‘Super Bowl of tax reform’: Groups gear up for fight over Biden plan to raise taxes on rich, corporations – Brian Schwartz, CNBC

"Advocacy groups from across the political spectrum are preparing for an all-out war over President Joe Biden’s coming tax reform proposal, which is expected to include tax increases on wealthier families and corporations as part of his massive infrastructure plan. It is shaping up to be the 'Super Bowl of tax reform,' according to one person who is planning to join the fight. This person, who declined to be named in order to speak freely, expects a 'protracted battle.'"

Dear Colleague letter to Senators - Senate Majority Leader Chuck Schumer (D-NY):

In the coming weeks and months, the Senate will consider legislation to rebuild our infrastructure and fight climate change, boost R&D and domestic manufacturing, reform our broken immigration system, and grow the power of American workers… In the coming days, we expect to learn more details regarding the President’s FY2022 budget and his Build Back Better proposals focused on the economic recovery, jobs and climate change.

Biden to unveil multitrillion-dollar infrastructure plan in Pittsburgh next week - Jarrett Renshaw, Reuters

"U.S. President Joe Biden [Wednesday] will travel to Pittsburgh, where he kicked off his presidential campaign in 2019, to unveil a multitrillion-dollar plan to rebuild America’s infrastructure, choosing a backdrop of an American city with a long union history. Biden is expected to push for a 'Build Back Better' plan that could have a price tag as high as $4 trillion to pay for traditional roads and bridges while also tackling climate change and domestic policy issues like income equality."

Powell Says Now Is Not the Time to Focus on Reducing Federal Debt - Paul Kiernan, Wall Street Journal:

Federal Reserve Chairman Jerome Powell said that the federal government can manage its debt at current levels but fiscal-policy makers should seek to slow its growth once the economy is stronger. “Given the low level of interest rates, there’s no issue about the United States being able to service its debt at this time or in the foreseeable future,” Mr. Powell said Thursday in an interview with National Public Radio.

Social Security sends beneficiary info to IRS for stimulus payments – Michael Cohn, Accounting Today

"The Social Security Administration transmitted the necessary information Thursday to the IRS so it can begin sending Economic Impact Payments to nearly 30 million beneficiaries after an ultimatum from Congress. On Wednesday afternoon, a group of Democrats on the tax-writing House Ways and Means Committee had complained about the slowdown in a letter to SSA Commissioner Andrew Saul, giving him 24 hours to send the information. On Monday, several Democratic leaders on the committee had written to the IRS Commissioner and the SSA about the delays in payments to Social Security, Supplemental Security Income, Railroad Retirement Board, and Veterans Affairs beneficiaries. The IRS informed them that the problem was that the SSA hadn’t sent over the information."

Sanders proposes bigger tax hikes than White House – Laura Davison, Accounting Today

"Senate Budget Committee Chairman Bernie Sanders is proposing tax increases that are even bigger than the ones President Joe Biden is considering. Sanders, in an interview with NPR, said that he is planning to introduce legislation Thursday that would raise the corporate tax rate to 35 percent, higher than the 28 percent that Biden has proposed. The corporate rate is currently 21 percent, which was cut from 35 percent in President Donald Trump’s 2017 tax overhaul."

The push for even steeper tax increases demonstrates that Democrats are divided on the scope of the levy hikes they should pursue as they look for ways to finance infrastructure, climate change programs and other priorities. Democrats largely agree that businesses and wealthy households should pay higher taxes, but they have yet to debate the specifics of those increases.

Senate Finance Chairman Readies International Tax Bill with an Uncertain Fate – Jay Heflin, Eide Bailly

"Senate Finance Chairman Ron Wyden (D-Ore.) on Thursday said in the coming days he intends to release a document on international tax proposals, but where it goes from there is unclear. 'I’ll be releasing a new framework for international taxation that reverses the Trump-era handouts to multinationals,' he announced while holding a committee hearing on international tax policy. Senators Sherrod Brown (D-Ohio) and Mark Warner (D-Va.), both members of the Senate Finance Committee, will help create the tax document. It will be circulated to other Senators for feedback on how to sculpt the nation’s international tax code. That document will then become the basis for legislation that Wyden hopes to introduce later this year."

