Related-Party Restriction Prompts Concern About Retention Credits - Kelley Taylor, Tax Notes:

Kristin Esposito, director for tax policy and advocacy at the American Institute of CPAs, noted that some practitioners were surprised to see the related-party distinction — a long-standing constructive ownership concept — included in the context of majority owner qualified wages for the ERC.

...

“Employers and CPAs were asking . . . ‘Do we have to file amended returns, or can we just back it out of the next year’s federal income tax return?’” Esposito said.

Esposito said Notice 2021-49 clarified that, “yes, you have to include that reduction in the wage deduction in the year the qualified wages were paid or incurred, even if the taxpayer has to file an amended return.”

IRS Provides Safe Harbor For Employee Retention Credit - Amy Lee Rosen, Law360 Tax Authority ($):

It was not the intent of Congress to include forgiven PPP loans or the grants in a company's gross income for purposes of determining eligibility for the employee retention credit, the IRS said in Rev. Proc. 2021-33. An employer can receive the payroll tax credit, which has gone through several iterations since passed in March last year, if gross receipts in a calendar quarter as determined under Section 448(c) decline by a certain amount when compared with a prior calendar quarter.

Including the amount of a forgiven PPP loan or the amount of the grants "in gross receipts for determining eligibility to claim the employee retention credit could frustrate this congressional intent," the revenue procedure said.

Employee retention tax credit could be worth a second look this year for businesses - Joe Gardyasz, Des Moines Business Record:

Iowa employers may want to take a second look with their tax adviser at whether their business might qualify for the Employee Retention Tax Credit in 2021, says Terry Merfeld, a tax partner with Eide Bailly in Des Moines.

The tax credit provisions have changed substantially this year compared with last year’s rules, and some lower thresholds could enable qualifying businesses to claim as much as $28,000 in payroll tax credits per employee if they meet the criteria for all four quarters of 2021.

Explainer on What Went Down in the Senate this Week - Jay Heflin, Eide Bailly

The House is expected to vote on the budget on August 23, 2021. Assuming it passes, the committees will begin publicly vetting the legislation that abides by the budget's instructions. It is currently expected that legislation will be finalized in the fall, at the earliest.

...

-

To keep moderate and progressive House Democrats happy, Speaker Nancy Pelosi (D-CA) has promised that the chamber will hold consecutive votes on the $1.2 trillion Bipartisan Infrastructure Bill and the $3.5 trillion tax and spending bill.

-

Yes, there is an argument over which bill should be voted on first.

-

It could take months for the $3.5 trillion tax and spending bill to be written, and time is risky when trying to pass legislation.

-

House Republicans are not expected to support either piece of legislation. This means that if four House Democrats oppose either of the bills they will not pass and will not be signed into law.

-

On the Senate side, all Democrats must support the $3.5 trillion tax and spending bill or it does not pass. No Senate Republican is expected to support the bill.

-

How Congress Will Spend Its Summer Vacation - Doug Sword, Tax Notes:

As a 14-hour debate over amendments to the $3.5 trillion budget resolution crawled toward an early August 11 vote, Senate Majority Leader Charles E. Schumer, D-N.Y., convened a meeting with chairs of the dozen Senate committees that will be involved in writing the final reconciliation bill.

“Every committee chair is going to be meeting at least on a weekly basis, maybe more often, with their members,” Schumer told reporters later that morning. “And we will do weekly Zooms with them as well,” he said, referring to online meetings with wider groups, such as the entire Senate Democratic caucus.

Democrats’ $3.5 Trillion Budget Framework Exposes Party Tensions - Kristina Peterson and Lindsay Wise, Wall Street Journal ($). "Mr. Manchin’s comments echoed an earlier concern from fellow centrist Democratic Sen. Kyrsten Sinema of Arizona over the package’s price tag. Senate Democrats hope to pass a $3.5 trillion package through a process tied to the budget, known as reconciliation. That would enable them to sidestep GOP opposition, but only if they can keep all 50 members of their caucus unified around the eventual bill."

Business groups prepare blitz against Democratic tax hikes - Karl Evers-Hillstrom, The Hill. "Business groups and lobbyists representing business interests are prepared to fiercely oppose such tax increases, confident that Democrats’ reconciliation package will inevitably be watered down or collapse entirely amid divisions within the caucus."

Senate Wraps Up For The Summer With An Infrastructure Bill And A Budget Resolution - Renu Zaretsky, Daily Deduction. "The Senate bill still includes the new transaction reporting requirements for cryptocurrency that were worked out by Treasury and GOP Senator Rob Portman. An industry effort to water down the new IRS disclosure rules never got a vote on the Senate floor."

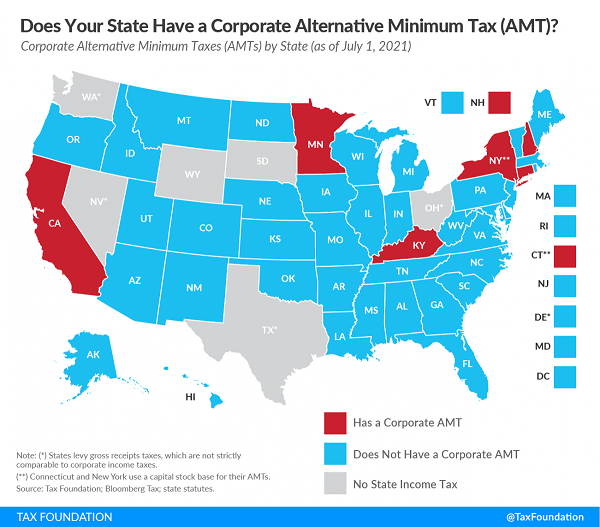

Does Your State Have a Corporate Alternative Minimum Tax? - Janelle Cammenga, Tax Policy Blog. "Six states currently collect corporate AMTs: California, Connecticut, Kentucky, Minnesota, New Hampshire, and New York."

