House passes budget package after cost concerns abate - Lindsey McPherson, Roll Call. "The House passed a roughly $2.2 trillion package of spending and tax breaks to expand the social safety net and combat climate change Friday morning, with nearly all Democrats backing the massive bill after months of painstaking intraparty negotiations."

The articles linked below regarding the bill were written before this morning's House vote to pass the Biden "Build Back Better" reconciliation bill. The vote was 220-213 along party lines, except for one Democrat voting "no." Look for updates at www.ebtaxblog.com during the day today.

Further guidance issued on tax treatment of PPP loan forgiveness - Paul Bonner, Journal of Accountancy:

Rev. Proc. 2021-48 covers the timing of receipt of PPP forgiveness tax-exempt income. Taxpayers may treat such income as received or accrued when either (1) expenses eligible for forgiveness are paid or incurred; (2) an application for PPP loan forgiveness is filed; or (3) PPP loan forgiveness is granted. The revenue procedure also describes adjustments that must be made on an amended return; information return; or, for certain partnerships, an administrative adjustment request, when a PPP loan is only partly forgiven.

While welcome, this guidance would have been more useful months ago, before the due dates - or even the extended due dates - for so many returns for PPP taxpayers.

The new guidance still fails to clarify whether S corporations should treat the expenses relating to PPP loans as "Accumulated Adjustment Account" expenses. This issue affects the amount of distributions former C corporations can make without triggering taxable dividends.

Links: Rev. Procs. 2021-48, 2021-49, and 2021-50

IRS Gives Guidance on Timing of PPP Loan Relief, as Well as Other Issues Related to Tax Exempt COVID Relief Programs - Ed Zollars, Current Federal Tax Developments. "The IRS finally addressed the options for the timing of PPP forgiveness for tax purposes in Revenue Procedure 2021-48 as well as issuing two related procedures at the same time dealing with related issues. This includes a very limited time period when an affected BBB partnership can file an amended income tax return in lieu of filing the otherwise required Administrative Adjustment Request."

House About To Pass Build Back Better - Renu Zaretsky, Daily Deduction. "This morning, the House plans to pass a scaled-down version of President Biden’s Build Back Better social spending, climate, and tax bill. The measure would extend the expanded Child Tax Credit for a year, raise the cap on the state and local tax (SALT) deduction, create a new minimum tax on corporate book income, and impose a surtax on households with incomes of $10 million or more. The vote comes after the Congressional Budget Office reported it would add about $160 billion to the deficit over 10 years, including the bill’s many phase-ins and phase-outs."

House Set to Approve $2 Trillion Social Spending and Climate Bill - Andrew Duehren and Richard Rubin. Wall Street Journal ($):

The House is set to pass a roughly $2 trillion education, healthcare and climate package Friday, as Democrats corralled their slim majority to approve the centerpiece of President Biden’s economic agenda after months of wrangling.

...

Democrats initially hoped to pass the bill Thursday night, but an hours long speech by House Minority Leader Kevin McCarthy (R., Calif.) slamming the legislation prompted Democrats to postpone the vote until Friday after 8 a.m. Republicans have united against the bill, arguing that it would exacerbate rising inflation and slow the economy’s growth.

Once passed, the bill would face nearly certain changes in the Senate. If passed there, the House would have to have another vote to agree to the Senate changes.

Pelosi Hails ‘Historic’ Bill as House Poised to Pass Biden Plan - Eric Wasson and Billy House, Bloomberg. "Even if the bill passes the House, there is no guarantee it can clear the Senate -- where Democrats have yet to line up the 50 votes they need to pass it using a filibuster-proof budget process known as reconciliation."

Punchbowl News adds:

We always knew that House Minority Leader Kevin McCarthy had a lot to say. We didn’t know he had this much to say.

The California Republican broke Speaker Nancy Pelosi’s record for the longest House floor speech, clocking in at more than eight-and-a-half hours in opposition to the Democrats’ $1.7 trillion Build Back Better Act. McCarthy stretched the “magic minute” afforded to congressional leaders to its extreme. McCarthy’s staff has been planning this for some time, but kept it secret from everyone.

McCarthy finally yielded the floor at 5:11 a.m. The House will be back in session at 8 a.m., with Pelosi set to speak.

House Democrats Near Final Vote on Massive Reconciliation Bill - Doug Sword and Frederic Lee, Tax Notes ($):

A procedural 220-211 vote earlier in the evening signaled that Democrats had bridged their differences and were ready to advance the massive reconciliation bill to the Senate, where the proposed boost of the state and local tax deduction cap to $80,000 and other proposals will likely be changed.

...

Last-minute changes to the bill were technical ones, leaving alone House Democrats’ controversial eightfold increase of the SALT cap. House leadership decided to leave their thorny SALT problem to the Senate, which next convenes the week of November 29.

