The IRS has released (Notice 2022-03) the 2022 standard mileage rates. The rates are used to determine the deductible costs of using a vehicle for business, charitable, medical, or moving purposes. The new rates are effective January 1, 2022.

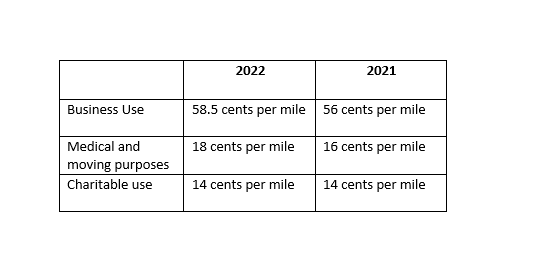

The new rates are as follows, compared to the 2021 rates:

For taxpayers who use a vehicle for business purposes, the amount of the standard mileage treated as depreciation is 26 cents per mile. This amount is unchanged from 2021. For those who use a fixed and variable rate plan, the maximum standard automobile cost that may be used in computing the allowance is $56,100. This amount was $50,400 in 2021.

Make a habit of sustained success.

Every organization deserves to realize its full potential. Let us help you find yours.

Learn More