Minn. Gov., Leaders Agree On Budget With Full PPP Relief - Daniel Tay, Law360 Tax Authority ($):

Democratic Gov. Tim Walz, Senate Majority Leader Paul Gazelka, R-Nisswa, and House Speaker Melissa Hortman, D-Brooklyn Park, said on Monday they had reached a "numbers-only" agreement on a budget for the 2022-2023 biennium. The deal includes full deductibility of forgiven PPP loans in line with federal treatment, instead of the cap of $350,000 per forgiven loan that was proposed in H.B. 991, the omnibus tax bill proposed by the Democratically controlled House of Representatives.

Under the deal, Minnesota will also provide a subtraction of up to $10,200 in unemployment benefits to match the tax break provided in the American Rescue Plan Act, a provision previously included in the omnibus bill. The deal will not include a proposed fifth individual income tax tier for high earners that had been proposed by House Democrats and Walz.

Iowa Senate OKs Tax Overhaul, Inheritance Tax Phase Out - James Nani, Law360 Tax Authority ($).

The bill would repeal thresholds the state must meet to enact various tax relief measures, including consolidating income tax brackets and slashing the top rate from 8.53% to 6.5%. It would also phase out the state's inheritance tax at an estimated cost of $107.4 million...

It would also allow fiscal-year tax filers to claim a deduction for business expenses paid through loans under the federal Paycheck Protection Program that were forgiven in the 2019 tax year.

Additionally, the bill would retroactively conform to federal bonus depreciation provisions for capital assets, such as equipment, that were placed into service on or after Jan. 1, 2021.

Iowa Legislature Sends Wide-Ranging Tax Plan To Governor's Desk - Katarina Sostaric, Iowa Public Radio. "The Iowa Legislature gave final approval to a wide-ranging tax bill Tuesday, sending it to the governor’s desk. It will shift the responsibility for funding mental health services from counties to the state, ensure more income tax cuts take effect in 2023, phase out “backfill” payments to local governments, and expand tax credits related to child care and housing."

The bill also extends Iowa's conformity to federal treatment of Paycheck Protection Program loans to fiscal-year filers. Calendar-year taxpayers already were conformed.

Governor Reynolds has praised the bill and is expected to sign.

Practitioners Cast Wary Eye on Periodic Advance Child Credit - William Hoffman, Tax Notes:

Some tax pros may advise most of their clients to opt out of the new periodic advance child tax credit payments for fear that reconciling it on next year’s return could inadvertently lead to a tax bill.

“I’m certainly leaning toward having clients opting out of” the periodic advance CTC program, enrolled agent Terry Durkin said during a May 18 Tax Talk Today webcast on personal tax credits. “It will make sense for some,” she said, "but I would say the majority I would be promoting to opt out when that is available.”

The article says the IRS will set up a portal to enable taxpayers to opt out ahead of the July 15 start of payments.

IRS provides guidance on premium assistance and tax credit for continuation health coverage - IRS. "The American Rescue Plan provides a temporary 100% reduction in the premium that individuals would have to pay when they elect COBRA continuation health coverage following a reduction in hours or an involuntary termination of employment. The new law provides a corresponding tax credit for the entities that maintain group health plans, such as employers, multiemployer plans, and insurers. The 100% reduction in the premium and the credit are also available with respect to continuation coverage provided for those events under comparable State laws, sometimes referred to as 'mini-COBRA.'"

IRS Provides Q&A on COBRA Subsidies, Credits - Caitlin Mullaney, Tax Notes. "The notice addresses eligibility for the new COBRA premium subsidy, application in situations of reduction in hours, involuntary termination of employment, what coverage is eligible for assistance, the beginning and end of the assistance period, extended election periods, extensions under emergency relief notices, payments to insurers under federal COBRA, comparable state continuation coverage, calculation of the credit, and claiming the credit."

High-ranking Democrats call for corporate tax increases to pay for infrastructure bill as rank-in-file grapple with the idea - Jay Heflin, Eide Bailly:

While most liberal lawmakers are willing to support increasing taxes on corporations, there are some who are cautious to do so. The reason is that moderate Democrats in the House face tough re-election bids in 2022 and supporting tax increases of any kind could hurt their odds for maintaining their seats.

The margin of error to pass a bill in the House is also incredibly narrow. It would only take four House Democrats to oppose legislation that increases taxes for that measure to fail. Congressional Republicans have long opposed tax increases and are unlikely to change their minds now.

Infrastructure Hearing Finds Common Ground on Bonds, Little Else - Jad Chamseddine, Tax Notes ($). "But even with a bond program or other ways to include the private industry, Democrats maintained that more is needed to fix the country’s roads and improve broadband."

