IRS backlog causing problems for taxpayers - Marielle Segarra, Marketplace:

Imagine this: You owe money on your taxes, you pay it and then months later the IRS sends you a letter like that never happened.

It says, basically, pay up. Or, in IRS lingo: “If we do not hear from you and you do not petition the U.S. Tax Court, we will assess the additional tax you owe plus any applicable penalties and interest and send you a bill,” said Matt Metras, a tax preparer in New York.

This is a real problem. Taxpayers are receiving follow-up notices from the IRS months after a reply was sent to the initial notice. The article refers to an IRS website that addresses some of the delay issues. The website says "Once you’ve answered the notice, you don’t need to answer it again. We’re working through all taxpayer replies on a first-come, first-served basis and will process your reply as of the date it was received. We appreciate your patience."

That's a nice thought, but it's hard for taxpayers to be patient when they receive a scary IRS letter because their reply to a prior notice is unopened in the bottom of a mail bin somewhere.

Related: How to Address COVID-19-Related Tax Collection Issues.

More Erroneous IRS Notices - Russ Fox, Taxable Talk. "Based on a phone call with the IRS, it appears that the IRS is still processing paper returns from July! Yikes!"

IRS warns of e-file identity theft scam - Michael Cohn, Accounting Today:

The IRS and its security partners in private industry and state government said the latest scheme, which comes only days before the beginning of tax season, offers a reminder that tax professionals are among the main targets of identity thieves who are trying to steal client data and tax preparers’ identities so they can file fraudulent tax returns for refunds. The latest scam email claims to come from “IRS Tax E-Filing” and bears the subject line “Verifying your EFIN before e-filing.”

Tax Preparers are an attractive target for identity thieves because they have access to confidential identifying information for their clients.

Link: IRS warning to preparers.

Scammers target tax preparers in new EFIN phishing email - Kay Bell, Don't Mess With Taxes. "Basically, the scammers are asking tax preparers to email documents that would disclose their identities and EFINs to the thieves. The thieves can use this information to file fraudulent returns by impersonating the tax professional."

House Ways and Means Committee Takes First Steps Toward Additional Coronavirus Relief Legislation - Erica York, Garrett Watson, and Huaqun Li, Tax Policy Blog. "Single individuals with an adjusted gross income less than $100,000, heads of household under $150,000 and joint filers below $200,000 would receive a third round of economic impact payments. Each adult and dependent would be provided $1,400, phasing out beginning at $75,000 for single filers, $112,500 for heads of household, and $150,000 for joint filers."

TPC Finds the Ways & Means Pandemic Relief Plan Mostly Helps Low- and Moderate-Income Households, But Higher Income Families Benefit as Well - Howard Gleckman, TaxVox. "About two-thirds of the benefits would go to low- and middle-income households (those making about $91,000 or less). But about 11 percent would go to the highest-income 20 percent of households—those making about $164,000 or more."

Where’s the Line Between Start-Up Expenses, the Conduct of a Trade or Business and Profit Motive? - Roger McEowen, Agricultural Law and Taxation Blog. "Just a few days ago, the Tax Court decided a hobby loss case where the taxpayer failed to clear the bar on showing a profit intent for the farming activity that he was attempting to start."

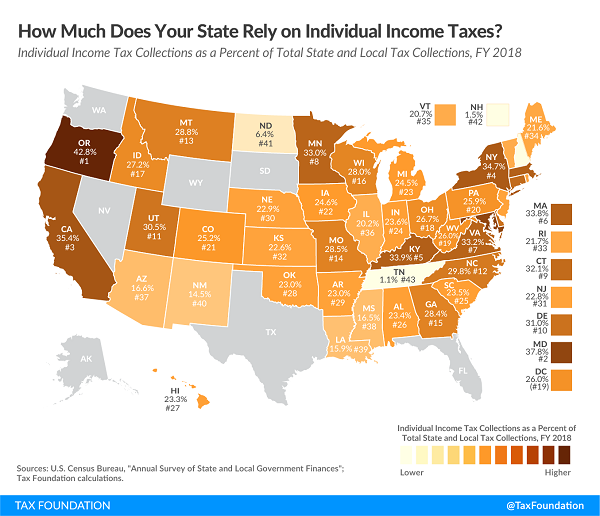

To What Extent Does Your State Rely on Individual Income Taxes? - Janelle Cammenga, Tax Policy Blog. "Typically, states with heavy reliance on income taxes—particularly progressive, high-rate income taxes which lean substantially on the state’s highest income residents—fare poorly during an economic downturn. Not only do wages decline due to layoffs and pay cuts, but investments usually experience steep losses, depriving states of capital gains income—a substantial portion of income tax collections, particularly in wealthier states."

New Jersey Conforms to Federal Tax Treatment of PPP Loans - Tax Notes. "New Jersey Gov. Phil Murphy (D) and the state treasurer announced that New Jersey will conform to the federal government’s tax treatment of Paycheck Protection Program loans, exempting the loans from tax and allowing recipients to deduct business expenses paid with loan funds for both gross income tax and corporation business tax purposes."

SALT Deduction Limit Repeal as COVID Relief - Marie Sapirie, Tax Notes Opinions. "The animating principle of the proposal to remove the SALT deduction limit as part of the COVID relief plan is therefore much more general than targeting the hardest-hit groups of people. It’s that any plan that directs more dollars to New Jersey, New York, Massachusetts, and California — the states identified in the letter as among the hardest hit of the pandemic — counts as relief."

Texas Apportionment Rule Changes - George Rendziperis, Freeman Law. "For Texas Margin reports due on or after January 1, 2021, only the 'net gain' from the sale of a capital asset or investment is included in gross receipts. A 'net loss' from the sale of a capital asset or investment is excluded from gross receipts."

Related: State Apportionment Reviews.

Love & Taxes: Are Valentines gifts taxable? - Jennifer Dunn, TaxJar. "Whether or not you will pay sales tax on that box of chocolates depends on where your lovebug is located."

This Valentine’s Day, talk money - AICPA. "With Valentine’s Day just around the corner, the AICPA® Financial Literacy Commission encourages Americans to give their loved ones the gift of an honest talk about money."

Who says accountants aren't romantic?

Get over it. Today is National Don't Cry Over Spilled Milk Day, which is a day where we "Do not worry and do not stress over the little things." True. With tax deadlines approaching, we have bigger things to stress over.

Make a habit of sustained success.