GOP senator: Raising corporate taxes is a 'non-starter' – Rachel Frazin, The Hill. “Sen. Shelley Moore Capito (R-W.Va.) said Thursday that she wouldn’t support legislation raising corporate taxes, calling the idea a “non-starter” during a press conference. ‘I voted for the Tax Cuts and Jobs Act. It had the desired effect of bringing capital back into this country, no corporate inversions, higher wages, lower unemployment,’ said Capito, referring to a 2017 bill that cut the corporate tax rate from 35 percent to 21 percent, when asked if Republicans would be open to any changes. ‘I think that’s a non-negotiable red line, she said. 'For me personally, that’s a non-starter.’ Other Republicans at the press conference expressed agreement."

Senate Finance Chairman Ron Wyden (D-Ore.) disagrees:

Republicans’ red line on corporate revenue is completely unreasonable. Corporations have never contributed less to federal revenues than they do now. Our analysis of CBO data shows corporate revenue is down nearly 40 percent from the 21st century average since Republicans’ tax giveaway. I’m not talking about comparing where we are today to where we were in the 1950s—I’m talking about comparing where we are today to where we were just five years ago. In 2018, the United States was dead last among OECD countries in how much corporate tax revenue it collected as a share of GDP. Republicans’ insistence that the most profitable companies in the world shouldn’t contribute a single penny to investments in roads, schools and our clean-energy future is simply not acceptable.

Tech industry group funded by Amazon, Facebook and Google says it supports a corporate tax hike – Lauren Feiner, CNBC. “Chamber of Progress, a new tech industry group funded by giants like Amazon, Facebook and Google, is announcing its support for a corporate tax increase like the one President Joe Biden proposed to fund his $2 trillion infrastructure plan.”

GOP readies competing infrastructure plan without corporate tax increases – Michael Cohn, Accounting Today. “Republicans are working on developing a far smaller infrastructure package than the Biden administration’s American Jobs Plan, relying on user fees such as tolls instead of corporate tax increases. The GOP package would cost between $600 billion to $800 billion, as opposed to the $2.3 trillion proposed by Democrats and the administration. Biden has called for raising the maximum corporate tax rate to 28 percent as a way to help pay for the infrastructure package.”

Lawmakers launch bipartisan caucus on SALT deduction – Naomi Jagoda, The Hill. “A bipartisan group of House members from high-tax states on Thursday launched a caucus focused on advocating for undoing the $10,000 limit on the state and local tax deductions (SALT), as lawmakers press to include repeal of the cap in infrastructure legislation.”

The formation of the bipartisan SALT caucus comes as Democrats from high-tax states have been ramping up pressure on congressional leadership and the White House to include repeal of the deduction cap in forthcoming legislation based on President Biden’s infrastructure package.

Ocasio-Cortez says she disagrees with holding up infrastructure over SALT – Naomi Jagoda, The Hill. “Rep. Alexandria Ocasio-Cortez (D-N.Y.) said Thursday that she disagrees with Democratic lawmakers who are demanding that infrastructure legislation include a repeal of the cap on the state and local tax (SALT) deduction.

"I don't think that we should be holding the infrastructure package hostage for a 100-percent full repeal on SALT, especially in the case of a full repeal," Ocasio-Cortez told reporters. "Personally, I can't stress how much that I believe that is a giveaway to the rich."

Buchanan to seek top GOP position on Ways and Means Committee – Naomi Jagoda, The Hill. “Rep. Vern Buchanan (R-Fla.) announced Thursday that he is running to be the top Republican on the House Ways and Means Committee in the next Congress, seeking to lead the powerful panel with jurisdiction over tax, trade and public health issues.”

Former Taxpayer Advocate Contests Rettig’s $1 Trillion Tax Gap – William Hoffman, Tax Notes ($). “Former National Taxpayer Advocate Nina Olson challenged the IRS commissioner’s ‘jaw-dropping’ estimate of a $1 trillion tax gap — and what she said were counterproductive media endorsements of that number. Commissioner Charles Rettig told the Senate Finance Committee April 13 that the annual tax gap ‘could approach, and possibly exceed, $1 trillion per year,’ more than double the tax agency’s last official estimate of $441 billion for the difference between what taxpayers owe and what they pay."

Speaking on an Urban-Brookings Tax Policy Center webinar April 15, Olson said her reaction to Rettig’s announcement was ‘Where did that number come from?’

Biden Ignites Global Effort to Keep Companies From Dodging Taxes – Peter Coy, Bloomberg Tax ($). “After decades of undermining one another, 139 rich and poor nations are closing in on a framework for taxing multinational corporations that would be the biggest change in the system since 1923. The goal is to create a united front to prevent corporations from playing one country off against another, recognizing that a race to the bottom in taxation has no winner, only a bunch of revenue-deprived losers.”

