Senate punts infrastructure vote after amendment meltdown – Burgess Everett, Politico. “Senate Majority Leader Chuck Schumer set up a pivotal vote on President Joe Biden's infrastructure plan for Saturday, after breakneck talks to wrap up the bill on Thursday night fell apart. Senators in both parties spent the entire day assembling a package of amendments for consideration that could grease the wheels to final passage, but Sen. Bill Hagerty (R-Tenn.) refused to sign off under intense lobbying from Republican colleagues.”

Schumer said the Democratic majority encountered 'numerous objections' to finalizing a list of amendments and wrapping up the bill more quickly. Now the Senate will take the effort back up on Saturday, when the bill's backers must overcome a filibuster to begin ending debate. The legislation will need 60 votes, and at least 10 Republicans, to advance.

Here’s what happened, when Senators debate and amend a bill the time spent on those activities is evenly divided between the political parties. Senate Majority Leader Chuck Schumer (D-NY) wanted to end debating and amending the bill before that time was up, and he needed every Senator to agree with him to end the process ahead of schedule. Senator Bill Hagerty (R-Tenn) was not onboard with this plan and his opposition meant the Senate could not end debating and amending the infrastructure bill on Thursday.

Here is the Senator’s statement, as reported by Punchbowl News:

Earlier this afternoon, the Congressional Budget Office released its long awaited score for this infrastructure bill. While we’ve heard for weeks that it would be paid for, it’s not. It didn’t just come up short, it came up a quarter of a trillion dollars short. The CBO indicated this bill will increase the deficit by at least $256 billion dollars when it was supposed to break even. Despite this news, I was asked to consent to expedite the process and pass it. I could not, in good conscience, allow that to happen at this hour—especially when the objective of the majority is to hurry up and pass this bill so that they can move quickly to their $3.5 trillion tax-and-spend spree designed to implement the Green New Deal and increase Americans’ dependence on the government so I objected.

Senators seeking quick passage on the bipartisan infrastructure bill also received a one-two punch late Thursday afternoon. Reports from two well-respected organizations not only stated that the bill would add to the deficit, but it would also not boost the economy.

Punch #1 (referenced by the Senator):

Senate Amendment 2137 to H.R. 3684, the Infrastructure Investment and Jobs Act – Congressional Budget Office. “On net, the legislation would add $256 billion to projected deficits over that [2021-2031] period.”

Punch #2:

Updated Bipartisan Senate Infrastructure Deal: Budgetary and Economic Effects – Penn Wharton Budget Model. “We project that proposal would have no significant effect on GDP by end of the budget window (2031) or in the long run (2050).”

The CBO report is a big deal because support from many Senate Republicans for the infrastructure bill was partly due to it not adding to the deficit.

CBO Estimates Infrastructure Bill Would Add $256 Billion to Deficits – Andrew Buehren, Wall Street Journal ($). “Congress’s nonpartisan scorekeeper found that the roughly $1 trillion infrastructure bill would widen the federal budget deficit by $256 billion over 10 years, countering negotiators’ claims that the price tag would be covered by new revenue and saving measures.”

What's next? The Senate will be out of session on Friday so lawmakers can attend the funeral of Sen. Mike Enzi (R-Wyo). They will return Saturday to work on the bill. Final passage is expected to be early next week, but it could be earlier if all Senators agree to yield back their time to debate and amend the bill.

When (or if) the bill passes the Senate, it moves to the House where Democratic lawmakers want input in the legislation:

House Democrats Want Say in Infrastructure Deal Inked by Senate – Emily Wilkins, Lillianna Byington and Stephen Lee. “The Senate spent months finessing its $1.2 trillion infrastructure plan. Now its House counterparts want their own say on the major legislation. House lawmakers, most notably House Transportation and Infrastructure Committee Chair Peter DeFazio (D-Ore.), have repeatedly criticized the Senate package for leaving out provisions from the House-passed surface transportation and water bill that address climate change and fossil fuel pollution.”

But making those changes could jeopardize Republican support for the final product after a bipartisan group of senators crafted a compromise intended to win at least 60 votes needed to advance the measure in that chamber. The Senate is working to pass that bill (H.R. 3684) before leaving for the August recess.

