How Congress Makes Infrastructure Math Add Up: ‘Killing the Dead’ and Other Budget Tactics – Richard Rubin and Andrew Duehren, Wall Street Journal ($). “Lawmakers trying to seal a bipartisan infrastructure deal and maneuver Democratic priorities through Congress will claim those plans are fully paid for, but they look likely to use a series of creative budgetary techniques to achieve that target.”

Instead of borrowing at historically low interest rates, as was the case in the $1.9 trillion coronavirus relief law in March, lawmakers appear set to open a well-worn bag of maneuvers, which analysts in both parties call gimmicks, to help claim their policies aren’t adding to the national debt, though Democrats will certainly have tax increases to point to.

There might be a quiz on this one day so pay attention:

Here’s a guide to a few common budget techniques.

-

Sunsets. The costs of congressional proposals typically get measured over a 10-year period, or budget window...

-

Sunrises. Conversely, lawmakers can schedule unpopular tax hikes or spending cuts to take effect in the future...

-

Killing the dead. Congress can eliminate a program and claim credit for savings, even if the program was going to end anyway...

-

Clock shifts. Congress can make tax cuts look like revenue-raising provisions depending on when revenue appears.

So how are talks progressing on the bipartisan infrastructure deal in the Senate?

Pray tell Punchbowl News:

If it’s Thursday, the House and Senate are gone even though they have huge back log of legislative work.

And here are some of the Senate infrastructure negotiators on their way out of town.

Hello Sen. Kyrsten Sinema (D-Ariz.), hanging out near a DCA to San Francisco direct this afternoon, our spy told us.

And there you are, Sen. Mitt Romney (R-Utah),heading to the DCA to Salt Lake City Delta flight, per our tipster.

Well, it is a Friday, and who works on a Friday? Wait a minute, recalculating...

Perhaps talks are going better with the budget?

Democrats expect unity on budget as they eye early August vote – Lindsey McPherson and Jennifer Shutt, Roll Call. “Senate Budget Chairman Bernie Sanders said Wednesday that he’s confident all 50 Democrats will support the fiscal 2022 budget resolution, the first step in the reconciliation process for enacting President Joe Biden’s economic agenda without GOP votes that he expects the Senate to consider in early August.”

‘My hope is that by early August we will have a budget proposal to bring to the floor for a vote and do what the American people want and that is create a budget that works for working families and not just the wealthy and the lobbyists and their campaign contributors,’ the Vermont independent said.

‘As I’ve said many times, I’m confident we’re going to have 50 votes plus the vice president to support reconciliation,’ Sanders added.

Sanders could be right, but currently reporters are being told off-the-record that not all Senate Democrats are onboard with the budget proposal -- and all Senate Democrats must support the budget or it fails.

The reason this is noteworthy is because the budget is supposed to include instructions for how Congress will increase taxes. No Republican is expected to support this budget, so that means all Senate Democrats must support it and only three House Democrats can oppose it before it fails (that number is currently four, but Republicans are expected to pick up a seat in a July 27 runoff election in Texas.)

In other words, if a total of four congressional Democrats oppose the budget, it will not pass, which means there will be no instructions for Congress to increase taxes.

Tight margins.

Senate GOP Urges Biden to Drop Plan for Capital Gains on Estates – Colin Wilhelm, Bloomberg ($). “All 50 Senate Republicans are calling for the Biden administration to drop a proposed change to how stocks, real estate, and other assets are taxed at death. The proposal, part of President Joe Biden’s plans to raise taxes on corporations and the wealthy, would eliminate the tax adjustment known as the ‘step up in basis.’ Currently heirs can use the value of an asset at the time they inherit it—rather than the original purchase price—as the cost basis for calculating capital gains when they sell those assets.”

In a letter sent Wednesday, Senate Republicans called the change a ‘backdoor death tax on Americans.’

The letter can be found here.

Shock Alert: Companies oppose tax increases!

Despite paying little or no income tax, some companies have big plans to profit from infrastructure deal – Todd Frankel, Washington Post:

At least a dozen profitable major U.S. companies like Nucor paid little or no U.S. income tax in 2020 — or, in some cases, over several years — and today are active in industry groups that object to helping fund with taxes the same public projects they want to profit from, according to interviews and data compiled by The Washington Post.

Home Lenders Warn of Higher Rates Without Book Tax Carveout – Genevieve Douglas and David Hood, Bloomberg ($). “The mortgage industry is pushing Congress for a carve-out from part of the Biden administration’s corporate tax plan, cautioning that a tax hike on the biggest lenders would trickle down to borrowers in the form of higher mortgage rates and fees. President Joe Biden’s proposals include a 15% minimum tax on book income, the pre-tax earnings corporations publicly report to investors on their financial statements. The book tax is aimed at very large corporations that end up with little-to-no taxable income some years."

