Pelosi de-links Biden economic agenda, making the fate of tax increases unclear - Jay Heflin, Eide Bailly.

Speaker Pelosi told reporters on Monday night that there isn’t enough time to continue to put a hold on passing the infrastructure bill while working out the kinks involved with the reconciliation bill. Funding for highway and transit programs expires on September 30th. The infrastructure bill would extend funding for these programs, which is why the vote is scheduled for the day the funding expires.

If the infrastructure bill passes the House and is signed into law, the likelihood that both chambers will pass the budget reconciliation bill becomes less clear.

Pelosi says Biden's infrastructure bill can't wait for social safety net bill - Sahil Kapur, NBC:

Progressive House Democrats have threatened to vote down the infrastructure bill if the vote is held Thursday before the mega-bill is completed, fearing that centrist Democrats would seek to shrink or kill the larger bill if the bipartisan infrastructure measure passes.

Rep. Pramila Jayapal, D-Wash., head of the Congressional Progressive Caucus, stuck by that position Monday evening after the meeting, saying House progressives are prepared to vote down the infrastructure bill Thursday.

Bluff, called?

Decision Week for Infrastructure Arrives - Haley Byrd Wilt, Ryan Brown, and Harvest Prude, The Dispatch ($). "House Speaker Nancy Pelosi is preparing to bring forward a bipartisan infrastructure package for floor consideration on Thursday, over the angst of progressives who fear it will undermine the odds of passing President Joe Biden’s not-yet-complete $3.5 trillion social investments bill... In an op-ed earlier on Monday, Jayapal, along with Reps. Ilhan Omar and Katie Porter, wrote that they 'remain committed to voting for the infrastructure bill only after the Build Back Better Act is passed.'"

House Democrats look for a sign from the Senate on budget bill - Jessica Wehrman and Lindsey McPherson, Roll Call:

House Democrats emerged from a caucus meeting Monday night without a clear strategy for passing both pieces of their party’s economic agenda, but progressives and moderates agreed they need more input from the Senate.

In particular, House Democrats want centrist Sens. Kyrsten Sinema, D-Ariz., and Joe Manchin III, D-W.Va., to communicate the topline amount they can support for Democrats’ budget reconciliation package so negotiations on the substance of the legislation can proceed.

House Sets Up $3.5 Trillion Reconciliation Bill for Floor Vote - Doug Sword and Frederic Lee, Tax Notes ($). "Pelosi announced September 26 that debate would begin on the infrastructure package on schedule but that a final vote wouldn’t occur until September 30. That is the last day of the federal fiscal year, and without congressional action reauthorizing them, the surface transportation programs would expire after that date."

Manchin raises red flag on carbon tax - Alexander Bolton, The Hill:

A plan to tax carbon as a way to combat climate change and raise revenue for the reconciliation package is gaining momentum, and some Senate Democrats think that Sen. Kyrsten Sinema (D-Ariz.) is open to the idea after she raised global warming as a key concern during an interview with the Arizona Republic last week.

But Manchin, who represents coal-rich West Virginia, is not a fan of the idea.

Democrats Debate Duration, Details of Child Tax Credit Extension - Richard Rubin and Andrew Duehren, Wall Street Journal ($):

In particular, Sen. Joe Manchin’s insistence on a work requirement for the credit is complicating the discussions, Senate Democratic aides said. In the evenly divided Senate, Democrats need Mr. Manchin’s vote to extend the credit and advance the rest of their fiscal-policy agenda, including Medicare expansion, tax increases and a national paid-leave program. He has shown his willingness to use that leverage before.

The West Virginia Democrat has raised concerns that the no-strings attached benefit fuels opioid use, according to people familiar with his views. Some other Democrats and outside advocates have argued that the payments help prevent opioid use in hopes of changing his mind on work requirements. West Virginia has the highest rate of opioid-related overdoses in the country, according to government data.

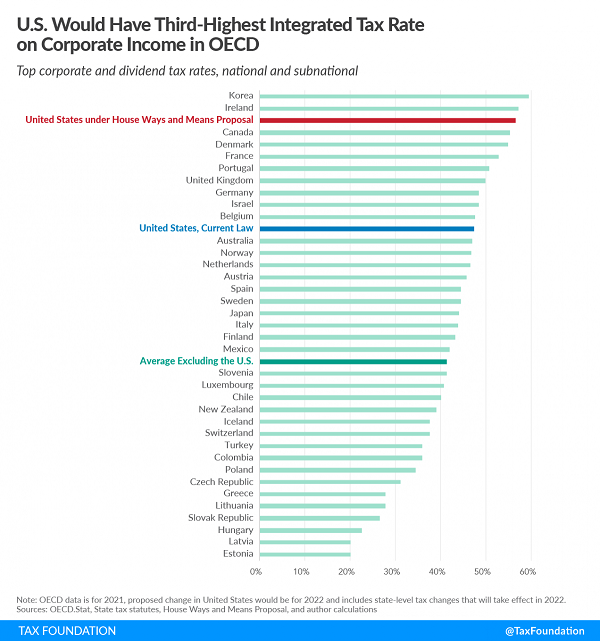

U.S. Corporate Income Faces Third-Highest Integrated Tax Rate in OECD Under Ways and Means Plan - Erica York, Tax Policy Blog. "Under the House Ways and Means tax plan, the United States would tax corporate income at the third-highest integrated tax rate among rich nations, averaging 56.6 percent."