‘We have had extensive negotiations with the White House, with the Democrats, and with Republicans to come to a bill that we can all agree on,’ Sen. Mitt Romney (R-Utah), one of the negotiators of the legislation, said in an interview. ‘Substantial changes of that bill would make it very difficult for it to ultimately become law.’

The infrastructure bill includes a cryptocurrency provision that was an issue unto itself:

Senators struggle to amend, finish $1T infrastructure bill – Kevin Freking and Lisa Mascaro, Associated Press:

The late-night session stalled out as new debates emerged over proposed amendments to change the 2,700-page package. Senators have processed nearly two dozen amendments, so far, and none has substantially changed the framework of the public works package. With more than a dozen amendments still to go, senators struggled to reach agreements. One of the amendments generating the most attention Thursday involved cryptocurrency.

Some Senators wanted to narrow it, but the Biden Administration opposed that move. Different Senators narrowed the provision less so, which the Biden Administration favored.

From White House Deputy Press Secretary Andrew Bates via Twitter:

Bloomberg reports that this issue is not settled: "[Sen.] Toomey said they were at 'an impasse' on the issue."

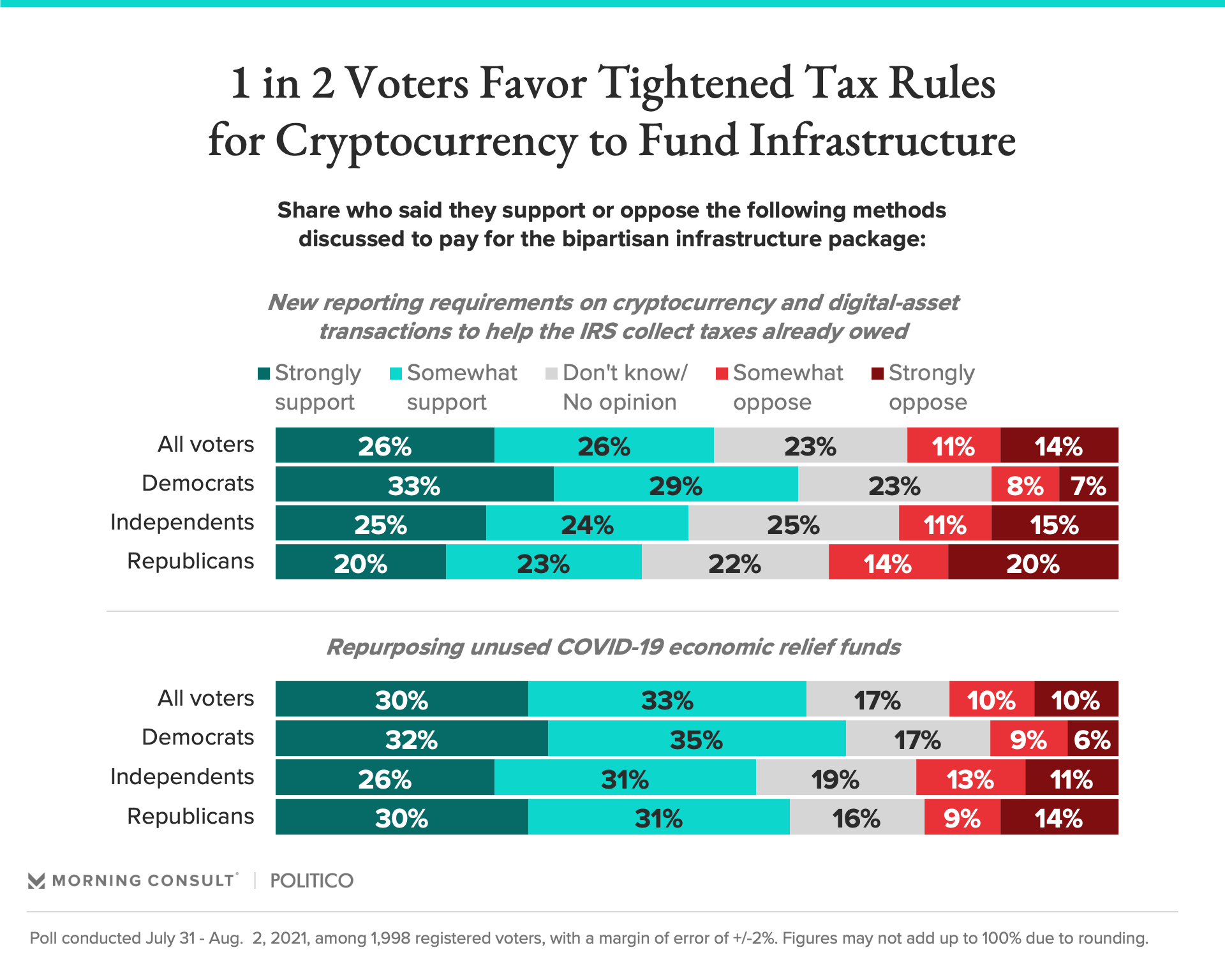

As Cryptocurrency Sits in Washington’s Crosshairs, Half of Voters Favor Tighter Rules on Digital-Asset Taxes to Fund Infrastructure – Claire Williams, Morning Consult:

- More than half of Republicans back the inclusion of paid family leave in the Democrats’ reconciliation bill.

- 63% of voters support redirecting unused COVID-19 economic relief funds to pay for infrastructure.

Pro Tip: When articles report on the “budget” or the “reconciliation” or the “budget reconciliation" package, they are referring to future legislation that will increase income and other taxes. For instance:

Budget reconciliation instructions likely to assume deficits – Paul Krawzak, Roll Call. “The budget blueprint Senate Democrats are preparing to unveil will likely assume, at least on paper, that the eventual reconciliation package to implement the more partisan pieces of President Joe Biden’s fiscal agenda will add hundreds of billions of dollars to deficits over the next decade. That’s despite top Democrats’ pledge that the entire $3.5 trillion proposal will be offset.”

According to sources familiar with the process, the economic growth dividend Democrats are expecting is unlikely to count as actual savings that could be applied to the package under Congressional Budget Office scoring rules. By the same token, CBO guidelines mean they won’t get credit for including beefed up IRS tax enforcement funds to go out and collect more revenue.

