IRS Extends Research Credit Transition by a Year – Chandra Wallace, Tax Notes ($):

The IRS is extending into 2024 the transition period during which taxpayers have 45 days to supplement research credit refund claims that are deemed incomplete, but the battle over claim requirements continues.

The announcement, posted to the IRS website September 30, extends transition relief through January 10, 2024, and follows requests from tax professionals for significant changes to procedural guidance for those claims and for a delay in its implementation. Critics of the submission requirements in the guidance (FAA 20214101F) released in October 2021 welcomed the extension but stood firm on their objections to the guidance itself.

The announcement is here.

Buyback Tax at 1% Is Too Small to Matter as CEOs Reward Holders - Laura Davison, Bloomberg ($). “A new tax created by Democrats to slow a record pace of stock buybacks has been largely shrugged off by corporations that see the 1% excise levy as a minor cost of doing business.”

After this tax was enacted, a person close to Wall Street said few firms would sweat it because markets can shift greater than 1 percent. In other words, the 1 percent tax can easily be offset if the stock price increases 1 percent – which stocks do regularly.

The Tax Angle: Corporate Book Taxes And Retirement Savings – Stephen Cooper, Law360 Tax Authority ($). “Congressional Democrats already are looking to fine-tune the new 15% minimum tax on wealthy corporations even before it takes effect next year, but the likelihood of that happening remains low since it will require help from Republicans.”

Action on retirement bill is looking likely:

[L]awmakers view enactment of tax provisions included in a comprehensive retirement security bill as a bipartisan priority that can move when Congress returns to Washington after the midterm elections, Cardin told reporters.

The House already has passed the Securing a Strong Retirement Act of 2022, known as H.R. 2954 or Secure 2.0, while the full Senate has yet to vote on the Enhancing American Retirement Now Act, or EARN Act, which passed the Senate Finance Committee.

‘It ought to be a prime opportunity in the lame duck session, for sure,’ said Neal, who noted the overwhelming bipartisan support for the retirement security bills. ‘It strikes me as though that ought to be an easy piece of legislation’ to pass Congress and get Biden's signature, he said.

Biden, student loans and the case of the missing tax estimate – Brian Faler, Politico Pro ($). “Democrats’ plan to waive taxes on student loans forgiven under President Joe Biden’s initiative will probably cost the government tens of billions of dollars — though you won’t find that in official estimates.”

Why Biden world isn’t overly worried about House GOP investigations – Eugene Daniels, Jonathan Lemire and Jordain Carney, Politico:

Congressional Republicans are talking more openly about their desire to investigate every aspect of the Biden administration — and family — should they regain control of one or both houses of Congress.

Inside Biden world, aides and allies aren’t entirely displeased with the chatter.

There is a growing confidence in the White House that the House Republicans clamoring for a hodgepodge of investigations will overreach — and that their attempts will backfire politically, with key voters recoiling at blatant partisan rancor. Officials believe they can use GOP efforts to their political advantage heading into the 2024 cycle…

The possible probes:

Why the White House isn't sweating GOP probes – Eugene Daniels and Ryan Lizza, Politico Playbook:

High on the Republican punch list:

- A microscopic look into the business dealings of HUNTER BIDEN;

- Multi-prong investigations into Biden’s border policy, which could morph into an impeachment of DHS Secretary ALEJANDRO MAYORKAS;

- A probe of the coronavirus’ origins, with a focus on ANTHONY FAUCI’s role in approving controversial research programs;

- A multi-committee dive into the chaotic U.S. withdrawal from Afghanistan; and

- A sweeping dig into the Justice Department and FBI, led by potential House Judiciary Chair JIM JORDAN (R-Ohio).

What does this development have to do with advancing legislative policies? Nothing. Absolutely nothing. In fact, it will make it harder for the political parties to work together on legislative issues. Items like extending the pass-thru deduction or expanding the interest deduction will require bipartisan support, and this effort could hurt that.

