The Internal Revenue Service will likely alter some definitions of what a large corporation is under its large corporate compliance program to more accurately audit businesses of different sizes, an agency commissioner said Thursday.”

LB&I Outlines Spending Priorities for $80 Billion in Funding – Chandra Wallace, Tax Notes ($). “The recent influx of IRS funding will allow the Large Business and International Division to grow enforcement in areas currently at historic lows and improve compliance and resolution programs for taxpayers, according to an agency official.”

‘With the funding that we have the opportunity to tap into, we don’t have an excuse anymore about resources,’ LB&I Commissioner Nikole Flax said October 6 at a conference in Washington sponsored by Crowell & Moring LLP.

So there is no longer an excuse to not increase enforcement. It will be interesting to see how taxpayers earning less than $400,000 will be effected by this new reality.

1 big thing: Inflation could lower your taxes – Emily Peck and Matt Phillips, Axios. “Inflation adjustments are kind of sexy again, after years of not mattering much. The cost of living adjustments the IRS makes for 2023 are expected to be higher than they've been in decades — and could lower your taxes next year, Emily writes.”

Sexy? Again???

FedEx Tax Wage Theft Argument Centers on Alleged Harm to Drivers - Robert Iafolla, Bloomberg ($). “A federal appeals court in Boston signaled that FedEx Corp. drivers’ bid to revive their lawsuit alleging the company engaged in wage theft by not paying their tax withholdings to the government will turn on whether they suffered an actual injury.”

Victims of Crypto and NFT Fraud Can Take Theft Loss Deductions - Steven Chung, Bloomberg ($). “While most victims of crypto and NFT fraud will not get their investments back, they may be able to take advantage of some tax benefits.”

Further down the article:

Despite the potential and promises, many cryptocurrencies and NFTs have gone bust in recent months, with swaths of investors losing most, if not all, of the value. In some cases, the creators and promoters were simply unable to achieve the goals they promised. But others were scams in which the creators had no intention of repaying their investors and would disappear after taking the investors’ money, also known as rug pulls.

While most crypto and NFT fraud victims will not get their investments back, they may be able to take advantage of tax benefits due to their losses. The most beneficial is the theft loss deduction, which can be used to offset ordinary income, although the Tax Cuts and Jobs Act has limited its use for personal losses.

U.S. Bank Owes South Dakota After Miscalculating Franchise Taxes – Perry Cooper, Bloomberg ($). "U.S. Bank owes South Dakota over half a million dollars in bank franchise taxes after the state high court found the company miscalculated its deduction for federal tax paid."

Single Portal for State Sales Tax Returns Still Years Away – Michael Bologna, Bloomberg ($):

The states’ vision for a centralized portal for e-commerce sellers to look up sales tax rates and file returns is a long way from reality, but a worthy goal that will slash burdens on taxpayers and boost compliance, leaders of a state sales tax harmony pact said.

The Streamlined Sales Tax Governing Board, which administers the 24-state Streamlined Sales and Use Tax Agreement, continues to make progress on a proposed voluntary online tax filing portal, and a separate state and local rate and boundary look up application. But the projects are very complicated and could take up to two years to launch, said executive director Craig Johnson during the board’s annual meeting on Wednesday and Thursday.

Tax Pact Rule Gives Sellers 90 Days To Show Exemptions – Maria Koklanaris, Law360 Tax Authority ($). “Sellers will not have sales tax liability in states participating in the Streamlined Sales and Use Tax Agreement if they provide states with exemption certificates within 90 days of the sale date, according to a rule adopted Thursday.”

Colorado Business Owners Get Pandemic Valuation Suit Revived – Perry Cooper, Bloomberg ($). “A group of Colorado business owners will get another chance to argue that Weld County should have reassessed their properties to take pandemic restrictions into account, after a state appeals court revived their suit.”

Iowa DOR Amends Regulations on Income, Excise, Sales, Property, Inheritance Tax-Related Due Dates – Bloomberg ($). “The Iowa Department of Revenue Oct. 5 amended regulations on tax-related due dates for individual income, inheritance, corporate income, trust income, property, sales and use, and excise tax purposes.”

Missouri Governor Signs Law Reducing Individual Income Tax Rates – Bloomberg ($). “The Missouri Governor Oct. 5 signed a law reducing individual income tax rates.”

What European Countries Are Doing about Windfall Profit Taxes – Cristina Enache, Tax Foundation:

As energy prices continue to rise, more European countries have been looking at windfall profit taxes—a one-time tax levied on a company or industry when economic conditions result in large, unexpected profits—to fund relief measures for consumers. As early as March 8, the European Commission recommended in its REPowerEU communication that member states temporarily impose windfall taxes on all energy providers. The Commission suggested such measures be technologically neutral, not retroactive, and designed in a way that doesn’t affect wholesale electricity prices and long-term price trends.

IRS Continues to Reevaluate Advance Pricing Agreement Selection – Erin Slowey, Bloomberg ($):

The IRS is considering making the advance pricing agreements more selective, which may increase the interest in the International Compliance Assurance Program, an official said.

The ICAP allows multinational companies to participate in a pre-audit program voluntarily to weigh their tax risk with international tax administrations. Advance pricing agreements are made between tax authorities and companies to give legal certainty on the amount of tax the company will pay.