G20 could agree to around 15% global minimum corporate tax rate, tax expert says - Divya Chowdhury, Yahoo! Finance. “The final agreement for a global minimum tax rate between the G20 countries could likely come at around 15%, a compromise between the current Irish rate of 12.5% and United States' proposed 21%, a global tax expert said on Thursday. U.S. Treasury Secretary Janet Yellen has thrown the weight of the U.S. government behind a push for a global corporate minimum tax rate, possibly carving a path to a long-sought deal updating international tax rules for the first time in a generation.”

Average Opportunity Zone Investor Is Millionaire: Study - Lydia O'Neal, Bloomberg Tax ($). “The benefits of contentious opportunity zone tax breaks are going to people who, on average, are millionaires, and their money is flowing into a small concentration of areas that are better off than other designated zones, according to new research.”

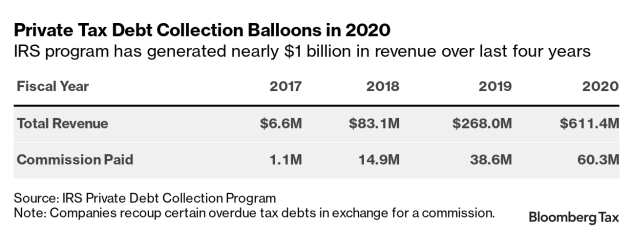

Private Tax Collectors Brought in Record Haul During Pandemic - Bloomberg Tax ($). “The IRS’s private debt collection program has brought in roughly $969 million in total revenue over the last four years, new agency data show. The latest iteration of the program kicked off in April 2017 with four companies—CBE Group Inc., ConServe Inc., Performant Recovery Inc. and Pioneer Credit Recovery Inc.—hired by the IRS to recoup certain overdue tax debts.”

Mississippi Cannabis Case Could Deem Other Laws Unconstitutional – Jennifer Kay, Bloomberg Tax. “The Mississippi Supreme Court will ponder the definition of a congressional district as it considers whether a medical cannabis ballot initiative wrongly went to voters. Chief Justice Michael Randolph pulled out a dictionary during Wednesday’s oral arguments as he questioned Justin Matheny of the Mississippi Attorney General’s Office about the state’s practice of using a four-district map to send representatives to Congress and a five-district map, as enshrined in state law, for other purposes.”

IRS Captive Insurance Summons Was Proper, 11th Circ. Told – Dylan Moroses, Law360 Tax Authority ($). “A Georgia federal court properly rejected a law firm's challenge to an Internal Revenue Service summons seeking information on its captive insurance clients because the request was within the agency's authority, the U.S. has told the Eleventh Circuit."

Moore Ingram Johnson & Steele LLP failed to prove that the summons it received from the IRS seeking information on its clients was abusive, and the lower court correctly rejected the suit, the government said in its Wednesday brief. The agency has broad authority to issue summonses that would aid investigations, and the request it made to the firm wasn't abusive, the government said.

Has Congress Learned the IRS Funding Lesson, or Will It Fail Again? - Prof. James Edward Maule, MauledAgain. “Anyone who takes the time to examine the connection between IRS funding and tax compliance learns that there is a causal connection. Increases in IRS funding increase audits and enforcement, which in turn reduces the tax gap.”