Biden Budget Plan Would Add $160B To Deficit, CBO Says - Stephen Cooper, Law360 Tax Authority:

"CBO estimates that enacting this legislation would result in a net increase in the deficit totaling $367 billion over the 2022 [through] 2031 period, not counting any additional revenue that may be generated by additional funding for tax enforcement," the agency said in a statement.

The CBO estimated that the IRS provisions would raise only about $207 billion over the next decade.

The CBO estimate assumes many "temporary" spending provisions will be allowed to expire, which is questionable.

How An $80,000 SALT Cap Stacks Up Against A Full Deduction For Those Making $400,000 Or Less - Howard Gleckman and Leonard Burman, TaxVox. "TPC estimates that 94 percent of the benefit of raising the SALT cap from $10,000 to $80,000 would go to the highest income 20 percent of tax filers, who make $175,000 or more. About 70 percent would go to those in the top 5 percent, who make about $365,000 or more."

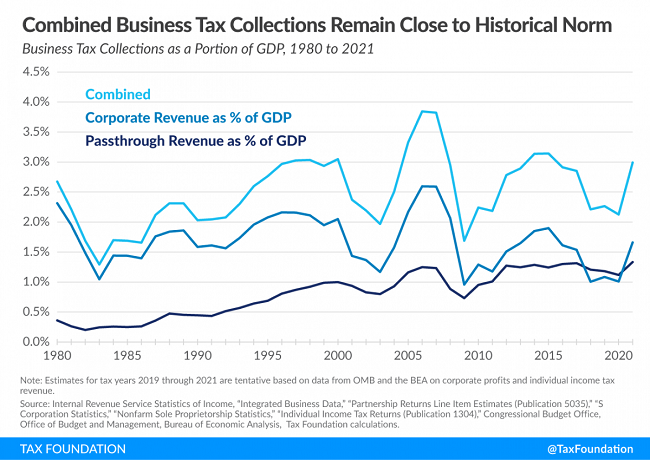

Business Tax Collections Within Historical Norm After Accounting for Pass-through Business Taxes - Garrett Watson, William McBride, and Alex Durante, Tax Policy Blog. "Pass-through business tax collections have grown substantially over the last 40 years, from about 0.5 percent of GDP or less in the 1980s to 1.3 percent this year and on average over the last 10 years. This reflects the growth in the number of pass-through firms and business income earned by pass-throughs since 1980."

S Corporation Or LLC ? A Misleading Question That Can Lead To Expensive Mistakes - Peter Reilly, Forbes:

You can find quite a few articles floating around in which the question under discussion is whether you should use an S Corporation or an LLC for your business. It would be two harsh to say that it is a stupid question. Let's rather say that it is the wrong question. And the right question is actually two questions. Those two questions are:

-

What sort of a state law entity do you want to have ?

-

What sort of a characterization do you want for federal income tax purposes ?

What’s in the $1.2 Trillion Infrastructure Bill? - Jay Heflin, Eide Bailly:

The legislation sunsets the Employee Retention Tax Credit (ERTC) after September 30, 2021, instead of December 31, 2021, as originally written. It is not clear how the government will address a retroactive expiration of a tax provision.

Eligible start-up companies can still claim the employee retention credit for the fourth quarter; however, their fourth quarter credit is capped at $50,000. Also, startup businesses that began operations after February 15, 2020, and had annual gross receipts of less than $1 million are exempt from this provision, and their ERTC expiration date remains December 31, 2021.

Practitioners Incensed Over International Penalty Assessment - Andrew Velarde, Tax Notes ($):

“The IRS should stop . . . and expand first-time abate [procedures] to clearly include the international penalties if there were no years of noncompliance because it is consistent with the penalty handbook — penalties should be objectively proportionate to the offense and be used as an opportunity to educate taxpayers and encourage future compliance,” Frank Agostino of Agostino & Associates PC said.

...

Guinevere Moore of Moore Tax Law Group LLC argued that whether the penalties can be legally assessed will be the subject of litigation. She asserted that no one at the IRS has been reading taxpayer reasonable cause statements that could excuse the penalties.

These penalties relate to, among other items, Form 5471 filed by certain U.S. shareholders of foreign corporations, and Form 8865, for owners of foreign partnership interests. The standard penalty is $10,000 for even a single day late.

Related: Penalty Help.

Relatively Few Partnerships Opt Out Of Regime, IRS Official Says - Amy Lee Rosen, Law360 Tax Authority ($):

When the new partnership tax law became effective in 2018, data indicated eligible partnerships allowed to opt out of the new rules would probably do so, said Maria Dolan, a technical executive assistant for the pass through entities practice area at the Internal Revenue Service. However, tax returns for the 2018 through 2020 tax years do not necessarily reflect that expectation, Dolan said at a conference held by the American Institute of Certified Public Accountants.