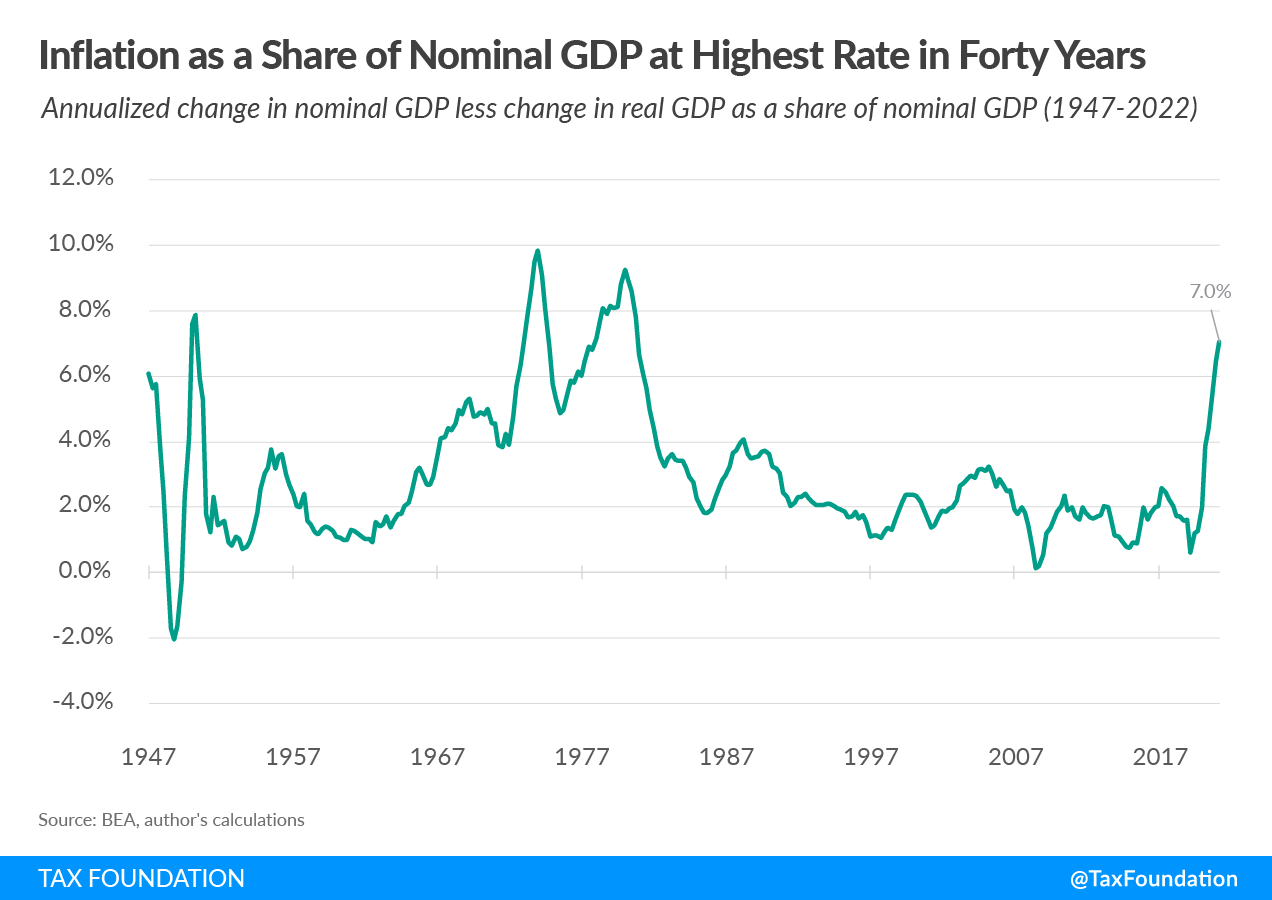

The “Inflation Tax” Is Regressive – William McBride and Alex Durante, Tax Foundation:

Inflation operates much like a tax, a particularly egregious one that disproportionately falls on the poor and leads to a variety of economic problems, including, as we’re seeing, higher interest rates, slow economic growth, and reduced incomes.

With inflation still running high, it is worth exploring who bears the cost of the surge in prices over the past year and a half. While academic evidence shows that bondholders and consumers bear much of the burden of inflation over the long run, a new Congressional Budget Office (CBO) report reveals that lower- and middle-income households are disproportionately shouldering the burden of this current inflation wave.

Justices To Review Firm's Bid To Shield Client Tax Comms – Theresa Schliep, Law360 Tax Authority ($). “The U.S. Supreme Court said Monday it will consider a law firm's bid to shield client communications from grand jury subpoenas seeking documents on its tax advice in a case concerning the scope of attorney-client privilege over mixed-use legal advice.”

