U.S. Tax Day Arrives Late With IRS Behind on Millions of Returns – Laura Davison, Bloomberg ($). “Monday brings a close to what tax advisers have dubbed the “never-ending tax season,” with the IRS scrambling to cope with repeated changes in law that offered just a foretaste of the challenges to come -- with President Joe Biden pressing for a raft of higher levies and stepped-up audits.”

Since the start of the pandemic, Congress authorized three rounds of stimulus checks, temporary expansions to tax credits and deductions, and repeated rule changes on the treatment of loans sent to small businesses. Special unemployment benefits were also distributed, with lawmakers later revising their tax treatment.

IRS extends May 17, other tax deadlines for victims of Tennessee storms; provides special guidelines for disaster area individuals needing further extensions - IRS. “Victims of severe storms, straight-line winds, tornadoes, and flooding that began March 25, 2021 now have until August 2, 2021, to file various individual and business tax returns and make tax payments, the Internal Revenue Service announced.”

The August 2, 2021 deadline applies to the first quarter estimated tax payment, normally due on April 15, and the second quarter payment normally due on June 15. It also applies to the quarterly payroll and excise tax returns normally due on April 30, 2021. In addition, it applies to tax-exempt organizations, operating on a calendar-year basis, that have a 2020 return due on May 17, 2021. Also, penalties on deposits due on or after March 25, 2021 and before April 9, 2021, will be abated as long as the tax deposits were made by April 9, 2021.

Besides Tennessee, taxpayers in part or all of five other states also have more time to file and pay:

- Individuals and businesses in Texas, Oklahoma and Louisiana have until June 15 to file and pay. All taxpayers in these three states qualify for relief.

- Individuals and businesses in parts of Kentucky have until June 30 to file and pay.

- Individuals and businesses in parts of Alabama have until Aug. 2 to file and pay.

IRS begins correcting tax returns for unemployment compensation income exclusion; periodic payments to be made May through summer – IRS. “The Internal Revenue Service will begin issuing refunds this week to eligible taxpayers who paid taxes on 2020 unemployment compensation that the recently-enacted American Rescue Plan later excluded from taxable income. The IRS identified over 10 million taxpayers who filed their tax returns prior to the American Rescue Plan of 2021 becoming law in March and is reviewing those tax returns to determine the correct taxable amount of unemployment compensation and tax. This could result in a refund, a reduced balance due or no change to tax (no refund due nor amount owed).”

Monthly Child Tax Credit Payments Set to Start July 15 – Richard Rubin, Wall Street Journal ($). “The Internal Revenue Service will make its first batch of monthly payments to about 39 million families with children on July 15, delivering the child tax credit that Congress expanded in March.”

IRS Release on the subject is here.

The IRS Is Coming for Crypto Investors Who Haven’t Paid Their Taxes – Laura Saunders, Wall Street Journal ($). “Cryptocurrencies are exploding—and so is the Internal Revenue Service’s pursuit of Americans who aren’t paying taxes on them. With Tax Day approaching, it’s a good time to clean up your act if you’ve been lax about taxes on crypto. Not doing so could compound future tax problems, especially if you have traded a lot or have more than a small stake.”

Covid-19 Opportunity Zone Working Capital Relief Not Automatic – Allyson Versprille, Bloomberg ($). “Recent Covid-19 relief providing extra time for working capital to be spent on projects in opportunity zones isn’t automatic, an IRS official said Friday. A qualified opportunity zone business is allowed to hold working capital if it has a written plan to spend the funds within 31 months. Covid-19 guidance released in January gave businesses holding such assets before June 30, 2021, up to an additional 24 months to use them.”

New York, New Jersey, California face long odds in scrapping SALT - Alexander Bolton, The Hill. “Senate Majority Leader Charles Schumer (D-N.Y.) and Speaker Nancy Pelosi (D-Calif.) face an uphill battle on one of their top tax priorities, repealing the cap President Trump put on deducting state and local taxes.”

