Democrats brace for toughest stretch yet with Biden agenda – Mike Lillis and Scott Wong, The Hill. “House Democrats this week wrapped up the bulk of committee work on a $3.5 trillion package of social benefits and climate programs — a massive undertaking that advances what would be a legacy-defining domestic agenda for President Biden. Now the harder part begins."

While 13 separate committees succeeded in drafting, massaging and ultimately approving the portions of the package under their jurisdiction, the process featured plenty of infighting between disparate factions over various provisions — differences that have created headaches for Democratic leaders and will need resolving before the legislation hits the floor.

Those clashes have threatened to sink a major cost-slashing drug benefit, risking liberal defections and potentially alienating moderates if deficit estimates swell as a result. A separate battle over tax benefits risks an erosion of support from a handful of Democrats in high-income regions — enough to bring the legislation to a halt.

The combination is raising new questions about whether House leaders have the votes to pass the package on the floor with a minuscule majority demanding virtual unanimity to overcome the communal opposition of Republicans.

K Street counting on Senate to pare back Democrats’ tax plan – Caitlin Oprysko, Politico. Business lobbyists have described House Democrats’ ambitious new tax plan as an “existential threat,” but for all the dire warnings, K Street isn’t freaking out — yet. In interviews this week, lobbyists representing a range of business interests said they aren’t too worried about the party’s opening salvo on tax increases, confident the bill — and the threats their clients insist it poses — will be pared back in order to thread its way through a narrowly divided House and Senate.”

'This is the beginning of the process,' said Arshi Siddiqui, a partner at one of Washington’s top lobbying firms, Akin Gump Strauss Hauer & Feld, and a former aide to House Speaker Nancy Pelosi. 'We are talking about landmark legislation and a legislative centerpiece for the Biden administration… By definition, signature pieces of legislation require a healthy give and take throughout the process.'

Biden Turns Up Pressure on Democrats Balking at Spending Bill – Nancy Cook and Josh Wingrove, Bloomberg ($). “President Joe Biden ratcheted up pressure on congressional Democrats on Thursday, as discord within the party threatened to derail key pieces of his economic agenda, including lowering prescription drug prices and some of his proposed tax hikes on the wealthiest Americans… The recent back-and-forth on Capitol Hill has shown the limits of Biden’s power to guide the $3.5 trillion plan through a narrowly divided Congress. Moderate Democrats have balked at recent efforts to negotiate on drug prices and to impose a new tax on the assets of the wealthiest people, measures that progressives applaud."

The White House can only afford to lose the support of three House Democrats for the package to pass; it needs all Democratic votes in the Senate…

‘For a long time, this economy’s worked great for those at the very top,’ Biden said in a speech Thursday at the White House. ‘This our moment to deal working people back into the economy.’

Democrats Rethink Climate Measures, Consider Carbon Tax – Andrew Duehren, Wall Street Journal ($). “Democrats are taking a fresh look at their proposals for reducing carbon emissions in their $3.5 trillion spending package, hoping to win over moderate party members who raised concerns about elements of the plan.”

Democrats have laid out a variety of provisions aimed at combating climate change in the wide-ranging proposal, including tax credits for purchasing electric vehicles, a program to push utilities to produce more clean electricity and a fee on methane emissions. Now, in an effort to unite the party, lawmakers are considering changes and eyeing alternative options, including a carbon tax.

Biden’s Capital Gains Overhaul Loses Traction in House – Colin Wilhelm, Bloomberg ($). “The House Ways and Means Committee approved its portion of a multi-trillion dollar economic and social spending plan this week. But despite this latest victory, Democrats still have a lot of work to do before their aspirations become law.”

The House tax plan doesn’t include some of President Joe Biden’s notable proposals, including an overhaul of the way unrealized capital gains are treated at death. The tax plan advanced by Ways and Means also aims for more modest hikes to the corporate and capital gains rates than Biden has floated.

Biden Plan To Limit Like-Kind Exchanges Faces Headwinds – Alan Ota, Law360 ($). “A drive by President Joe Biden to cap the deferral of capital gains taxes on like-kind exchanges has drawn opposition from rural lawmakers and faces an uphill fight to be included in an emerging $3.5 trillion reconciliation bill.”

A summary by the U.S. Department of the Treasury said the plan to cap the tax deferral for exchanges of real property would raise nearly $20 billion in revenue over 10 years ‘while increasing the progressivity of the tax code.’ But the plan to restrict like-kind exchanges under Internal Revenue Code Section 1031 has faced opposition from rural lawmakers, who also have pushed back against a Biden plan to tax unrealized capital gains of wealthy taxpayers at death.