Tax Cut Fever Surges in Arizona, Iowa, Missouri, Oklahoma – Michael Bologna, Bloomberg ($):

Arizona Gov. Doug Ducey (R) said his state will shift to a 2.5% flat personal income tax, dumping the current graduated system. The change responds to a 2021 law that sought to phase in the tax program over three years, but Ducey said Arizona is ahead of schedule due to a “record surplus.”

Iowa’s top corporate income tax rate will drop to 8.4% from 9.8% in response to a law passed this year providing a formula for business rate reductions when net corporate income tax receipts exceed $700 million, a target the state recently exceeded. Gov. Kim Reynolds (R) said the shift also reduces the number of tax brackets from three to two several years earlier than projected.

Tax cutting was the top priority during a special session of the Missouri Legislature, which passed a bill dropping the individual rate to 4.95% from 5.3% next year. The measure also shifts the state to a rate of 4.5% over several years if certain revenue targets are hit.

Oklahoma is looking at passing a flatter and lower income tax that would phase-in over several years.

Kentucky Governor Announces Availability of Small Business Tax Credit for Investing in Community, Creating Jobs – Bloomberg ($). “The Kentucky Governor Sept. 29 announced the availability of the Small Business Tax Credit up to $25,000 for small businesses investing in the community and creating jobs, for individual income and corporate income tax purposes.”

Minnesota DOR Issues Revised Withholding Fact Sheet on Definition of Taxable Wages – Bloomberg ($):

The Minnesota Department of Revenue Sept. 26 issued a revised withholding fact sheet on the definition of wages, for corporate income and individual income tax purposes. The fact sheet explains an employer’s income tax withholding responsibilities.

Ian victims get federal filing relief – Jeff Stimpson, Accounting Today:

Hurricane Ian victims throughout Florida now have until Feb. 15 to file various federal individual and business tax returns and make tax payments.

The IRS is offering relief to any area designated by the Federal Emergency Management Agency, which means that individuals and households that reside or have a business anywhere in Florida qualify for the relief. (The current list of eligible localities is always available on the disaster relief page.)

The relief postpones various tax filing and payment deadlines that occurred starting on Sept. 23. Affected individuals and businesses will have until Feb. 15, 2023, to file returns and pay any taxes that were originally due during this period. Individuals who had a valid extension to file their 2021 return due to run out on Oct. 17 will also now have until Feb. 15 to file. Because tax payments related to these 2021 returns were due on April 18, 2022, those payments are ineligible for this relief.

The IRS announcement is here.

Remote Worker Loses Appeal Over Michigan City’s Income Tax – Perry Cooper, Bloomberg ($). “A remote worker who challenged an income tax levied on nonresidents in Jackson, Mich., doesn’t have standing to sue because he never sought a refund, the state appeals court ruled.”

Newsom Seeks Oil Company Windfall Profits Tax As Prices Spike - Laura Mahoney, Bloomberg ($):

California Gov. Gavin Newsom proposed a windfall profits tax on oil companies Friday.

As gas prices increased by a record 84 cents per gallon in the past 10 days and oil companies have failed to provide an explanation for the jump in prices and the difference between prices in California compared to prices in other states, the Democratic governor said.The average price per gallon in California is $6.29 compared to the national average of $3.79, according to the American Automobile Association.

Newsom Signs California SALT Tweak to Help Multistate Firms – Laura Mahoney, Bloomberg ($). “Members of national accounting firms and other multistate partnerships can more easily use California’s workaround to the $10,000 federal cap on state and local tax deductions under a bill signed by Gov. Gavin Newsom on Wednesday.”

California Governor Signs Law Excluding From Gross Income Settlement Amounts Received for Specified Fires – Bloomberg ($). “The California Governor Sept. 29 signed a law excluding from gross income, until Jan. 1, 2028, any qualified amount received in settlement by a qualified taxpayer from the Fire Victims Trust established under the June 20, 2020, order of the U.S. Bankruptcy Court for the Northern District of California, for corporate income and individual income tax purposes.”

