Dems Eye Sunsets Of Family Credits To Bolster Budget Bill - Alan K. Ota, Law360 Tax Authority ($):

Congressional Democrats are taking a hard look at advocating for temporary rather than permanent extensions of the soon-to-expire expanded child credit and two other temporary family incentives in order to solidify support for an emerging $3.5 trillion filibuster-proof reconciliation bill.

...

The drive by DeLauro and other liberals for a permanently expanded child credit faces potential pushback from centrist Democrats, who have calledfor curbing proposed tax hikes to pay for the family incentives, including plans to raise the corporate rate and capital gains rate for wealthy investors.

What's the Latest on Tax Reform? - Kristine Tidgren, Ag Docket:

The Democrats seeking to pass the $3.5 trillion reconciliation bill face no small task. The “success” of some provisions with more support—like increasing the capital gains tax on those making more than $1 million a year—seem dependent upon provisions with less support, like taxing unrealized capital gain at death. Without a forced recognition event, increased taxes on gain would serve to increase the lockout effect and limit revenue potentially generated by any increase. Additionally, despite the widespread support for some type of exemption or deferral provision for family businesses and farms, such exemptions are difficult to write so as to properly protect those lawmakers wish to protect, but effectively leave out those they seek to tax.

Related: House approves procedural vote that puts Biden economic agenda in motion

TAS Facing Similar Challenges as the IRS: Processing Delays and Low Level of Service - National Taxpayer Advocate Blog:

I am painfully aware that taxpayers are experiencing more delays with the IRS this year than usual. Our advocates have been handling unusually high levels of inventory for the last year. The past two filing seasons have been particularly difficult. On top of dealing with personal, medical, and financial challenges brought on by COVID-19, taxpayers have struggled to get advice and answers from the IRS, and millions of refunds are still pending. The IRS’s level of service on its toll-free telephone lines has been at all-time lows, paper correspondence and paper returns have added other complexities and delays throughout the year, and many taxpayers are still waiting for their returns to be processed or their refunds to be paid. As the IRS has been struggling with these challenges, many taxpayers have appropriately reached out to TAS for assistance.

However, these same challenges have been directly impacting TAS’s ability to help taxpayers get relief. TAS, while independent in structure and thought, is not independent in actions. As an ombuds function, we generally do not have the delegated authority to perform a “fix;” rather, we advocate within the IRS to make the “fix” happen.

If the IRS Taxpayer Advocate can't speed up refunds, don't expect your friendly tax preparer to somehow do better.

Global Tax Revamp To Require Tricky New Multilateral Treaty - Natalie Olivo, Law360 Tax Authority ($). "The finalizing of an international corporate tax overhaul will require a multilateral treaty for implementation — one that would fundamentally rewrite how the profits of large multinational businesses are allocated among countries, making the pact unprecedented in terms of content and complexity."

Are the DOJ and IRS backpedaling on considering cryptocurrency as property? - Charles Kolstad, Accounting Today. "The Department of Justice made a startling claim in a legal filing last week that cryptocurrencies or virtual currencies are not in all instances property for U.S. tax purposes."

Related: New Tax Guidance Issued on Cryptocurrency Transactions

California Explains 2021 Main Street Small Business Tax Credit - California Department of Tax And Fee Administration, via Tax Notes:

The California Department of Tax and Fee Administration released guidance on the Main Street Small Business Tax Credit — originally created by legislation enacted in 2020 and recently extended for 2021 — which provides COVID-19 relief to qualified small business employers in the form of a credit equal to $1,000 “per net increase in qualified employees,” up to $150,000; the guidance covers qualifications and how the credit is calculated.

Direct link to California Guidance.

Rhode Island Explains Tax Treatment of Forgiven PPP Loans - Rhode Island Division of Taxation. "If you have not yet filed your Rhode Island tax return for the 2020 tax year, and the amount of your loan forgiveness for that year exceeds $250,000, go ahead and file the return — but do not include, on that return, the increment of loan forgiveness that is taxable for Rhode Island purposes."

California Lawmakers Vote to Extend Pawn Buyback Tax Break - Paul Jones, Tax Notes ($). "If a borrower defaults on a loan and ownership of the collateral item is transferred to the pawnbroker, a repurchase of the item by the borrower would normally be treated as a sale subject to sales tax. However, legislation approved in 2017 (A.B. 119) provides an exemption from sales tax when the borrower reacquires the property after defaulting on the loan if specific conditions are met."