Hottest Tax Break for Richest Americans Is a Middle-Class IRA – Ben Steverman, Bloomberg ($). “Most Americans rely on retirement accounts as a way to eventually stop working without falling into poverty. For the rich, they’ve become something more — a powerful tool to avoid taxes and pass on wealth to heirs. More than $279 billion sits in mega-IRAs, individual retirement accounts with at least $5 million each, according to Congress’s nonpartisan Joint Committee on Taxation. Despite rules designed to limit IRA contributions by the wealthy, almost 29,000 Americans hold these giant accounts, and nearly 500 of them somehow managed to get $25 million or more into their IRAs.”

Democrats in Washington are trying to thwart the trend of ever-larger IRAs. A tax plan approved by the House Ways and Means Committee on Wednesday includes limits on their use by the wealthy, including a provision that would impose restrictions on retirement accounts whose value exceeds $10 million.

House Weighs Bank-Reporting Rules to Pay for SALT Expansion – Allyson Versprille, Bloomberg ($). “House Democrats are working with the Biden administration to add bank account reporting requirements to their tax bill, a measure that could be used to pay for a modification of the cap on the federal deduction of state and local taxes.”

Ways and Means Committee Chairman Richard Neal said his committee and Treasury officials are discussing boosting reporting requirements to the Internal Revenue Service to address tax cheats without burdening the middle class.

Tax Hike Seen Luring Banks Back to Munis After Trump-Era Exodus – Michelle Kaske, Bloomberg ($). “The Democrats’ push to raise the corporate income tax will likely drive banks and insurers to step up their purchases of municipal bonds, a haven for tax-averse investors. House Democrats are looking to increase the top corporate rate to 26.5% from 21% to help finance President Joe Biden’s $3.5 trillion economic plan.”

That could spark demand for state and local government debt from financial firms seeking to ease their tax burden. Banks, property and casualty insurers and life insurance providers are active investors in the $4 trillion municipal-bond market, collectively holding a combined $1 trillion of the securities as of March 31, according to Federal Reserve data.

