IRS offers further guidance on employee retention credit, even as Congress may end it soon - Michael Cohn, Accounting Today:

The new notice issued by the IRS and the Treasury on Wednesday explain some of the recent changes from the American Rescue Plan Act. The changes include, among other items, (1) making the credit available to eligible employers that pay qualified wages after June 30, 2021, and before Jan. 1, 2022, (2) expanding the definition of eligible employer to include “recovery startup businesses”, (3) modifying the definition of qualified wages for “severely financially distressed employers”, and (4) providing that the employee retention credit does not apply to qualified wages taken into account as payroll costs in connection with a shuttered venue grant under section 324 of the Economic Aid to Hard-Hit Small Businesses, Non-Profits, and Venues Act, or a restaurant revitalization grant under section 5003 of the ARP.

Link: Notice 2021-49

IRS Provides ERC Guidance for Start-Ups, Distressed Employers - Caitlin Mullaney, Tax Notes. "The guidance provides that in the third and fourth calendar quarters of 2021, a recovery start-up business that is a small eligible employer under section 3134 may treat all wages paid to an employee during the quarter as qualified wages. The determination of whether an employer is a recovery start-up business is made separately for each quarter."

IRS Clarifies Employee Retention Credit Through End Of Year - Amy Lee Rosen, Law360 Tax Authority ($). "The IRS released employee retention credit guidance Wednesday for the third and fourth quarters of 2021 that said cash tips paid to workers qualify for the credit and it can be used by recovery startup businesses."

IRS Releases Additional Guidance on the Employee Retention Credit, And It's Not Good News for Majority Shareholders - Ed Zollars, Current Federal Tax Developments. "The most controversial portion of the Notice is likely to be the IRS analysis of the impact of the related party rules found in all versions of the ERC. The answer is not totally surprising—as discussed earlier, we had previously come to the same conclusion the IRS arrived at that the text referenced was unambiguous and would most often render the wages paid to a majority owner ineligible for the ERC. But the result is one that will greatly surprise many business owners and more than a few tax professionals."

It's not just the owners themselves. Notice 2021-49 explains how the attribution rules disallow the credit with respect to wages paid to "related parties" under Sec. 267(c). These include family members, as the notice lists:

(A) A child or a descendant of a child;

(B) A brother, sister, stepbrother, or stepsister.

(C) The father or mother, or an ancestor of either.

(D) A stepfather or stepmother.

(E) A niece or nephew.

(F) An aunt or uncle.

(G) A son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law.

(H) An individual (other than a spouse...) who, for the taxable year of the taxpayer, has the same principal place of abode as the taxpayer and is a member of the taxpayer's household.

The notice explains that the related party rules also take into account "constructive ownership":

(1) stock owned, directly or indirectly, by or for a corporation, partnership, estate, or trust is considered as being owned proportionately by or for its shareholders, partners, or beneficiaries;

(2) an individual is considered to own the stock owned, directly or indirectly, by or for the individual's family;

(3) an individual owning (otherwise than by the application of (2)) any stock in a corporation is considered to own the stock owned, directly or indirectly, by or for his partner;

(4) the family of an individual includes only his brothers and sisters (whether by the whole or half-blood), spouse, ancestors, and lineal descendants;

The notice includes several examples. The application of these rules has not been uniformly agreed upon in the tax world, but it should be clear now.

Bipartisan Group of Senators Seeks to Amend Crypto Provision - Frederic Lee, Tax Notes ($). "The amendment would also clarify that the provision doesn’t require information reporting from those engaged in 'mining or staking, selling hardware or software that an individual may use to control a private key, or developing digital assets or their corresponding protocols for use by other persons if such other persons are not customers,' according to an August 4 release."

Sens. Float Leaner Cryptocurrency Rule For Infrastructure Bill - Stephen Cooper, Law360 Tax Authority ($):

"Our amendment makes clear that reporting does not apply to individuals developing blockchain technology and wallets," Wyden said in a statement, adding that the cryptocurrency reporting rule proposed in the infrastructure bill is designed to ensure that those who trade cryptocurrency meet their federal tax liabilities.

GOP Leaders Oppose Wyden’s Mega-IRA Crackdown - Doug Sword, Tax Notes ($). "At the July 28 hearing on dozens of bipartisan retirement savings proposals, Wyden said he hoped there would be bipartisan support to close the loophole on outsized IRAs. A major retirement bill has only an outside chance of moving this fall and is likely a candidate to advance next year."

MTC Adopts Online Business Tax Shield Guidance - Maria Koklanaris, Law360 tax Authority:

Echoing language from P.L. 86-272, the updated guidance says soliciting orders for tangible personal property is the same whether it is done over the internet or by another method.

"Thus, an internet seller is shielded from taxation in the customer's state if the only business activity it engages in within that state is the solicitation of orders for sales of tangible personal property," the newly adopted guidance said.

In addition, a business can "present static text or photos on its website," without that counting as business activity, and thus subject to taxation, in states where customers are located.

