IRS warns of 'frustrating' refund delays as tax-filing season kicks off - Sylvan Lane, The Hill. IRS Commissioner Charles Rettig tells us not to get our hopes up:

In a Monday call with reporters, Retting urged Americans to begin preparing their taxes well ahead of the deadline, set up a direct deposit system with the IRS and file their returns electronically to avoid delays.

“This could be a very frustrating filing season for all taxpayers and tax professionals,” Rettig said.

Filing Season Kicks Off for 2022 With Some Warnings - Benjamin Guggenheim, Tax Notes ($):

Noting a significant backlog of 2020 returns — 6.7 million unprocessed individual returns and 2.6 million unprocessed amended individual returns as of December 4, 2021 — Kenneth Corbin, IRS chief taxpayer experience officer and commissioner of the IRS Wage and Investment Division, emphasized in an accompanying statement that filing electronically with direct deposit is more important than ever to obtain timely refunds.

...

In response to a question about a possible deadline extension in the future, [IRS Commissioner Charles] Rettig said the IRS and Treasury will monitor the progress of the filing season and continue to take advice from various professional tax organizations.

At the moment, the IRS doesn’t intend to change the deadline, “and we don’t make that decision lightly,” Rettig said.

The filing season is here - Bernie Becker, Politico.

Some of the problems have already been pretty well documented. For instance, getting through to the IRS on the telephone — never all that easy to begin with — will be especially difficult.

The paper backlog at the IRS also stands at millions and millions of pieces, and the agency is pleading with taxpayers to file electronically. (Those who do, and who don’t have particularly complicated returns and file without mistakes, can expect a refund within about three weeks.)

IRS begins 2022 tax season; urges extra caution for taxpayers to file accurate tax returns electronically to speed refunds, avoid delays - IRS. "For people whose tax returns from 2020 have not yet been processed, they can still file their 2021 tax returns. For those filing electronically in this group, here's a critical point. Taxpayers need their Adjusted Gross Income, or AGI, from their most recent tax return when they file electronically. For those waiting on their 2020 tax return to be processed, make sure to enter $0 (zero dollars) for last year's AGI on the 2021 tax return. Visit Validating Your Electronically Filed Tax Return for more details."

IRS Simplifies Filing Procedures for Nonfiler Credit Claims - Caitlin Mullaney, Tax Notes ($):

For 2021, eligible individuals with an adjusted gross income of zero can electronically file forms 1040, 1040-SR, or 1040-NR, but must enter $1 for their total income, according to the revenue procedure.

The revenue procedure outlines a simplified procedure for both paper and electronic filing for individuals claiming multiple credits, saying that the IRS will process both categories of eligible individuals’ forms 1040, 1040-SR, or 1040-NR if, in addition to providing the general required information listed in the revenue procedure, individuals indicate Rev. Proc. 2022-12 on their filing form.

The simplified filing procedures are spelled out in Rev. Proc. 2022-12.

IRS Looking Into Incorrect Info On Child Tax Credit Letters - David van den Berg, Law360 Tax Authority:

The Internal Revenue Service is looking into concerns about taxpayers receiving letters regarding advance child tax credit payments that show incorrect information, but expects the problem affects a limited set of taxpayers, agency officials said Monday.

Chuck Rettig, the agency's commissioner, said on a news call that he's confident the scope of the problem is limited and further information would be released as it becomes available....

"The commissioner is highly confident it is nowhere near millions or hundreds of thousands. I won't give you a number," Rettig said. "When we have this information, we will be releasing it."

IRS online taxpayer account access soon will require selfies, more personal info - Kay Bell, Don't Mess With Taxes:

Last week, the security news website KrebsOnSecurity reported that by this summer, taxpayers can manage their online official IRS tax accounts only if they have an ID.me account.

This change will apply to existing IRS account owners (like me) and those who establish new accounts.

For now, I and other online tax account owners can sign on at IRS.gov by entering the username and password we created when we opened the account.

But with the ID.me requirement, we'll have to go through that McLean, Virginia-based company's confirmation steps to get an account which we then will use to log on to our tax account.

