Lawmakers Say Infrastructure Deal Within Reach - Kristina Peterson and Andrew Duehren, Wall Street Journal ($). "Lawmakers said they also had had to search for some new sources of revenue to pay for the bill after the nonpartisan Congressional Budget Office’s estimates of their proposals came up short of what they were expecting."

Ways and Means Dems Gaming Out How to Raise $3.5 Trillion - Doug Sword, Tax Notes ($). "According to Treasury’s green book explanation of President Biden’s fiscal 2022 revenue proposals, increasing the top marginal individual tax rate to 39.6 percent would raise more than $30 billion per year, while raising capital gains rates to that level would bring in more than $300 billion over 10 years and changing the global minimum tax system would add more than $500 billion over 10 years."

Carveouts from overseas profits tax sought for US territories - Laura Weiss, Roll Call. "Puerto Rico, Virgin Islands, others hurt by treatment as foreign jurisdictions under US tax code"

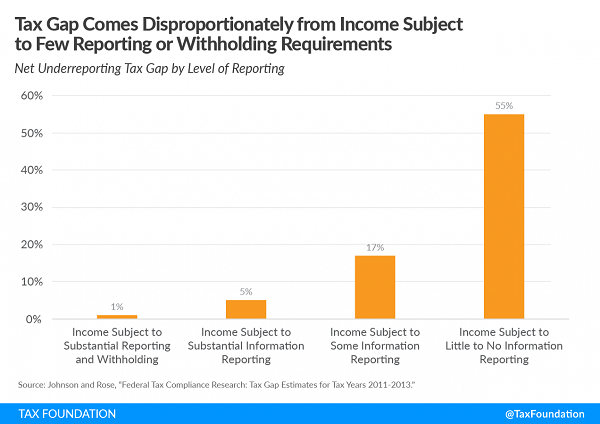

Simplifying the Tax Code and Reducing the Tax Gap: What Can Be Achieved? - Alex Muresianu, Tax Policy Blog. "More broadly, income subject to substantial information reporting requirements includes pensions, annuities, interest income, dividend income, unemployment compensation, and taxable Social Security benefits. Income subject to some information reporting includes partnership and S corporation income, capital gains, and alimony payments, while the income subject to little or no information reporting includes farm income, nonfarm proprietor income, and rents and royalties."

4 states holding end-of-July sales tax holidays - Kay Bell, Don't Mess With Taxes. "Shoppers in Florida, Mississippi, Tennessee, and West Virginia, get your lists ready."

Interest in opportunity zones peaks as higher rates loom - Roger Russell, Accounting Today. "The real benefit is the 100% exclusion of tax on the appreciation of assets placed into the fund, Gevertzman said, noting that the 10% forgiveness after five years applies to the gain on the sale of assets put into the fund, while the entire exclusion from tax applies to any appreciation after the amount is in the fund."

Of course, as the article notes, that only is helpful if the investment actually appreciates.

Calculating Contributions to 529 College Savings Plans - Tax Warrior Chronicle. It features the Pennsylvania college savings plans, but many states, including Iowa, offer similar tax savings.

Idaho’s Marketplace Facilitator Sales Tax Law, Explained - Jennifer Dunn, TaxJar. "This means that if you sell on a platform like Amazon, then Amazon will collect sales tax from your Idaho buyers on your behalf, and remit it to the state. "

Related: Missouri About to Become the Last State to Adopt Economic Nexus.

"An Identity Protection PIN prevents someone else from filing a tax return using your Social Security number," said Chuck Rettig, IRS commissioner. "We've now made the IP PIN available to anyone who can verify their identity. This is a free way for taxpayers to protect themselves, but we need the help of tax professionals to make sure more people know about it."

The IRS created Publication 5367 (EN-SP), IP PIN Opt-In Program for Taxpayers, PDF in English and Spanish, so that tax professionals could print and share the IP PIN information with clients...

For security reasons, tax professionals cannot obtain an IP PIN on behalf of clients. Taxpayers must obtain their own IP PIN.

Interview: The Beginning of the End? An Update on the OECD Tax Reform Plan - David Stewart & Stephanie Soong Johnston, Tax Notes Opinions. "One problem is that the existing tax rules aren't keeping up with how business is carried out anymore. Companies are taxed based on physical presence in a jurisdiction, but with globalization and digitalization, they can now profit from activities in jurisdictions without physical presence, which has frustrated governments."

Iowa Department of Revenue Seeks to Narrow Sales Tax Exemption Through “Clarifying” Rulemaking - Cody Edwards, Iowa Tax Cafe. "So, the Department’s purported 'clarification' of the existing statute is anything but that. The Department is trying to legislate via rulemaking, which is not allowed."

Is a Tax Credit or Tax Deduction the Answer to Every Problem? - Jim Maule, Mauled Again. "They aren’t even the answer to most problems. They are the answer to few, if any, problems."

Kearney nail salon owner sentenced for filing false tax returns - IRS Criminal Investigation [Name omitted]:

Defendant was sentenced to 2 years in prison and 3 years of supervised release with special conditions. There is no parole in the federal system. Defendant was ordered to pay $83,063 in restitution.

Defendant owned and operated a nail salon business, Nails Unlimited, in Kearney, since 2009. From around February of 2009, Defendant would skim the cash and check payments of the business by cashing a majority of all customer checks received at the business and by conducting currency exchanges in which he would exchange small bills for $100 bills. Credit/Debit card transactions at the business would automatically be deposited into the business bank account, however, cash and check payments were rarely deposited into the business account. Defendant willfully failed to report the cashed customer checks and currency received as part of his gross income on his yearly tax return. The Internal Revenue Service (IRS) began investigating Defendant's actions sometime in 2017.

What tipped off the IRS? From an earlier IRS press release:

The nail salon customers who testified at trial indicated that they were instructed to issue checks payable to Defendant personally and not the business. The salon also had signs displayed that instructed customers to make checks payable to Defendant.

If you post a sign by the cash register that pretty much tells customers that you are skimming and cheating on your taxes, you just may increase the likelihood of an IRS visit.

I'll celebrate, of course, but I try to observe this holiday every day. It's National Milk Chocolate Day!

Make a habit of sustained success.