Developing Countries Focus on Revenue Impact of Global Deal - Isabel Gottlieb, Bloomberg ($):

Developing countries will put their energy into the global tax deal’s negotiations on a treaty-based minimum tax provision and a plan to simplify some transfer pricing—two issues that will be of the greatest benefit to them, an OECD report said.

Last year, nearly 140 countries joined a global tax agreement that includes a plan to reallocate a portion of the largest multinationals’ profits—called Amount A of Pillar One—and a 15% global minimum corporate tax rate, known as Pillar Two.

But the parts of the deal that developing countries anticipate will best help their domestic resource mobilization include Amount B, a plan to streamline some transfer pricing, and the subject-to-tax rule, which ensures certain related-party payments aren’t taxed too low under treaties, the report said.

The report is here.

From the "tax policy intersects with politics" file:

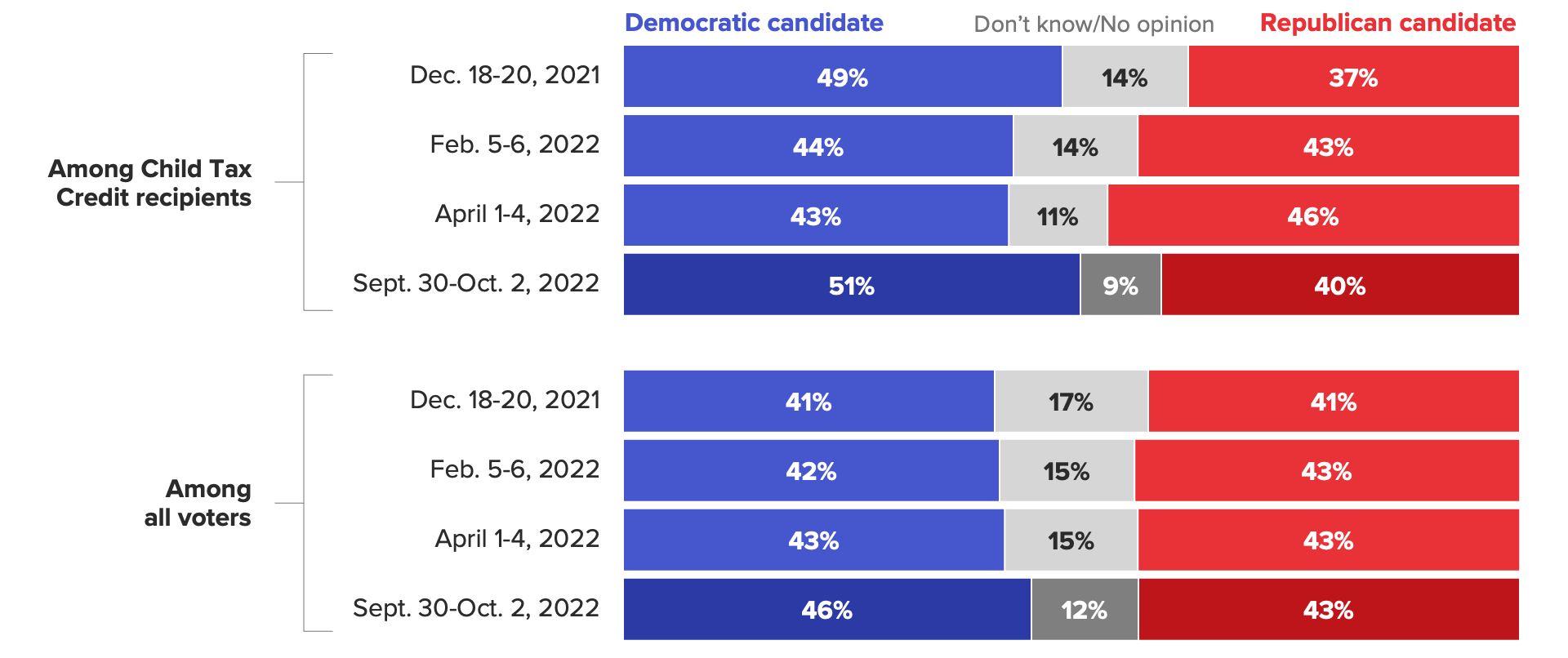

Democrats Reclaim Advantage Among Child Tax Credit Recipients on Generic Congressional Ballot – Amanda Jacobson Synder, Morning Consult.

After months of waning support on the generic congressional ballot from voters who received expanded child tax credit payments, Democrats have staged a comeback with the group, according to a new Morning Consult/Politico survey.

From the report:

Voters were asked if they were more likely to vote for a Democratic congressional candidate or a Republican congressional candidate if the election were held in their district today

Bottom line: The mid-term elections are expected to be incredibly tight and voters who recieved the expanded Child Tax Credit could decide who wins - assuming they vote.

It’s National Chocolate Covered Pretzel Day! The antidote for having a bad day!

National Day Calendar:

Salty, crunchy pretzels and chocolate are the gold mine of the snack world, and their combination is the epitome of the oh-so-popular sweet and salty flavor craze. Change up the chocolate from white to milk to dark chocolate, and they satisfy even a mild sweet tooth.

That’s how you turn a frown upside-down.

Make a habit of sustained success.