"Billionaire Tax." Corporate minimum tax based on financial statement income. Congressional Democrats floated two ideas yesterday to finance the Biden "Build Back Better" spending plan. Oh, and the Tax Court ruled on the treatment of the Chicago Tribune sale of the Chicago Cubs to the Ricketts family. A lot to talk about today.

Senate Finance Committee Chair Ron Wyden released a 107-page "Billionaire Tax" proposal early this morning. He also issued a one-page summary that says it will apply to "taxpayers with more than $100 million in annual income or more than $1 billion in assets for three consecutive years.

Senate Democrats also resurrected a 15% corporation minimum tax based on financial statement income. Per the authors of the tax it would:

-

Apply to roughly 200 companies that report over $1 billion in profits;

-

Create a 15% minimum tax on the profits that these giant companies report to their shareholders;

-

Preserve the value of business credits – including R&D, clean energy, and housing tax credits – and include some flexibilities for companies to carry forward losses, utilize foreign tax credits, and claim a minimum tax credit against regular tax in future years;

-

Raise hundreds of billions in revenue over 10 years.

Are these the proposals that will get the Biden plan over the top?

Probably not this week, anyway. From Punchbowl News:

Let’s be blunt. Democrats aren’t close to a framework agreement on their massive reconciliation package.

We’ve heard President Joe Biden, Speaker Nancy Pelosi and Senate Majority Leader Chuck Schumer talk about great progress, but our reporting and the available public evidence doesn’t match these sunny claims.

Biden hoped to have that framework deal in place before he leaves for Rome on Thursday. But without a big turnaround in the next 24 hours, that’s not going to happen.

The Punchbowl newsletter does say "a path to a deal on both the framework and the broader reconciliation package is slowly emerging," but that "after six weeks of pretty steady negotiations, Democrats haven’t come to agreement on the topline cost of the package, what’s in the legislation or how to pay for it."

Tax Proposals Hit Headwinds as Democrats Try to Finalize Social-Spending Deal - Andrew Duehren and Natalie Andrews, Wall Street Journal ($):

An 11th-hour push by Democrats to fund their social-spending and climate bill faltered, with a proposed tax on billionaires’ unrealized capital gains and revised bank-reporting requirements both running into opposition from party lawmakers.

Democrats have scrambled for days to find hundreds of billions of dollars of new revenue acceptable to Sen. Kyrsten Sinema (D., Ariz.), who is opposed to the increases in the top marginal rates on companies, capital gains and personal income that the party planned to rely on to finance the bill. With Republicans opposed to the package, Democrats need unanimous support to pass the legislation in the 50-50 Senate and can afford to lose only a few votes in the House.

Billionaires Income Tax Proposed by Senator Ron Wyden - Senate Finance Committee:

Taxation of gains and losses from assets like stocks

Tradable assets (assets like stocks that are easily valued on an annual basis) owned by billionaires will be marked to market each year. This means that billionaires will pay tax on gains or take deductions for losses, whether or not they sell the asset. Taxpayers would be able to carry back their losses for up to three years in certain circumstances.

Deferral charge on gains from assets like real estate

When a billionaire sells a nontradable asset (like real estate or a business interest), they would pay their usual tax, plus a “deferral recapture amount,” which is akin to interest on tax deferred while the individual held that asset.

The deferral recapture amount is calculated by allocating an equal amount of gain to each year in the holding period, determining how much tax would have been owed on the gain in each year, and assessing interest on unpaid tax for the time the tax was deferred. The interest rate used is the short-term federal rate plus one percentage point, and no interest accrues prior to the date of enactment of the proposal or the first tax year the individual is subject to the Billionaires Income Tax, whichever is later.

Democrats’ billionaire tax would heavily target 10 wealthiest Americans, but alternative plan is emerging - Jeff Stein, Andrew Van Dam, and Tony Romm, Washington Post ($):

While Democrats have increasingly eyed the plan as a way to win the support of Sen. Kyrsten Sinema (D-Ariz.), who has expressed opposition to increasing the corporate tax rate, some legal scholars have warned it could get struck down by the Supreme Court. And while negotiations are rapidly evolving, Democrats are considering swapping the billionaire tax for a separate 3 percent “surtax” on millionaires earning more than $5 million per year, according to two people familiar with the negotiations who spoke on the condition of anonymity to reflect internal negotiations.

Wyden fills in details for 'Billionaires Income Tax' - Brian Faler, Politico:

Finance Chair Ron Wyden (D-Ore.) wants to begin requiring people with more than $1 billion in assets, or who earn more than $100 million in three consecutive years, to begin paying capital gains taxes each year on the appreciation in value of their assets, regardless of whether they are sold.