Senate clears PPP bill, extending loan applications through May - Caitlin Reilly, Roll Call

"The Senate voted 92-7 Thursday to extend the Paycheck Protection Program to the end of May after rejecting two Republican amendments and waiving a budget point of order. The vote cleared the measure that would extend the program, now due to expire on March 31. The House passed the bill 415-3 earlier this month. It next heads to President Joe Biden for his signature."

"The Internal Revenue Service's Criminal Investigation Division (IRS-CI) marks the one-year anniversary of the Coronavirus Aid, Relief and Economic Security (CARES) Act by pledging its continued commitment to investigating COVID-19 fraud. Over the last year, IRS-CI has been combatting COVID-19 fraud related to the Economic Impact Payments, Paycheck Protection Program (PPP) and Employee Retention Credit. The agency has investigated more than 350 tax and money laundering cases nationwide totaling $440 million. These investigations covered a broad range of criminal activity, including fraudulently obtained loans, credits and payments meant for American workers, families, and small businesses."

Brady, Crapo Press Treasury for Clear Guidance on Democrats’ Ban on State Tax Cuts –Republican leaders on tax-writing committees

"Treasury Secretary Janet Yellen has so far provided little information in response to 21 state Attorneys General, who raised concerns in a March 16 letter about a provision in recently enacted COVID-19 response legislation that could severely restrict states’ ability to provide tax relief to local workers, families, small businesses, and farms."

“The response to concerns raised by the state Attorneys General or in our letters has so far been entirely inadequate,” said Rep. Kevin Brady (R-TX), Republican Leader of the House Committee on Ways and Means, and Senator Mike Crapo (R-ID), Republican Leader of the Senate Finance Committee. “As states make important fiscal decisions about how to crush the virus and help businesses and workers, there can be no room for confusion about this unconstitutional law that allows Washington to intimidate states into a tax relief ban for the next three years. Treasury must provide prompt and clear guidance to avoid undermining states’ authority to design their own tax system.”

What European OECD Countries Are Doing about Digital Services Taxes – Elke Asen, Tax Foundation