Schumer said getting rid of Trump’s cap would be one of his highest priorities as majority leader and Pelosi has called the cap on deductions “devastating” for California taxpayers. But getting it done with extremely small Democratic majorities in the Senate and House is turning into a major headache and at this point it looks like leaders may have to settle for lifting the cap instead of getting rid of it entirely.

Biden Like-Kind Proposal Raises Cap Application Questions – Nathan Richman, Tax Notes ($). “Many exchange transactions may still be viable under the proposed cap on like-kind exchange treatment in the Biden administration’s infrastructure plan, but taxpayers need details about how that cap will apply, according to one practitioner.”

Infrastructure deal imperiled by differences on financing – Alex Gangitano and Brett Samuels, The Hill. “President Biden and Republican lawmakers say they’re making progress on an infrastructure package but still disagree on one key area: how to pay for it.”

Tax the rich? Executives predict Biden’s big plans will flop – Ben White, Politico. “President Joe Biden wants to fund his $4.1 trillion infrastructure and family policy agenda with a huge pile of tax increases on corporations and the wealthy. The business community is dismissing the threat."

Corporate executives and lobbyists in Washington, New York and around the country say they are confident they can kill almost all of these tax hikes by pressuring moderate Democrats in the House and Senate. And they think progressive Democrats don’t really care about the costs of new programs and will be happy to push through as much spending as they can and then run on tax hikes in 2022 rather than actually pass them this year.

How Dems learned to stop worrying (mostly) and embrace tax hikes – Sarah Ferris, Politico. “President Joe Biden and congressional Democrats are taking a big gamble: that raising taxes can be popular. As discussions heat up about how to pay for trillions in new spending on infrastructure, Biden and his party want to hike taxes on the wealthiest Americans and on companies that have evaded federal taxes for years. Poll after poll shows those proposals are broadly popular with voters, particularly amid a deadly pandemic that's exacerbated the nation’s already stark economic divisions.”

How to Pay for Infrastructure: Not by Taxing Carbon – Mindy Herzfeld, Tax Notes ($). “Given the strong backing by some senior administration members, economists, international organizations, and some lawmakers of both parties, Biden’s lack of support for a comprehensive carbon pricing mechanism is a mystery.”

Republicans are setting a tax trap for Biden – Rick Newman, Yahoo Finance. “Republicans in Congress want to raise the federal gas tax. Yes, the same Republicans who oppose tax hikes most of the rest of the time. You won’t hear them say, ‘let’s raise the gas tax,’ exactly. There’s a code phrase: ‘user fees.’ Senate Minority Leader Mitch McConnell, for instance, says Republicans will support $600 billion in infrastructure spending, as long as user fees cover the cost. ‘We’re happy to look for traditional infrastructure pay-fors, which means the users participate,’ McConnell said in Louisville on May 3.”

“By ‘participate,’ McConnell means whoever uses the infrastructure should pay for it, through taxes, tolls or other charges. That’s quite different from what President Biden wants to do, which is raise taxes on businesses and the wealthy to pay for nearly $2 trillion in road and bridge projects, green energy, and numerous other building programs. Republicans are dead-set against Biden’s proposed tax hikes, which would reverse some of the 2017 tax cuts that passed with only Republican votes.”

It’s like a husband and wife saying they agree on the importance of money, except he wants to spend it while she wants to save it.

White House: User fees for infrastructure deal would "violate" Biden's tax pledge – Oriana Gonzalez, Axios. “The White House on Friday said that Republicans' idea to impose user fees for infrastructure spending would "violate" President Biden's promise not to raise taxes on Americans making less than $400,000 annually.”

Financing Infrastructure Spending with Corporate Tax Increases Would Stunt Economic Growth – Alex Durante, Huaqun Li and Garrett Watson, Tax Foundation. “The Biden administration’s American Jobs Plan (AJP) proposal to fund infrastructure spending relies on a bet that the benefits outweigh the costs of a higher corporate tax burden. Using the Tax Foundation model, we find that this trade-off is a bad one for the U.S. economy, resulting in reduced GDP, less capital investment, fewer jobs, and lower wages."