Colorado DOR Publishes Guidance on COVID-19 Tax Changes - Colorado Department of Revenue, Via Tax Notes. "The Colorado Department of Revenue released a publication on the effects of the CARES Act (P.L. 116-136) and the Consolidated Appropriations Act of 2021 (P.L. 116-260) on state-level individual and corporate taxation, detailing changes regarding net operating losses; the business interest expense limitation; the excess loss limitation; recently enacted state legislation that restored several tax deductions; residential rental real estate; Paycheck Protection Program loans; and emergency Economic Injury Disaster Loan grants."

6 hurricane prep tips for businesses - Kay Bell, Don't Mess With Taxes. "Don't forget to include tax records in your move of company data to a storm-safe space. If you file a claim in connection with a major disaster, you're likely to need current and prior tax year information."

Certified Mail, Return Receipt Requested, Is More Important than Ever - Russ Fox, Taxable Talk. "On my way out of town on my vacation, I stopped at the Post Office to mail a response to an IRS notice. This was a request for a Collection Due Process (CDP) Hearing, and it had a deadline of July 28th. I mailed the response on July 26th (using certified mail, return receipt requested). I haven’t received the return receipt yet, but the filing was delivered on August 4th (per USPS tracking). Given all the delays in the IRS reading and responding to mail, am I concerned for my client? Definitely not. I have proof of the mailing, and the fact that something a six-hour drive took the Postal Service nine days doesn’t matter–most IRS filings are postmark deadlines."

IRS to Taxpayers Receiving Notices: What, Like Math Is Hard? - Kelly Phillips Erb, Bloomberg. "When the IRS makes the adjustment, it will issue a notice—typically a CP11 or CP12—by mail. The notice is supposed to make clear what it adjusted and then advise if there is a change to the amount due or to be refunded, but that’s often not the case. Sometimes, the notices are just confusing."

Qualified Amended Returns: How to Avoid Tax Penalties - Jason Freeman, Freeman Law. "A 'qualified amended return' is an amended tax return that, if properly filed before a taxpayer is 'on the IRS’s radar,' protects a taxpayer against accuracy-related penalties—in layman’s terms, it is a get-out-of-jail-free card."

IRS Tax On Sexual Abuse Victims Needs Clarification - Robert Wood, Forbes. "Sadly, though, for many victims, the award of cash comes with tax worries too. Can the IRS tax this? The answer is nuanced, adding more angst to the victim’s experience. The tax rules are not black and white, and the stakes can be huge."

Wealthy donors benefited from lesser-known Trump tax break: report - Karl Evers-Hillstrom, The Hill. "Wealthy political donors successfully pushed for a tax break in Republicans’ 2017 tax bill that saved them tens of millions of dollars in taxes, ProPublica reported Wednesday."

A non-story, only made into a story because ProPublica feels it has to use its stolen tax information somehow.

How Can Congress Protect Families Who Receive Excessive Child Tax Credit Payments? - Elaine Maag, TaxVox. "Life is not always predictable. Giving families more flexibility in how they receive CTC payments and providing relief if they are paid too much can be important safeguards for those who cannot always forecast how their lives will change in the coming year."

Buying Property from the IRS - Keith Fogg, Procedurally Taxing. "A short Chief Counsel Advisory opinion provides a cautionary tale for those purchasing property from the IRS. CCA 2021021011190596 explains that if the buyer at an IRS sale does not follow through and make all of the payments necessary to complete the purchase, the IRS can declare the sale null and void. When it does so, the purchaser forfeits all of the payments made to that point and the IRS can resell the property."

But if you are still game, visit the official IRS Auction page to find a tax sale in your area.

Car Salesman Misreported Incentive Pay, Tax Court Says - Emlyn Cameron, Law360 Tax Authority ($). "A Kansas car salesman can't list incentive payments he received as self-employment income because the advertising work he did helped him in his job selling cars, the U.S. Tax Court said Wednesday."

The opinion covers a salesman who received incentive payments directly from the manufacturer, reported on a 1099, in addition to W-2 payments from his dealership. He reported the payments on Schedule C, where he claimed expense deductions for unreimbursed expenses for the business.

The IRS said that the income should be reported as "other income" not subject to self-employment tax, and that the deductions were employee business expenses, only deductible on schedule A, and only to the extent they exceeded 2% of adjusted gross income (such expenses are entirely nondeductible in 2021).

The Tax Court agreed with the IRS, eliminating self-employment tax on the incentive payments, but consigning the deductions to schedule A. Some of the deductions weren't even allowed there because the taxpayer failed to substantiate them.

The taxpayer did win on one important item. From the opinion (names omitted):

In addition to credible testimony, the Taxpayers provided contemporaneous mileage logs, which they were able to relate back to Mr. Taxpayer's customer lists. For 2014 Mr. Taxpayer's mileage log states that he drove 19,907 miles for business purposes. Similarly, Mr. Taxpayer's 2015 mileage log states that he drove 15,610 miles for business purposes. We will accept the mileage shown in the contemporaneous mileage log for each year. Thus, we hold that the Taxpayers are entitled to deduct car and truck expenses of $11,148 (19,907 ×.56) for 2014 and $8,976 for 2015 (15,610 ×.575).

The Moral? Coincidentally, another taxpayer yesterday lost $20,000 in car expenses in Tax Court. That taxpayer didn't keep a mileage log. Keeping a current auto log, whether on paper or on an app on your phone, changes the game when the IRS comes calling. It sure helped our car salesman.

Take it for a spin. Today is National Vinyl Record Day, so take that old record off the shelf.

Make a habit of sustained success.