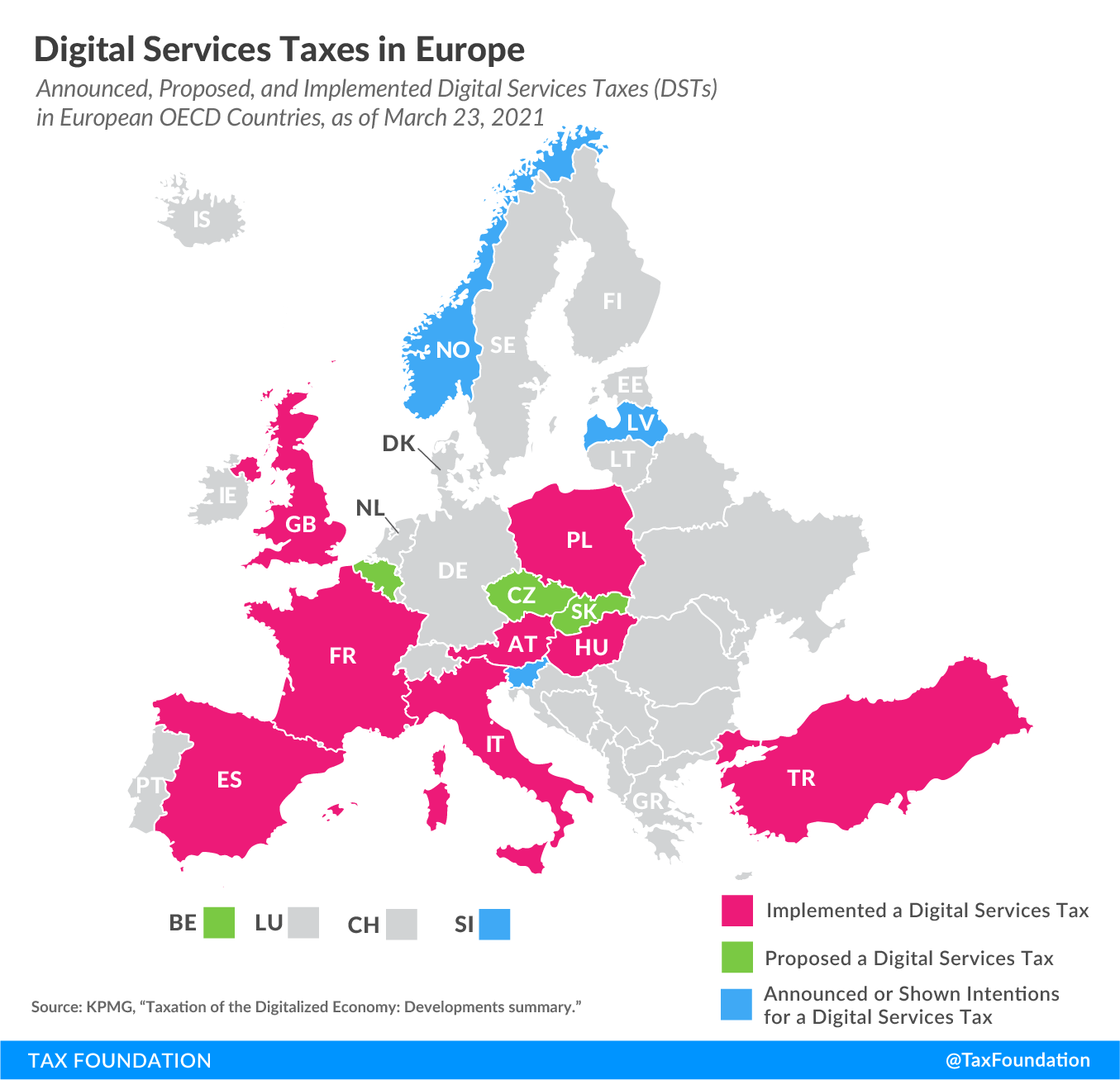

"Over the last few years, concerns have been raised that the existing international tax system does not properly capture the digitalization of the economy. Under current international tax rules, multinationals generally pay corporate income tax where production occurs rather than where consumers or, specifically for the digital sector, users are located. However, some argue that through the digital economy, businesses (implicitly) derive income from users abroad but, without a physical presence, are not subject to corporate income tax in that foreign country. To address these concerns, the Organisation for Economic Co-operation and Development (OECD) has been hosting negotiations with more than 130 countries to adapt the international tax system. The current proposal would require multinational businesses to pay some of their income taxes where their consumers or users are located. According to the OECD, an agreement is expected midyear."

However, despite these ongoing multilateral negotiations, several countries have decided to move ahead with unilateral measures to tax the digital economy. About half of all European OECD countries have either announced, proposed, or implemented a digital services tax (DST), which is a tax on selected gross revenue streams of large digital companies. Because these taxes mainly impact U.S. companies and are thus perceived as discriminatory, the United States has responded with retaliatory threats.

Unpacking the growing push to tax drivers by the mile instead of at the pump – Joann Muller, Axios:

There's growing acceptance among federal lawmakers for a road user fee to fund highway repairs, but how it would work — and who would end up paying — are unclear. Why it matters: The Highway Trust Fund, which pays for roads and transit systems, is going broke. The existing federal gas tax isn't enough to meet rising costs, and the budget gap will only grow wider as cleaner cars burn less fuel. Electric cars don't even need gas, which is why finding an alternative to the current 18.4-cent per gallon fuel tax is inevitable.

Perceived GILTI Shortcomings Focus of Senate Hearing – Andrew Velarde, Tax Notes ($)

"The global intangible low-taxed income provision was a primary target of criticism from Democrats and witnesses at a Senate Finance Committee hearing, although most critiques focused on reforming GILTI rather than advocating a complete rewrite. The criticism at the March 25 hearing appeared to coalesce around three aspects of GILTI — its exemption from tax for qualified business asset investment income, its reduced rate, and its inapplicability on a per-country basis. These critiques come as Finance Committee Chair Ron Wyden, D-Ore., announced that he will release a new international tax framework 'in the coming days' in cooperation with committee members Sherrod Brown, D-Ohio, and Mark R. Warner, D-Va."