[F]inancing the new infrastructure with an increase in the corporate tax rate reduces long-run GDP by 0.3 percent, because it raises the cost of corporate investment. It also reduces GNP by 0.2 percent, lowers the capital stock by 0.7 percent, reduces employment by 48,000 full-time equivalent jobs, and reduces wages by 0.2 percent. While this option would be deficit neutral in the long run on a conventional basis (which holds GDP constant), on a dynamic basis annual revenue would drop by $39 billion in the long run due to a smaller economy.

Tax Proposals Lead to Massive Job Loss – National Association of Manufacturers. “There have been numerous proposals to alter the tax system enacted in 2017 under the Tax Cuts and Jobs Act. To understand the consequences of those proposed changes, Rice University economists John W. Diamond and George R. Zodrow conducted a study for the National Association of Manufacturers […] The study shows that the above changes, including the increased corporate tax rate, would result in less economic activity and 1 million jobs lost in the first two years.”

The report can be found here.

Biden’s Tax Enforcement Target of $700 Billion Won’t Be Easy – Richard Rubin, Wall Street Journal ($). “Tougher tax enforcement is one of the least controversial pieces of President Biden’s economic agenda, a way to raise revenue without raising taxes. As the Biden plan advances, there are crucial open questions on how much money it will generate and how well the Internal Revenue Service will implement it.”

IRS Trawling Through Small Business Bank Accounts? – Lee Shepard, Tax Notes ($). “Former Treasury Secretary Lawrence H. Summers believes the tax gap is collectible […] So in a recent tax gap release, Treasury expressed a desire to peek into taxpayers’ bank accounts by requiring banks to report individual account inflows and outflows. Here’s the pertinent language:”

Importantly, this proposal provides additional information to the IRS without any increased burden for taxpayers. Instead, it leverages the information that financial institutions already know about account holders, simply requiring that they add to their regular, annual reports information about aggregate account outflows and inflows. Providing the IRS this information will help improve audit selection so it can better target its enforcement activity on the most suspect evaders, avoiding unnecessary (and costly) audits of ordinary taxpayers.