"Several hundred billion." House Speaker Pelosi last week said she was looking at a $250 billion revenue score for the bill over 10 years. For perspective, the federal government spends about $500 billion each month.

Wyden details proposed tax on billionaires’ unrealized gains - Laura Weiss, Roll Call. "The legislative text could win over some House Democrats and others who’ve framed the idea as too new and amorphous to get into the multitrillion-dollar budget reconciliation package Democrats are hoping to agree on soon. But it’s yet to be seen how skeptics will receive the draft."

Wyden Plan Would Tax Billionaires To Fund Biden's Agenda - Stephen Cooper, Law360 Tax Authority ($). "The proposal would force billionaires to value their stocks and bonds each year and then pay capital gains taxes or take deductions on their losses, even if they don't sell the assets. In certain circumstances, taxpayers could carry back or carry forward losses for three years."

Ways and Means Dems Concerned, Skeptical About Billionaires Tax - Doug Sword, Tax Notes ($). "An 11th-hour scramble in the Senate to draft a tax on the unrealized gains of the wealthiest Americans is drawing skepticism from House Ways and Means Committee Democrats over the expected complexities of the proposal, along with irritation over its lateness."

Billionaire Tax Faces Likely Constitutional Challenge - Richard Rubin, Wall Street Journal ($). "The likely argument: Taxing capital gains that haven’t been realized yet falls outside the income taxes allowed by the 16th Amendment that don’t have to be apportioned based on state population. Under current law, individuals pay capital-gains taxes only when the gain is realized, typically when they sell an asset, such as a stock, closely held business or painting."

Revamped Corporate Minimum Tax Floated to Pay for Senate Deal - Doug Sword, Tax Notes ($). "Senate Democrats are proposing a new 15 percent corporate minimum tax on companies that report more than $1 billion in profits to shareholders, as part of their plans for a broad budget deal."

Tax Proposals Coming Fast And Furious - Renu Zaretsky, Daily Deduction. "Speaker Nancy Pelosi urged moderate and liberal Democrats to compromise and 'embrace' the developing deal for President Biden’s social spending agenda, or Build Back Better (BBB) plan, yesterday. Her commitment to first secure that agreement before bringing the Senate-passed bipartisan infrastructure (BIF) bill to a vote on the House floor reassured the progressive wing of her caucus. But Democrats remain at odds over tax provisions of the BBB bill."

Manchin: IRS bank reporting proposal dropped from budget bill - David Lerman, Roll Call. "The West Virginia Democrat, a key negotiator on the partisan spending and tax package, said during an Economic Club of Washington discussion that President Joe Biden agreed with his assessment that the bank reporting plan would be overly intrusive and unworkable."

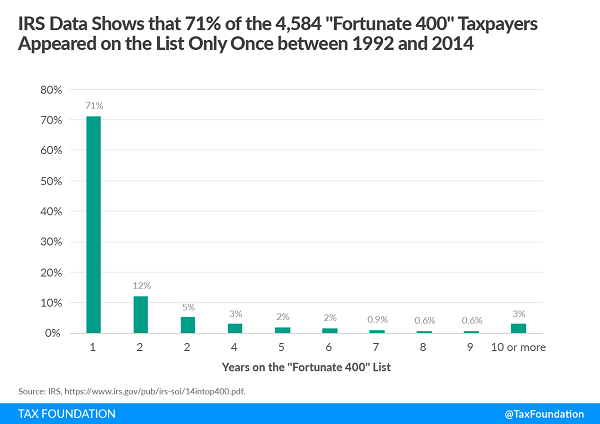

The Rich Are Not Monolithic and Taxing Their Wealth Invites Tax Collection Volatility - Scott Hodge, Tax Foundation. "There are two fundamental challenges to such a plan. First, the incomes and wealth of such individuals are anything but stable; they rise and fall with the economy and other market conditions, so taxes tied to them will be volatile. Second, the rich are not monolithic. People move into and out of millionaire status, even billionaire status, all the time. Thus, taxing the rich is like taxing a river—rarely the same people year after year, which adds to the volatile nature of the taxes tied to them."

Most taxpayers get to be "rich" once, when they sell their business or farm or have some other unusual event - cashing out on a lifetime of earnings in one year. The tax law treats them as if it all happened at once.

Tribune Can't Cut Cubs Sale Gains By $249M, Tax Court Says - Theresa Schliep, Law360 Tax Authority ($):

The $249 million in funds used to finance the 2009 sale of the Chicago Cubs from Tribune to the Ricketts family cannot reduce the gains the media company earned from the sale, the Tax Court said in a memorandum opinion. A number of factors indicate that the financing was equity, and not debt, for tax purposes, including the intent of the financing and the expectation of repayment, the Tax Court said.