To get around that problem, the plan is to simply write reconciliation instructions to various authorizing panels, who will draft the actual implementing legislation this fall, giving them a certain amount of deficit-spending leeway.

The exception, sources said, would be the tax-writing Finance Committee, which is entrusted with most of the ‘pay-fors’ through tax increases and prescription drug savings; that panel is likely to receive an instruction to reduce deficits, while others would get a deficit-increase allowance.

Translation: Congress's arcane rules make it hard for lawmakers to count an increase in revenue as an increase in revenue. But have no doubt, regardless how a tax increase is accounted for in legislation, it affects taxpayers the same way.

Senators gird for all-nighter ‘on steroids’ to propel $3.5T Democratic plan – Caitlin Emma and Jennifer Scholtes, Politico. “Senate Democrats are speeding to sew up the budget framework that unlocks their multitrillion-dollar social spending plan, hoping to minimize the self-inflicted pain of the impending and arduous process.”

Democrats plan to take up the $3.5 trillion budget resolution immediately after the bipartisan infrastructure bill passes the Senate, kicking off the reconciliation process for their massive domestic package that lacks any Republican support. With a slow amendment process on the bipartisan bill and former Sen. Mike Enzi’s (R-Wyo.) funeral scheduled for Friday, the start of budget action will almost certainly cut into August recess.

Dems Hashing Out Taxes On Wealthy To Fund Recovery Plan – Alan Ota, Law360($). “Democratic support for President Joe Biden's proposed new top individual rate of 39.6% has spurred interest in a flock of proposals to raise taxes on individuals earning more than $400,000 to help finance an ambitious $3.5 trillion filibuster-proof reconciliation bill.

Several senior Democrats said Biden's proposal for a 39.6% top individual tax rate had resonated in his party and likely would move in September in a reconciliation bill designed to advance parts of Biden's recovery plan, following up on the newly enacted American Rescue Plan Act. They said new proposals to increase levies on those earning more than $400,000 could gain support as Democrats continue to squabble over items in Biden's framework, including plans to set a new corporate rate of 28%, expand capital gains taxesand tax some unrealized capital gains at death.

