First Easement Indictment Built on Conventional Tax Fraud Blocks - Nathan Richman, Tax Notes ($). "The heavy emphasis on conventional backdating and individual income omission in the first criminal indictment involving conservation easements struck practitioners as a clear sign of the government’s strategy for asserting tax fraud in the area."

Also: "It’s remarkable how small some of those backdated deals were in the allegations against Lewis, [Anson] Asbury added. For example, some of the emails quoted in the indictment involved $25,000 or $50,000 payments."

IRS wraps up its 2021 ‘Dirty Dozen’ scams list with warning about promoted abusive arrangements - IRS

Syndicated conservation easements

In syndicated conservation easements promoters take a provision of tax law for conservation easements and twist it through using inflated appraisals of undeveloped land and partnerships. These abusive arrangements are designed to game the system and generate inflated and unwarranted tax deductions, often by using inflated appraisals of undeveloped land and partnerships devoid of a legitimate business purpose. More information can be found at IRS increases enforcement action on Syndicated Conservation Easements.

Abusive micro-captive arrangements

In abusive "micro-captive" structures, promoters, accountants or wealth planners persuade owners of closely held entities to participate in schemes that lack many of the attributes of insurance. For example, coverages may "insure" implausible risks, fail to match genuine business needs or duplicate the taxpayer's commercial coverages. But the "premiums" paid under these arrangements are often excessive and used to skirt tax law. Additional information can be found at IRS offers settlement for micro-captive insurance schemes; letters being mailed to groups under audit. Recently, the IRS has stepped up enforcement against a variation using potentially abusive offshore captive insurance companies domiciled in Puerto Rico and elsewhere.

Also: "Potentially abusive use of the US-Malta tax treaty" and "Improper claims of business credits."

Top Republican signals early resistance to any global tax deal - Naomi Jagoda, The Hill:

Rep. Kevin Brady (R-Texas) on Wednesday said he thinks it will be challenging for Congress to sign off on an international tax deal, as the Biden administration seeks to make progress on such an agreement this week.

"I think this is frankly years from being done, and I'm confident that Congress will reject any tax agreement that advantages foreign companies and workers over U.S. companies, or surrenders a key part of America's tax base that we'll need frankly to pay for our government services going forward," Brady, the top Republican on the House Ways and Means Committee, said on a call with reporters.

If it is "years" from being done, it's vulnerable if control of either the House or Senate shifts in 2022.

IRS offers clarity around transportation grants - Jeff Stimpson, Accounting Today:

A new set of FAQs from the IRS answer:

- Are the grants taxable? Yes, a CERTS Act grant is not excluded from the recipient’s gross income, and is taxable; and,

- Are costs for which the grants are used deductible? Yes, they are, to the extent that they are otherwise deductible. Wages, salaries and benefits to employees and other amounts paid to carry on a trade or business can generally be deducted as ordinary and necessary business expenses.

When Free Isn’t Free: Your Guide to Fringe Benefits at Work - Kelly Phillips Erb, Bloomberg Tax. "The good news: Gifts aren’t subject to income tax. The not-so-good news: The general rule is that an employer cannot make a gift, as it’s almost always considered compensation. This is true even if the gift is not from the company but from the owner of the company. For example, if I gave my paralegal a car, the IRS would typically consider that compensation, even if it didn’t come from my law firm. The idea is that our relationship is tied to the employment relationship."

Commuting is back, along with tax-free transportation fringe benefits - Kay Bell, Don't Mess With Taxes. "Basically, federal law allows companies to offer commuting workers a tax-free employer-paid benefit or a pre-tax employee-paid payroll deduction, often referred to as a commuter benefits plan."

Watch out — too much tax deferral can backfire on small business owners - Bill Bischoff, MarketWatch. "So, the question for the day is: should you take full advantage of all the federal-income-tax-deferral opportunities that you may still have available for an extended 2020 return and that you definitely still have available for your 2021 return? Answer: maybe not. Please keep reading for reasons why."

Biden’s Tax Proposals Could Impact Small Businesses Over Time - Alex Durante, Tax Policy Blog:

Taxing capital gains at death for those with unrealized capital gains above $1 million could potentially hit many small, family-owned businesses. Under current law, when a business owner dies and transfers the business to an heir, the heir does not incur any additional capital gains tax liability (but does potentially incur estate tax liability). Furthermore, the heir may “step up” the basis of the asset to the current fair market value, so that if the heir sells the business, capital gains tax is due only on the gain occurring during the heir’s ownership.