You can view the MTC statement here. The statement discusses how "cookies" might create nexus:

5. The business places Internet “cookies” onto the computers or other electronic devices of in-state customers. These cookies gather customer search information that will be used to adjust production schedules and inventory amounts, develop new products, or identify new items to offer for sale. This in-state business activity defeats the business’s P.L. 86-272 immunity because it does not constitute, and is not entirely ancillary to, the in-state solicitation of orders for sales of tangible personal property.

6. The business places Internet “cookies” onto the computers or other devices of in-state customers. These cookies gather customer information that is only used for purposes entirely ancillary to the solicitation of orders for tangible personal property, such as: to remember items that customers have placed in their shopping cart during a current web session, to store personal information customers have provided to avoid the need for the customers to re-input the information when they return to the seller’s website, and to remind customers what products they have considered during previous sessions. The cookies perform no other function, and these are the only types of cookies delivered by the business to its customers’ computers or other devices. This in-state business activity does not defeat the business’s P.L. 86-272 immunity because it is entirely ancillary to the in-state solicitation of orders for sales of tangible personal property.

Be careful out there.

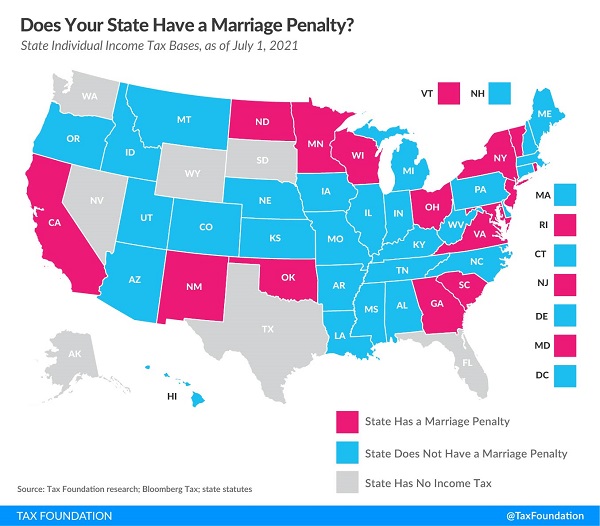

Does Your State Have a Marriage Penalty? - Janelle Cammenga, Tax Policy Blog. "Fifteen states have a marriage penalty built into their bracket structure. Seven additional states (Arkansas, Delaware, Iowa, Mississippi, Missouri, Montana, and West Virginia), as well as the District of Columbia, fail to double bracket widths, but offset their marriage penalty in the bracket structure by allowing married taxpayers to file separately on the same return, avoiding loss of credits and exemptions."

No gas tax increase in federal infrastructure bill, but Missouri's fuel hike will stand - Kay Bell, Don't Mess With Taxes. "On July 13, the Show Me State's Republican Gov. Mike Parson signed Missouri's first fuel tax hike since 1996. The state legislature approved the incremental increase, with the current 17 cent per gallon rate going up gradually over five years until it tops out at 29.5 cents."

Iowa's tax-free weekend: Here's how you can avoid paying sales tax on clothing, shoes this month - Hannah Rodriguez, Des Moines Register. "Clothing and shoes priced under $100 are sales tax-free. The items run the gamut, from socks and hiking boots to costumes and diapers."

More from the Iowa Department of Revenue: Iowa's Annual Sales Tax Holiday.

Weather-Related Sales of Livestock - Roger McEowen, Agricultural Law and Taxation Blog. "Sometimes drought and other weather conditions can cause livestock owners to sell more livestock than normally would be sold in a particular year. When that happens, special tax rules can apply to address the additional income triggered by the excess sales."

Tolling the Statute of Limitations by Filing Bankruptcy - Keith Fogg, Procedurally Taxing. "Several actions can suspend the statute of limitations on collection. I wrote recently that the IRS is having trouble correctly calculating the statute of limitations on collection primarily related to installment agreements."

Flipping Out: What You Need to Know About Tax and Real Estate - Kelly Phillips Erb, Bloomberg. "While it’s true that you must pay tax on capital gains from the sale of a personal residence, the opposite isn’t true. You can’t claim a capital loss on the sale of a personal residence—no matter how much it hurts."

Biden’s Expanded EITC Adds Significant Marriage Penalties - C. Eugene Steuerle, TaxVox. "A key feature of President Biden’s effort to expand government support for low-income families is its increase in the earned income tax credit (EITC) for workers without qualifying children living at home. But, as designed, the so-called childless EITC adds to significant marriage penalties and divorce bonuses for many low earners who marry other low earners with children. And Biden’s effort to enhance the credit makes the problem worse... Fortunately, Congress could eliminate much of this EITC marriage penalty with some relatively modest design changes."

Trump to Court: Tell IRS to Stop Auditing Me - Kristen Parillo, Tax Notes ($). "In addition to interim relief, the filing seeks 'a permanent injunction ordering Defendants to end all ongoing examinations of' Trump and his businesses."

I'll stick my neck out and say that's not going to happen.

Kalsarikännit! Today is both National IPA Day and National Underwear Day. That means it's a good day to learn and use the Finnish word for "drinking at home, alone, in your underwear." It's a sure way to maintain social distance.

Make a habit of sustained success.