Exemption Row Could Stymie Plan To Tax Gains At Death - Alan K. Ota, Law360 Tax Authority ($). "Several senior Democrats said Biden's plan to end the step-up in basis for unrealized capital gains upon a wealthy taxpayer's death could face hurdles because some lawmakers are concerned it could disrupt the continuation of family-owned farms and businesses."

Dems' trouble with tax hikes - Ben White and Qubree Eliza Weaver, Politico. "Lots of react to our piece suggesting lobbyists and corporate executives are not exactly terrified of many of President Joe Biden’s proposed tax hikes becoming law. In fact, most are almost certain that the hikes will not happen because moderate Democrats won’t accept them."

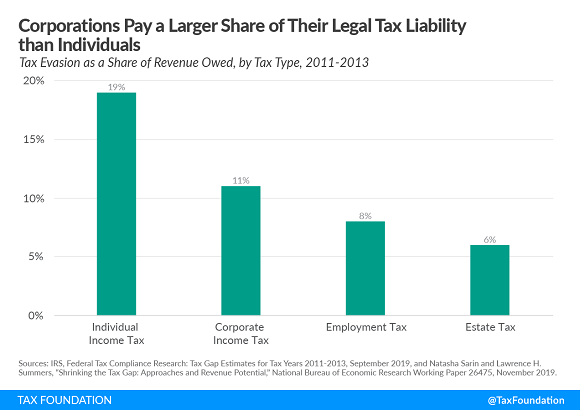

How Biden’s Corporate Tax Increases Could Make Tax Enforcement Harder - Alex Muresianu, Tax Policy Blog. "Instead, the tax with the highest evasion rates is the individual income tax. And income tax evasion mostly occurs on income subject to few reporting requirements. That includes many forms of business income, particularly income earned through pass-through businesses."

Remote nexus scores final victory in last holdout state - Roger Russell, Accounting Today:

The legislation goes into effect on Jan. 1, 2023. “The sole purpose of the delay is to give local jurisdictions enough time to have elections and implement a use tax,” Peterson remarked. “This is unusual. The elections will happen one at a time, and each will have an impact on how retailers comply with the sales tax requirement.”

Related: A Sales Tax Reform Game Changer: How Wayfair Changed the Sales Tax Reform Landscape.

IRS Announces Beginning of Program to Correct Pre-ARPA Returns Reporting Unemployment and Excess Advance Premium Tax Credit - Ed Zollars, Current Federal Tax Developments. "The IRS announced this week that the agency is beginning to issue refund checks to taxpayers who filed tax returns treating unemployment compensation as taxable in cases that Congress later made nontaxable in the American Rescue Plan of 2021 (ARPA)."

FBAR Civil Willful Penalty Collection Suit for $17+ Million with Damning Allegations - Jack Townsend, Federal Tax Crimes. "It is interesting in this regard that the complaint does allege that the decedent kept the truth about the foreign accounts from her CPA."

What someone should do if they missed the May 17 deadline to file and pay taxes - IRS. "Anyone who didn't file and owes tax should file a return as soon as they can and pay as much as they can to reduce penalties and interest. Electronic filing options, including IRS Free File, are still available on IRS.gov through October 15, 2021, to prepare and file returns electronically."

Lifecycle of a Tax Return - National Taxpayer Advocate Blog. "This means the IRS is now holding over 30 million returns in total for manual processing, delaying millions of taxpayers from receiving their much-needed refunds during this difficult economic time."

Supreme Court Hands Tax Advisor Big Win in CIC Services, LLC v. IRS - Matthew Roberts, Freeman Law. "Some time ago, the IRS labeled micro-captive transactions as a '“reportable transaction,' subject to reporting requirements. For those not familiar with micro-captive transactions, an insured party often deducts its premium payments as business expenses whereas the recipient of the payments (the insurer, often a related party) excludes such payment from gross income. This is permitted under the Code, provided certain requirements are met—however, the IRS has found that many taxpayers are engaging in these types of transactions without complying with the specified requirements."

NFTs: Not Free of Tax - Jonathan Kalinsky, Taxlitigator.com:

What is an NFT? For the uninitiated, it is a non-fungible token that lives in the blockchain. Unlike bitcoin, it is unique. No NFT is like another, and that is in part what gives it value. There is a digital certificate that can be bought and sold, but the records stay on the blockchain. This isn’t a blog on NFT basics, so are NFTs taxable?

The short answer is yes, but that doesn’t really tell you anything.

5 movies to binge if you’re a tax pro or accountant - National Association of Tax Professionals. Not for those of us seeking escapist fare.

Cake! Today is National Devil's Food Cake Day!

Make a habit of sustained success.