The Treasury Department projected the book tax would only hit about 120 companies with annual book income of $2 billion or more. Some tax professionals say the financial institutions that would pay it are so large that it would likely have a limited impact on borrowers and small lenders.

Maybe things are better in the House when it comes to these two bills (which haven't been written)?

What say you Bloomberg:

House Ways and Means Chair Richard Neal (D-Mass.) said he met with Senate Finance Chairman Ron Wyden (D-Ore.) to to check in about progress on the infrastructure package and a separate budget resolution intended to advance the rest of Biden’s economic agenda.

'We’re gonna write our own bills in the end. That’s a foregone conclusion,' Neal said.

Now might be a good time to share a saying uttered by House lawmakers in both parties: "The other party is the opposition, but the Senate is the enemy."

It appears that saying still holds true.

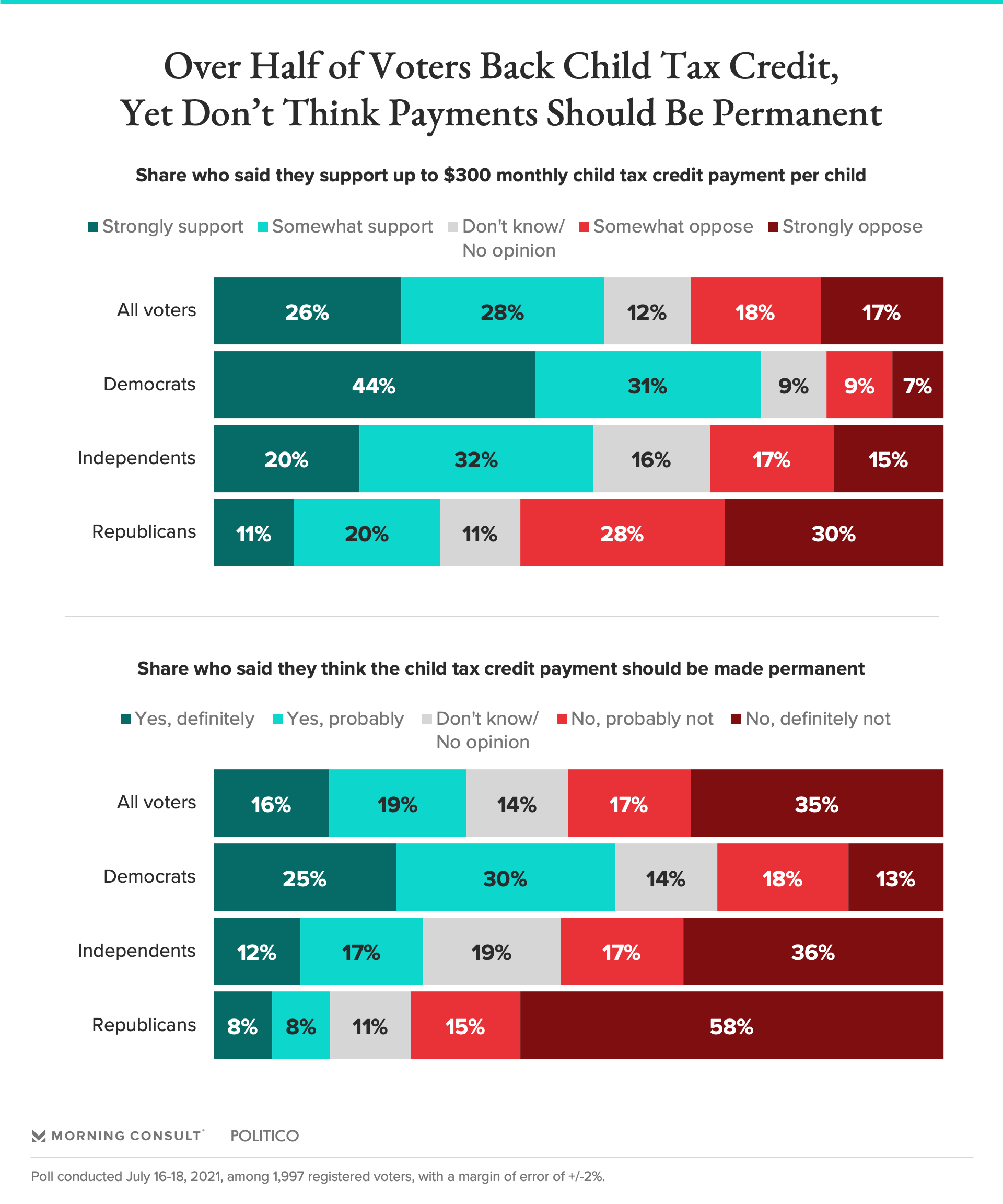

Biden’s Child Tax Credit Gets Support From Over Half of Voters. A Similar Share Says It Should Expire – Claire Williams, Morning Consult. “Just over half of voters, so far, support the payments, according to a new Morning Consult/Politico poll. Extending the benefits indefinitely, however, isn’t nearly as popular.”