Corporate Taxes Increasingly Seen as Social Obligation (Podcast) – Colleen Murphy, Bloomberg ($). “Investors interested in how companies meet environmental, social, and governance (ESG) standards are also becoming increasingly interested in where—and whether—a company is paying tax.”

Note: The House is not expected to vote on the infrastructure bill until the Senate passes the reconciliation legislation that will include tax increases. To create a reconciliation bill, both chambers in Congress must first approve a budget, which will instruct committees to write legislation that increases taxes. The budget will not include tax increases. The Senate could approve this budget as early as this weekend. It is not clear when the House will vote on the budget. Legislation that increases taxes could be ready for a vote by the fall, at the earliest.

Senators Go Beyond Biden Plan to End Private-Equity Tax Break – Laura Davison, Bloomberg ($). “Senate Finance Committee Chairman Ron Wyden and Rhode Island’s Sheldon Whitehouse, a member of the panel, are introducing legislation Thursday to repeal the break for carried interest, which allows private equity fund managers to pay lower tax rates on their earnings than they would for regular income. The bill would also prohibit them from deferring tax payments on those earnings, another benefit embedded into the current law.”

Requiring fund managers to pay taxes when they receive the profits would raise $63 billion over the next decade, according to an estimate from the Joint Committee on Taxation.

Biden, in his American Families Plan, called for an end to carried interest, but stopped short of eliminating investors’ ability to delay paying taxes on the income. Halting the tax break but allowing deferral would raise only about $14 billion over that time period, according to a previous estimate from the congressional tax scorekeeper.

The text of the legislation can be found here.

A one-page explanation of the bill can be found here.

A detailed summary of the bill can be found here.

A technical explanation of the bill can be found here.

Wyden Bill Ensures Wealthy Investors Pay Their Fair Share in Taxes – Senate Finance Committee. “Senate Finance Committee Chair Ron Wyden, D-Ore., today introduced legislation to close loopholes that allow wealthy investors to use derivatives contracts to not pay tax on the underlying investments.”

Derivatives are a financial bet that a stock or other investment will go up or down in value. Wealthy investors are able to exploit complex tax rules to make these bets risk-free by avoiding, deferring or minimizing paying tax. For example, a forward contract allows a wealthy investor to secure a low tax rate if they expect the underlying investment to gain significant value.

The Modernization of Derivatives Tax Act would require investors to annually pay tax on their gains or deduct their losses. Gains would be taxed at ordinary income rates, which is already the case for banks and securities dealers with respect to derivatives. This bill would also repeal nine tax code sections and revise many others, making the code less complex.

The text of the legislation can be found here.

A summary of the bill can be found here.

A one-page summary of the bill can be found here.

Senate Democrats to introduce measure taxing major polluters – Zack Budryk, The Hill. “Senate Democrats are set to unveil legislation that would tax energy companies responsible for major greenhouse gas emissions to pay for the costs of climate disasters."

The Polluters Pay Climate Fund Act, sponsored by Sen. Chris Van Hollen (D-Md.), would require between 25 to 30 of the U.S. corporations responsible for the most greenhouse gas pollution to pay $300 billion into a fund over 10 years.

The legislation would require companies to pay into the fund if they were responsible for at least .05 percent of global carbon dioxide and methane emissions between 2000 and 2019 based on data from the Treasury Department and Environmental Protection Agency.

America should bring back a financial transaction tax – Chris Griswol, The Hill opinion. “The late Jack Bogle, founder of Vanguard Group and advocate for low-fee retirement investing, was once asked what he thought about a financial transaction tax. The man named by Fortune as one of the four investment giants of the 20th century responded: ‘I love it.’”

A financial transaction tax (FTT) would levy a small fee (say, 0.10 percent) on the sale or purchase of securities such as stocks, bonds and derivatives. The most important reason for adopting such a tax, Bogle understood, is that it separates the wheat of vital, long-term value creation from the chaff of unproductive speculation and market churn. High-frequency trading, for example, now accounts for the majority of trading volume yet accomplishes little beyond transferring capital and talent from more productive pursuits. An FTT would help reverse those trends.

