Tax filing season to start Feb. 12, IRS announces - Alistair M. Nevius, J.D., Journal of Accountancy. “The IRS on Friday announced that it will start accepting and processing 2020 tax returns on Friday, Feb. 12. This is later than in most previous years, when tax season has started in January. The IRS says the delay is due to the extra time it needs for programming and testing its systems following the tax law changes made by the Consolidated Appropriations Act, 2021 (CAA 2021), P.L. 116-260, which was enacted Dec. 27.”

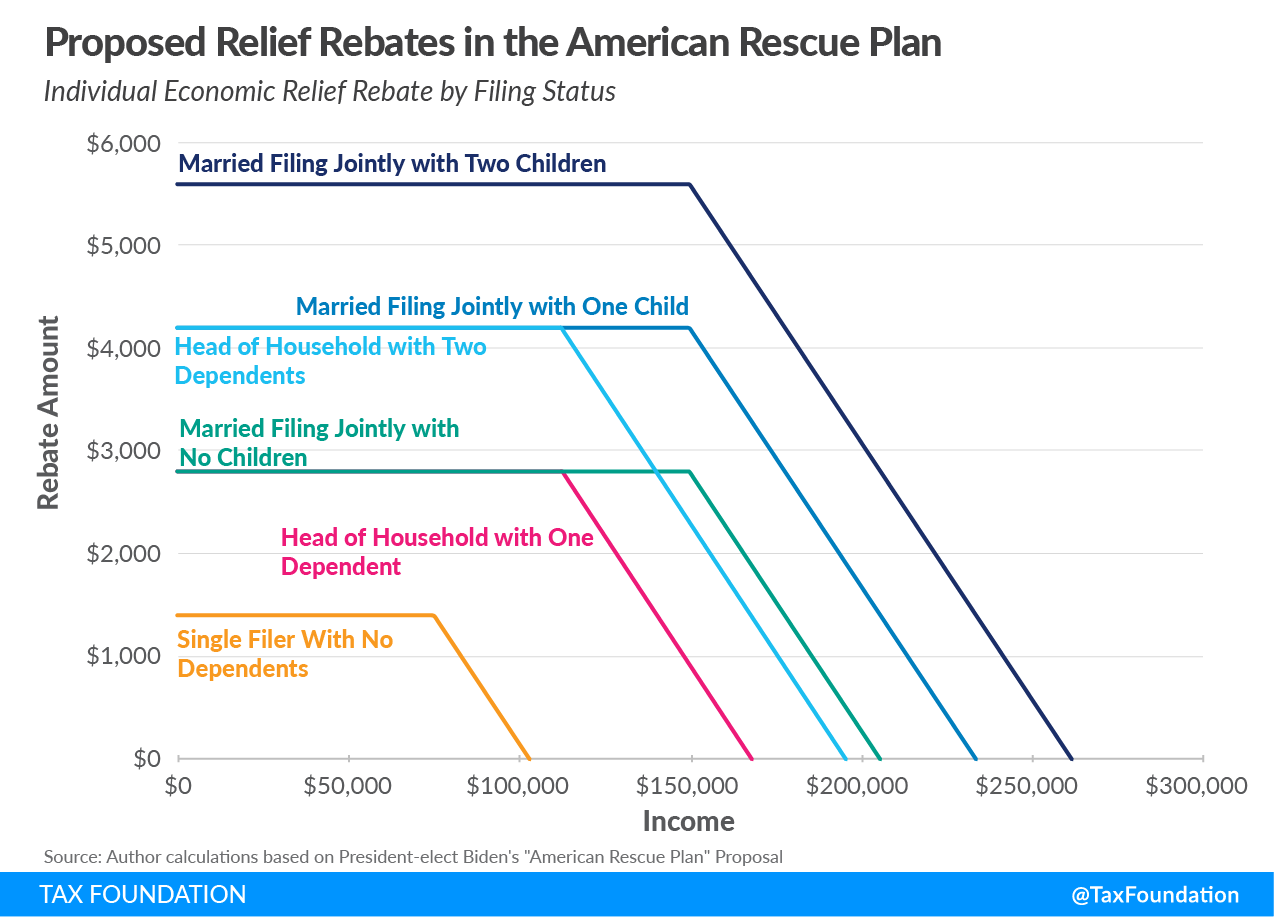

President-elect Biden Outlines Plan for Additional Coronavirus-Related Relief and Stimulus – Erica York, Garrett Watson, and Hauqun Li. “individuals would receive an additional $1,400 direct payment, topping off the $600 passed as part of the Consolidated Appropriations Act of 2021 (CCA21) in December 2020, for a combined $2,000 per individual. It would include qualifying adult dependents and households with mixed immigration status.”

Biden Covid-19 Relief Plan Aims to Ease Poverty, Advance Democratic Priorities – Richard Rubin and Kate Davidson, WSJ($). “President-elect Joe Biden’s economic-relief plan places low-income families at its center, delivering cash, housing assistance, food and child-care support to the most vulnerable Americans. It is also a way for Democrats to get some long-sought priorities into law.”

Biden’s Huge Pandemic Relief Plan Would Cut Taxes for Low- and Moderate-Income Households – Howard Gleckman, TaxVox. “Biden’s plan would compete with the Coronavirus Aid, Relief, and Economic Security (CARES) Act as the biggest relief bill in US history. On top of the total $3.4 trillion in pandemic relief Congress passed last year, it would mean the federal government would provide more than $5 trillion in assistance to households, business, and state and local governments.”

Some highlights of the plan include:

- “Increase the $600 per person direct payments approved by Congress in December by an additional $1,400. Biden did not say whether the eligibility rules would be the same as for the $600 payments.”

- “Make the Child Tax Credit (CTC) fully refundable for 2021, increase the credit to $3,000 per child ($3,600 for each child under age 6) and make 17-year olds eligible.”