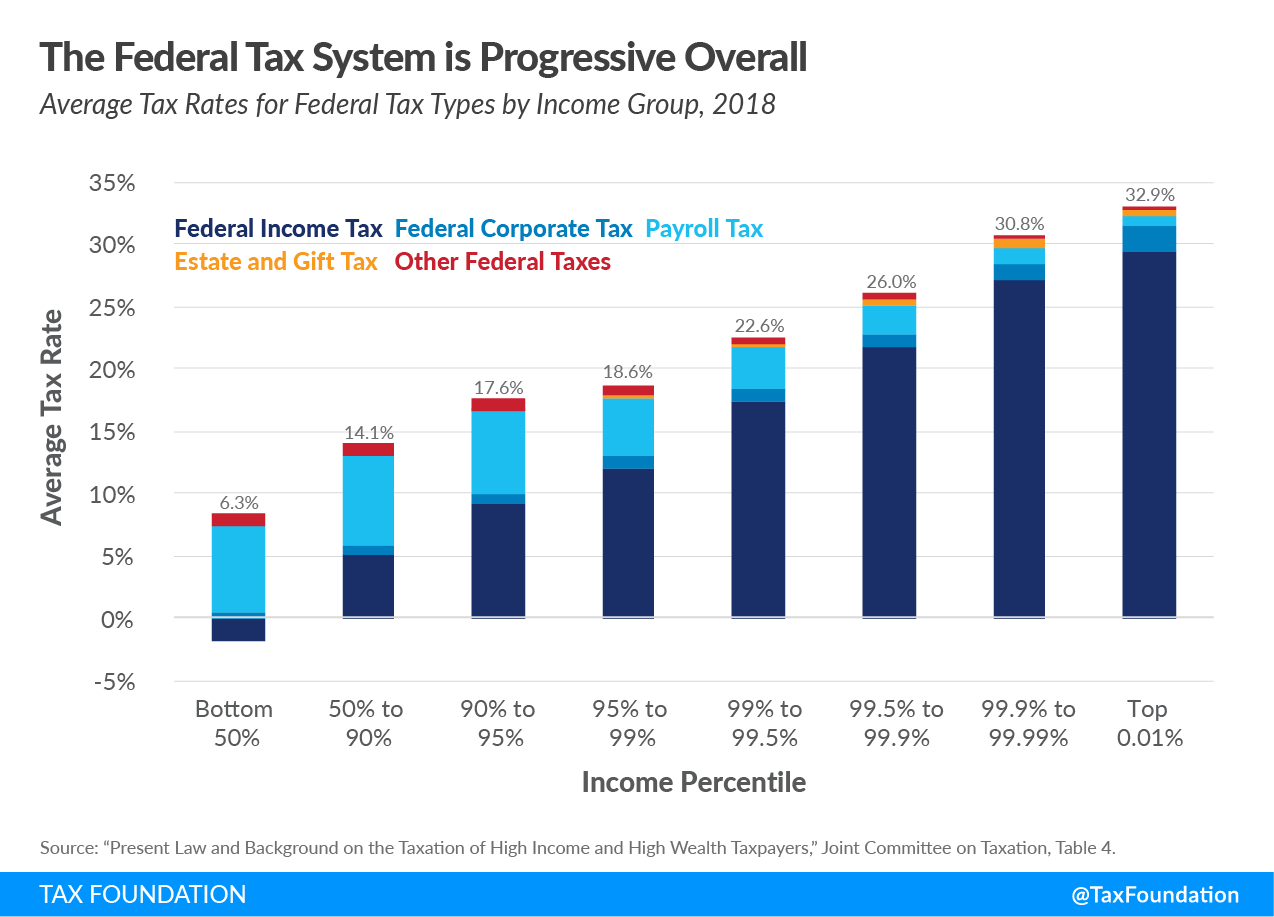

Joint Committee on Taxation Data Shows Federal Tax System Is Progressive – Garrett Watson, Tax Foundation. “The Joint Committee on Taxation (JCT) recently released data on taxes paid at various levels of income, indicating the federal tax system is progressive, consistent with similar analysis by the Congressional Budget Office (CBO), and the Organisation for Economic Co-operation and Development (OECD). The JCT found that the bottom 50 percent of taxpayers faced an average tax rate of 6.3 percent at the federal level, compared to an average tax rate of 32.9 percent for the top 0.01 percent of income earners.”

Offset Provision Guidance Could Be Thorny for States Eyeing Tax Cuts, Practitioners Say – Lauren Loricchio, Tax Notes ($). “Treasury’s interim guidance on the emergency funds provided by the federal government to state and local governments is helpful but could also complicate policymaking in states looking to reduce taxes, according to tax practitioners.”

U.K.’s Sunak Isn’t Convinced on Biden’s Global Business Tax Plan – Tim Ross and Lizzy Burden, Bloomberg ($). “British officials aren’t convinced by President Joe Biden’s plan for a global minimum business tax rate of 21%, drawing accusations of “evasion and sophistry” from tax justice campaigners. Chancellor of the Exchequer Rishi Sunak and his team are concerned the rate may be too high over the long term, even though the U.K. intends to raise its corporation tax to 25% in 2023 to repair public finances after the pandemic.”

Today is not only the tax filing deadline for (most) federal returns, it is also National Pack Rat Day. Not to be confused with the Rat Pack from the sixties, National Pack Rat Day “encourages us to take a look at ourselves and see if we have ‘Pack Rat’ tendencies within us.”

Make a habit of sustained success.