But it also partially sided with Tribune in finding that the portion of a $704.9 million distribution from a holding company to Tribune under the agreement, attributable to a different tranche of financing, is not subject to tax, according to the opinion. Moreover, the Tax Court rejected the Internal Revenue Service's attempts to recharacterize the transaction from a disguised sale to an outright sale.

The Tribune was operating as an ESOP-owned S corporation at the time. Because the S election was relatively recent, the Tribune was subject to corporate-level tax on "built-in gains" accrued prior to the S corporation election. The Tribune reported $34 million of built-in gains from the sale of the Cubs. The IRS said the right number was about $704.9 million. The Tax Court boosted the gain by about $249 million.

Under current law, a C corporation that makes an S corporation election to have the shareholders taxed directly on corporate earnings remains subject to corporate tax on "built-in gains" for a five year "recognition period" after the S election takes effect. S corporations that acquire assets with carryover basis from C corporations start a new recognition period for those assets.

Tax Court Splits the Baby on Tribune Media Debt Guarantees - Nathan Richman, Tax Notes ($):

Neither side in Tribune Media Co. v. Commissioner disputed that the transaction was a disguised sale, according to Judge Ronald L. Buch in his October 26 decision.

The two main issues left for decision were instead whether the $425 million in senior debt that Tribune media borrowed as part of its sale of the Cubs to the Ricketts family was recourse to the seller and whether the $250 million in subordinated debt borrowed by the family in the transaction was really debt or equity for federal tax purposes.

The Ricketts family may get some extra amortizable intangibles out of the decision. Who says the Cubs never win in October?

Link to opinion: T.C. Memo. 2021-122

Looming R&D Capitalization Would Hit Manufacturing And Tech Sectors Hardest - Thornton Matheson, Thomas Brosy, TaxVox. "If Congress allows R&D expensing to expire as scheduled after 2021, the marginal tax rate on domestic research would increase by between 16 and 28 percentage points, depending on whether the investment also qualifies for the R&E tax credit. (While most R&D qualifies for expensing, the credit only applies to a fraction of expenditures.) This could trigger a decline in research that would hit the IP-intensive manufacturing and tech sectors particularly hard. The extent of the decline will depend on how sensitive marginal investment in R&D is to tax rates."

Related: The Benefit of the Research & Development Tax Credit

Bill to save Social Security would increase payroll tax wage base, change annual COLA calculation - Kay Bell, Don't Mess With Taxes. "Larson's proposal would make wages up to $400,000 subject to the Social Security portion of Federal Insurance Contributions Act payroll taxes. That means both the workers earning that amount and their employers would pay 6.2 percent of the wage amount toward Social Security."

Dear IRS: Sexual Abuse & PTSD Settlements Should Never Be Taxed - Robert Wood, Forbes. "Sadly, for many victims, an award of cash comes with tax worries too. Can the IRS tax it? The answer is nuanced, adding more anxiety to the victim’s experience."

Tax Reporting of Sale Transactions By Farmers - Roger McEowen, Agricultural Law and Taxation Blog. "Famers engage in numerous types of sales transactions. Of course, common sales involve sales of harvested crops and raised livestock. But, a farmer or rancher can receive income from other types of sales and for services rendered. Each of these transactions has its own income tax reporting requirements."

Court Denies Refund Claim Because Taxpayer Missed Deadline for Changing Filing Status - Parker Tax Publishing. "A district court held that the IRS properly denied a taxpayer's claim for a refund because her claim, filed on an amended return, sought to change her filing status from married filing separately to married filing jointly outside of the three-year period for changes of election status in Code Sec. 6013(b)."

Taxpayers can find legitimate charities using the Tax Exempt Organization Search tool - IRS. "When taxpayers decide to support a cause they care about, they want their donation to do as much good as possible. Doing some research can help ensure donations go to legitimate and qualified charities and help donors avoid scams. The IRS's Tax Exempt Organization Search tool, is a great place to start."

NFT Markets Create More Tax Concerns Than Just Gains - Carrie Brandon Elliot, Tax Notes Opinions. "Discussion of tax and nonfungible tokens (NFTs) usually focuses on gain income. Analysis of expense deductions, charitable contributions, and worthlessness are less common. As the market for NFTs swells, so will the relevance of those topics."

I think worthlessness may come up a lot.

Good luck. Today is National Black Cat Day. "In some locales, notably Scotland, Britain, and Japan, the presence or appearance of a black cat is indicative of imminent good fortune and prosperity."

Tell that to Ron Santo.

Make a habit of sustained success.