- “Expand the Child and Dependent Care Tax Credit (CDCTC) to cover half of child care costs up to $4,000 for one child or $8,000 for two or more. Families making up to $125,000 annually would be eligible for the full 50 percent credit, while those making up to $400,000 could claim a smaller ”

Biden tax-hike proposals face bumpy road ahead – Naomi Jagoda, The Hill. “This month’s Democratic sweep of Senate runoffs in Georgia, giving Democrats control of the Senate for the first time since 2014, increases the odds of tax proposals advancing through Congress. However, slim margins in both the House and the Senate mean enacting tax increases will prove challenging.”

My Top Ten Concerns About The 2021 Tax Filing Season – Claudia Hill, Forbes. “Having been a return-preparing tax professional for the last 40+ years, I annually prepare a top-ten list of concerns about the filing season ahead. Earlier today IRS Commissioner Rettig announced that the upcoming filing season start date will be delayed. IRS will begin accepting tax returns on February 12.

IP-PIN Program Available to All Taxpayers – Ed Zollars, Current Federal Tax Developments. “The IRS has outlined the details of its voluntary Identity Protection Personal Identification Number (IP-PIN) program where taxpayers will receive an IP-PIN, as well as opening up the process nationwide.”

What to Know About PPP Options for Destination Marketing Organizations and 501©(6) Organizations – Kim Hunwardsen, Eide Bailly. “The legislation expanded eligibility for those who receive PPP loans, including destination marketing organizations as well as certain 501(c)(6) organizations, such as business leagues, chambers of commerce, real estate boards and boards of trade. These types of organizations were previously disallowed from applying.”

Slow tax refunds again make the annual Top 10 list of taxpayer problems – Kay Bell, Don’t Mess With Taxes. “If you were part of the millions of taxpayers who didn't get their refunds — and I am seeing on social media that even into 2021, some people are still waiting … — the National Taxpayer Advocate (NTA) feels your pain.”

Make a habit of sustained success.