Tax Pros Bemoan Slow Rollout of IRS Child Tax Credit Tool – Allyson Versprille, Bloomberg ($). “The IRS plans to continue adding features to its Child Tax Credit system through the fall, but with checks starting to go out next month, the delay could complicate the situation for some families, tax professionals said."

The IRS released two tools Tuesday: the first, called the Child Tax Credit Eligibility Assistant, will help families determine if they qualify for the payments. The second tool, called the Child Tax Credit Update Portal, allows families to verify their eligibility and to opt out of the monthly payments if they would rather receive their credit as a lump sum on their tax return filed next year.

Proposed Passthrough Deduction Overhaul Prompts Questions – Kelley Taylor, Tax Notes ($). “A Senate proposal to make changes to the 20 percent passthrough deduction is raising technical and practical questions among practitioners, including about its effect on publicly traded partnership income. The Small Business Tax Fairness Act, introduced July 20 by Senate Finance Committee Chair Ron Wyden, D-Ore., would simplify and expand eligibility for the section 199A passthrough deduction for what Wyden describes as ‘Main Street small businesses,’ but would make it unavailable for individuals earning more than $400,000.”

Glenn Dance of Holthouse Carlin & Van Trigt LLP said that the section 199A deduction is automatic for amounts earned for investments in publicly traded partnerships and real estate investment trusts and so is an important tax deduction for those passthrough entities. However, he pointed to a confusing aspect of Wyden’s proposal.

‘The bill appears to drop some section 199A provisions dealing with publicly traded partnership income being qualified business income but keeps or adds other provisions that suggest that publicly traded partnership income is still qualified business income,’ Dance said...

Nathan Smith of CBIZ Inc. acknowledged that eliminating the specified service trade or business limitation would simplify the mechanics of the section 199A deduction. But he highlighted a potential challenge.

‘Given that the original reasoning behind the limitation was to restrict benefits for compensation-like income, the proposal could disadvantage traditional wage earners,’ Smith said, adding that it could extend the deduction ‘to those who are able to classify comparable earnings in the form of business income.’ ...

Anthony Nitti of RubinBrown LLP, speaking at an Urban-Brookings Tax Policy Center webinar on July 22, said he thinks there will still be aggregation issues with Wyden’s proposal.

‘I couldn't glean from this proposal — do the W-2 limitations [and] UBIA go away, or do they still apply in addition to this phaseout over income?’ he asked.

Nitti also pointed out that a major criticism of section 199A is the ‘seemingly arbitrary creation of winners and losers between industries. There's no reason why a law firm or accounting firm shouldn’t share in a benefit if they're out hiring people and they're investing capital into the business,’ he said.

Senate tax-writing chief introduces retirement legislation – Jay Heflin, Eide Bailly. “Senate Finance Chairman Ron Wyden (D-Ore) has introduced retirement legislation that, in part, retools the existing saver’s credit.”

If enacted, the bill would replace the current saver’s credit with a 50% government match on contributions of up to $2,000 per year made to 401(k)-type plans and IRAs by individuals with income up to $32,500 and couples with income up to $65,000. Under current law, the maximum credit is $1,000 per individual.

IRS overlooked FEMA numbers to verify casualty and theft loss deductions – Michael Cohn, Accounting Today. “The Internal Revenue Service didn’t flag hundreds of millions of dollars in casualty and theft loss deductions from taxpayers who didn’t include the information needed to verify their claims.”

Taxpayers are asked to include a Federal Emergency Management Agency number that qualifies as a federally declared disaster area when they claim casualty and theft losses on a Form 4684. But a report released Monday by the Treasury Inspector General for Tax Administration found that 12,075 (35%) of the 34,699 claims for tax year 2019 processed as of Sept. 3, 2020, either had a FEMA number that didn’t match the FEMA number on the taxpayer’s tax account, had an invalid FEMA number, or were missing the FEMA number. The deductions claimed on the returns totaled over $309 million. The report estimates the individuals underpaid approximately $41.3 million in income taxes.

The TIGTA report can be found here.