"For tax year 2018, we saw about 20% of the returns indicating election-out," she said. "For 2019, about 25% elected out, and the current data that we've got on tax year 2020 shows a little more than 25% electing out, so that's definitely trending."

Many partnerships that might opt out cannot do so because partnerships with grantor trusts as partners are ineligible.

Self-Employment Taxation of CRP Rents – Part Three - Roger McEowen, Agricultural Law and Taxation Blog. "The key to understanding the IRS position is that, with respect to the CRP, a recipient of CRP payments is either a farm landlord or a farmer. There is no room, in the IRS view, for a non-farmer who is not a landlord. A non-farmer is an 'operator' for which the material participation requirement doesn’t apply. Thus, the CRP income is subject to self-employment tax without any requirement that the income be derived from the taxpayer’s conduct of a trade or business."

Capital gains, kiddie, and estate tax inflation adjustments for 2022 - Kay Bell, Don't Mess With Taxes. "Part of the appeal here is that when investments are long-term, the profit they produce is taxed at a lower rate. The tax rates on the proceeds from assets held for more than a year are 0 percent, 15 percent and 20 percent. Which one applies depends on your overall income and filing status."

IRS Reckons With Its Estate Tax Return Hoarding Tendency - Jonathan Curry, Tax Notes ($). "The IRS has a policy of retaining estate tax returns and associated gift tax returns for 75 years, but in response to the federal government’s effort to shift to electronic storage of records, the agency plans to cut that back to 40 years and to destroy older returns early next year."

Did you lose your copy of Great Grandpa's Form 706? "Once the record agency approves the 40-year retention period, the IRS will move forward with destroying the older estate tax returns and their related documents, including gift tax returns and appraisals. In the meantime, taxpayers have until February 11, 2022, to submit requests for the older, soon-to-be-destroyed returns using Form 4506, 'request for Copy of Tax Return.'"

Coins in IRA Owner’s Possession Were Taxable Distributions - Tax Notes. From Tax Notes summary of 157 TC No. 10:

The Tax Court held that an individual received taxable distributions from her self-directed IRA when she took possession of American Eagle coins purchased by a single-member limited liability company owned by the IRA and that she and her husband are liable for accuracy-related penalties.

...

The court found that the wife had unfettered control of the coins and was free to use them in any way she chose even though they purportedly belonged to the LLC. Therefore, the court concluded that she received taxable distributions from the IRA. The court rejected the couple's argument that the flush text of section 408(m), which applies to collectibles, provided an exception that allowed the wife to take physical possession of the coins.

From the Tax Court Opinion:

An owner of a self-directed IRA is entitled to direct how her IRA assets are invested without forfeiting the tax benefits of an IRA. However, IRA owners cannot have unfettered command over the IRA assets without tax consequences...

A qualified custodian or trustee is required to be responsible for the management and disposition of property held in a self-directed IRA. Sec. 1.408-2(e), Income Tax Regs. A custodian is required to maintain custody of the IRA assets, maintain the required records, and process transactions that involve IRA assets. See sec. 408(h) and (i); sec. 1.408-2(e)(4), (5)(i)(2), (iii), (vii), Income Tax Regs. The presence of such a fiduciary is fundamentally important to the statutory scheme of IRAs, which is intended to encourage retirement savings and to protect those savings for retirement. Independent oversight by a third-party fiduciary to track and monitor investment activities is one of the key aspects of the statutory scheme. When coins or bullion are in the physical possession of the IRA owner (in whatever capacity the owner may be acting), there is no independent oversight that could prevent the owner from invading her retirement funds. This lack of oversight is clearly inconsistent with the statutory scheme. Personal control over the IRA assets by the IRA owner is against the very nature of an IRA.

So if you have gold in your IRA, it needs to be, well, in your IRA.

Minimum Competency Standards for Return Preparers Are Crucial Taxpayer Protections - NTA Blog. "Because the tax code is so complex, the majority of taxpayers pay preparers to complete their returns for them. Unfortunately, many taxpayers have no easy way to determine whether the preparer they are hiring can do the job adequately."

Unfortanately, "national competency standards" may backfire. Especially in rural areas, practitioners are aging out with no successors in signt. Adding additional paperwork and bureaucratic hassle to tax practice will likely just reduce the number of practitioners available without measurably improving the skills of those remaining. This may drive more taxpayers to self-prepare, with worse results, or to drop out of the tax system altogether.

I'm confused. Today is both "International Men's Day" and "Women's Entrepreneurship Day."

Make a habit of sustained success.