Arizona AG Sues Treasury Over Tax Cut Restriction – Andrea Muse, Tax Notes ($):

Arizona Attorney General Mark Brnovich (R) has filed suit against the Treasury Department, arguing that a provision in the recently adopted federal COVID-19 law that could prevent states from using federal aid to lower state taxes is unconstitutional. In a March 25 complaint in the U.S. District Court for the District of Arizona, Brnovich claimed that the provision is too ambiguous to pass constitutional muster and “represents an unprecedented and unconstitutional intrusion” on state sovereignty. Arizona is asking the court in Arizona v. Yellen to declare the provision unconstitutional and prohibit the federal government from recouping funds based on violations of the provision.

Supreme Court Urged to Sustain California Donor Disclosure Decision – Jennifer McLoughlin, Tax Notes ($)

"California’s charitable donor disclosure requirement passes constitutional muster, according to the state’s acting attorney general, who filed a merits brief with the U.S. Supreme Court countering two organizations’ First Amendment challenges. In a March 24 brief filed in two consolidated cases — Americans for Prosperity Foundation v. Rodriquez and Thomas More Law Center v. Rodriquez — acting Attorney General Matthew Rodriquez asked the Supreme Court to affirm a Ninth Circuit panel’s 2018 decision."

Revamp of Global Tax Rules Looms Under Biden, Treasury Review - Michael Rapoport, Bloomberg ($)

"President Joe Biden and congressional Democrats are warning they may get tough on taxing U.S. companies abroad to raise more revenue and walk back some policies they see as being too corporate-friendly. Their plans include raising the corporate tax rate and increasing taxes on U.S. companies’ foreign income. They might also revise or reverse still-pending regulations to implement foreign-tax provisions of the 2017 tax law—with the aim of getting multinationals to pay more in U.S. taxes."

U.S. Tax Refunds Down 24% As IRS Filing Season Drags - Laura Davison, Bloomberg ($):

The Internal Revenue Service has issued 23.6% fewer refunds so far this year compared with the same point in the tax filing season in 2020, according to agency data.

Most Small Businesses Still Unaware of Retention Credit: Survey - Lydia O'Neal, Bloomberg ($)

"Familiarity with a pandemic-relief tax credit for companies that don’t lay off their employees—which was extended to more businesses by recent stimulus laws—ticked up just slightly among small businesses, according to new survey results. Among 526 small business owners surveyed by the National Federation of Independent Business, 42% said they were at least somewhat familiar with the employee retention credit as of mid-March, up from 36% in late January. Only 17% said they were planning to take the credit in 2021 in the more recent survey, compared to 10% who said in the January survey that they would take it in the first half of the year and 8% in the latter survey who said they used it in 2020."

More accounting firms embrace office space reduction: AICPA survey – Sean McCabe, Accounting Today:

The rise in remote work since the start of the COVID-19 pandemic has a growing number of accounting businesses reconsidering their physical office spaces, according to data from the 2021 Q1 AICPA Economic Outlook Survey. The survey was conducted Feb. 2-24, 2021, and included 693 responses from CPAs and accountants who hold leadership positions within their organizations. Seventy-two percent of those polled said their organizations had no plans to reduce their current office space over the next year, down five percentage points from Q3 2020, when the question was first asked. More notable, though, was that 9 percent of professionals — up from 5 percent in Q3 2020 — said they planned to reduce their office space by approximately 10 to 24 percent over the next year.

Shots in Arms! It was on this day in 1953 that American medical researcher Dr. Jonas Salk announced on a national radio show that he had successfully tested a vaccine against poliomyelitis, the virus that causes the crippling disease of polio. It took him over twenty years to develop the vaccine. Imagine waiting in your home for more than twenty years for the COVID-19 vaccine.

Make a habit of sustained success.