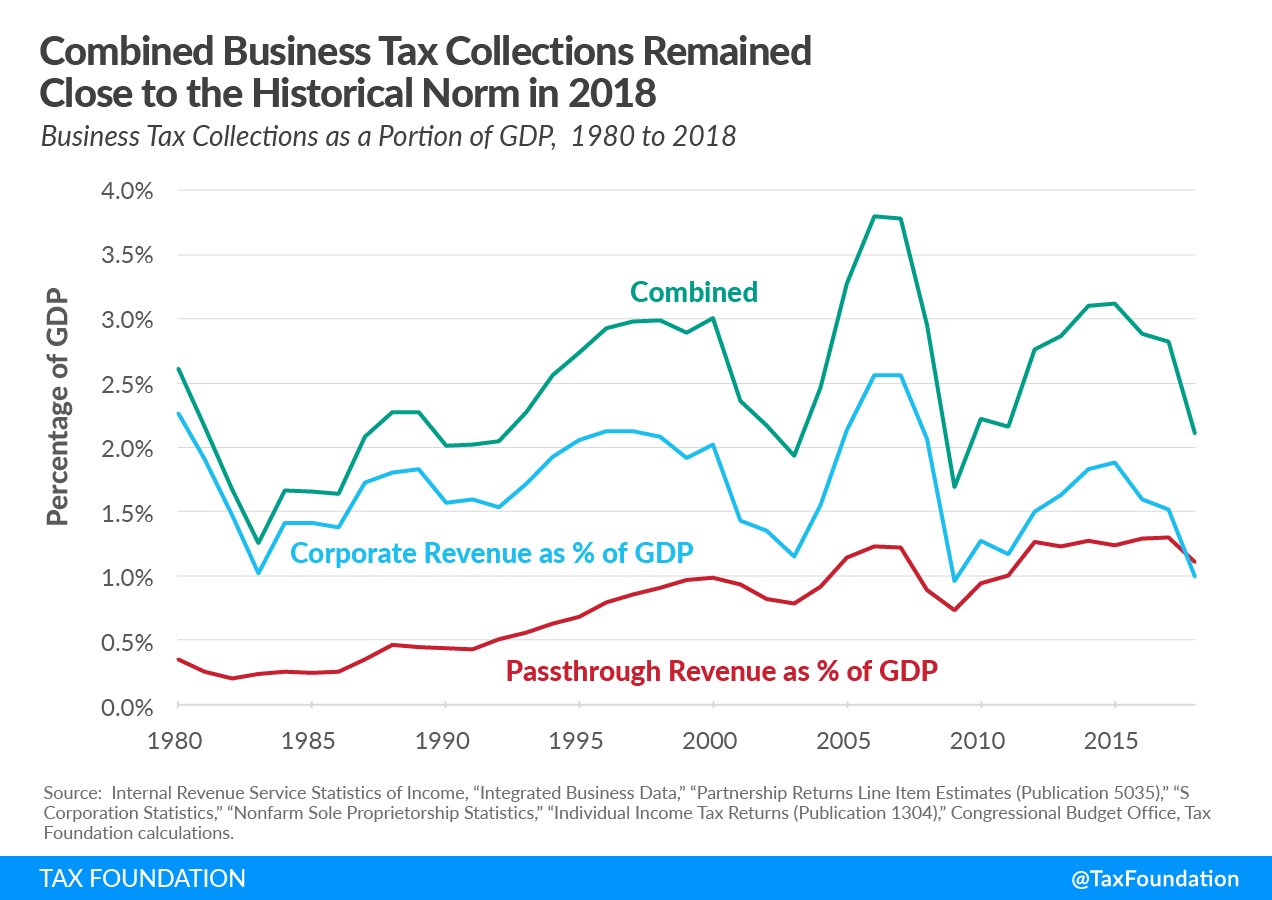

Business Tax Collections Within Historical Norm After Accounting for Pass-through Business Taxes – Garrett Watson, Tax Foundation. “A common argument for raising the corporate income tax rate is that collections as a share of gross domestic product (GDP) fell after the rate was reduced to 21 percent as part of the Tax Cuts and Jobs Act (TCJA) in 2017. But that argument is incomplete, as the U.S. also has a large pass-through business sector where taxes are collected through the individual income tax system. When including those tax collections, it becomes clear that the U.S. is within the historical norm for business tax collections.”

IRS offers penalty relief on employment tax payments amid COVID-19 – Michael Cohn, Accounting Today. “The Internal Revenue Service is providing penalty relief for an employer’s failure to deposit employment taxes with the IRS on a timely basis. In Notice 2021-24, the IRS amplified prior guidance from 2020. The new notice provides relief for employers who are required to pay qualified sick leave wages and qualified family leave wages, along with qualified health plan expenses that can be allocated to those wages, as mandated by the Families First Coronavirus Response Act, which was amended by the COVID-related Tax Relief Act of 2020, along with the American Rescue Plan Act of 2021.”

4 Key Considerations For The 2020 Employee Retention Credit – Amy Lee Rosen, Law 360 Tax Authority ($). “The employee retention credit could provide some businesses much-needed relief, but before claiming the credit employers should be aware of its requirements, the interplay with Paycheck Protection Program loans, payroll filing options and potential delays with amended payroll forms.”

Overview Of The Federal Tax System As In Effect For 2021 – Joint Committee on Taxation. “This document, 1 prepared by the staff of the Joint Committee on Taxation (‘Joint Committee staff’), provides a summary of the present-law Federal tax system as in effect for 2021.”

A perfect pair! It’s National Wear Pajamas to Work Day AND National Eggs Benedict Day! With rampant work from home orders, PJs are donned! Time to poach-up some eggs and serve-up some Hollandaise sauce. Stat!

Make a habit of sustained success.