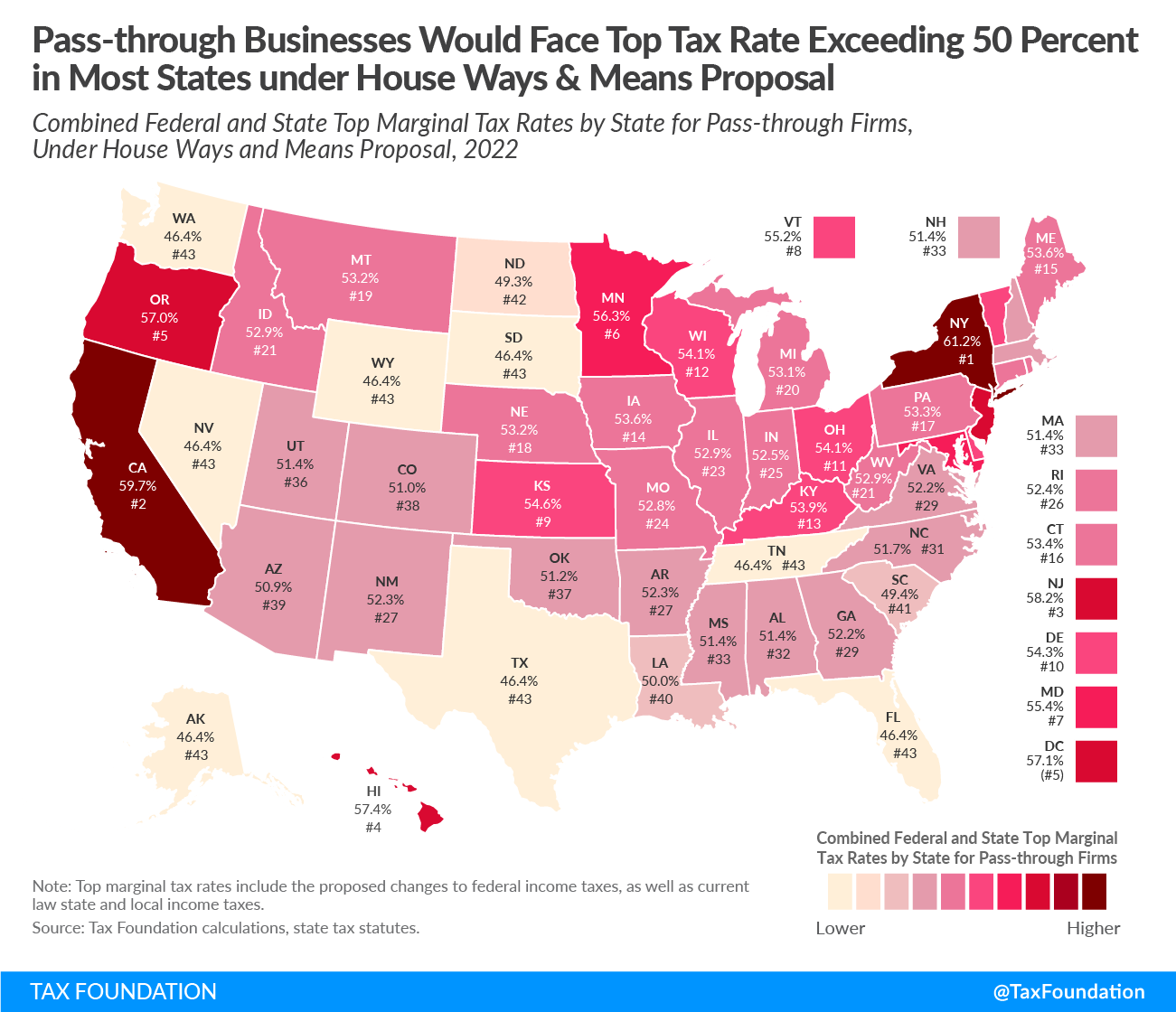

Top Tax Rate on Pass-through Business Income Would Exceed 50 Percent in Most States Under House Dems’ Plan – William McBride and Alex Durante, Tax Foundation. “Under the House Democrats’ reconciliation plan, the top tax rate on pass-through business income would exceed 50 percent in most states. Pass-through businesses, such as sole proprietorships, S corporations, and partnerships, make up a majority of businesses and majority of private sector employment in the United States. The owners of these firms pay individual income tax on income derived from these businesses. The marginal tax rates vary for pass-through firms depending on the state where they operate, as states tax individual income differently.”

Wisconsin firm to benefit from obscure House tax bill provision – Lindsey McPherson, Roll Call. “Tucked into the sweeping tax package the House Ways and Means Committee approved Wednesday is a $4 million tax break sought by a Wisconsin fuel distributor with friends on both sides of the aisle.”

Under U.S. tax code section 4081, motor fuel is subject to tax once it leaves the terminal. But the tax only applies to clear fuel intended for on-road use. Dyed fuel, intended for off-road use like construction or agriculture, is tax-exempt.

Before the pipeline segment closed, U.S. Venture was only taxed when it removed fuel from the Green Bay terminal. Now it’s subject to a duplicative tax for removing the fuel from other terminals to transport to Green Bay…

Wisconsin Rep. Gwen Moore, a Milwaukee Democrat who sits on the tax-writing Ways and Means Committee, had introduced a standalone bill to provide the permanent fix in August and it was included in the reconciliation package the committee approved on Wednesday.

The provision could be removed as the legislation moves through the House and the Senate, but with bipartisan support from every member of the Wisconsin delegation it’s probably safe.

State Tax Revenues Rose 56% in 2Q; California Up 135% - Bloomberg ($). "State tax revenues increased 56% to $394.5 billion in the second quarter compared with the same period last year, according to U.S. Census Bureau data. Tax receipts rose $142.2 billion from last year and $99.5 billion, or 34%, from the previous quarter."

Among the 10 biggest states by tax revenues:

- California increased the most, up 135% from the year-earlier quarter to $81.6 billion

- Massachusetts fell the most, down 6.8% to $8.31 billion

Delays From Ida May Bolster La. Tax Referendums, Backers Say – Paul Williams, Law360 ($). “A delay to Louisiana's elections from Hurricane Ida may bode well for approval of referendums on a centralized tax commission and income tax code overhaul by giving voters additional time to understand the proposals, supporters of the measures said Thursday. A one-month pushback of the elections offers more chances for voters to grasp how constitutional amendments seeking a streamlined sales tax collection commission and lowering of income and franchise tax rates might benefit Louisiana's business landscape, said Robert Travis Scott, president of the Public Affairs Research Council of Louisiana, an independent nonprofit research organization."

‘The fact that it's now in November gives us more time to educate the public about how advantageous amendments number one and two are for the people and the businesses in Louisiana,’ Scott said during a webinar hosted by Advantous Consulting.

Texas Offers Property Tax Relief In Counties Hit By Storm – Asha Glover, Law360 ($). “Texas' comptroller said that qualified property in several counties where a state of disaster has been declared this week in response to storm Nicholas is entitled to receive a temporary property tax exemption. The comptroller said Wednesday that qualified property in nearly 20 counties included in the disaster declaration may be eligible to receive a temporary exemption of a portion of its appraised value.”

I’m sending an SOS! It’s National Professional House Cleaners Day. And trust me, the pandemic has not made my house cleaner (but one can wish). “This day of recognition celebrates a career many overlook or take for granted,” states National Day calendar. I do not fall into that bucket. My dust bunnies have become Pitbulls.

Make a habit of sustained success.