Learning Curve Still Steep for IRS Partnership Audit Regime – Tripp Baltz, Bloomberg ($). “Pass-through businesses subject to the IRS’s centralized partnership audit regime are still dealing with a complicated transition period in what many tax practitioners and state tax administrators regard as one of the most complex areas of federal and state taxation, a former IRS chief counsel said Wednesday.”

‘It’s going to be a learning curve for the IRS and its partners for a long time to come,’ said Michael Desmond, who joined Gibson, Dunn & Crutcher LLP this year. ‘But once this learning curve is over, I’m optimistic it will facilitate more partnership audits.’

Congress Eyes IRS’s Deteriorating Free File Tax Prep Service – William Hoffman and Doug Sword, Tax Notes ($). “The recent departure of TurboTax maker Intuit from the Free File program is making the controversial tax preparation partnership with the IRS a topic of conversation once again in Congress. Declaring that Intuit’s withdrawal has ‘made the case for what I’ve been trying to do for a long time,’ Senate Finance Committee Chair Ron Wyden, D-Ore., said he may include provisions in an anticipated $3.5 trillion reconciliation bill to allow the IRS to program and market its own free tax return filing software.”

Big Box Stores Losing Property Tax Fights, but Likely to Persist – Michael Bologna, Bloomberg ($). “Municipalities in the Midwest have shifted from legislation to litigation as their primary strategy for shielding their commercial property tax bases from erosion in the face of ‘dark store’ theory property valuation challenges. Towns and counties in Indiana, Minnesota, and Wisconsin battling Lowe’s Cos. Inc., Wal-Mart Inc., Home Depot Inc., and Target Corp. have won significant court victories in the last year after the big box retailers appealed local property assessments, asserting their stores must be valued as if vacant, or ‘dark,’ and available for sale to a future property owner.”

Arizona DOR Issues Information on Payment Plan Requests for Individual Income Tax Liabilities – Bloomberg ($). “The Arizona Department of Revenue (DOR) July 21 issued information regarding payment plan requests for individual income tax purposes. Taxpayers have an option to manage their income tax liabilities by requesting a payment plan through the DOR’s website. Taxpayers can already make full or partial payments on the website, but if unable to pay tax liability in full, an individual can request a monthly installment plan. This new feature will make it faster and easier to set up a payment plan and reduce the number of calls and paper submissions to be processed by the DOR.”

Former IRS Chief Counsel Weighs In on SALT Cap Workarounds – Amy Hamilton, Tax Notes ($). “Former IRS Chief Counsel Michael J. Desmond provided a glimpse behind the scenes as Treasury and the IRS considered how to address workarounds to the $10,000 cap on the state and local tax deduction. Strategies involving charitable contributions in exchange for state tax credits were already well known to Treasury and the IRS when the cap entered into force, Desmond said July 21 during a virtual seminar hosted by the Multistate Tax Commission."

‘Many of these state programs predated the TCJA and were viewed as a mechanism to avoid application of the federal alternative minimum tax,’ said Desmond, who recently joined Gibson, Dunn & Crutcher LLP. He said that was because the charitable contributions deduction under section 170 is not an AMT preference, whereas the section 164 SALT deduction is.

Global Minimum Tax May Triple U.S. Foreign Tax Rate, Study Says – Stephanie Soong Johnston, Tax Notes ($). “An OECD global minimum taxation proposal could nearly triple the effective U.S. tax rate on foreign income and make the United States a more profitable destination for American firms’ intangible investments, researchers say. In a Penn Wharton tax policy brief published July 21, researchers examined the effects of the global minimum taxation provisions outlined in a two-pillar international tax reform plan that recently received broad political backing from more than 130 jurisdictions. The work, which G-20 finance ministers also recently approved, follows up on action 1 of the G-20/OECD base erosion and profit-shifting project, which focused on the tax challenges of the digital economy.”

Dividends Received Deduction Regs May Offer Coordination Rule – Andrew Velarde, Tax Notes ($). “The IRS is considering drafting a coordination rule between two different dividends received deduction (DRD) provisions in coming guidance stemming from changes to the DRD made by the Tax Cuts and Jobs Act.”

‘As part of the general [section] 245A package, we’re thinking about and considering areas where coordination is needed between [section] 245(a) and [section] 245A. . . . The language between the two provisions isn’t exactly the same, though it’s very similar,’ Chadwick Rowland of the IRS Office of Associate Chief Counsel (International) said. ‘Differences in the respective provisions can lead to odd results. That could broadly mean situations where both provisions just don’t fit very well together. . . . It’s reasonable to expect some sort of coordination between these provisions.’

It’s Gorgeous Grandma Day! “Gorgeous Grandma Day embraces the age of the nana and encourages all women to flaunt their granny attitudes with purpose and style.” Tip of the hat to all of you!

Make a habit of sustained success.