The ID.me system also is required of tax professionals

Smile! The IRS Wants You To Send Selfies to a Facial Recognition Company - Elizabeth Nolan Brown, Reason. "The IRS began rolling out the new requirement for child tax credit accounts last summer. By this upcoming summer, it will be required for all IRS online service accounts (existing online account credentials will no longer work). 'The new process is one more step the IRS is taking to ensure that taxpayer information is provided only to the person who legally has a right to the data,' states the IRS website."

Dems Divided On How To Split Up Build Back Better Act - Alan Ota, Law360 Tax Authority ($):

At a news conference Wednesday, Biden called for action on the BBB Act's green energy incentives, aid for early education and revenue-raising measures, but he said the expanded child tax credit was one of several items he was "not sure I can get in the package." He urged Democrats to "get as much as we can now, and come back and fight for the rest later."

Rep. Don Beyer, D-Va., a member of the Ways and Means Committee, said a deal such as the one roughly framed by Biden could gain traction. If passed by the Senate, Beyer predicted a smaller version of the BBB Act would survive any House complaints about omissions.

"We would probably just pass it," Beyer told Law360.

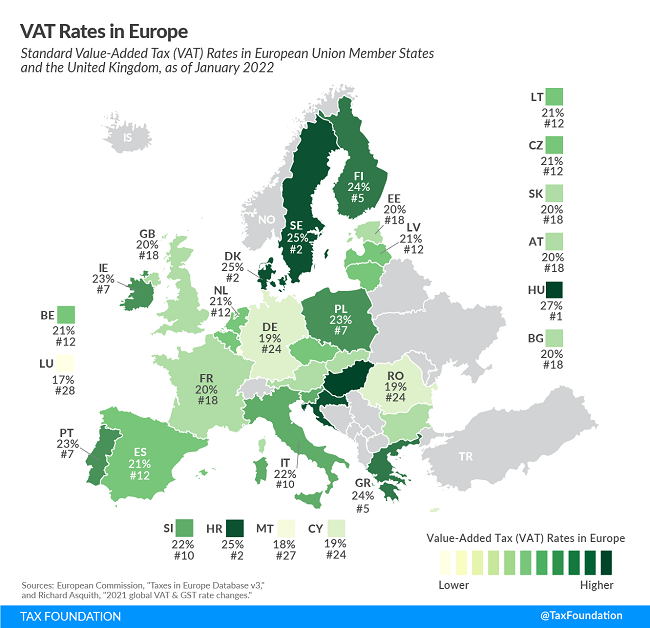

2022 VAT Rates in Europe - Cristina Enache, Tax Policy Blog. "More than 170 countries worldwide—including all European countries—levy a Value-Added Tax (VAT) on goods and services... The VAT is a consumption tax assessed on the value added in each production stage of a good or service. Every business along the value chain receives a tax credit for the VAT already paid. The end consumer does not, making it a tax on final consumption."

The U.S. has no VAT.

New York Remote Work Rules Clash With COVID-19 Realities, Experts Say - Amy Hodges, Tax Notes. The article quotes Jones Walker LLP attorney Alysse B. McLoughlin:

McLoughlin explained that New York’s rule is that New York tax is withheld if your office is based the state, regardless of where the work is performed.

“I think this rule is really, to some extent, antiquated,” McLoughlin said. She explained that the rule “seemed to have more relevance in the time period where people really did work from one office all of the time.” She said that many people think the rule needs to be updated in some way, adding, “The tax law really does have to catch up to what has happened in the world."

Virginia Governor Pushes for Expanded Business Tax Relief - Benjamin Valdez, Tax Notes. "Youngkin’s Day One Game Plan legislative agenda, released January 21, outlines a slew of proposed bills and budget amendments. Included is H.B. 971, which would update the state’s conformity to the IRC to December 31, 2021, and retroactively increase from $100,000 to $1 million the cap on the deduction for business expenses paid by forgiven PPP loans for tax year 2020."