IRS Schedules Date for Estate Tax Closing Letter User Fee - Jonathan Curry, Tax Notes ($). "A $67 user fee for issuance of an estate tax closing letter is scheduled to go into effect October 28, according to the IRS."

IRS Inadequately Identifying Fraud on International Returns - Benjamin Guggenheim, Tax Notes ($):

In a report released September 27, TIGTA found that the IRS missed 8,332 international tax returns with potentially erroneous or fraudulent information that year, representing nearly $20.6 million in potentially fraudulent refunds. That’s out of more than 873,000 international returns filed in 2018.

While some of the report’s findings are redacted, TIGTA said the returns it identified likely claimed fraudulent additional child tax credits and other tax refunds.

California Governor Signs Bill Exempting Some COVID-19 Grants - Benjamin Valdez, Tax Notes. "The bill implements a corporate income tax exemption for grants received through the California Microbusiness COVID-19 Relief Grant Program for tax years beginning on or after September 1, 2020, and ending before January 1, 2023. According to a Senate Budget and Fiscal Review Committee analysis of the bill, a personal income tax exemption was already allowed for grants made through the program. The bill also implements a personal income tax exemption for grants made through the California Venues Grant Program for tax years beginning on or after September 1, 2020, and ending before January 1, 2023."

State Variations on SALT Cap Workaround Are a Potential IRS Issue - Amy Hamilton, Tax Notes ($):

In Wisconsin and Louisiana, the passthrough entity participating in the SALT cap workaround can elect to be treated as a C corporation for state tax purposes. The tax bases for the workaround are different among the states; for example, California, New Jersey, and New York have a special passthrough entity tax base consisting only of distributive shares to individuals. The tax rate structures also vary, with states like California and Connecticut imposing flat rates while the New Jersey and New York approaches use rate brackets.

This issue doesn't get much attention, but it will be a big deal this coming filing season.

Nexus Issues a Concern as Employers Permit Remote Work - Andrea Muse, Tax Notes ($):

Wilson said many employers will likely permit remote work arrangements going forward, which may create nexus issues. He explained that nexus is traditionally based on physical presence but states may also have factor presence and economic presence standards for income tax purposes.

Wilson further said that some states can treat having one employee within their borders as creating nexus, citing the New Jersey Tax Court's 2010 decision in Telebright Corp. Inc. v. Director, New Jersey Division of Taxation. The New Jersey Superior Court, Appellate Division, affirmed the tax court's holding in 2012.

Employers should prepare to file in more states.

Almost 20% of CA restaurants used zappers to evade taxes - Kay Bell, Don't Mess With Taxes. "So-called zappers are used to delete actual sales from a business' point of sale records. The set-ups essentially divert sales from the sums that restaurants use to calculate how much sales tax the business owes."

Providing Resources to Help Cannabis Business Owners Successfully Navigate Unique Tax Responsibilities - De Lon Harris, IRS:

While IRS Code Section 280E is clear that all the deductions and credits aren’t allowed for an illegal business, there’s a caveat: Marijuana business owners can deduct their cost of goods sold, which is basically the cost of their inventory. What isn’t deductible are the normal overhead expenses, such as advertising expenses, wages and salaries, and travel expenses, to name a few.

I understand this nuance can be a challenge for some business owners, and I also realize small businesses don’t always have a lot of resources available to them. That’s why I’m making sure the IRS is doing what it can to help businesses with our new Cannabis/Marijuana Initiative.

The goal of this initiative is to implement a strategy to increase voluntary compliance with the tax law while also identifying and addressing non-compliance. I believe this will positively impact filing, payment and reporting compliance on the part of all businesses involved in the growing, distribution and sales of cannabis/marijuana.

It's hard to imagine this coming from the IRS in, say, 1978.

New Jersey Couple Owe $500K In FBAR Penalties, US Says - David Hansen, Law360 Tax Authority. "A married couple in New Jersey owe nearly $500,000 in penalties and fees for nonwillful failures to report their foreign bank account holdings to the Internal Revenue Service, the government alleged in a lawsuit."

That's for "nonwillful" failure to file. Imagine if they had done it on purpose. If you have foreign assets, you need to make sure you are filing the proper reports.

Coincidence? Today is both National Voter Registration Day and World Rabies Day.

Make a habit of sustained success.