Congressional Budget Office Shows 2017 Tax Law Reduced Tax Rates Across the Board in 2018 – Garrett Watson, Tax Foundation. “Wednesday, the Congressional Budget Office (CBO) published its annual analysis of the distribution of American household incomes and tax burdens, this time for 2018, the year after the Tax Cuts and Jobs Act (TCJA) was enacted. CBO data shows that the TCJA reduced federal tax rates for households across every income level while increasing the share of tax paid by the top 1 percent.”

CBO found that average federal tax rates fell for households across the board because of the TCJA’s individual income tax provisions, including the doubled standard deduction from $12,400 to $24,800, reduced income tax rates, and expanded child tax credit (CTC). High-earning households saw a reduction in their effective tax rates primarily from the corporate tax rate dropping from 35 percent to 21 percent and tax reductions for pass-through firms.

The Congressional Budget Office's report can be found here.

IRS urges tax pros to combat unemployment identity theft fraud – Michael Cohn, Accounting Today. “The Internal Revenue Service is asking tax professionals to help clients who fell prey to identity thieves who have been filing unemployment claims in their names during the pandemic.”

The IRS has been working with state tax agencies and the tax prep industry as part of an effort known as the Security Summit. They reported that unemployment compensation fraud was one of the more common ID theft schemes that emerged last as criminals exploited the COVID-19 pandemic and the resulting economic impact. The fraudsters filed claims for the generous expanded unemployment benefits that the federal government began offering last year in conjunction with state unemployment agencies in response to the outbreak of the pandemic. The U.S. Department of Labor's Inspector General estimated approximately $89 billion in unemployment compensation was lost last year due to fraud.

SALT Fix Gets Vetoed in Massachusetts Amid Partisan Dispute – Adrianne Appel, Bloomberg ($). “Massachusetts Gov. Charlie Baker (R) vetoed state lawmakers’ latest effort to get around the cap on federal deductions for state and local tax payments. Baker’s late Tuesday veto of H. 4009 comes after much back and forth over the appropriate way to remedy the $10,000 limit, which was created in the 2017 federal tax law. Democratic lawmakers have large majorities in both chambers and likely have the votes to override the governor’s veto once they return from summer recess.”

Vaping Companies Flee Some States Amid Tax Law Confusion – Sam McQuillan and Isabelle Sarraf, Bloomberg ($). “For Dana Shoched, CEO of O2 Vape, a cannabis vaping device supplier in Michigan, complexities from a recent tax reporting law aimed at e-cigarettes, have forced her to abandon business in some states. ‘It’s been a nightmare,’ she said. Hers is just one of over 10,000 businesses struggling to comply with a congressional mandate that forces vaping companies to register with federal and state governments as tobacco sellers for tax collection or face fines. It also extends cigarette shipping restrictions to any product associated with heating aerosolized substance.”

Texas Oil Regulator Floats Tax Credits for Natural Gas Projects – Sergio Chapa, Bloomberg ($). “The natural gas industry should receive tax incentives similar to those provided for renewable energy projects, according to one of Texas’s top oil and gas regulators. Texas Railroad Commissioner Jim Wright, who sits on the powerful agency that oversees drilling in the biggest oil-producing states, advocated tax credits for gas pipelines, storage projects and power plants. Such provisions would better protect the state’s infrastructure from weather disasters like the deadly February freeze while also reducing flaring, the practice of burning off excess gas supplies.”

US Vows To Nix FDII As Harmful Tax Practice, OECD Says – Joseph Boris, Law360($). “The U.S. government confirmed it will abolish its tax deduction for foreign-derived intangible income, according to an update Thursday from the Organization for Economic Cooperation and Development on the status of harmful tax practices around the world.”

FDII is ‘in the process of being eliminated’ after President Joe Biden's administration 'confirmed its intention to abolish this regime,' the OECD said in a statement. The remarks accompanied the latest roundup of peer reviews under Action 5 of the organization's base erosion and profit shifting project. BEPS Action 5 pushes countries and territories to adopt a minimum standard of eliminating any preferential tax practice that could be used to enable tax avoidance or evasion. A representative of the U.S. Treasury Department said it had no immediate comment on the OECD report.

Today has everything! Not only is it National Root Beer Float Day, it’s also International Beer Day!

Raise a tall, frosty one with your kids!

Make a habit of sustained success.