IRS Expands on Reporting Expenses Used to Obtain PPP Loan Forgiveness on Form 1120S, Schedule M-2 - Ed Zollars, Current Federal Tax Developments. "The IRS has added more clarification in the final Form 1120S instructions about how expenses paid with PPP loan funds that lead to debt forgiveness should be treated in the computation of the accumulated adjustments account (AAA) and the other adjustments account (OAA)."

Back To The BBB Drawing Board - Renu Zaretsky, Daily Deduction. "The White House and Senate Democrats want to revive talks on President Biden’s Build Back Better (BBB) agenda for climate and social spending. In a press conference last week, Biden acknowledged that the massive bill would likely need to be broken up."

Tax Industry Organizations Send Letter To IRS Requesting Targeted Relief For Taxpayers - Amber Gray-Fenner, Forbes. "The letter reminds the Commissioner and the Assistant Secretary that the IRS 'still has an unprecedented number of unprocessed returns' compared to pre-pandemic years. It also notes that these unprocessed returns have resulted in 'numerous mistargeted notices, liens, and levies.' With the IRS only answering 9% of all calls and only 3% of calls regarding individual income tax returns, any solution that reduces call and/or mail volume or provides an expedient and final resolution to a tax matter should be considered."

Watch for Child Tax Credit and Economic Impact Letters from the IRS- Eide Bailly. "If you received advance Child Tax Credit (CTC) or Economic Impact Payments (EIPs) from the government in 2021, be on the lookout for letters from the IRS. The letters provide important information that could be relevant when preparing 2021 income tax returns."

Does Your Company Qualify for the Federal R&D Credit? - Michael Donahue. Tax Warrior Chronicle. "If your company operates in software development, technology, architecture, engineering, manufacturing, or is a contractor, it may be entitled to an approximate 7% credit or refund on eligible expenditures."

If An IRS Form 1099 Is Wrong, How To Disagree - Robert Wood, Forbes. "So if the issuer of the Form 1099 has already sent it to the IRS, ask for a “corrected” Form 1099. The issuer will prepare a Form 1099 in the correct amount and check a “corrected” box on the form. The corrected form is supposed to cancel out the first one in the IRS system, once you give it time to settle. But what happens if the issuer won’t cooperate at all, or you can’t convince them that your numbers are right and theirs are wrong? There’s no good answer."

How to Handle Missing Forms W-2 and Forms 1099 - Parker Tax Publishing. "Taxpayers who haven't received their Form W-2 or Form 1099-R in time to file their tax return can use the Form 4852 to estimate their wages or payments and withheld taxes as accurately as possible. The IRS may delay processing the return while it verifies the information."

Gorsuch Wanted Supreme Court To Overrule Virginia Courts On Real Estate Tax Issue - Peter Reilly, Forbes. "The economic issue was real estate tax exemption for a residence on Church property occupied by Josh Storms and Anacari Storms. Justice Gorsuch sees it as a matter of bureaucrats and judges subjecting religious beliefs to verification. The real estate exemption turned on whether Josh and Anacari can be considered ministers under the Virginia statute that exempts parsonages."

FAQ Observations and Cautions - Annette Nellen, 21st Century Taxation. "When you find an FAQ that answers your question, you should find the underlying binding authority to be sure it exists and because that is what you need to rely on. I think probably 95% of IRS FAQs are just describing the Code, text from a Public Law, regs, or court cases, so are binding."

What the U.S. Can Learn from the Adoption (and Repeal) of Wealth Taxes in the OECD - Daniel Bunn, Tax Policy Blog. "According to these data, the number of current OECD members that have collected revenue from net wealth taxes has grown from eight in 1965 to a peak of 12 in 1996 to just five in 2020."

Charlie Sheen ‘Winning’ in Tax Court Dispute - Kristen Parillo, Tax Notes ($). "Actor Charlie Sheen has succeeded in having his Tax Court collection due process case remanded to IRS Appeals so that he can again pitch his $3.1 million offer in compromise to settle tax debts for three tax years."

Link: Order, Docket No. 29680-21L.

I see it's cold. Today is Observe The Weather Day, making a holiday of what I do when I should be working.

Make a habit of sustained success.