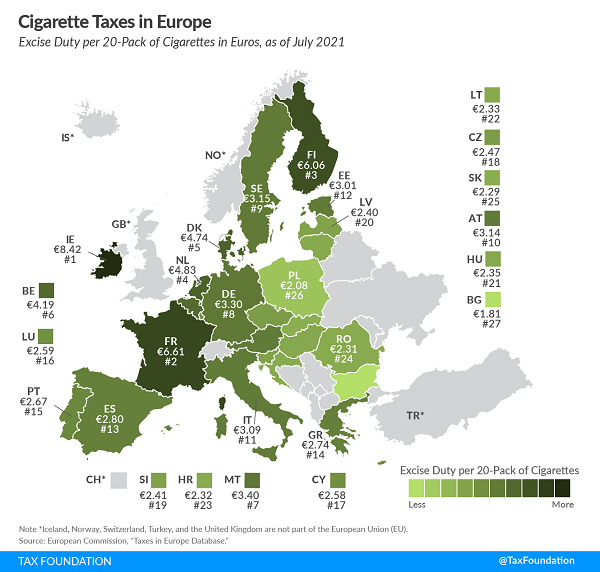

Cigarette Taxes in Europe - Elke Asen, Tax Policy Blog. "To ensure the functioning of its internal market, the European Union (EU) sets a minimum excise duty on cigarettes. It consists of a specific component and an ad valorem component, resulting in a minimum overall excise duty of €1.80 (US $2.05) per 20-cigarette pack and 60 percent of an EU country’s weighted average retail selling price (certain exceptions apply). As this map shows, most EU countries levy much higher excise duties on cigarettes than legally required."

U.S. cigarette taxes range from $.17 per pack in Missouri to $4.35 in New York and Connecticut.

Protect Tax and Other Financial Records Before Disaster Strikes - Kelly Phillips Erb, Bloomberg. Lots of good advice here, including:

Scan important documents. The IRS has accepted scanned receipts since 1997, a policy that was memorialized by Rev. Proc. 97–22. For tax purposes, your scanned or electronic receipts must be as accurate as paper records, and you must be able to index, store, preserve, retrieve, and reproduce the records. Your records should be organized and easily convertible to hard copy form if required.

4 tax moves to make this September - Kay Bell, Don't Mess With Taxes. "Make your third 1040-ES payment: Speaking of estimated taxes, Sept. 15 is the due date (for most taxpayers; more on this in a minute) for the third payment of the 2021 tax year."

Online Gambling & Sports Betting: The IRS Perspective - Tax Warrior Chronicles. "In simple terms, if you win, you have taxable income, and it should be reported when you file your tax return that year. Based on your personal income tax and tax bracket that year, taxes are due on the winnings earned."

GILTI of Neglecting Losses - Daniel Bunn, Tax Policy Blog. "GILTI calculations should be changed so that companies are not required to use domestic losses to reduce the value of the Section 250 deduction or eliminate the value of foreign tax credits. Domestic losses should be allowed to offset future domestic profits rather than being wrapped up in offsetting liabilities connected to foreign profits."

Georgian sentenced for stealing tax refunds from UI employees - O. Kay Henderson, Radio Iowa:

A 39-year-old Georgia woman has been sentenced to nearly four years in federal prison for stealing the identities of “dozens” of University of Iowa employees to claim their tax refunds.

The Department of Justice issued a press release on the sentencing (defendant name removed):

Defendant opened bank accounts in Georgia under a fictitious business name and used them to launder hundreds of money orders purchased with the proceeds of the fraudulently obtained tax refunds. More than $450,000 in tax refunds using University of Iowa employees’ names were obtained fraudulently through the overall scheme and more than $1,400,000 in fraudulently obtained funds passed through the fictitious business accounts during early to mid-2015. In April of 2015, Defendant had $44,000 in laundered funds sent to a Nashville, Tenn. car dealer to purchase a Mercedes Benz automobile.

Be careful with your confidential information. Don't send documents with your social security number as e-mail attachments. And be especially careful at work with information on employees. You don't want them buying someone a Benz.

Go nuts! Today is World Coconut Day! "One of nature’s most versatile products, the coconut plant (and its various parts) can be used for food and drink, cosmetic preparations, and decorating. Some coconut proponents (cocoproponents?) even claim that the fruit’s oil can reverse dental decay — if you swish it around in your mouth for 20 minutes a day!"

I'll stick with National Dentists Day, thank you.

Make a habit of sustained success.