Democrats to Change Eligibility for Stimulus Checks in Covid-19 Aid Bill - Kristina Peterson, Andrew Duehren, and Richard Rubin, Wall Street Journal ($). "Under the plan approved in the House last week, those $1,400 payments phase out completely for individuals making $100,000 and married couples making $200,000. Lawmakers in the Senate are expected to bring the payments to zero for individuals making $80,000 and married couples making $160,000. Individuals making less than $75,000 and married couples with incomes lower than $150,000 will still receive the full $1,400 check."

Taxpayers with 2020 income in these phase out ranges, but whose 2019 income was below them, should consider delaying their 2020 filings. The legislation would use 2019 income to determine the check amounts if the 2020 return has not been filed.

Democrats Seek Temporary Expansion of Child Tax Credit, but Making It Permanent Is Real Goal - Richard Rubin, Wall Street Journal ($). "Once the larger credit is in place, it won’t go away, regardless of the Dec. 31 expiration date, predicted Brian Riedl, a former Senate GOP aide who is now a senior fellow at the Manhattan Institute, a conservative think tank."

SALT Cap Repeal Not Part of Senate Relief Bill Talks - Alexis Gravely, Tax Notes ($). "The Senate is working to amend the American Rescue Plan Act of 2021 (H.R. 1319), which passed the House February 27. Supporters of the SALT cap repeal on the House Ways and Means Committee didn’t include an amendment for the repeal in that bill, but Senate leadership is presumed to have the final say."

Trusts have until Saturday to distribute 2020 income. Many trusts have the option to distribute their income to beneficiaries or to accumulate the income. If trusts distribute cash to their beneficiaries, taxable income of the trust also shifts to the beneficiaries.

Code Sec. 663(b) allows trusts to count distributions made within 65 days after year-end to count as prior year distributions. March 6 is Day 65 this year. As trusts face the top 37% bracket after only $12,950 of taxable income, tax savings may be available by distributing trust income to beneficiaries whose income will be taxed at lower rates.

Contact Eide Bailly's Wealth Transition Services group to learn more.

IRS Updates FAQs to Address Crypto Purchases - Kristen Parillo, Tax Notes ($). "New FAQ 5, added to the IRS website March 2, essentially reiterates an agency spokesperson’s February 7 explanation to Tax Notes that 'if the only activity someone has is a purchase/acquire and hold, then they don’t have to check the box.'"

Wait, When Did This Virtual Currency Question Appear on My 1040 Tax Form? - NTA Blog. "The sale or exchange of virtual currency, including its use to pay for goods and services, has tax implications. These transactions are a disposition of the virtual currency that results in taxable gains or losses, just like a transaction involving any other property. The IRS treats virtual currency as property for federal income tax purposes and the general tax principles applicable to property transactions apply to transactions using virtual currency."

House approves millions in tax breaks for Iowa businesses, unemployed - O. Kay Henderson, Radio Iowa. "The plan means Iowans who qualified for temporary federal unemployment would not have to pay state income taxes on those benefits for tax year 2020. In addition, state income taxes would not be charged on the federal Paycheck Protection Program grants and loans to Iowa businesses. The total tax savings for Iowa businesses and individuals would amount to an estimated $128 million."

Iowa automatically conforms to federal tax changes for tax years beginning after 2019, but taxpayers with PPP loans and fiscal years beginning during 2019 would not be eligible for federal tax-free treatment of the loan forgiveness without this bill (SF 364).

Do you have more time to use FSA money? Here are 6 spending suggestions - Kay Bell, Don't Mess With Taxes. "The Consolidated Appropriations Act that was signed into law on Dec. 27, 2020, included among its many coronavirus-related provisions the option for companies to extend the medical FSA grace period beyond the usual March 15 deadline."

COVID-19-Related Expansion of Tax Break for Teachers - Tax Warrior Chronicles. "The new law clarifies that unreimbursed expenses paid or incurred after March 12, 2020, by eligible educators for protective items to prevent the spread of COVID-19 qualify for the already-existing educator expense deduction."

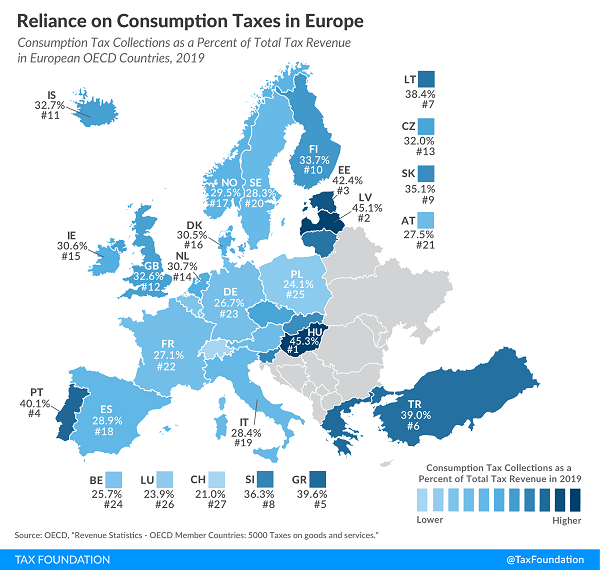

Reliance on Consumption Taxes in Europe - Elke Asen, Tax Policy Blog. "Consumption taxes are on goods and services. All European countries levy consumption taxes in the form of Value-added Taxes (VAT), excise taxes, and other taxes on goods and services. In 2019 (most recent data available), consumption taxes were the largest source of tax revenue in European OECD countries, at an average of 32.4 percent of total tax revenue."

The U.S. doesn't have a VAT. If federal spending continues to outstrip revenues from the taxes we do have, that may change.

Big Tech Has Our Data. Should We Tax Them on It? - Renu Zaretsky, TaxVox. "Any such effort misses a more obvious—and simpler—solution. With the corporate income tax, most countries already tax the tech industry on their income, including the earnings they derive from the collection and sale of customer data. But countries may not do this very well. Before creating a new tax on a hard-to-value asset like data, it might be better to focus first on fixing the imperfections of the corporate income tax."

The Billionaire Behind the Biggest U.S. Tax Fraud Case Ever Filed - Miriam Gottfried and Mark Maremont, Wall Street Journal ($):

Mr. Brockman bought used furniture for company offices, rarely gave raises and forbade employees from smoking to save money on health insurance, according to former employees and associates. He stayed at budget hotels and ate frozen dinners in his room during monthly visits to one of his company’s offices near Dayton, Ohio, a former vice president at his software firm recalled.

The article says thriftiness may have inadvertently drawn the attention of the IRS:

The IRS was alerted more than 20 years ago to Mr. Brockman’s offshore activities as a result of the litigation by his former salesmen.

In court documents, the salesmen asserted Mr. Brockman founded the Cayman Islands entity not only to evade paying commissions but also to avoid federal taxes.

The government alleges that $2 billion in taxes were evaded.

I'm hungry. Fortunately, today is National Snack Day!

Make a habit of sustained success.