NYC Faces $1 Billion Tab From Migrant Influx, Comptroller Says – Martin Braun and Emma Court, Bloomberg ($). New York faces fiscal challenges as asylum seekers flow into the state, Wall Street profits drop and remote work policies drain the state’s coffers. Meanwhile, income tax revenue has declined and other revenue options are being considered:

[Comptroller Brad] Lander said the state should consider resurrecting a commuter tax or regional tax sharing —in addition to congestion pricing— to help fund the Metropolitan Transportation Authority’s operations and other infrastructure. A commuter tax is sure to bring howls of protest from suburban state legislators, who are already feeling the heat from constituents over congestion pricing. In 1999, the state legislature repealed a 33-year-old income tax on suburban commuters.

‘If less income tax is being paid in New York City and we don’t have a restored commuter tax, then it’s hard to figure out how to capture enough value to maintain the subways and invest in the schools and keep the city safe and clean and all the things that really matter,’ Lander said.

Arkansas Appeals Office Sustains Use Tax Assessment on Out-of-State Purchase of Tangible Personal Property – Bloomberg ($). “The Arkansas Office of Hearings and Appeals (OHA) Sept. 29 decided to sustain a sales and use tax assessment on Taxpayer’s purchase of tangible personal property from an out-of-state vendor.”

Illinois DOR Issues Revised 2021 Subgroup Schedule Instructions for Corporate, Individual Income Taxpayers – Bloomberg ($). “The Illinois Department of Revenue Dec. 1, 2021 issued revised 2021 subgroup schedule instructions for corporate income and individual income tax purposes.”

Illinois DOR Releases Income Tax Schedule K-1-T(2), Beneficiary’s Instructions – Bloomberg ($). “The Illinois Department of Revenue Dec. 1, 2021 released Schedule K-1-T(2), Beneficiary’s Instructions, for individuals and entities who receive the form from trusts or estates, for individual income, corporate income, and trust income tax purposes.”

Wide IRS Foreign Account Penalty Power Defended at Supreme Court – Aysha Bagchi and Jeffery Leon, Bloomberg ($):

The Justice Department urged the Supreme Court to endorse the IRS’s power to impose penalties for each foreign account that US residents and citizens non-willfully fail to report.

The Friday filing advances the IRS’s position as the government readies for oral arguments at the high court Nov. 2. Officials are defending the agency’s ability to impose the penalties each year on a per-account basis for non-willful failures to report foreign bank and financial accounts through annual forms known as FBARs.

UK scraps tax cut for wealthy that sparked market turmoil – Jill Lawless, Associated Press:

The British government on Monday dropped plans to cut income tax for top earners, part of a package of unfunded cuts unveiled only days ago that sparked turmoil on financial markets and sent the pound to record lows.

In a dramatic about-face, Treasury chief Kwasi Kwarteng abandoned plans to scrap the top 45% rate of income tax paid on earnings above 150,000 pounds ($167,000) a year.

Kwarteng and Prime Minister Liz Truss have spent the better part of two weeks pushing for this tax cut before doing an about-face.

‘We get it, and we have listened,’ Kwarteng said in a statement. He said ‘it is clear that the abolition of the 45p tax rate has become a distraction from our overriding mission to tackle the challenges facing our country.’

Why the about-face? Conservative lawmakers opposed giving a tax break to the wealthy while middle-class taxpayers struggled to pay their bills, according to the article.

India cuts windfall tax on crude oil output, diesel exports – Reuters:

The Indian government has cut a windfall tax on domestically produced crude oil to 8,000 rupees per tonne from 10,500 rupees per tonne from Sunday, after a decline in global oil prices.

India has also scrapped an export tax on jet fuel and halved export duties on diesel to 5 rupees per litre from Sunday, a government notification said.

From the “See How They Run” file:

Lawmakers literally sprint from the Capitol to run for midterms – Paul Kane, Washington Post. Shortly after the House approved a spending bill on Friday to fund the federal government through December 16th lawmakers exited Congress like the place was on fire. Kane beautifully captured this moment. How did he know it would happen? Because lawmakers do this all the time. Before last votes, staffers park lawmakers' cars as close to the Capitol as possible with luggage already packed. Once the vote is over, the lawmakers split.

Happy National Consignment Day! Today is one-part donation (clothing and/or accessories) and another-part shop til you drop!

Make a habit of sustained success.