An analysis from the Agricultural and Food Policy Center of a similar proposal to repeal step-up in basis and tax capital gains at death found that as many as 98 percent of family-owned farms could be impacted, resulting in an increase in tax liability of more than $700,000 on average.

Related: Information Released Detailing Tax Proposals in President Biden’s Budget.

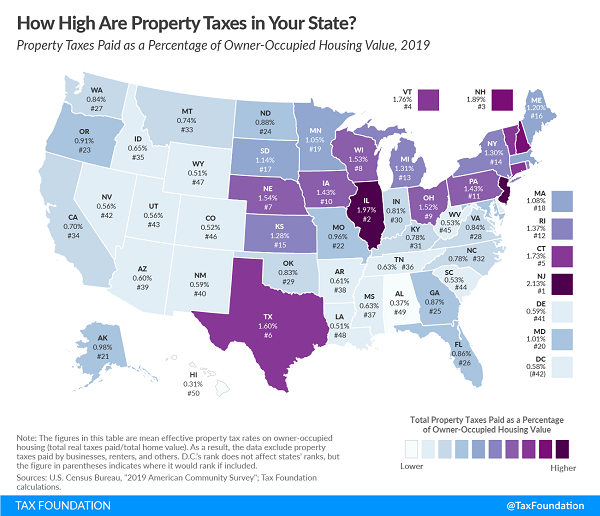

How High Are Property Taxes in Your State? - Janelle Cammenga, Tax Policy Blog. "Because property taxes are tied to housing values, it makes sense that the actual dollar amounts of property taxes tend to be higher in places with higher housing prices. This map takes housing value into account to give a broader perspective for property tax comparison."

Supreme Court Reverses Ninth Circuit; Rejects California's Donor Disclosure Law - Parker Tax Publishing. "The Court concluded that the disclosure requirement under California law was facially invalid because it burdened donors' First Amendment rights and was not narrowly tailored to an important government interest."

Tax-Exempt Hospitals and Charity Care: Should Those Hospitals Do More? Renu Zaretsky, TaxVox. "Could tax-exempt hospitals—especially larger, well-resourced ones like Ballad—simplify the process for patients needing charity care? Could they do a better job working with uninsured patients to settle debts?"

Christian Group That Battled IRS Receives Exemption After All - Fred Stokeld, Tax Notes ($). "Christians Engaged, which encourages Christian involvement in civic affairs, has received exemption as an organization described under section 501(c)(3), according to a July 7 release from the First Liberty Institute, which represented Christians Engaged when the group appealed the proposed denial."

IRS Wakes Up, Still Smells Like Crown Imperials - Russ Fox, Taxable Talk:

So does the IRS come up smelling like roses? Hardly. The IRS didn’t explain why Christians Engaged didn’t receive 501(c)(3) status to begin with. Had I formed a new charity (and complied with all the minutiae regarding 501(c)(3) organizations) titled, “Ultra Liberals Engaged,” does anyone think that I wouldn’t have quickly received approval?

So the IRS comes up smelling like the Crown Imperial plant. You haven’t heard of this plant? It’s “a dazzling and unique member of the Lily family…In addition to adding visual interest, these flowers…have a potent, musky scent almost like a skunk….”

Tax Coverage for Future CPA Exam - CPA Evolution - Annette Nellen, 21st Century Taxation:

I had the honor and privilege to participate with practitioners, tax faculty and AICPA exam staff recently to work on a model curriculum that ties to the next version of the CPA exam, referred to as CPA Evolution. The purpose of the revision is to better reflect how CPAs operate in today's global, digital environment where accounting, audit, tax compliance and planning, and technology are all important.

The exam will have a core that everyone takes with a foundation of accounting, audit, tax, business law, ethics and technology. Then prospective CPAs take one of three discipline exams:

- Tax compliance and planning

- Information systems and controls

- Business analysis and reporting

This exam is expected to launch in 2024.

Well, now that they let exam takers take only one section at a time, I guess anything goes. Letting people test on what they will actually practice in! Kids today, they don't know what a real CPA exam is! Hundreds of people in a room with a smoking area, the smell of defeat and despair in the air...

OK, I'll take my meds now.

You can't be young forever, but you can always be immature. So today is Be A Kid Again Day!

Make a habit of sustained success.